http://sbr.com.sg/economy/in-focus/...-rising-redundancies-imf#sthash.YPE2c3Mi.dpuf

Singapore economy under threat from high leverage, rising redundancies: IMF

Published: 11 May 2016

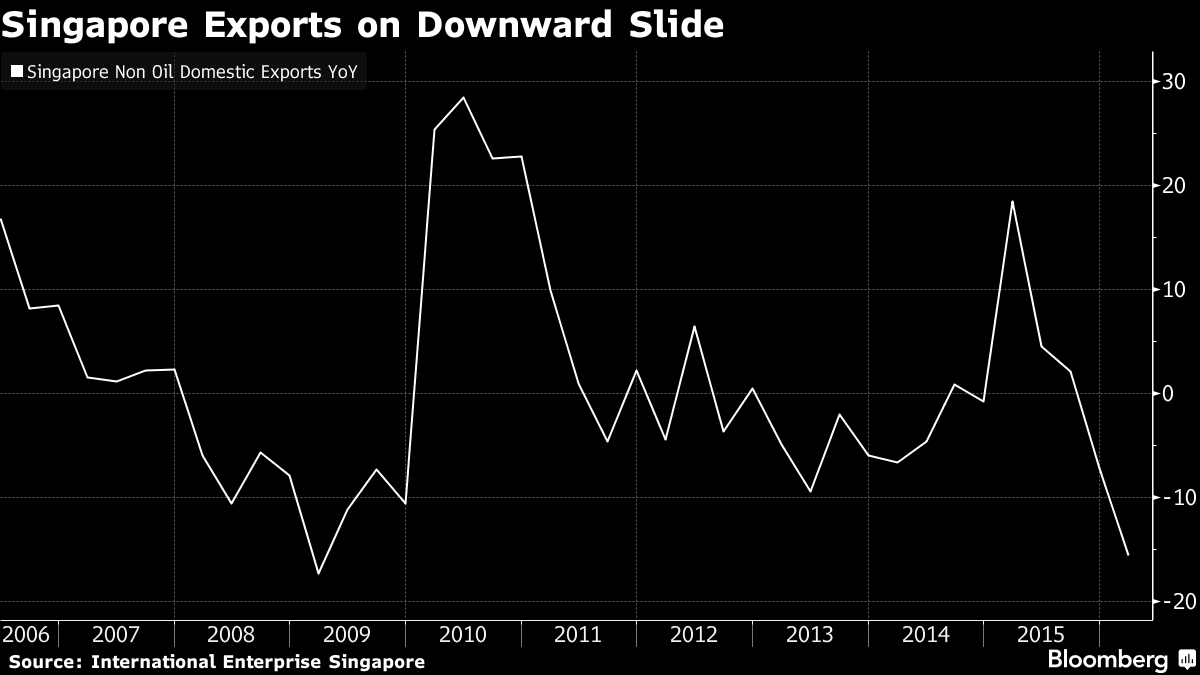

The domestic economy will continue to weaken as muted global growth takes its toll on Singapore, according to the International Monetary Fund.

