What can one expect from a cuntry that is more than willing to launder money for corrupted gahmens all over the world ?

-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SG is financial loss/fraud/scam hub. Huat ah!

- Thread starter LITTLEREDDOT

- Start date

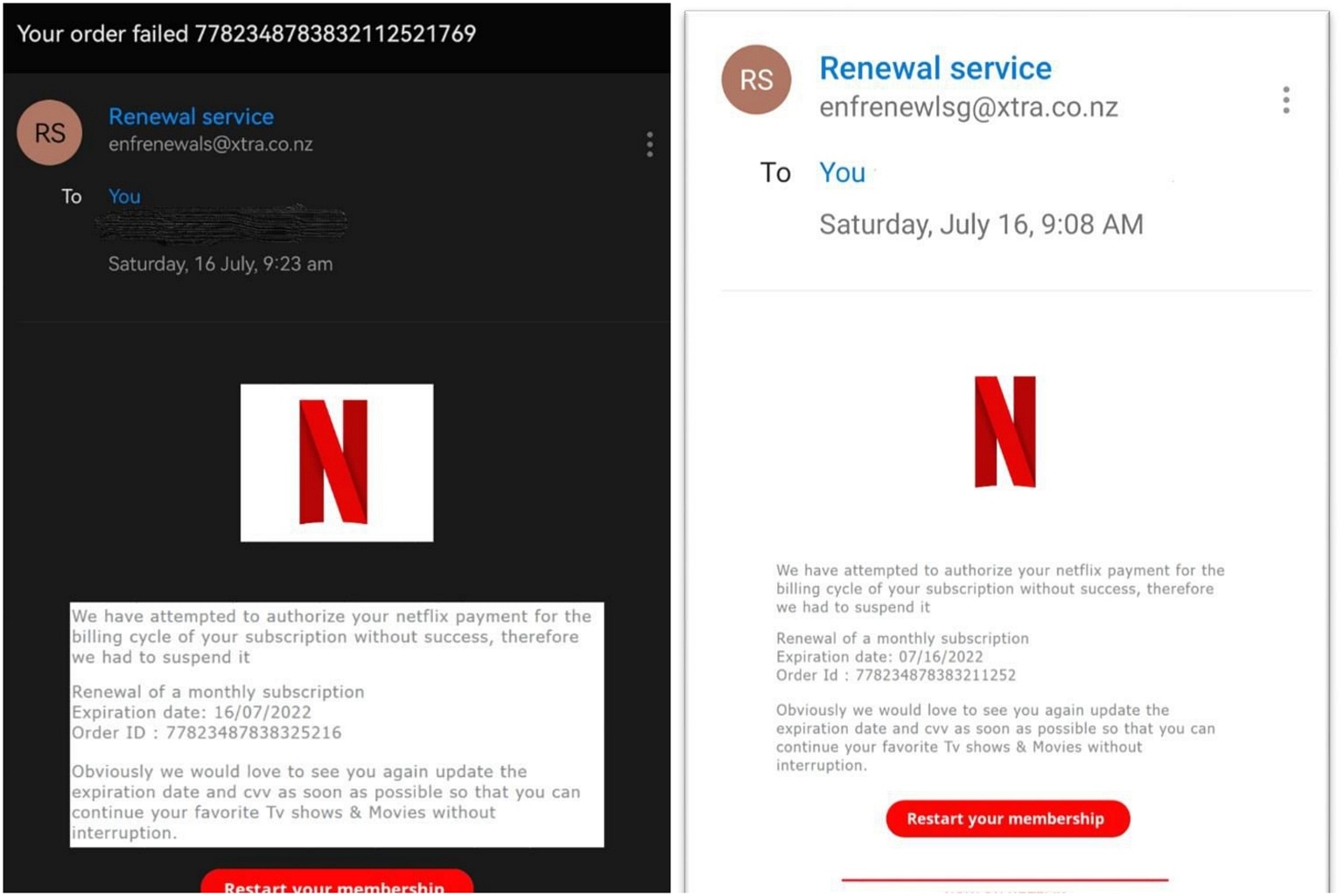

Netflix phishing scams: At least $12,500 lost in July

Police said the total losses from the scams have added up to at least $12,500. PHOTO: REUTERS

July 19, 2022

SINGAPORE - Phishing scams involving spoof e-mails from Netflix are emerging again, with at least five people falling victim to the ruse in July, said the police.

In a statement on Monday (July 18), police said the total losses from the scams have added up to at least $12,500.

In the scam, victims would first receive e-mails, allegedly from trusted sources such as Netflix, containing a link to renew subscriptions.

Upon clicking on the links, victims would be redirected to phishing websites where they would be asked to provide their credit or debit card details and one-time passwords or OTP.

Victims would realise that they have been scammed only when they discover unauthorised transactions that had been made using their credit or debit card.

The police said people should take precautions when they receive similar e-mails claiming to be from trusted sources like Netflix.

That would include ensuring that the e-mail domain matches the merchant requesting for payment, and checking if the website link appears dubious.

Get tips to grow your investments and career in weekly newsletter

Sign up

By signing up, you agree to our Privacy Policy and Terms and Conditions.

Screenshots of phishing e-mails from Netflix with “@xtra.co.nz” domain. PHOTOS: SINGAPORE POLICE FORCE

The police added that people should follow crime prevention measures such as not clicking on links provided in unsolicited e-mails and text messages, verifying the authenticity of the information with the official website or sources, and not disclosing personal or Internet banking details and OTP to anyone.

People should also report any fraudulent credit or debit card charges to the respective banks and cancel their card immediately, the statement added.

Continental Travel Singapore's licence suspended over alleged SRV cashback scheme

The five-month-long suspension takes effect on July 19, 2022. PHOTO: CONTINENTAL TRAVEL SINGAPORE/FACEBOOK

July 19, 2022

SINGAPORE - Local tour agency Continental Travel Singapore will have its travel agent licence suspended by the Singapore Tourism Board (STB) over suspected involvement in abusing the SingapoRediscovers Voucher (SRV) scheme, the board said on Tuesday (July 19).

The suspension takes effect on that day and will last five months.

Continental Travel Singapore allegedly engaged in cashback arrangements by partially refunding, in cash, the value of the SRV bookings made by some members of the public.

STB had previously issued a Notice of Intent to suspend Continental Travel Singapore's licence in October 2021, against which the agency had appealed. It had also been suspended from the SRV scheme then.

The police also arrested three people linked to the agency for alleged involvement in a series of suspected fraudulent SRV redemptions in September last year.

Investigations are ongoing.

The $320 million SRV campaign was launched in July 2020 to drive local spending on Singapore's hotels, attractions and tours as the tourism sector was battered by the Covid-19 pandemic.

Under the scheme, each Singaporean aged 18 and above was given $100 worth of credits to spend.

However, SRVs were meant for personal use only, and reselling or exchanging them for cash was not allowed.

In a press release on Tuesday, STB said: "(We take) a serious view of errant travel agents and will not hesitate to take necessary action to protect the reputation of Singapore's travel industry, including referring cases to the police."

