So i am too late to do a spac?

-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SPACs - the next big fraud

- Thread starter LITTLEREDDOT

- Start date

Goldman, Citi, & BofA Are All Quietly Backing Out Of The SPAC Business

Never too late

https://www.zerohedge.com/markets/goldman-sachs-quietly-backing-out-spac-business

try NFTsSo i am too late to do a spac?

SPAC produces one of world's biggest billionaire implosions

SPACs can go from a means of wealth creation into one of destruction. PHOTO: BT FILE

May 18, 2022

NEW YORK (BLOOMBERG) - The merger machine that's minted some of the world's biggest new fortunes is also responsible for one of the largest wealth implosions.

Arrival Ltd's Denis Sverdlov, who was worth US$11.7 billion (S$16.2 billion) a year ago, lost his billionaire status last month as shares of the electric-vehicle maker he founded have cratered since combining with a special purpose acquisition company (Spac).

His 94 per cent decline in net worth is the largest wealth loss of anyone outside China who appeared on last year's Bloomberg Billionaires Index, exceeding even the 90 per cent drop of Carvana Co's Ernie Garcia III.

Only Chinese education-tech billionaires Zhang Bangxin and Larry Chen, who lost 96 per cent and 99 per cent of their fortunes, respectively, amid the country's crackdown on the industry, have notched larger percentage declines.

Mr Sverdlov's collapse is a cautionary tale of how Spacs - a financial maneuvre that boomed in recent years - can go from a means of wealth creation into one of destruction. Even some banks that helped create the Spac market are now spurning them over risk concerns, with Goldman Sachs and Bank of America both curtailing their involvement.

The once-niche market was seen as a way to help companies get a public listing while avoiding some of the disclosure requirements of an IPO, attracting all kinds of deep-pocketed financiers, celebrities and athletes. This year through mid-May, 66 Spacs had raised just US$11.5 billion on US exchanges, compared with 317 that had amassed US$102 billion at this point in 2021, according to data compiled by Bloomberg.

"Arrival is dealing with the negative halo effect of Spac companies," said Susan Beardslee, principal analyst at ABI Research.

Margin loan

Adding to Mr Sverdlov's troubles was a margin loan he took out last year from Citigroup against US$1.5 billion of Arrival stock. In April, a company controlled by the former billionaire granted the bank a security interest in about 5 per cent of his shares in exchange for US$79 million, which he used to pay back the loan.A former Russian deputy minister, Mr Sverdlov, 43, founded the UK-based company in 2015 using money from a previous fortune in telecoms. By 2020 he'd invested US$450 million in Arrival and the following year took it public after combining with CIIG Merger Corp, a Spac led by Peter Cuneo, the former chief executive officer of Marvel Entertainment.

Arrival's market value quickly soared to more than US$13 billion, making Mr Sverdlov one of the wealthiest people on the planet thanks to his roughly 75 per cent stake. Spacs were especially popular method at the time for taking EV companies public, with investors rewarding companies like Nikola Corp, Lordstown Motors and Canoo Inc with super-sized valuations. Last week, Canoo warned that it may not have enough cash to keep doing business.

Hampered by production delays and forced to abandon earlier forecasts, Arrival's share price has fallen about 95 per cent since its post-merger peak. Aside from concerns over its Spac route to market, investors don't appear enthusiastic about its plans to use microfactories to build electric vans and buses. The company - which currently has one factory in the UK and is building two more in the US - has yet to bring a product to market.

Unlike the founders of Nikola and Lordstown Motors, who left their companies after shares cratered, Mr Sverdlov is staying put. Partly that's out of necessity. The entity through which he controls Arrival, known as Kinetik, is required to maintain control of 50 per cent or more of its voting shares until the end of the year, according to a November securities filing.

Asia's SPAC hopefuls have nowhere to turn as IPO market dries up

Of 12 blank-cheque firms that have filed to go public in Hong Kong, only one has actually started trading. PHOTO: BT FILE

May 18, 2022

DUBAI (BLOOMBERG) - Asian sponsors of blank-cheque firms are facing a tough market for initial public offerings (IPOs) wherever they turn, as a combination of increasing regulatory scrutiny and fading investor demand shutters the window for new listings from the US to Asia.

In the past three months, at least six Asia-related special purpose acquisition companies (Spacs) seeking a combined US$1.3 billion (S$1.8 billion) from US IPOs have been scrapped, according to data provider Spac Research. Of 12 blank-cheque firms that have filed to go public in Hong Kong, only one has actually started trading.

It's a similar pattern in Singapore, where Spacs have stalled after three inaugural IPOs in January.

"The global IPO market has obviously been very quiet so far this year," Paul Uren, JPMorgan Chase and Co's Asia Pacific head of investment banking, said in an interview with Bloomberg TV. "What we need to see for that to change is lower volatility and investors with more of a risk-on mentality."

Asia was late to the Spac fest that gained pace in the United States in the midst of the pandemic as central banks flooded markets with liquidity and contributed to record volumes of IPOs last year. Exchanges from Hong Kong to Singapore rushed to set up their own Spac rulebooks in a bid to attract some of the activity, while Asian tycoons and entrepreneurs began listing blank-check firms in the US.

Asian sponsors that have abandoned their US Spac IPO plans this year include private equity firm Gaw Capital and Hong Kong-based investor Jeneration Capital Management. Both had initially filed for US IPOs in early 2021. Hony Capital Acquisition Corp and Serendipity Capital Acquisition Corp are other Spacs stemming from Asia that have officially pulled their planned US listings. Both Hony Capital and Gaw Capital had already cut the planned size of their IPOs as the market soured.

The US - the epicentre of the Spac market - has seen the industry go from boom to bust as investors turn their backs on speculative investments and as some international banks limit their involvement in blank-check firms after proposals from the SEC to clamp down on overly rosy growth and profit forecasts. A rush of interest during the stock market boom has resulted in a glut of more than 600 Spacs that are still looking out for deals.

In Asia, the outlook is similarly tepid. Just one Spac has gone public in Hong Kong, Aquila Acquisition Corp, while another 11 wait in the wings. A blank-cheque firm backed by VMS Asset Management has put its IPO on hold because of volatile markets, Reuters reported last month.Given the proposed US rule changes, "Ostensibly aligning Spacs more in lockstep with traditional IPOs, coupled with news that bulge bracket outfits are dialing down their involvement in such investment vehicles, I'd expect the appetite for Spacs in Hong Kong and Singapore to continue to decline," said David Blennerhassett, an analyst at Ballingal Investment Advisors.

