Will it be another government-linked company Keppel Corporation, with its dour, straight-laced facade?

Umbrage Ng will fit in like a glove, having worked in government and government-linked entities for his whole career: army, Temasek Holdings, NOL, SPH.

SPH announces $3.4 billion privatisation offer from Keppel Corp post-media restructuring.PHOTO: ST FILE

Choo Yun Ting

AUG 2, 2021

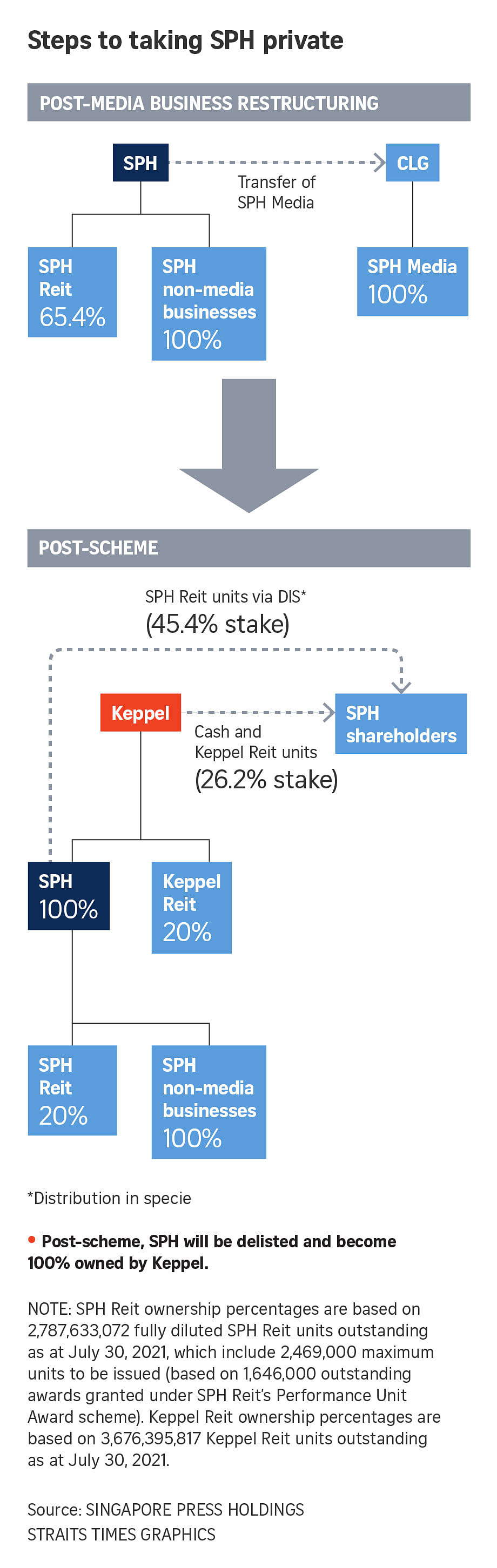

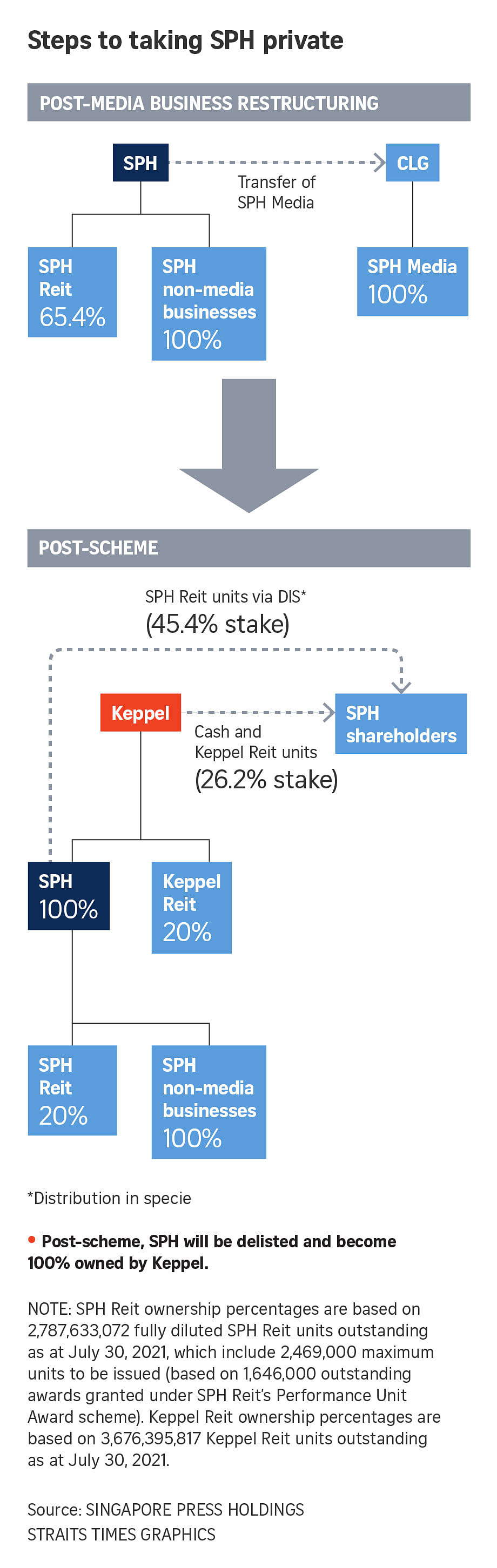

SINGAPORE - Keppel Corp has offered to take Singapore Press Holdings (SPH) private under a scheme which gives SPH a $3.4 billion value following the restructuring of its media business, it announced on Monday (Aug 2).

Here is a recap of the recent developments for SPH, which publishes The Straits Times.

Oct 13, 2020: SPH posts its first ever net loss of $83.7 million for the full financial year ended Aug 31 last year, and a loss before taxation of $11.4 million for its media business. This reversed profits seen in the previous financial year.

Oct 14, 2020: Shares of SPH dip below $1 for the first time.

March 30, 2021: SPH announces it is undergoing a strategic review to consider options for its various businesses.

May 6, 2021: SPH says it will restructure its media business into a not-for-profit entity.

May 10, 2021: Former Cabinet minister Khaw Boon Wan is announced as chairman of SPH's media entity by then Minister for Communications and Information S. Iswaran in Parliament.

May 12, 2021: SPH Media Trust holds a press conference, during which Mr Khaw announces that former SPH deputy chief executive Patrick Daniel will be interim CEO of the new company limited by guarantee.

July 19, 2021: SPH reports that media operating revenue fell for the first nine months of FY2021, led by a decline in newspaper print ad revenue.

Aug 2, 2021: SPH announces $2.2 billion privatisation offer from Keppel Corp post-media restructuring, which values SPH at $3.4 billion. The scheme will see SPH delisted and become a wholly owned subsidiary of Keppel, and is subjected to shareholders' approval.

Next steps (indicative)

Aug-Sept 2021: Extraordinary general meeting (EGM) to be held to approve media business restructuring.

Oct-Nov 2021: EGM to be held to approve distribution in specie of SPH Reit units and scheme meeting is expected to be held for SPH acquisition.