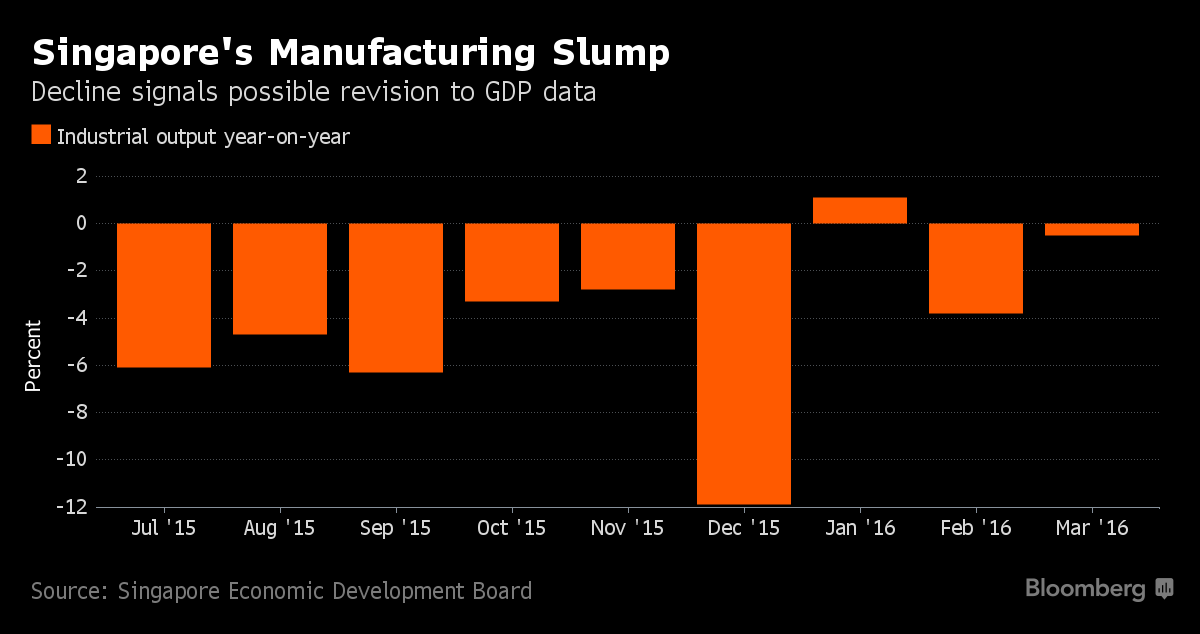

The city-state's GDP growth is expected to slow further to 1.8% this year as the full impact of the slowdown in global trade and capital outflows experienced in 2015 are felt and private investment is held back by the uncertainties on the horizon.

"Risks to the outlook are tilted to the downside. A sharper-than-expected slowdown in global growth is the most important short-term external risk," said the IMF.

The IMF also noted that the global slowdown could manifest itself through a significant downshift in China and other large emerging economies as well as weak growth in key advanced economies.

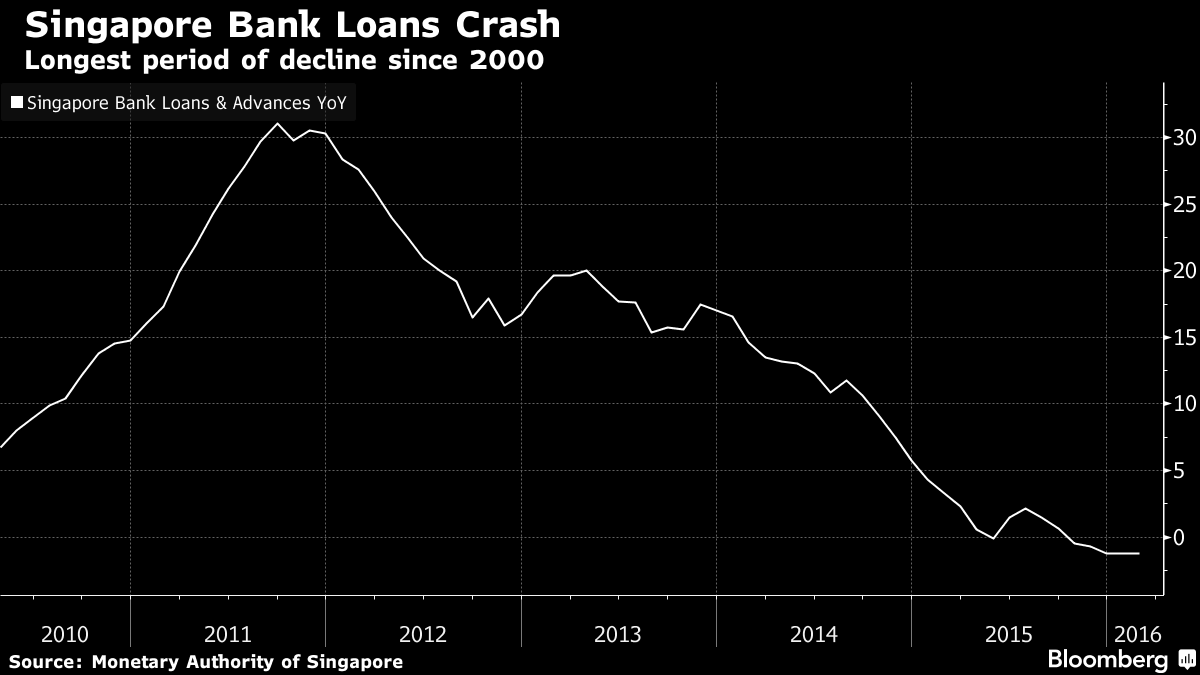

"Tighter or more volatile global financial conditions could lead to sharp asset price declines, a rise in credit spreads and a surge in the U.S. dollar. These external risks could be magnified by, and interact with, domestic vulnerabilities from elevated levels of leverage," the IMF added.