The broader IPO market in Hong Kong has all but shut this year, following a global slowdown in listings due to rising inflation and central banks tightening monetary policy. Just US$2 billion has been raised through first-time share sales in the Asian financial hub this year, less than a 10th of the amount fetched a year ago, data compiled by Bloomberg show.

Still, some deals are going ahead. Middle Eastern alternative asset manager Investcorp last week raised almost US$260 million in a Spac that will target a combination with a company located in India. On Wednesday, Hong Kong Covid-19 testing laboratory Prenetics makes its stateside trading debut after a merger with tycoon Adrian Cheng's US-listed blank-cheque company Artisan Acquisition Corp.

"Hopefully, as market conditions become more accommodative, we will see more activity" in IPO markets, said JPMorgan's Uren, whose view is that there "will be relatively few Spacs" in Asia.

Grab revenue rises, loss narrows on delivery, ride demand

Grab managed to grow paying users 10 per cent after South-east Asian countries removed pandemic-era restrictions. PHOTO: ST FILE

May 19, 2022

NEW YORK (BLOOMBERG) - Grab Holdings said revenue rose 6 per cent in the first quarter after the ride-hailing and delivery company won back consumers as the pandemic receded in South-east Asia.

Revenue increased to US$228 million (S$316 million) after the Singapore-based company added sales from Jaya Grocer, a platform it acquired in January.

That was more than the US$139.2 million analysts were expecting, according to data compiled by Bloomberg.

Grab's net loss narrowed to US$435 million, as the company fights to gain profitability following years of heavy spending in pursuit of market share.

The company managed to grow paying users 10 per cent to 30.9 million after South-east Asian countries removed pandemic-era restrictions. Per-user spending climbed 19 per cent, it said.

Unlike other Internet companies that are grappling with cooling post-Covid-19 online activity, Grab's car-hailing and delivery businesses benefit as life returned to normal.

The company had struggled since becoming a publicly listed company in the United States through a merger with a blank-check company in December.

Mounting losses, coupled with a broad tech sell-off, have weighed on its shares, which have lost more than 70 per cent since the start-up went public.

Revenue from the delivery business jumped 70 per cent to US$91 million, while revenue from the mobility business declined 22 per cent to US$112 million.

Revenue from financial services rose to US$11 million.

Deliveries gross merchandise value (GMV) was US$2.56 billion versus its forecast of US$2.4 billion to US$2.5 billion.

Mobility GMV was US$834 million versus its forecast of US$750 million to US$800 million.

The company said it expects full-year revenue to increase to US$1.2 billion to US$1.3 billion.

Grab's cash and cash equivalents fell to US$3.4 billion at the end of March from about US$5 billion at the end of 2021, partly because of cash outflow from operating activities and the acquisition of Jaya Grocer.

Partner incentives climbed 55 per cent to US$216 million, while consumer incentives rose 85 per cent to US$344 million.

The company sees GMV growing 30 per cent to 35 per cent in 2022.

Grab shares rose more than 3.5 per cent in pre-market trading in New York.

Carousell ends talks on SPAC merger amid market rout, sources say

The platform Carousell was founded in 2012. ST PHOTO: CHONG JUN LIANG

MAY 19, 2022

HONG KONG (BLOOMBERG) - Online classifieds marketplace Carousell has recently ended talks to go public through a merger with blank-cheque company L Catterton Asia Acquisition Corp amid market volatility, according to sources familiar with the matter.

The special purpose acquisition company (Spac), which has been conducting due diligence on Carousell over the past few months, has not been able to reach a merger agreement with the company, the sources said.

The stock market rout has made it difficult to arrange a private investment in public equity (Pipe), the sources said, where typically other investors chip in funds alongside those contributed by the Spac itself to the merged entity.

Macroeconomic uncertainty and valuation concerns are also among the factors weighing on a potential deal, they added.

A representative for Carousell declined to comment, while a representative for L Catterton Asia Acquisition did not immediately respond to requests for comment.

Shares of L Catterton Asia Acquisition touched their lowest level in more than five weeks in New York after the Bloomberg News report.

The stock was down 0.2 per cent at its Wednesday close.

The companies were in exclusive talks to merge in a transaction that could have valued the combined entity at as much as US$1.5 billion (S$2.09 billion), Bloomberg News reported in January.

The deal was meant to include a Pipe worth a few hundred million dollars, sources familiar with the matter said at the time.

Enthusiasm for Spacs has waned amid heightened market volatility with a growing number of prominent deals fizzling out.

The changing regulations from the US Securities and Exchange Commission have also hurt sentiment in the once-heated sector.

The US-listed Spac is backed by L Catterton, the US$30 billion buyout firm minority-owned by Paris-based luxury goods company LVMH and billionaire Bernard Arnault's investment firm.

Led by managing partners Chinta Bhagat and Scott Chen, the Spac raised US$250 million last year to target a combination with companies in the high-growth, consumer technology sectors across Asia.

It is sponsored by L Catterton Asia's US$1.45 billion third fund.

Carousell was founded in 2012 and counts Telenor Group, Rakuten Ventures, Naver and Sequoia Capital India among its backers.

The company has since expanded to eight markets across South-east Asia, Taiwan and Hong Kong, allowing users to buy and sell a diverse range of products from cars to gadgets and fashion accessories.

It runs several online marketplaces, including Carousell, Chotot.com in Vietnam, Mudah in Malaysia and OneKyat in Myanmar, according to its website.

Mega SPAC mints $29 billion fortune that collapses in minutes

MSP, based in Florida, obtains reimbursements for payments wrongly made by Medicare and other healthcare groups. PHOTO: MSP RECOVERY/FACEBOOK

May 25, 2022

NEW YORK (BLOOMBERG) - If the Spac craze is over, it's going out with a bang by making a Miami lawyer who has owned speedboats named Class Action and Power Of Attorney one of the richest people in the United States - if only briefly.

MSP Recovery was valued at US$32.6 billion (S$44.7 billion) in its merger with special purpose acquisition company (Spac) Lionheart Acquisition Corp II, the largest such combination ever in the US as measured by enterprise value. It began trading on Tuesday on the Nasdaq, plunging more than 60 per cent to US$3.85 at 10.04am in New York, less than an hour after its debut.