Dec 2021: Potential completion of media business restructuring; and only after completion of media restructuring, the expected conclusion of privatisation by Keppel.

In 1996, SPH linked up with partners to acquire The Promenade and the Paragon by Sogo buildings, as part of its strategy to diversify its core businesses.

It later spun off its property business under SPH Reit, which debuted on the mainboard in July 2013. SPH Reit's portfolio now includes a shopping centre in Adelaide, Australia, in which the Reit holds a 50 per cent stake.

SPH moved into broadcast media at the turn of the decade, with SPH MediaWorks set up in June 2000. It received a nationwide television broadcasting service licence less than a year later. But the move was short-lived, as SPH sold its television operations to national broadcaster Mediacorp in 2004.

In 2019, Keppel Corporation and SPH together acquired local telco M1 through joint-venture company Konnectivity. The joint-venture firm is majority-owned by Keppel.

In June last year, SPH was removed from the Straits Times Index, which tracks 30 of the largest companies by market capitalisation listed on the SGX mainboard.

Last October, SPH posted its first full-year net loss of $83.7 million for the financial year ending Aug 31, 2020.

The following years saw it delve into regionalisation and diversification efforts, and were also key in the development of its infrastructure business.

In 1994, Keppel led a Singapore consortium to develop the Suzhou Industrial Park, the first government-to-government project between China and Singapore.

Keppel restructured its key businesses into four divisions - offshore and marine, property, infrastructure, and investments - at the start of the 2000s.

In 2006, Keppel Reit, then named K-Reit Asia, listed on the mainboard. Keppel's growing focus on data centre assets later culminated in the listing of Keppel DC Reit in 2014.

In June this year, Keppel said it was exploring a potential merger between its offshore and marine arm and Sembcorp Marine, in a bid to create a stronger player in the long term.

In recent years, Keppel has gone deeper into sustainable urbanisation. It announced its Vision 2030 last year, focusing on four key areas - energy and environment, urban development, connectivity, and asset management.