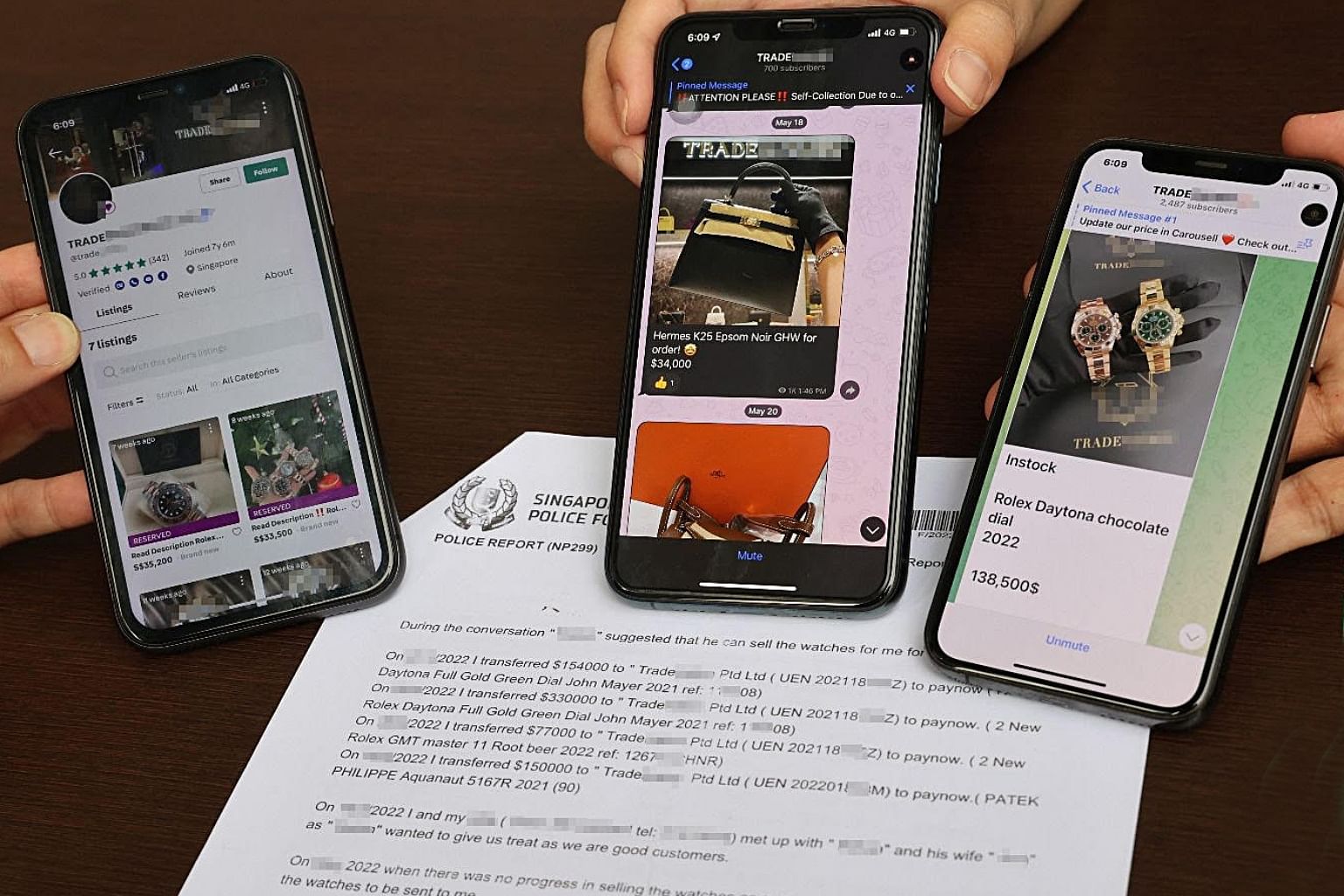

MinLaw suspends company's licence over undelivered luxury goods worth $32m

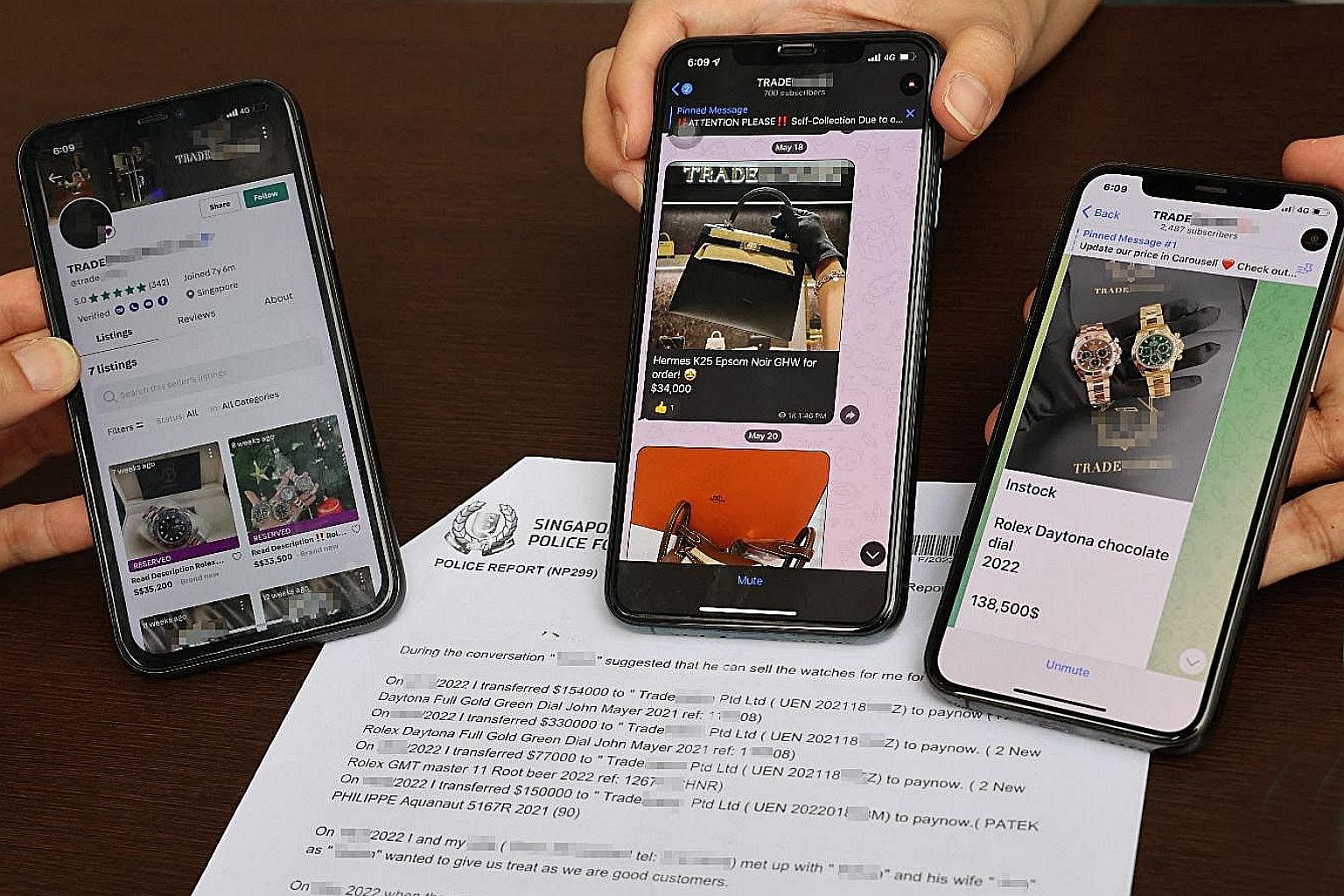

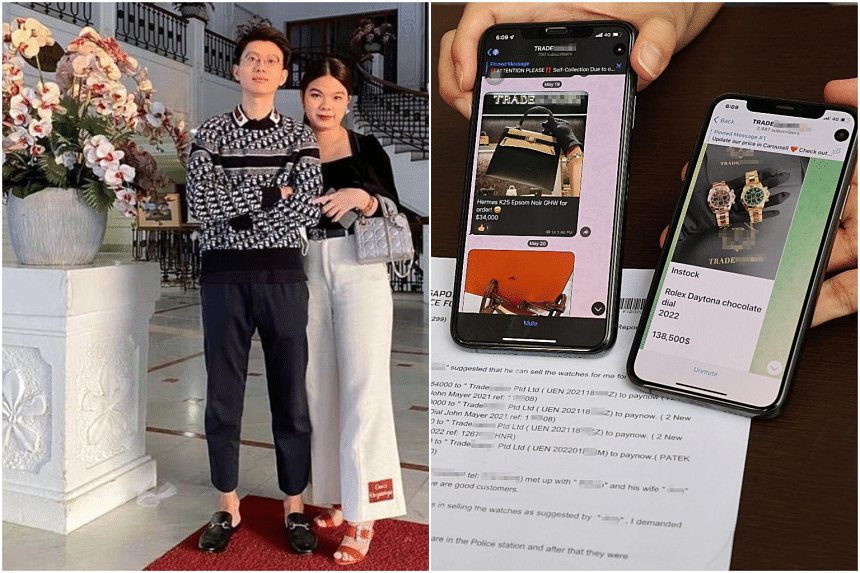

Police reports have been made against the couple over undelivered luxury goods, mostly watches, worth at least $32 million. PHOTO: SHIN MIN DAILY NEWS

Nadine Chua

July 19, 2022

SINGAPORE - Eager to get two Rolex watches to sell for a profit, watch collector Max (not his real name) paid a couple $280,000 for them and for a Patek Philippe watch.

He did so even before receiving the watches.

When the couple became uncontactable, he realised his money was as good as gone.

And Max isn't the only one.

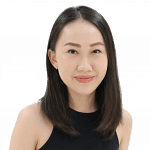

The Straits Times understands police reports have been made against the couple over undelivered luxury goods, mostly watches, worth at least $32 million.

Over the past week, ST spoke to 10 victims, aged between 24 and 52. They included a chef, an interior designer, an advertising manager and a retiree.

Most of them said they trusted the couple as their business was registered as a regulated dealer and had a certificate from the Ministry of Law to prove it.

In response to ST's queries, a MinLaw spokesman said the business, named Tradenation, was registered as a precious stones and precious metals dealer on April 2.

"Registered dealers are regulated by the Registrar of Regulated Dealers only for anti-money laundering and countering the financing of terrorism purposes," said a MinLaw spokesman.