Mr John Ruiz, 55, owns a 65 per cent stake in the company. That position was worth US$21.4 billion (S$29.4 billion) at the US$10 merger price, but plunged to US$8.3 billion after MSP began trading.

With the Spac boom veering towards a bust as risk appetite wanes, the merger could end up being one of the last outrageous deals to reach the market. It stands out for its transactions between stakeholders, huge fees and lack of capital raised.

Mr Ruiz, in an interview on Tuesday, said the drop in MSP's share price was a result of poor market conditions and was not specific to the company he founded in 2014.

MSP, based in Coral Gables, Florida, obtains reimbursements for payments wrongly made by Medicare and other healthcare groups. It combs records and identifies potentially erroneous payments using data analysis. It owns a portfolio of claims with a billed amount of US$1.5 trillion, though it says revenue from the business has not yet been substantial.

Billionaire lifestyle

That hasn't stopped Mr Ruiz, a son of Cuban immigrants, from living a billionaire lifestyle for some time.He purchased a Boeing 767 previously owned by Qantas Airlines to use as his private jet, the Miami New Times reported in April. The plane once would have flown about 300 people.

After a six-month refit costing almost US$10 million, it sports a theatre, two lounges, a master bedroom with a full bathroom and shower, and space for about 30 guests. The plane is registered to MSP Recovery Aviation, a company controlled by Mr Ruiz that MSP pays for transportation services.

Mr Ruiz and Mr Frank Quesada, the company's chief legal officer who has a stake in the post-combination company that is now worth about US$3.5 billion, separately own a law firm that will be the exclusive lead counsel for MSP. That positions them to receive 20 per cent of all recovered payments.

Meanwhile, it is the second post-merger Spac deal for Lionheart chief executive Ophir Sternberg, after taking fast-food chain BurgerFi International public in December 2020. Those shares traded at about US$3 on Tuesday, down 81 per cent since its merger. BurgerFi's founder sued Mr Sternberg earlier this year relating to an investment he said he made in the sponsor of Lionheart. The lawsuit was later withdrawn.

Mr Sternberg has a history with Mr Ruiz. They bought luxury powerboat manufacturer Cigarette Racing Team together last year. Also in 2021, Mr Ruiz got a US$20 million loan from Mr Sternberg to buy a condo he was developing. He will pay it back in shares of MSP.

"Any time we see these kinds of relationships, in particular financial relationships, between parties who are meant to be negotiating a transaction at arm's length, it raises a red flag as to whether it's a good deal," said professor of corporate finance Usha Rodrigues at the University of Georgia's law school, who has written about Spacs.

Mr Ruiz said such issues were "red herrings" and do not matter if they are properly disclosed.

"People have multiple business transactions among themselves - that's the way America works," he said.

GIC-backed Traveloka nears $274 million funding after ending Spac talks

Traveloka is pulling in fresh funds after its board decided not to pursue a listing via Bridgetown Holdings. PHOTO: TRAVELOKA/LINKEDIN

June 3, 2022

SINGAPORE (BLOOMBERG) - Traveloka, South-east Asia's biggest online travel start-up, is close to raising more than US$200 million (S$274 million) from investors after ending talks to go public via a merger with a blank-cheque company last year, according to people familiar with the matter.

The Jakarta-based firm is pulling in fresh funds after its board decided not to pursue a listing via Bridgetown Holdings, a special purpose acquisition company (Spac) backed by billionaires Richard Li and Peter Thiel.

Traveloka, backed by investors including sovereign wealth fund GIC and Expedia Group, is aiming for an initial public offering in the United Stated this year but the location and time could still change, the people said.

A Traveloka representative declined to comment. The current fund raising is not finalised and could also change, the people said.

The valuation of the deal now under discussion could not be learnt. Traveloka had been valued at US$3 billion, according to CB Insights, but Bloomberg News reported in 2020 that it was seeking funds at a lower valuation.

South-east Asia's tourism industry was plunged into a deep crisis in the pandemic when lockdowns all but ground travel to a halt. Traveloka ventured into financial services during the pandemic by partnering with commercial banks including Bank Rakyat Indonesia Persero, Bank Negara Indonesia and Siam Commercial Bank.

Things have started to look up this year as South-east Asian countries removed pandemic-era restrictions and reopened borders for travel. For example, Thailand - where international tourism contributes about 15 per cent to gross domestic product - is seeing a rush of foreign travellers after scrapping its Covid-19 testing and quarantine requirements.

Traveloka claims to be a lifestyle "super-app", allowing consumers to book a range of services including airline tickets and hotels as well as spas and tourism attractions. It also offers food delivery and financing, payment and insurance products. Its app has been downloaded more than 60 million times.

Pimco stops sponsoring ex-Credit Suisse boss’ SPAC

SAT, JUN 18, 2022It’s very rare for one of a SPAC’s early backers to end their sponsorship after it starts trading

PHOTO: THE BUSINESS TIMES

FUND management giant Pimco has ended its role as a sponsor of former Credit Suisse Group chief executive Tidjane Thiam’s fintech SPAC.

Pimco, which was one of the financial backers behind the creation of Thiam’s Freedom Acquisition I Corp., has agreed to sell its entire stake in the sponsor vehicle for the blank-cheque firm to an affiliate of China Bridge Capital, according to a Jun 8 filing.

Jamie Weinstein, Pimco’s head of corporate special situations, has resigned from the board of the special purpose acquisition company effective Jun 6. China Bridge Capital founder Edward Zeng has been appointed as a director in his place, Freedom Acquisition said in the filing.

It’s very rare for one of a SPAC’s early backers to end their sponsorship after it starts trading. Blank-cheque firms often attract investors based on their sponsors’ credentials.

Sponsors help front the money to set up a blank-cheque firm and, in return, stand to benefit handsomely from a successful deal. That’s become less of a sure bet as souring sentiment leaves hundreds of SPACs scrambling to find a target in a difficult environment.

Freedom Acquisition raised US$345 million in its February 2021 initial public offering (IPO) after Thiam increased the size of the transaction. It’s seeking a merger with a technology-enabled business in the financial services industry, according to previous filings. One of Pimco’s private funds was part of its sponsor group and committed to buying shares in the IPO.

There’s been a sharp turnaround in sentiment from last year, when high-profile investors were flocking to support SPACs from financiers in Europe. Thiam’s blank-cheque IPO attracted investors including Francois Pinault, the billionaire founder of luxury conglomerate Kering.