Umbrage Ng will fit in like a glove, having worked in government and government-linked entities for his whole career: army, Temasek Holdings, NOL, SPH.

Keppel's privatisation offer for SPH: Timeline of key developments

SPH announces $3.4 billion privatisation offer from Keppel Corp post-media restructuring.PHOTO: ST FILE

Choo Yun Ting

AUG 2, 2021

SINGAPORE - Keppel Corp has offered to take Singapore Press Holdings (SPH) private under a scheme which gives SPH a $3.4 billion value following the restructuring of its media business, it announced on Monday (Aug 2).

Here is a recap of the recent developments for SPH, which publishes The Straits Times.

Oct 13, 2020: SPH posts its first ever net loss of $83.7 million for the full financial year ended Aug 31 last year, and a loss before taxation of $11.4 million for its media business. This reversed profits seen in the previous financial year.

Oct 14, 2020: Shares of SPH dip below $1 for the first time.

March 30, 2021: SPH announces it is undergoing a strategic review to consider options for its various businesses.

May 6, 2021: SPH says it will restructure its media business into a not-for-profit entity.

May 10, 2021: Former Cabinet minister Khaw Boon Wan is announced as chairman of SPH's media entity by then Minister for Communications and Information S. Iswaran in Parliament.

May 12, 2021: SPH Media Trust holds a press conference, during which Mr Khaw announces that former SPH deputy chief executive Patrick Daniel will be interim CEO of the new company limited by guarantee.

July 19, 2021: SPH reports that media operating revenue fell for the first nine months of FY2021, led by a decline in newspaper print ad revenue.

Aug 2, 2021: SPH announces $2.2 billion privatisation offer from Keppel Corp post-media restructuring, which values SPH at $3.4 billion. The scheme will see SPH delisted and become a wholly owned subsidiary of Keppel, and is subjected to shareholders' approval.

Next steps (indicative)

Aug-Sept 2021: Extraordinary general meeting (EGM) to be held to approve media business restructuring.

Oct-Nov 2021: EGM to be held to approve distribution in specie of SPH Reit units and scheme meeting is expected to be held for SPH acquisition.

Dec 2021: Potential completion of media business restructuring; and only after completion of media restructuring, the expected conclusion of privatisation by Keppel.

SPH and Keppel: A brief history

SPH

Singapore Press Holdings (SPH) was incorporated on Aug 4, 1984, as a holding company for the merger of several publishing companies to cut costs and reduce duplication of resources. It listed on the Singapore Exchange (SGX) mainboard later in the year.In 1996, SPH linked up with partners to acquire The Promenade and the Paragon by Sogo buildings, as part of its strategy to diversify its core businesses.

It later spun off its property business under SPH Reit, which debuted on the mainboard in July 2013. SPH Reit's portfolio now includes a shopping centre in Adelaide, Australia, in which the Reit holds a 50 per cent stake.

SPH moved into broadcast media at the turn of the decade, with SPH MediaWorks set up in June 2000. It received a nationwide television broadcasting service licence less than a year later. But the move was short-lived, as SPH sold its television operations to national broadcaster Mediacorp in 2004.

In 2019, Keppel Corporation and SPH together acquired local telco M1 through joint-venture company Konnectivity. The joint-venture firm is majority-owned by Keppel.

In June last year, SPH was removed from the Straits Times Index, which tracks 30 of the largest companies by market capitalisation listed on the SGX mainboard.

Last October, SPH posted its first full-year net loss of $83.7 million for the financial year ending Aug 31, 2020.

Keppel

Keppel Corp started as a ship repair yard in 1968, corporatised from the dockyard department of the then Port of Singapore Authority. It moved into the offshore rig business in the early 1970s and listed on the SGX in 1980.The following years saw it delve into regionalisation and diversification efforts, and were also key in the development of its infrastructure business.

In 1994, Keppel led a Singapore consortium to develop the Suzhou Industrial Park, the first government-to-government project between China and Singapore.

Keppel restructured its key businesses into four divisions - offshore and marine, property, infrastructure, and investments - at the start of the 2000s.

In 2006, Keppel Reit, then named K-Reit Asia, listed on the mainboard. Keppel's growing focus on data centre assets later culminated in the listing of Keppel DC Reit in 2014.

In June this year, Keppel said it was exploring a potential merger between its offshore and marine arm and Sembcorp Marine, in a bid to create a stronger player in the long term.

In recent years, Keppel has gone deeper into sustainable urbanisation. It announced its Vision 2030 last year, focusing on four key areas - energy and environment, urban development, connectivity, and asset management.