Tradenation submitted their registration application to MinLaw as they were conducting regulated dealing and at the point of registration, there were no grounds to refuse the registration, said MinLaw.

The spokesman added: "MinLaw has suspended Tradenation's registration due to the ongoing police investigations. As police investigations are ongoing, we are unable to comment further.

"If Tradenation is found guilty of an offence following the police investigations, MinLaw will terminate the registration of Tradenation."

Max, 48, who works in manufacturing, said he had entrusted most of his life savings to them in April.

He said: "I haven't slept properly in two months. I just keep thinking how stupid I was to trust them. My wife still doesn't know about the money I lost. How can I even tell her?"

Max made his first purchase with the couple last November.

He spent $72,000 on a Rolex Daytona and it was delivered to his home a month after he made the order. Max had the watch authenticated.

He said: "That was when I began trusting them. I even became friends with them and we would go out for dinner.

"I made eight more purchases with them in a span of three months, but sold most of those watches to make a profit."

His nightmare started when the watches he ordered in April never arrived. The couple blamed the delay on supply chain issues and avoided his calls.

He knew he had been scammed when he was added in a group chat on messaging platform Telegram with over 140 other angry customers of the couple who also had not received their goods that included Hermes Birkin and Kelly bags, Rolex and Patek Philippe watches.

Choking up, Max said: "I feel betrayed. I went on holiday with my wife and kids last month, and I had to put up a front that I was okay, because I couldn't tell my family."

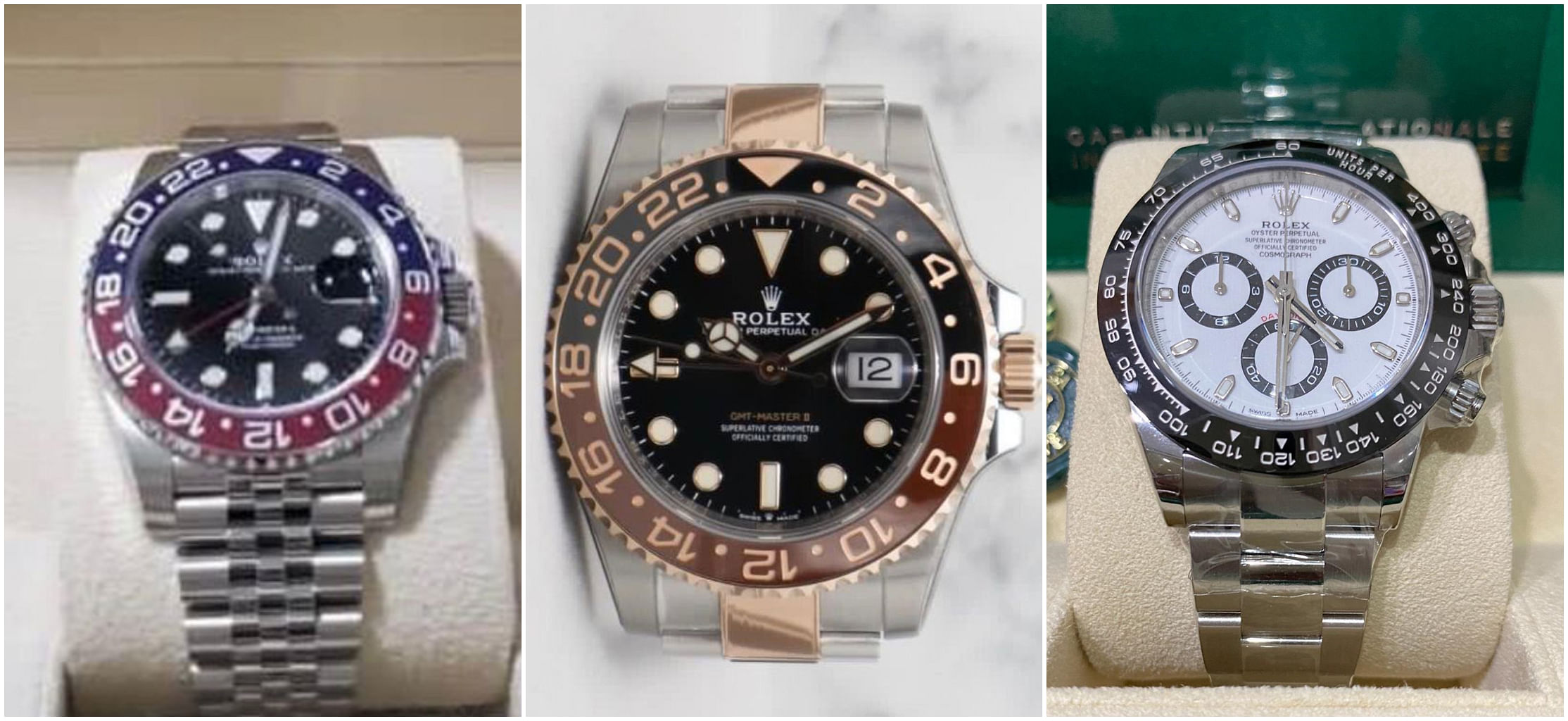

Over 140 customers have not received their goods, which include Hermes Birkin and Kelly bags, Rolex and Patek Philippe watches. PHOTO: SHIN MIN DAILY NEWS

Another person who lodged a police report against the couple was Ms Tan, 24, a fresh graduate from a local university, who works in marketing. She had paid $62,500 for a Rolex Cosmograph Daytona in March but it never arrived.

Ms Tan, who declined to reveal her full name, said the watch was supposed to be a post-graduation gift for herself.

She said: "The watch would normally cost $70,000, so I thought it was a good deal. They had multiple good reviews and I also bought a $27,000 Rolex from them in October last year which was delivered in a month. So, I trusted them completely."

Ms Tan said she feels helpless, adding: "I just don't think I will see that money again, which is frustrating because it is my hard-earned money I worked for while studying."

Another victim, Mr Wang, lost $68,000 after placing an order for two Rolex watches as he felt they would be a good investment.

Also declining to reveal his full name, Mr Wang, who works in advertising, 39, said: "I'm not a watch enthusiast, but I thought I could buy watches now and sell them for a profit.

"I actually saved up for many years to buy the watches. All I can say is this was such a bad investment."

What to look out for when buying luxury goods from resellers/dealers

- Pay a deposit upon ordering the goods. Do not pay the full amount until you have received them- Make payment via a bank transfer and request for a receipt

- Check the seller's reviews across various platforms

- Purchase from sellers who have physical stores

- Buying from an approved and licensed dealer is safer than buying from an unregulated entity

- Walk away from deals that seem too good to be true

Sources: Mr William Tan, manager of authorised dealer Watch Exchange, and Mr Tom Chng, founder of Singapore Watch Club.

Interpol alerted as couple go missing after allegedly failing to deliver $32m of luxury goods

Police reports have been made against the couple over undelivered luxury goods, mostly watches, worth at least $32 million. PHOTO: SHIN MIN DAILY NEWS

Nadine Chua

Jul 19, 2022

SINGAPORE - At least 180 reports have been lodged since June against a couple who allegedly failed to deliver luxury goods to customers, said the police on Tuesday (July 19).

The Straits Times understands the undelivered items, which are mostly watches, are worth at least $32m.

In response to ST's queries, a police spokesman said the reports were made against two companies, Tradenation and Tradeluxury.

He added: "The complainants alleged that they made advance payments for luxury watches or luxury bags to the companies, which failed to deliver them."

The police arrested a 26-year-old Singaporean man on June 27 for his suspected involvement in cheating offences.

His passport was impounded and he was released on bail the next day, pending the completion of investigations, said the police.

His wife, 27, was also assisting the police with investigations and surrendered her passport to the police on June 30. The couple subsequently became uncontactable.

ST understands the woman is a Thai national.

The police said they arrested a 40-year-old Malaysian man last Wednesday who had allegedly helped the couple in leaving Singapore on July 4.

The man was charged last Friday (July 15) with abetting another person to depart Singapore illegally.

The police spokesman added: "The police are working closely with foreign law enforcement counterparts to trace the couple and the criminal proceeds.

"Warrants of arrest and Interpol red notices have been issued against the couple."

ST understands that the undelivered items, which are mostly watches, are worth at least $32 million. PHOTO: SHIN MIN DAILY NEWS

Those convicted of cheating can be jailed for up to 10 years.

The Ministry of Law had told ST on Tuesday morning that Tradenation was registered as a precious stones and precious metals dealer on April 2.

"Registered dealers are regulated by the Registrar of Regulated Dealers only for anti-money laundering and countering the financing of terrorism purposes," said the ministry spokesman.

Tradenation submitted its registration application to MinLaw as it was conducting regulated dealing and at the point of registration, there were no grounds to refuse the registration, said MinLaw.

The spokesman added: "MinLaw has suspended Tradenation's registration due to the ongoing police investigations. As police investigations are ongoing, we are unable to comment further."