The listing recorded an oversubscription level in the mid-teens, and about a third of the deal went to rich individuals’ family offices, Bloomberg News reported at the time.

Thiam is executive chairman of the SPAC, which is run by one of his key lieutenants, ex-investment banker Adam Gishen. Freedom Acquisition, which is still hunting for a deal, has until February 2023 to complete a transaction or it will need to return investors’ capital.

Silicon Valley venture capital firm Tribe Capital announced this month it’s ending the sponsorship of a SPAC it helped set up. The investment firm will no longer back the sponsor of Tribe Capital Growth Corp. I, which started trading last year and hasn’t found a target yet. BLOOMBERG

Bill Ackman's Spac returns $5.6b to investors; too early to tell if S'pore Spac market will lose steam

Mr Bill Ackman said the unexpected recovery of capital markets thwarted the Spac's efforts to find a target company. PHOTO: BLOOMBERG

Jul 12, 2022

NEW YORK (BLOOMBERG) - Billionaire investor Bill Ackman told investors in the largest blank-cheque company that it is returning their US$4 billion ($5.6 billion) after failing to consummate a merger deal.

The move follows a dip in interest in special purpose acquisition companies (Spacs) worldwide, including in Singapore, where the share prices of such companies have fallen between 2 per cent and 6 per cent since listing this year.

Pershing Square Tontine Holdings' (PSTH) efforts to find a target company were thwarted in part by what Mr Ackman said was the unexpected recovery of capital markets during the coronavirus pandemic, according to a statement on Monday (July 11).

"The rapid recovery of the capital markets and our economy were good for America but unfortunate for PSTH, as it made the conventional initial public offering (IPO) market a strong competitor and a preferred alternative for high-quality businesses seeking to go public," said Mr Ackman, referring to the blank-cheque firm by its trading symbol.

PSTH in July 2020 helped catapult Spacs to record levels as the pandemic took hold. Since the start of that year, more than 1,200 Spacs have raised in excess of US$271 billion in IPOs, almost three times the volume of all previous years combined, according to data compiled by Bloomberg.

A Spac is a company without commercial operations and is formed strictly to raise capital through an IPO for the purpose of acquiring or merging with an existing company.

Experts said it will take more time to gauge how well Singapore's Spacs fare compared to global peers.

Mr Tham Tuck Seng, capital markets leader at PwC Singapore, said: "It is still too early to say whether the local Spacs are in or out of favour as investors' preference will very much be influenced by their view on the quality and valuation of the eventual Spacs' acquisition targets."

He added that the risk of Singapore's three Spacs returning funds to investors is currently low. This is because they are backed by experienced and reputable sponsors in the mergers and acquisitions space and still have ample time to look for targets.

In Singapore, Spacs are given two years with an additional one-year optional extension to complete a merger or acquisition.

In addition, more than 90 per cent of the funds raised are held in escrow, hence credit default risk is low, Mr Tham said.

Singapore, which announced its Spac listing framework on Sept 3 last year, saw three blank-cheque companies list on the local exchange in the first half of this year.

The listings raised total proceeds of about $528 million, accounting for the bulk of the funds raised in Singapore's IPO market for the period.

The Spacs are Vertex Technology Acquisition Corp, which raised $208 million, and Pegasus Asia and Novo Tellus Alpha Acquisition, which raised $170 million and $150 million respectively.

Grab’s sales beat estimates, but falls behind GoTo in market value

Grab still counts Singapore as its largest market even as it tries to expand in countries including Indonesia, South-east Asia's largest economy. PHOTO: ST FILE

UPDATED

Aug 26, 2022

SINGAPORE (BLOOMBERG) - Grab Holdings reported a better-than-expected 79 per cent revenue increase, buoyed by resilient demand from consumers who continued to hail rides and order food despite rising inflation.

Revenue climbed to US$321 million in the second quarter, the Singapore-based company said in a statement Thursday. That beat the US$273.1 million average of analysts’ estimates compiled by Bloomberg.

Grab’s net loss narrowed to about US$547 million as it fights to reduce cash burn after spending several years locked in an expensive battle for dominance in the region.

Grab, led by Anthony Tan, has struggled since it went public via a merger with a US blank-check company last year.

Its shares have lost more than 60 per cent of their value since then as losses piled up during pandemic-era lockdowns and money-losing companies have fallen out of favor with investors.

Now Mr Tan must navigate through an era of rising inflation that could dampen demand just as Grab is trying to emerge from the Covid challenges.

Grab said revenue this year is expected to be US$1.25 billion to US$1.3 billion, compared with its previous forecast of US$1.2 billion to US$1.3 billion.

The company said its gross merchandise value will expand 21 per cent to 25 per cent this year, compared with 30 per cent to 35 per cent it had projected previously.

Once South-east Asia’s most valuable start-up, Grab is faltering behind GoTo Group in the stock markets as it fights to gain ground on its Indonesian ride-hailing rival’s home turf.

The unprofitable companies are both struggling to convince investors of their moneymaking potential after staging their stock market debuts in recent months.

Yet GoTo has fallen less than its competitor and its market value of about US$26 billion is now twice that of its Singaporean peer.

Grab and GoTo have been locked in an expensive battle for dominance over the past several years.

Grab still counts Singapore as its largest market even as it tries to expand in countries including Indonesia, South-east Asia’s largest economy.

GoTo is enjoying a leadership position in its home nation of more than 270 million people whose mobile-savvy consumers are shopping on its online-retail platform Tokopedia and ordering rides and food via its Gojek app.

The growth potential of Indonesia has helped GoTo outperform Grab, which became a publicly traded company through a merger with Brad Gerstner’s Altimeter Growth in December. GoTo has lost about 3 per cent since its initial public offering in Jakarta in April, while Grab is down more than 60 per cent since combining with the US blank-cheque company.

While Gojek has a strong grasp of the crucial Indonesia market, Grab has made inroads in food delivery.

Grab had 49 per cent of the Indonesian food delivery market last year, compared with GoTo’s 43 per cent, according to Momentum Works.

GoTo is set to release results on Aug 30.

PropertyGuru quarterly earnings back in black for first time since US listing

PropertyGuru reported that net income for the second quarter of FY2022 ended June 30 came in at $3.8 million. ST PHOTO: DIOS VINCOY JR

Janice Lim

Aug 26, 2022

SINGAPORE (THE BUSINESS TIMES) - PropertyGuru is the first among Singapore-based start-ups to turn profitable following its listing in the United States.