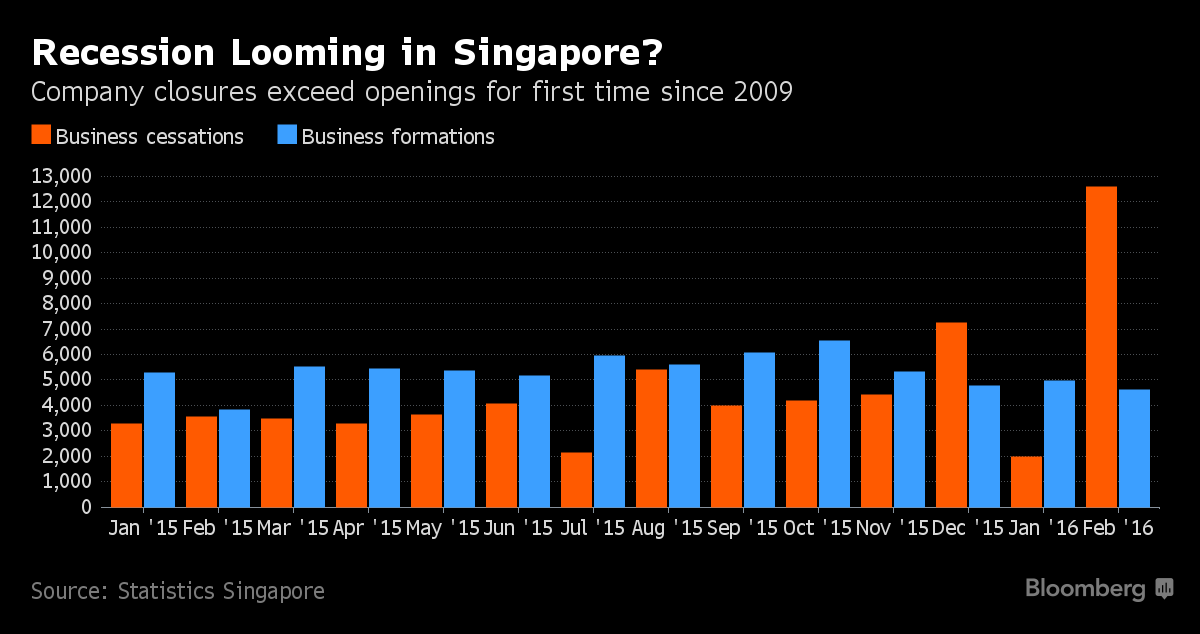

The labour market is also projected to weaken further this year, as companies report little appetite to hire and bank credit remains subdued.

Singapore economy under threat from high leverage, rising redundancies: IMF

Published: 11 May 2016

The domestic economy will continue to weaken as muted global growth takes its toll on Singapore, according to the International Monetary Fund.

The city-state's GDP growth is expected to slow further to 1.8% this year as the full impact of the slowdown in global trade and capital outflows experienced in 2015 are felt and private investment is held back by the uncertainties on the horizon.

"Risks to the outlook are tilted to the downside. A sharper-than-expected slowdown in global growth is the most important short-term external risk," said the IMF.

The IMF also noted that the global slowdown could manifest itself through a significant downshift in China and other large emerging economies as well as weak growth in key advanced economies.

"Tighter or more volatile global financial conditions could lead to sharp asset price declines, a rise in credit spreads and a surge in the U.S. dollar. These external risks could be magnified by, and interact with, domestic vulnerabilities from elevated levels of leverage," the IMF added.

The labour market is also projected to weaken further this year, as companies report little appetite to hire and bank credit remains subdued.