ST spoke to 10 victims, aged between 24 and 52, over the past week.

They had paid between $20,000 and $280,000 for luxury goods that were never delivered to them.

One victim, 48, who declined to be named, forked out $280,000 - a majority of his life savings - for two Rolex watches and a Patek Philippe watch.

He had planned to sell both Rolex watches for a profit but they never arrived.

Another victim, 24, spent $62,500 on a Rolex watch as a post graduation present for herself.

She told ST that she trusted the couple as she had made a purchase with them in October last year.

Woman involved in luxury goods scam in Singapore probed by Thai police for similar ruse in 2019

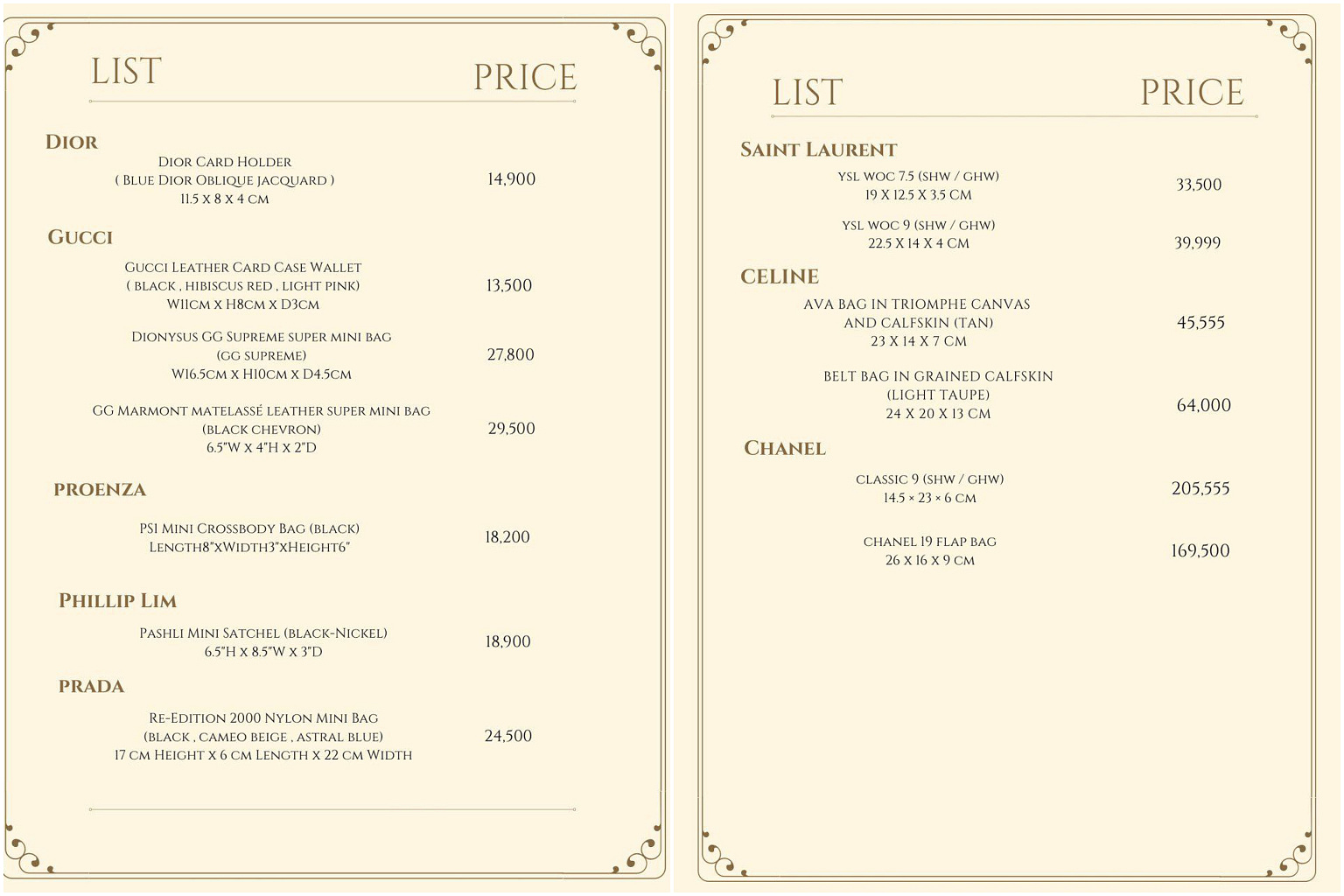

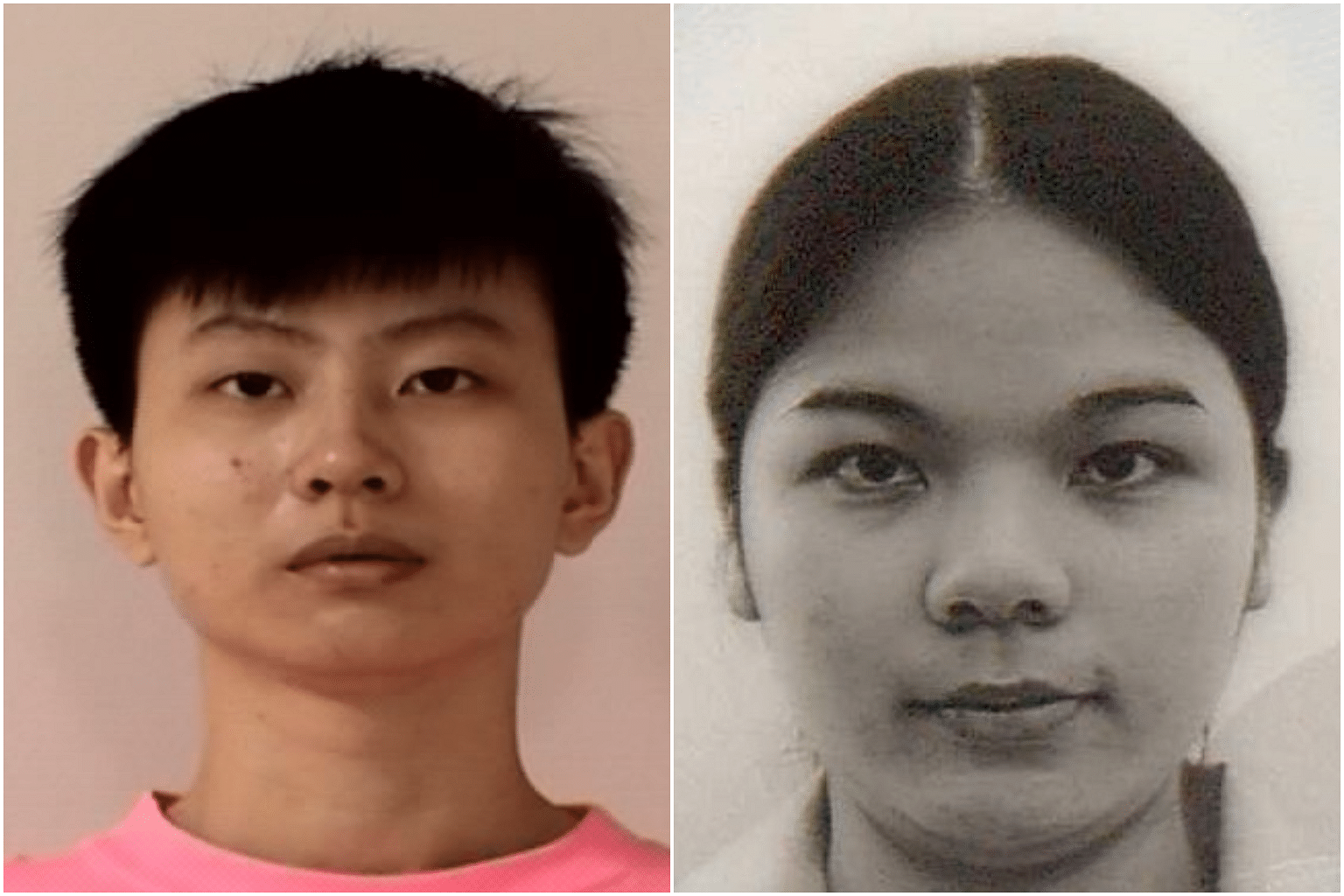

Thai national Pansuk Siriwipa (right) had helped run a luxury business on Instagram with her husband Pi Jiapeng (left). PHOTO: PANSUK SIRIWIPA/INSTAGRAM

Nadine Chua

JUL 23, 2022

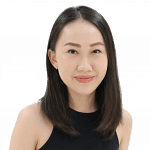

SINGAPORE - The woman said to be behind a scam in Singapore that involved about $32 million in luxury goods had allegedly conducted a similar ruse in Thailand.

The Straits Times has learnt that Thai national Pansuk Siriwipa, 27, was investigated by Thai authorities in 2019.