For the first time since its listing in March, the property portal reported on Thursday (Aug 25) that its net income for the second quarter of FY2022 ended June 30 had turned positive, coming in at $3.8 million.

This is a reversal from a net loss of $139.8 million in the same quarter a year ago.

PropertyGuru's revenue increased 44.3 per cent year on year to $33 million from $23 million over the same time period. For the first half of FY2022, revenue came in at $61.3 million.

The proptech company said in a statement that this was balanced with growth across all markets and business segments.

"Investments made over the last 2 years are gaining traction now, as real estate markets emerge from the pandemic-induced slowdown," it said.

Its Malaysia marketplace segment recorded the highest revenue growth, increasing from $2.2 million to $5.9 million, a jump of 169.7 per cent.

Revenue for its Singapore marketplace increased by 30.6 per cent to $17.3 million, from $13.2 million over the same period.

Its adjusted earnings before interest, taxes, depreciation and amortisation (Ebitda) was $3 million in the second quarter of FY2022, a reversal from a loss of $2 million a year ago.

Its earnings per share, attributable to shareholders of the New York-listed company, is also in the black at 2 cents per share, compared to a loss of U$2.48 per cent share over a year ago.

PropertyGuru maintains its full-year outlook of approximately 44 per cent revenue growth, driven by the strong start to 2022 and growth across all core markets.

It expects to return to full-year positive adjusted Ebitda, as it realises the full benefits of its pandemic-period investments. However, it also cautioned that this outlook could be hit by uncertainty around rising inflation and interest rates, government policy and fiscal intervention, political instability and other macro factors.

Hari Krishnan, the company's chief executive officer and managing director, said that its strategy of increasing its customer value proposition is proving effective, as returns on investments made over the past few years have begun to come in.

"Going forward, we expect to capitalise on both organic and inorganic opportunities to further expand our world-class solutions to customers. Even with our growing business strength, we remain vigilant around potential market challenges from rising inflation and interest rates and other global macro headwinds," he added.

PropertyGuru's shares closed up 2.6 per cent or 12 US cents at US$4.80 on Thursday in New York, after its earnings announcement.

Grab sees no big layoffs despite weak market

Grab has not got to the "desperate" point of a hiring freeze or mass layoffs, said its chief operation officer. ST PHOTO: KUA CHEE SIONG

Sep 25, 2022

SINGAPORE - Grab - South-east Asia's biggest ride-hailing and food delivery firm - does not envisage having to undertake mass layoffs as some rivals have done, and is selectively hiring, while reining in its financial service ambitions.

Chief operating officer Alex Hungate said that earlier in 2022, Grab had been worried about a global recession and was "very careful and judicious about any hiring", and as a result, it had not got to the "desperate" point of a hiring freeze or mass layoffs.

"Around midyear, we did some kind of specific reorganisations, but I know other companies have been doing mass layoffs, so we don't see ourselves in that category," Mr Hungate, 56, told Reuters in his first interview since joining Singapore-based Grab Holdings in January.

The company was hiring for roles in data science, mapping technology and other specialised areas, though every hire was a much bigger decision than it used to be, he said.

"You want to make sure that we're conserving capital. The hurdle for making a hire has definitely been raised," Mr Hungate added.

Decade-old Grab, a household name in South-east Asia, had about 8,800 staff at the end of 2021. Like its rivals, it has benefited from a boom in food services during the Covid-19 pandemic, while ride-hailing suffered.

As economies open up, food delivery demand is softening while ride-hailing has yet to fully recover. Tech valuations have also fallen dramatically, and inflation, slower growth and rising interest rates have emerged as risks.

In recent weeks, South-east Asia's largest e-commerce firm Shopee cut jobs in various countries and shut some overseas operations, after parent Sea reported widening losses and scrapped its annual e-commerce forecast.

Mr Hungate, a veteran of the financial services, logistics and food sectors, has spearheaded a push away from low-margin business lines as Grab races to turn profitable.

Second-quarter loss narrowed to US$572 million (S$817 million), from US$801 million a year earlier. But in August, it cut its gross merchandise volume outlook for the year, blaming a strong dollar and ebbing food delivery demand.

In August, Grab said it was shutting dozens of so-called dark stores - distribution hubs for on-demand groceries - and slowing the roll-out of its "cloud kitchen" centralised facilities for deliveries.

"The other area where we've really tightened our strategic intent is in financial services, where we were growing payments, wallets and non-bank financial lending quite significantly off-platform and on our platform," said Mr Hungate.

Grab reorganised its fintech unit this year to focus on more lucrative areas, and Reuters reported on the exit of some senior executives.

Grab is now mainly focusing on selling its lending products and insurance on its platform to merchants and drivers who often repay from their income streams on the platform.

"As we make this shift, the business mix will move towards higher margins," said Mr Hungate.

Grab, which operates in 480 cities in eight countries, has more than five million registered drivers and more than two million merchants on its platform.

It caught global attention in 2018 when it acquired Uber's South-east Asian business after a costly five-year battle.

Grab is betting on growing financial services by offering banking and other products with partner Singtel in key markets.

It listed on the Nasdaq last December after a record US$40 billion merger with a blank-cheque company.

Mr Hungate said it was "good timing" for the company to look again at how it spends money, given the increased scrutiny of finances and the need to respond to shareholders.

"Maybe we were lucky in a sense that the discipline of being a public company came at just the right time," he said, adding that Grab's US$7.7 billion cash liquidity meant it was one of the best-capitalised industry players in South-east Asia.

Grab's shares have tumbled about 60 per cent this year, to give it a market value of US$10.6 billion.

Reuters reported in August that Grab's Indonesian rival GoTo was seeking to raise about US$1 billion through a convertible bond issue.

Mr Hungate said Grab would provide details of its progress towards profitability and other metrics at its first investor day on Tuesday.

REUTERS

Grab sees slower growth while it pursues turning profitable in 2024

Grab Holdings chief executive officer Anthony Tan says Grab is firing on all cylinders to improve its profitability trajectory. PHOTO: ST FILE

UPDATED

Sep 27, 2022

SINGAPORE - Grab Holdings expects sharply slower revenue growth next year as the South-east Asian Internet giant adjusts to a market downturn and speeds up efforts to reverse years of losses.

The ride-sharing and delivery provider gave the forecast for a 45 per cent to 55 per cent increase at its first investor day, trying to reassure shareholders that it is on the rebound. Analysts were projecting 84 per cent growth for 2023 on average.

The company also said it anticipates breaking even in the second half of 2024 on a conditional basis, and excluding one-time items.

“Looking ahead, we’re firing on all cylinders to improve our profitability trajectory,” chief executive officer Anthony Tan said at the company’s event in Singapore on Tuesday. “Grab is trying to achieve this by growing our top line in a sustainable manner.”

Grab, long considered one of the rising stars of South-east Asia, has struggled since it went public through a merger with a special purpose acquisition company (Spac) in December 2021. Shares have tumbled more than 70 per cent as the company racked up losses in the post-Covid-19 era and the stock market soured on unprofitable tech ventures.

The company, which went public by merging with Altimeter Capital Management’s Spac in what was originally a US$40 billion (S$57.4 billion) deal, is now worth about US$10.8 billion.

Grab, which counts Japan’s SoftBank Group and Uber Technologies as its two biggest shareholders, expects losses to narrow to US$380 million on an adjusted basis in the second half of 2022.

Executives said it now aims to break even by the latter half of 2024 on an adjusted earnings basis before interest, taxes, depreciation and amortisation (Ebitda). That excludes as many as a dozen exceptional items, from fair value losses in investments to “restructuring costs”.

“It’s the right strategy, although the market is less patient now,” said DBS analyst Sachin Mittal, who rates Grab a "hold". He had estimated revenue growth of 77 per cent for 2023 and adjusted Ebitda breakeven in 2025.

In the meantime, the company said it has about US$6 billion of cash and liquid items on hand, giving it time to turn its on-demand and fintech services around.

Mr Tan’s vision of creating a so-called super app for South-east Asia was aggressive, but led to extensive losses. Grab lost US$3.4 billion in 2021 and has piled up almost US$1 billion of losses in the first two quarters of this year. Revenue this year is set to roughly double to as much as US$1.3 billion, Grab said last month.

The company started out focused on the ride-hailing business and competed effectively against Uber. The US company ended up selling Grab its business in South-east Asia in return for a stake in its Singapore rival. Grab then launched an ambitious - and expensive - campaign to expand into adjacent businesses, including food delivery and finance. It also added everything from hotel bookings and health services to gifts and entertainment experiences to its app.

Chief operating officer Alex Hungate said Grab will now have a more defined strategy, outlining an effort to make the company "South-east Asia's largest and most efficient on-demand platform that enables local commerce and mobility".

"This is not just a bunch of words on a page," he said. "This defines our strategy in a more focused way than we've ever defined before."

Grab also plans to expand its monthly subscription programme, where users pay a flat fee for deals across mobility, food and parcel delivery services on its app. It will also focus on corporate customers, groceries and advertising and fintech services to boost profitability.

The company is counting on turning around its loss-making delivery and financial services businesses to hit its profit target. It had previously forecast its deliveries division would get into the black by the second quarter of next year, when it should have margins of at least 3 per cent.

Grab expects its digital bank operation, run with Singtel, to break even only by 2026. BLOOMBERG

US rate hikes put pressure on SPACs

The New York Stock Exchange in August. PHOTO: AFP

OCT 23, 2022

NEW YORK - As the US economy slowly buckles under the strain of soaring interest rates, corporate bankruptcies will pile up.

Few on Wall Street doubt this. The real question they have is which sorts of companies and industries will succumb first.

A good place to start looking: Businesses that went public via special purpose acquisition company (Spac), that anything-goes world of speculative investing that has come to represent the unbridled financial mania the pandemic wrought and the bust that followed.

Bedrock AI, an investment research company that scours regulatory documents, pored through filings issued by hundreds of de-Spacs – which are Spacs, or blank-cheque companies, that found companies to merge with – and determined that more than 40 per cent of them flagged questions about their own viability as going concerns, signalling a risk they could go out of business. A few of them have since filed for bankruptcy.

It is a high percentage, more than double the rate of such filings by companies that went public via traditional initial public offerings over the same period, according to Bedrock AI. And it is a reminder, analysts say, that fewer restrictions were in place and earnings forecasts were very rosy – targets of 50-, 100-, even 300-fold increases in revenue were common – during a nine-month boom in which investors blindly bid up the value of just about anything Spac that financiers brought to market.

With the US Federal Reserve pushing up rates at the fastest pace in decades and demand in the economy cooling, those projections look even more unrealistic now.

“There was so much Spac capital looking for deals that they were lowering the bar for companies that they were partnering with because they were highly motivated to get a deal done,” said Mr Greg Martin, co-founder of Rainmaker Securities, a merchant bank focused on private securities deals.

“You’ll see a greater than expected percentage of bankruptcies.”

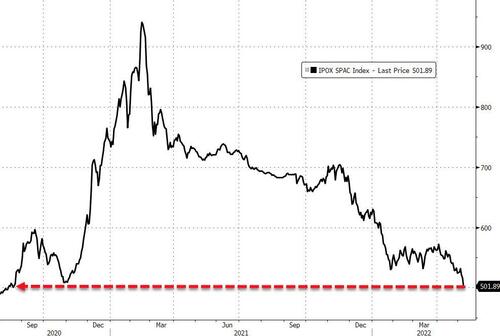

An index that tracks de-Spacs is down 62 per cent this year, and 82 per cent since hitting a peak in February 2021.

All told, more than a quarter of the roughly 400 companies that merged with a Spac are now trading below US$2 a share, just a fraction of the US$10 mark the blank-cheque companies typically go public at.

Battered share prices paired with soaring interest rates may put companies with fragile balance sheets in jeopardy. More than 75 former Spacs are already likely to need more financing in the next year to just keep operating. Biotechnology businesses, companies pushing electric vehicles and those who hoped to ride the environmental, social and governance hype are most at risk based on cash on hand and their current spending habits.

Canoo, an electric vehicle start-up that has a pact with Walmart to sell electric vans, had just US$34 million (S$48.4 million) in cash as at June 30.

A month earlier, it issued a warning about its ability to continue as a going concern. But it does have options to access at least US$500 million – one through a deal with hedge fund Yorkville Advisors, and a mixed securities shelf registration. Its stock has sunk 90 per cent since its December 2020 debut and it reported a net loss of US$289.8 million in the first six months of the year.

View, a maker of smart-glass products, has just US$111 million in cash and is seeking to raise additional capital while warning in a file dated Aug 8 of its ability to fund operations beyond next month. The company has reported a net loss of more than US$135 million so far this year. Its stock closed at 99 US cents on Oct 14. When it debuted back in March, it traded near US$9.