In Thailand, she was allegedly part of a business selling cosmetic products and luxury goods on Instagram. That business fell apart when customers did not receive orders they had paid for.

Her history in Thailand came to light after victims in Singapore were contacted by her alleged Thai victims. The media there had carried reports of the incident in Singapore involving Ms Pansuk and her husband - 26-year-old Singaporean Pi Jiapeng.

Cheryl (not her real name) said she was contacted by a Thai national in her 30s on Thursday (July 21). Cheryl had paid $23,500 for a Rolex for her brother and filed a police report here when she did not receive the item.

The Thai woman claimed she lost over 680,000 baht (S$25,700) after she allegedly ordered several Chanel handbags in 2019 from Ms Pansuk through her Instagram-based business, which sold bags from brands such as Celine and Gucci and watches like Patek Philippe and Rolex.

The Thai victim, a spa manager, declined to have her real name published. Speaking through Cheryl, she said Ms Pansuk was the face of the business but had four people helping her.

She said she did receive the first few bags she ordered, and they arrived on time and in good condition. But when she started ordering more luxury goods, they were not delivered. She then made a police report in mid-2019.

"What happened to us seems to be similar to what the Singaporean victims experienced. We received a few products, ordered more, and that was it," she said.

Her friend also made a police report after paying 100,000 baht for a luxury bag that was never delivered.

Another Thai victim, Choi (not her real name), claimed to have lost 5 million baht after ordering Hermes, Dior and Chanel bags that were never delivered.

ST has contacted the Thai police for more information.

A list of branded goods Pansuk Siriwipa may have sold in Thailand in 2019. PHOTOS: THAI VICTIMS, SCREENGRABS FROM TWITTER

Mr Pi was arrested on June 27 in Singapore and released on bail the next day. Ms Pansuk was never arrested but was assisting the Singapore Police Force (SPF) with their investigations.

The authorities here said they fled Singapore on July 4 in the container compartment of a lorry.

The 40-year-old Malaysian man who helped the couple leave the country has been charged.

Mohamed Alias was charged in court on July 15 for helping Ms Pansuk and on Friday for helping Mr Pi.

The couple had allegedly stowed away in the container compartment of a Malaysia-registered lorry with the licence plate number JUH7245.

Mohamed Alias is said to have driven the vehicle carrying the fugitive couple on July 4, at around 7.25pm at Tuas Checkpoint's departure cargo section.

If convicted, he can be jailed for up to two years and fined up to $6,000.

Mr Pi and Ms Pansuk are wanted by the authorities in Singapore and Interpol red notices have been issued against them as well.

The police are also investigating allegations of cheating involving Tradenation and Tradeluxury, two companies associated with the couple.

At least 180 reports have been lodged in Singapore since June against the couple. Their victims claimed they had made advance payments for luxury watches or luxury bags to the couple, who failed to deliver them.

Meanwhile, Colonel Krisina Pattanacharoen, deputy spokesman for the Royal Thai Police, said on Friday evening that the Thai police are ready to cooperate with their Singaporean counterparts in tracking down the couple.

SPF had previously said it is working closely with foreign law enforcement counterparts to trace the couple and the criminal proceeds.

Couple in undelivered luxury goods saga fled Singapore in lorry container compartment: ICA

The victims claimed they had made advance payments for luxury watches or luxury bags to the couple, who failed to deliver them. PHOTOS: KLVNJP123_/INSTAGRAM, SHIN MIN DAILY NEWS

Nadine Chua

JUL 20, 2022

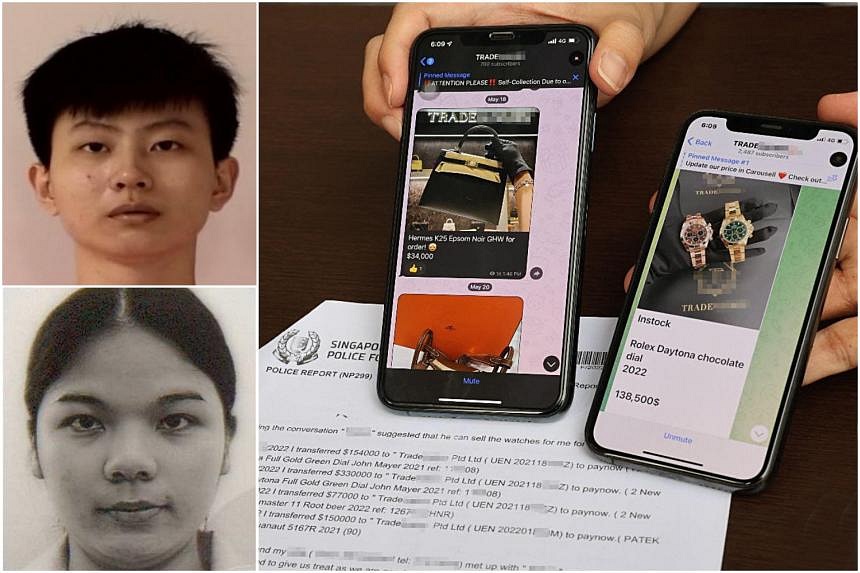

SINGAPORE - The couple who fled Singapore after allegedly failing to deliver luxury goods, worth at least $32 million, to customers did so by hiding in the container compartment of a lorry.

The Immigration and Checkpoints Authority (ICA) said this on Wednesday (July 20).

In response to queries from The Straits Times, an ICA spokesman said a 40-year-old Malaysian man helped the couple leave Singapore illegally.

According to court documents, the man, Mohamed Alias, allegedly aided a female Thai national who did not present her Thai passport to an immigration officer at the authorised departing location.

The spokesman said the man allegedly hid the woman and her husband in a lorry's container compartment. His case has been adjourned to Friday (July 22).

The spokesman added: "ICA takes a serious view of attempts to enter or depart Singapore illegally and will not hesitate to prosecute offenders for such cases.

"We are working closely with the relevant authorities on this case."

ICA said it conducts checks on all arrivals and adopts a risk management approach for checks on departing conveyances, in order to balance smooth departure clearance and border security at the checkpoints.

ICA added: "Departing conveyances may also be directed for further checks based on risk profiling or any information received."

The police told ST on Tuesday that they arrested a 26-year-old Singaporean man on June 27 for his suspected involvement in cheating offences.

His passport was impounded and he was released on bail the next day, pending the completion of investigations.

His wife, 27, was also assisting the police with investigations and surrendered her passport to the police on June 30. The couple subsequently became uncontactable, said the police.

Police said Singaporean man Pi Jiapeng (left) and Thai national Pansuk Siriwipa were assisting with investigations but subsequently became uncontactable. PHOTOS: SINGAPORE POLICE FORCE

The police arrested Mohamed last Wednesday for allegedly helping the couple leave Singapore on July 4.

He was charged last Friday with abetting another person to depart Singapore illegally.

The police said it is working closely with foreign law enforcement counterparts to trace the couple and the criminal proceeds.

"Warrants of arrest and Interpol red notices have been issued against the couple," added the police.

At least 180 reports have been lodged against the couple since June.

The victims claimed they had made advance payments for luxury watches or luxury bags to the couple, who failed to deliver them.

ST spoke to 10 victims, aged between 24 and 52, over the past week and most of them said they trusted the couple as their business was registered as a regulated dealer and had a certificate from Ministry of Law (MinLaw) to prove it.

A MinLaw spokesman had said the business, named Tradenation, was registered as a precious stones and precious metals dealer on April 2.

"Registered dealers are regulated by the Registrar of Regulated Dealers only for anti-money laundering and countering the financing of terrorism purposes," said the spokesman.

At the point of Tradenation's registration, there were no grounds to refuse it, said MinLaw.

But the ministry has now suspended its registration, which can also be terminated if it is found guilty of an offence.

Posh meals, sports cars: Life of alleged masterminds of $32m luxe goods scam was all a front

The victims later learnt that the couple's Holland Grove property, which the couple said was their home, was a rental. PHOTOS: KLVNJP123_/INSTAGRAM, KEVIN LIM

Nadine Chua

Jul 24, 2022

SINGAPORE - They ate at posh restaurants and invited customers to a property near Holland Grove which they said was their home - a triple-storey detached house complete with four luxury cars with a combined value of $1.5 million.

Singaporean Pi Jiapeng, 26, and his wife Pansuk Siriwipa - a 27-year-old Thai national - were often decked out in branded clothes and luxury watches.

Enticed by their lavish lifestyle, Max (not his real name) parted with $280,000 - the bulk of his life savings - for two Rolex watches and a Patek Philippe in April.

He never got them and made a police report earlier this month.

His was among more than 180 police reports filed since June against the couple, who are now on the run.

Max, 48, who works in manufacturing but does not want say how much he earns, recalled how waiters rushed to serve them when they had dinner at the upmarket Yakiniquest Japanese restaurant in Orchard Road in January.

“It was like they were royalty. Everyone working there knew them and were excited to see them,” said Max.

Ms Pansuk was carrying a handbag which costs upwards of $20,000.

“She carried a Hermes Birkin bag, he had stacks of Cartier bracelets on both his wrists and a brand new Rolex Daytona that he showed me,” said Max, who had known them for three months at that point.

Ms Pansuk, who Max knew as Ann, told him they dined at such places regularly.

“The bill came up to $700 for the three of us even though we did not order alcohol. I cannot imagine how much they spend a day on such classy food,” added Max, who insisted on paying for the meal.

He wanted to treat them as it was their first time dining together. He had bought four watches from them earlier, which he sold for a profit. He did not want to say how much he made.

The couple he thought were his friends are now on the run after allegedly failing to deliver luxury goods - mostly watches - worth about $32 million to customers in Singapore.

On July 4, the couple hid in the container compartment of a Malaysian-registered lorry and left Singapore. They are now on the Interpol wanted list.

It has since also emerged that Ms Pansuk was allegedly embroiled in a similar ruse in 2019 in Thailand, where she sold cosmetic products and luxury goods on Instagram.

Over the last two weeks, The Straits Times spoke to 15 people to piece together a picture of the pair and how they exploited the luxury goods grey market.

The market is the domain of unofficial resellers of hard-to-secure items, such as some models of Rolex watches which can be sold for thousands more than their official retail price.

The couple claimed the goods they sold were all new.

The 15, aged between 24 and 52, said they felt angry and betrayed. They include a chef, a marketing manager, a financial consultant and a retiree.

None wanted to be identified, some because they were embarrassed as they had ordered the items to resell later for a profit.

The couple, they said, also gave them the option of selling the items back to them because they always had ready customers.

Many victims came to know the couple through word of mouth. Others saw how their business had hundreds of good reviews on Carousell.

They paid either in cash or through bank transfers, and received a soft copy of the receipt.

Some of the watches the victims ordered from the couple. PHOTOS: ST READER

Young though the couple were, most said they trusted Mr Pi and Ms Pansuk as their business, Tradenation, was registered as a precious stones and precious metals dealer.

The couple had a certificate from the Ministry of Law (MinLaw) to prove it, and posted a screenshot of the digital certificate on their Instagram page.

MinLaw has since suspended the business’ registration.

Some customers were invited to the property near Holland Grove, which they claimed was their home.

The triple-storey detached house near Holland Grove which the couple said was their home but which turned out to be a rental. ST PHOTO: KEVIN LIM

Mr Pi’s mother, whom victims described as in her mid-50s and a spitting image of him, lived there as well.

When Max visited in April, four cars were parked in the driveway - a Chevrolet Corvette C8, McLaren 720s, Porsche Macan and Toyota Vellfire.

Mr Pi Jiapeng with the McLaren 720S that his wife supposedly bought for him earlier this year, according to a customer. PHOTO: ST READER

The house had high ceilings, a dining table that could easily sit more than 10 guests, and a swimming pool, said the victims.

Bryan, a 40-year-old businessman who said he gave the couple $300,000 for six Rolex watches that never arrived, had dinner at the home in February.

“They showed off their watch collection to me. They had around 10 watches and I could tell they were rare pieces,” he added.

“There were some Rolex watches and even Richard Milles. The value of one watch was easily $2 million,” said Bryan.

He had been their customer since August last year and had bought seven watches which he received.

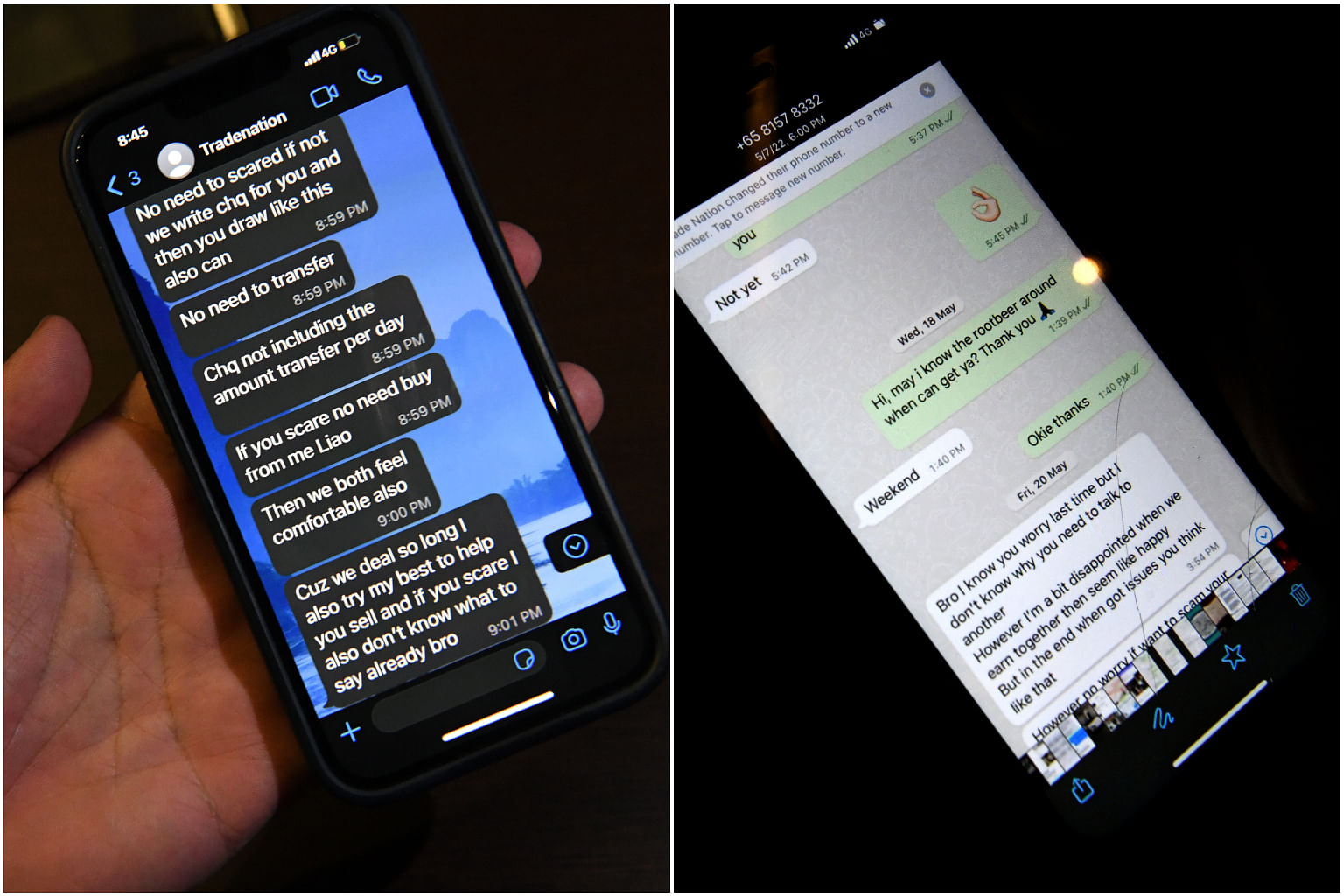

Text messages between the victims and Tradenation. ST PHOTOS: DESMOND FOO

Kim, 24, lost $62,500 after ordering a Rolex Cosmograph Daytona in March. She said Ms Pansuk appeared nice and was “good with sweet talk”.

“But after the payment, she stopped replying. I would have to constantly ask for updates about the delivery progress,” said Kim, who is in marketing and had saved the money while working at event jobs and studying.

The victims said Ms Pansuk did most of the talking, though she described her husband as “the boss”.

She spoke mostly in English but was not completely fluent.

While friendly at the start, she would get testy when quizzed about orders.

Bryan said: “When I asked about the status of my order, she said that if I’m scared that the goods won’t be delivered, I might as well not buy from her anymore. She turned from charming to threatening so quickly.”

In June, the couple started dodging calls. They told worried customers there were shipment delays and set up a Telegram chat group to explain this.

They also threatened that those who made police reports would not receive their watches.

A week after the chat group was set up, the couple stopped answering texts and calls.

The customers later learnt that the Holland Grove property was a rental. Checks showed it was let for $17,500 a month. Max, who is still filled with regret for putting so much money into the watches he has yet to receive, said: “All I can hope is that the couple will be caught. Many of us are at a loss. Our money is gone and we need them to be brought to justice.”