Winding down

Since June, two companies that merged with Spacs filed for bankruptcy after less than a year of being public. Retail start-up Enjoy Technology and electric vehicle company Electric Last Mile Solutions met the same fate in June, while Packable Holdings, an e-commerce business backed in part by the Carlyle Group, started to wind down operations in August after a blank-cheque merger collapsed.“With these market conditions, there are a lot of companies that are going to need to go away or recapitalise,” said Mr Mike Bennett, managing partner at investment banking company Crewe Capital. “There really are fewer options or no options for some industries like pre-profitable tech unless you’re an outlier or focused on industries doing well even with the market conditions.”

Many of the Spac industry’s most savvy investors are opting to eat millions in losses and close their doors. Serial dealmaker Bill Foley joined “Spac king” Chamath Palihapitiya and billionaires Bill Ackman and Sam Zell when he said he would return roughly US$2.1 billion to investors and shutter a pair of blank-cheque firms.

At least 23 blank cheques have liquidated in 2022, more than double the total seen over the previous five years, data compiled by Spac Research show.

Despite the malaise, some Spac deals continue to lure investors. LiveWire Group, the electric motorcycle business spun off by Harley-Davidson, has been among those able to complete mergers. BLOOMBERG

Stablecoin issuer Circle’s Spac deal with Concord scrapped

The collapse of Circle’s Spac comes after more than year of falling crypto prices. PHOTO: CIRCLE/TWITTER

UPDATED

DEC 6, 2022

LONDON – Circle Internet Financial, the issuer of the world’s second-largest crypto stablecoin, USDC, said its planned merger with special purpose acquisition company (Spac) Concord Acquisition has been scrapped.

Circle received in-principle approval in November from the Monetary Authority of Singapore to offer digital payment token products.

Termination of the deal with Concord underscores receding enthusiasm for both Spacs and cryptocurrencies as turbulent markets fuel a bearish sentiment for risky bets.

An amendment to the deal in February doubled Circle’s valuation to US$9 billion (S$12 billion), when Circle’s USDC stablecoin had a market circulation of about US$52 billion – a figure that has since dropped to around US$43.4 billion, according to pricing data from CoinGecko.

The collapse of Circle’s Spac deal comes after more than a year of falling crypto prices, which alongside several major hacks and company failures, have damaged the crypto industry’s reputation. The bankruptcy of crypto exchange FTX, which is being investigated by a number of United States authorities on allegations of potential mishandling of customer assets, has worsened that landscape.

Circle joins a growing list of private companies, ranging from Bitcoin miner Prime Blockchain to investing app Acorns Grow, that have had mergers fall apart. At least 56 Spac tie-ups have been called off in 2022, more than double the number in the five years prior, as the Spac industry and global markets have been rocked by volatility.

The stablecoin issuer is not likely to be the last Spac deal to crumble, with nearly 150 racing against deadlines to complete mergers amid market turmoil.

Circle chief executive Jeremy Allaire said becoming a public company “remains part of Circle’s core strategy”. The company became profitable in the most recent quarter, the statement said, with total revenue and reserve interest income of US$274 million and net income of US$43 million.

Circle raised an additional US$400 million in funding in April from traditional Wall Street names, including BlackRock, Fidelity Management and Research, and Marshall Wace.

Mr Bob Diamond, chairman of Concord and former chief executive of Barclays, said in a statement on Monday that he remained confident in blockchain’s ability to disrupt financial services, and of Circle’s future growth. He added that a “regulatory-first approach” to building trust between crypto and the financial sector “has never been more important”.

Spacs are known as blank cheques because they raise money in initial public offerings (IPOs) with the goal of taking an unidentified company public. They give themselves a short window, typically two years, to buy something or return the cash to investors. Management teams can get short extensions to find and close deals, but they usually have to get shareholder approval and pay them to do it.

The Spac ecosystem has been hammered by a broader rout in more speculative assets amid concerns about increased government oversight. The De-Spac Index is down 68 per cent in 2022 compared with a 15 per cent drop in the S&P 500 Index, as the companies that have gone public through blank-cheque firms struggle. More than one-third of about 400 firms that merged with a Spac are now trading below US$2 a share.

BLOOMBERG, REUTERS

Singapore fintech MoneyHero tumbles in trading debut after merger with US Spac

Chief executive Prashant Aggarwal (centre) said the group opted to list in the US to gain exposure to a larger and more diverse investor base. PHOTO: MONEYHERO

Kang Wan Chern

Deputy Business Editor

OCT 17, 2023

SINGAPORE – Financial products platform MoneyHero Group fell on its first day of trading on the Nasdaq stock exchange, as it joined a list of Singapore start-ups going public in the US despite poorer investor appetite for growth stocks in 2023.

Shares of MoneyHero, which is dual-headquartered in Singapore and Hong Kong, sank 42.2 per cent from their opening price of around US$5.39 to close at US$3.39 on Friday, when they began trading after the firm’s merger with Bridgetown Holdings.

Nasdaq-listed Bridgetown is a special purpose acquisition company (Spac) backed by PayPal co-founder Peter Thiel’s venture capital firm Thiel Capital and Pacific Century Group, the private investment vehicle of Mr Richard Li, son of Hong Kong tycoon Li Ka Shing.

The deal valued MoneyHero at an enterprise value, or total economic value taking into account the firm’s equity and debt, of US$310 million (S$425 million), the fintech firm said on Friday.

MoneyHero chief executive Prashant Aggarwal told The Straits Times that the company received US$100 million in gross proceeds from the merger, which it will utilise to expand its existing portfolio of products in South-east Asia and invest in new products such as insurance and rewards programmes.

The fintech firm operates online platforms that compare and recommend personal financial products such as credit cards, personal loans, mortgages and insurance.

These include personal finance websites SingSaver and Seedly in Singapore, its largest market, and other similar platforms in Hong Kong, Taiwan, Malaysia and the Philippines.

The firm earns a fee each time a consumer signs up for a service with the financial institutions through one of these platforms.

It has approximately 9.1 million unique monthly users and more than 270 commercial partner relationships with financial institutions, and in 2022 saw a total of 1.3 million product service applications, up 62.5 per cent from 2021.

MoneyHero competes with other platforms such as MoneySmart, which is aiming for an initial public offering (IPO) within the next two years.