Watches in demand

Some of the items that victims ordered and the estimated prices on the grey market:- Rolex Daytona “John Mayer” Yellow Gold, Green Dial: $120,000

- Rolex GMT-Master II, Oystersteel: $40,000

- Rolex Cosmograph Daytona: $62,500

- Rolex GMT Master II Root Beer: $45,000

- Rolex Cosmograph Daytona, Yellow Gold, Black Index Dial, Gold Subdials: $150,000

- Rolex Daytona Rose Gold, Chocolate/Brown Dial: $90,000

- Rolex Daytona Rose Gold, Oysterflex: $145,000

- Patek Philippe Nautilus: $200,000

- Hermes Kelly: > $20,000

- Hermes Birkin: >$25,000

Luxury goods that the couple owned

- Richard Mille watches

- Cartier bracelets, rings

- Hermes Kelly, Birkin

- Lady Dior, Chanel, Gucci bags

- Celine, Gucci clothes

- Balenciaga shoes

Cars

- Chevrolet Corvette C8

- McLaren 720S

- Porsche Macan

- Toyota Vellfire

Couple who fled S'pore after alleged luxury goods scam: Checks on all departures will worsen traffic, says ICA

ICA said that any delay in clearing departure traffic during peak hours can cause traffic tailback on the roads, such as on the BKE for the Woodlands Checkpoint. ST PHOTO: KUA CHEE SIONG

Nadine Chua

Jul 24, 2022

SINGAPORE - Conducting checks on all departing vehicles will have significant impact on trade and travel at the land checkpoints and severely worsen the traffic situation there, said the Immigration and Checkpoints Authority (ICA).

It was responding to queries from The Straits Times on Saturday (July 23) about how the couple allegedly involved in a luxury goods scam managed to flee Singapore early this month.

The spokesman said: "Our land checkpoints are one of the busiest land crossings in the world, where about 200,000 travellers depart daily pre-Covid-19."

He added that any delay in clearing departure traffic during peak hours can cause traffic tailback on the roads, such as the Bukit Timah Expressway for Woodlands Checkpoint and the Ayer Rajah Expressway for Tuas Checkpoint.

"It would also disrupt trade flows between Singapore and Malaysia. A more balanced approach has therefore been adopted," said ICA.

The spokesman explained that ICA conducts regular and random operations on departing vehicles daily to deter and detect attempts by people to depart Singapore illegally.

This includes checking car boots, the luggage and engine compartments of buses, as well as the cabin and container compartments of lorries.

Enhanced checks will also be conducted on departing vehicles in the aftermath of major security incidents to prevent the perpetrators from leaving Singapore.

ICA told ST that an example of a major security incident in Singapore would be a terrorist attack inland and thus the need to conduct enhanced checks to stop the terrorists from leaving.

"Targeted and thorough checks may also be conducted on those departing based on risk profiling and information received. While the checks may not be 100 per cent, they are not minimal or negligible in number," said the authority.

The spokesman added that adopting a risk management approach to balance security checks and facilitate smooth departure clearance at the checkpoints is a common practice internationally.

"Safeguarding Singapore's borders against the entry of smuggled, illegal or undesirable persons and goods, and especially security-sensitive items, is the key priority for ICA," said the spokesman, adding that it checks all vehicles arriving here.

Last Wednesday, ICA said the couple, who allegedly failed to deliver luxury goods worth about $32 million to customers, fled Singapore in a container compartment of a lorry on July 4.

Mr Pi Jiapeng and and his Thai wife Pansuk Siriwipa allegedly failed to deliver luxury watches and bags worth at least $32 million to customers. PHOTO: @KLVNJP123_/INSTAGRAM

A 26-year-old Singaporean, Mr Pi Jiapeng, was arrested on June 27 for his suspected involvement in cheating offences. His passport was impounded and he was released on bail the next day.

His wife, Thai national Pansuk Siriwipa, 27, was not arrested but was assisting the police with their investigations. She surrendered her passport to the police on June 30.

The couple subsequently became uncontactable, said the police last Tuesday.

Mohamed Alias, a 40-year-old Malaysian man, who helped the couple leave the country has been charged.

$32m scam: Suspect's wife bought him whatever luxury goods he wanted, says friend

Mr Pi Jiapeng met his wife Pansuk Siriwipa in December 2019. PHOTO: ST READER

Nadine Chua

Jul 24, 2022

SINGAPORE - When he was in Secondary 3, Mr Pi Jiapeng dropped out of school but he always told friends that he would make it big one day.

An only child, he lived with his single mother in a three-room flat in Yishun until December 2019, when he met Thai national Pansuk Siriwipa. They got married in September the next year but did not have a big wedding dinner.

Around that time, the couple and Mr Pi’s mother moved to a condominium in Bukit Timah, then to a landed home near Holland Grove in October last year.

Adam (not his real name) met Mr Pi, 26, in Secondary 1 when they were in the same school.

“He was quite full of himself, although sometimes he would find it hard to find things to brag about,” said Adam, 25, on Friday.

“He was just an ordinary teenager like all of us. But in his heart, he always had this dream to lead a lavish lifestyle.”

After he left school, Mr Pi worked odd jobs and was said to have developed a gambling habit that allegedly left him in debt.

“He also worked as a retail assistant at a sports shoe store and later as a car salesman,” said Adam.

Mr Pi’s life changed after he met Ms Pansuk on the dating app Tinder, his friend said.

Within a week of their first meeting, she bought him Balenciaga shoes, which can cost upwards of $1,000. She also paid off his debts of about $5,000.

“She bought him whatever luxury goods he wanted. They would go on holidays often to places like London and Japan. They also ate at expensive restaurants all the time,” said Adam, who works in the airline industry.

Jun (not his real name), another of Mr Pi’s friends, said friends were suspicious of Ms Pansuk’s claims that she was born wealthy.

“As we got to know her, she said she was from the royal family in Thailand,” said Jun, 27, who got to know Mr Pi through a mutual friend 10 years ago.

They lived near each other in Yishun then, and Jun invited Mr Pi to his wedding. Mr Pi lent his Porsche Panamera to Jun for the big day.

“We drifted apart over the years but got closer again last year,” recounted Jun on Friday.

Mr Pi Jiapeng and his wife Pansuk Siriwipa moved to a landed home near Holland Grove in October last year. ST PHOTO: KEVIN LIM

Posh meals, sports cars: Life of alleged masterminds of $32m luxe goods scam was all a front

$32m luxury goods scam: A timeline of key events

Mr Pi would invite him and a few other friends to the Bukit Timah condo quite often.

Jun said that his friend, who is tall, lean and has a tattoo on his right thigh, often talked about gambling and making money. He described Ms Pansuk as down to earth and welcoming when they first met her.

At their condo, which the couple said they owned, they proudly showed off what they called a “luxury room”.

It was filled with cabinets of handbags from brands such as Dior and Hermes. There were also Rolex watches stored in an expensive-looking watch winder – a device that keeps automatic watches moving.

Jun said he had a falling-out with Mr Pi in March this year after he bought a Rolex GMT-Master II Pepsi from Mr Pi for $35,000.

On the same day, Jun sold it on the Carousell site, but the watch’s serial number – which could identify the timepiece – could be seen in the photo.

Mr Pi was angry because he said the retailers he got it from would stop selling watches to him.

Jun and Adam said they were shocked to learn that their friend and his wife are wanted by the police and have fled Singapore.

Adam said: “I don’t know what will happen next. I guess we’re all on the edge of our seats to find out.”

$32m luxury goods scam: A timeline of key events

More than 180 reports were made claiming that Mr Pi Jiapeng and his wife Pansuk Siriwipa failed to deliver luxury goods. PHOTOS: SINGAPORE POLICE FORCE, SHIN MIN DAILY NEWS

Nadine Chua

Jul 24, 2022

SINGAPORE - Within two short years, Singaporean Pi Jiapeng, 26, met his wife - Thai national Pansuk Siriwipa, 27 - and they started a business trading luxury goods.

They spent lavishly but are now fugitives on the Interpol wanted list.

Here is a look at events that built up to their disappearance on July 4:

December 2019: Mr Pi, who was working odd jobs and in a retail shop, meets his wife on Tinder. Within a week, she pays off his gambling debt.

August 2020: They move into a condominium in Bukit Timah with Mr Pi’s mother.

September 2020: They get married but decide not to hold a dinner.

April 2021: They start Tradenation and Tradeluxury to trade in luxury goods.

October 2021: They move into a landed property near Holland Grove.

April 2, 2022: Tradenation is registered with the Ministry of Law as a precious stones and precious metals dealer. At the point of Tradenation’s registration, there were no grounds to refuse it.

June 1: Customers notice significant delays in getting their goods and confront the couple.

June 11: To address the delays, Mr Pi and his wife set up a Telegram chat group for customers.

June 27: Mr Pi is arrested and his wife is called up for police investigations. More than 180 reports have been made claiming luxury items worth more than $32 million were undelivered.

June 28: Mr Pi is released on bail.

June 30: Ms Pansuk’s passport is impounded.

July 4: The couple escape in a Malaysian-registered lorry.