GoBear, another Singapore-based firm offering similar services, shuttered in 2021 due to the inability to raise funds.

Mr Aggarwal said MoneyHero opted to list in the United States to gain exposure to a larger and more diverse investor base at a time when interest in South-east Asian tech companies is high.

“This can be seen from the low redemption levels of 36 per cent (in Bridgetown public shares) despite the current market conditions. In other markets, redemptions can be as high as 90 per cent, especially in this climate,” he said.

Spacs are shell companies formed to raise capital through an IPO with the intention of later acquiring or merging with an existing private company.

Share redemptions provide investors who do not agree with the acquisition target or its valuation with an option to redeem their shares and recover their initial investment in the Spac before it completes the transaction.

Mr Aggarwal added that US investors are excited about MoneyHero’s “deep understanding and growth potential in Singapore as well as other emerging markets in South-east Asia”, leading to the merger with Bridgetown.

MoneyHero is also backed by Mr Richard Li, who participated in funding rounds for the firm in the past.

MoneyHero was founded in Singapore in 2014 as CompareAsia Group.

It rebranded to Hyphen Group after acquiring product review platform Seedly from fintech firm ShopBack in 2020, and now trades under the MNY ticker following the merger with Bridgetown.

The company, which has yet to turn profitable, in 2022 implemented a restructuring to bring down costs.

This involved two rounds of layoffs – which included its then CEO of more than six years. Mr Aggarwal, who joined MoneyHero in 2016 as its chief commercial officer, took over as CEO in April 2022.

The firm now employs a total of 349 staff across five markets, 99 of whom are in Singapore. It has a headcount of 129 in the Philippines, which is its fastest-growing market.

Consequently, MoneyHero was able to bring down its adjusted operational losses to US$900,000 for the first half of 2023, compared with losses of US$5.6 million in the second half of 2022, and US$10.9 million in the first half of 2022. Revenue for the period remained flat at US$34.9 million.

This is MoneyHero’s second attempt at going public after a merger reportedly valuing it at US$1 billion with blank-cheque company Provident Acquisition Corporation in 2021 fell through.

Referring to the big difference in the company’s valuation then and now, Mr Aggarwal said: “Investors have matured in how they look at growth start-ups. Just a few years ago, valuations were all about topline growth at the expense of bottom lines, but now they expect more sustainable growth.”

The recent merger also comes three years after Mr Li and Mr Thiel first took Bridgetown public as a Spac targeting South-east Asia tech start-ups in October 2020.

The pair listed a second blank-cheque company, Bridgetown 2, on the New York Stock Exchange in January 2021.

It later merged with Singapore online real estate firm PropertyGuru in March 2022. Shares of PropertyGuru have halved since they began trading.

The other Singapore company to have gone public via a Spac in the US is Grab Holdings, which merged with Nasdaq-listed Altimeter Growth Corp in December 2021. Shares of Grab are down nearly 69 per cent since then.

Singapore Spac Vertex Technology to buy Taiwanese streaming platform for up to $925 million

Singapore's first listed Spac has announced a landmark deal. PHOTO: LIANHE ZAOBAO

Timothy Goh

OCT 2, 2023,

SINGAPORE - Temasek-backed Vertex Technology Acquisition Corporation (VTAC), the first Spac listing on the Singapore Exchange (SGX), has inked a deal to buy Taiwanese live-streaming platform 17Live for up to $925.1 million.

If the deal goes through, VTAC would become Singapore’s first special purpose acquisition company to acquire a target firm. The merged company would be valued at up to $1.16 billion.

VTAC said on Monday the conditional sale and purchase agreement is subject to approval by its shareholders and SGX. It expects to secure necessary approvals by end-2023, after which the firm would be renamed 17Live Group and trade on SGX’s mainboard.

VTAC chief executive Jiang Hong Hui said: “We are proud to be the first SGX Spac to announce a business combination.”

“We are thrilled to work with the 17Live team as they continue to break new grounds in the evolving consumer-Internet space as an innovative and cutting-edge market leader.”

A Spac or blank-cheque company is created to raise capital through an initial public offering (IPO) for the purpose of acquiring or merging with a private firm.

VTAC’s merger with 17Live will see it acquire the entire issued and paid-up share capital of its target.

It proposes to finance the acquisition through the issue of 160.6 million new shares at $5 each, amounting to $803 million, to 17Live shareholders.

If 17Live hits the financial target set, an earnout of 24.4 million new shares at $5 each will be allotted to applicable shareholders, amounting to $122 million.

17Live chairman and co-founder Joseph Phua said: “Listing on SGX will allow 17Live to grow its businesses in South-east Asia and globally.”

Founded in 2015, 17Live operates the top Internet live-streaming platform by revenue in Japan and Taiwan. It also has a regional presence in Singapore, the Philippines and Malaysia. As at June, it has contracts with roughly 87,000 live-streamers.

The content on 17Live spans music, games, education and fashion, among others. Live-streamers on the platform interact and socialise in real time with users, who can send virtual gifts, which results in successful monetisation.

17Live has introduced new initiatives to drive future sustainable growth, such as V-Livers, live-streamers who use computer-generated characters to represent themselves, as well as in-app gaming and live commerce.

17Live co-founder and chief technology officer Jing Shen Ng said: “Beyond growing in Japan and Taiwan, we see opportunities for geographical expansion... We see the SGX as the perfect expansion into South-east Asian markets.

“In addition to Asia, we also see global opportunities for V-Livers specifically in the United States.”

In 2022, 17Live generated revenue of US$363.7 million (S$497 million). It has reported positive earnings before interest, taxes, depreciation and amortisation (Ebitda) since 2020.

VTAC is sponsored by Vertex Venture Holdings, a subsidiary of Singapore’s investment firm Temasek. It raised about $200 million in its IPO in January 2022.

The Spac was the first of three to list on the Singapore Exchange (SGX) in January 2022. The other two Spacs are Pegasus Asia and Novo Tellus Alpha Acquisition. The trio raised IPO proceeds of about $528 million in total.

Under the SGX framework, they have a two-year deadline from listing to identify and acquire a target company, although an extension of 12 months may be considered under prescribed conditions.

Shares of VTAC, which have risen 6.2 per cent to date this year, last traded at $4.81 on Friday.

Similar threads

- Replies

- 3

- Views

- 552

- Replies

- 0

- Views

- 538

- Replies

- 9

- Views

- 1K