July 15: A 40-year-old Malaysian man is charged in court for helping Ms Pansuk escape.

July 19: The Singapore police say warrants of arrest and Interpol red notices have been issued against the couple.

July 22: The Malaysian lorry driver is charged with helping Mr Pi flee.

How a celebrity CEO's rule of fear helped bring down hot Singapore start-up Zilingo

Zilingo suspended its 30-year-old chief executive officer Ankiti Bose over complaints about alleged financial irregularities in March. ST PHOTO: FELINE LIM

Aug 4, 2022

SINGAPORE (BLOOMBERG) - At first glance, the implosion of vaunted fashion start-up Zilingo looked jarringly sudden.

When the Singapore tech darling suspended its 30-year-old chief executive officer Ankiti Bose over complaints about alleged financial irregularities, it was March. Within weeks, creditors were recalling loans, more than 100 employees had left, and Ms Bose found herself fired, though she denies any wrongdoing. The company's survival is now in question.

The Zilingo meltdown has rattled the tech industry in South-east Asia and beyond. The start-up had raised more than US$300 million (S$414 million) from some of the region's most prominent investors, including Singapore investment company Temasek and Sequoia Capital India, the regional arm of the Silicon Valley firm that backed Apple and Google. Ms Bose was a celebrity who criss-crossed the globe to speak at tech gatherings from Hong Kong to California.

Interviews with more than 60 people, including current and former staff, merchants, investors, entrepreneurs and friends of the key players, suggest that Zilingo struggled for years under Ms Bose's leadership. Her management style alienated employees and undermined the business, according to staff who worked under her.

The start-up veered from one strategy to another in pursuit of sales, including a US$1 million promotional trip in Morocco, loans to customers and a short-lived push into the United States. At one point, she became fixated on "crazy growth" to catch the attention of Japanese tech titan Masayoshi Son, according to two former employees with direct knowledge of the matter.

At the heart of the company's breakdown lies the soured relationship between Ms Bose and her long-time supporter, Mr Shailendra Singh, head of Sequoia India. Allies for years, they fell out as financial pressures mounted. Mr Singh lost faith in the management skills of the young founder he had championed, while Ms Bose believed Mr Singh betrayed her by pushing her out of her own company, according to people familiar with their relationship, who requested anonymity as the talks were private.

The clash grew so acrimonious that Sequoia's lawyers demanded in a May legal notice that Ms Bose stop making allegations that could tarnish Sequoia's reputation, the people said.

Zilingo's turmoil highlights an apparent lax internal corporate governance culture that is not uncommon in the start-up industry. For two years, the company failed to file annual financial statements, a basic requirement for all businesses of its size in Singapore. Auditor KPMG has yet to sign off on Zilingo's financial year 2020 results. While it is not unusual for start-ups to miss these deadlines, which can result in a fine of up to $600, it is typically a warning sign that firmer action may be needed by the board.

Yet, investors, including Temasek and the Economic Development Board's investment arm EDBI, put more funds into Zilingo at the end of 2020. Shareholders that together own a majority stake of the company only formally acted against Ms Bose after whistle-blower complaints were filed earlier this year.

Tech warning

The saga has also become a warning for the region's tech community, which is assessing the fallout of global economic shocks from Covid-19, the war in Ukraine and global inflation."Whatever happened at Zilingo, there will be a lot more dramas in the next couple of years as the big worldwide recession impedes hot shots from raising money," said veteran investor Jim Rogers, chairman of Rogers Holdings in Singapore. "I have seen this rodeo before."

Bloomberg News reviewed dozens of internal documents, e-mails, texts and other media from Zilingo, and Ms Bose sat for two extensive interviews, one before and one after her dismissal from the company on May 20. The board's decision to fire her was not abrupt, but rather the culmination of years of tension, according to the documents and people with direct knowledge of the matter.

"Board members were concerned about the company's performance over the last few years and sought to share suggestions to address the company's performance including cash burn," Zilingo and its board said in a statement to Bloomberg News.

"In March 2022, investors received complaints about serious financial irregularities which appeared to require investigation. With the support of the majority investor shareholders, an independent forensic investigations consultancy was appointed to look into the said complaints. After a comprehensive process lasting almost two months, including numerous opportunities for Ms Bose to provide documents and information, the company subsequently terminated Ms Bose for cause based on the findings of that investigation."

SPH Brightcove Video

Ms Bose said the process to terminate her was an "unfair witch hunt" and denied that she was given numerous opportunities to respond to allegations. She said she has not seen the investigation report, which was not made public. On the board's suggestion to implement changes, she said the team cut the cash burn by 70 per cent between the end of 2019 and the end of 2021.

"It was not easy, we did not succeed at everything," she said in July. "It was chaotic and painful, but we did do it and we made the best effort we could."

Zilingo's origin story is part of South-east Asia's start-up lore. Ms Bose came up with the idea as she wandered through Bangkok's Chatuchak market, where 15,000 stalls offer goods from across Thailand. She and co-founder Dhruv Kapoor wanted to build a platform that would allow such small merchants to sell to consumers across South-east Asia.

Mr Singh was instrumental from the start. He and Ms Bose had worked together at Sequoia and he was happy to support one of the firm's own. Mr Singh had started his career in Sequoia's Silicon Valley office, learning at the side of veteran investors Michael Moritz and Doug Leone. Mr Singh had transformed Sequoia Capital India over 16 years into the region's biggest venture capital (VC) firm with some US$9 billion of assets under management and 36 unicorns on its score sheet across India and South-east Asia.

He invested in Zilingo's seed round in 2015, when Ms Bose was 23 years old, and in every fund raising since. "We think the world of her," he told a fellow venture capitalist in 2016, in an e-mail seen by Bloomberg News.

Mr Dhruv Kapoor, co-founder and chief technology officer of fashion e-commerce marketplace Zilingo. PHOTO: ZILINGO

But like many upstarts, Ms Bose and Mr Kapoor faced challenges almost from the beginning. Their consumer-focused fashion site struggled because of the thin margins and low average income in South-east Asia, a fragmented region with different languages and currencies. By late 2017, they decided to reposition Zilingo into a business-to-business platform, where small manufacturers and wholesalers could sell goods directly to small retailers in the region.

In 2018, Zilingo raised US$54 million from investors. The company decided to splurge US$1 million to whisk nine social media influencers to Morocco for a three-day extravaganza, complete with camel rides, a hot-air balloon trip, yoga lessons and gourmet dinners.

It was a massive flop, according to an early employee with direct knowledge of the event. The goal of #ZilingoEscape was to bring in one million new users, one for each US$1 spent. The final tally was about 10,000, the person said. Ms Bose declined to comment specifically on the campaign, but said it was part of the company's US$10 million annual marketing budget.

This appears to have become a pattern for Ms Bose. With cash in Zilingo's coffers, she would dive into new initiatives to supercharge growth even if the immediate financial benefits were questionable. In one example, Ms Bose suggested that Zilingo subsidise a 2 per cent to 4 per cent discount for transactions, effectively paying merchants to trade with one another. She cheered on the team as gross merchandise value hit US$1 million for the first two months, even though Zilingo was getting no fees from the merchants, said a person directly involved.

In 2018, Ms Bose came up with the idea of giving out loans to suppliers and vendors who needed capital. It took off, so in the coming months Ms Bose cranked up the pressure. She told the team to give out more loans each month on a running basis, the person said. But no one could have predicted the pandemic, or the toll it would take on start-ups like Zilingo, and much of the debt had to be written off.

Yet Ms Bose's star was rising in the industry. In early 2019, Zilingo raised US$226 million, lifting its valuation to US$970 million. The charismatic CEO wooed tech gatherings with her vision of how start-ups like hers were a new model for the emerging world.

"We are about to shake things up quite a bit," Ms Bose said at a panel discussion in Singapore, flashing a wide smile and drawing applause from the audience.

Inside the company, she drove staff relentlessly. In one instance, Ms Bose messaged a senior lieutenant early on a Sunday morning and called about a dozen times. When the employee did not pick up immediately, she told the lieutenant: "You obviously don't care about the company enough."

Publicly, the company seemed to be going from strength to strength. In July 2019, Mr James Perry, former managing director and Asia-Pacific head of technology investment banking for Citigroup, joined Zilingo as its first chief financial officer.

It was a coup for Ms Bose, some 20 years Mr Perry's junior. Ms Bose said in an interview with Bloomberg News in 2019 that Mr Perry's experience and respect in the financial world would complement her "young and crazy" self and give confidence to investors. "He's James Perry, he's a god in finance," she said.

In the investment world, her big target remained Mr Son, whose SoftBank Group had upended venture capital by making huge bets on unproven start-ups. Ms Bose told her deputies that Zilingo needed to achieve rapid growth to catch Mr Son's attention, one of the deputies said.

Ms Bose met Mr Son twice that year, once in Jakarta and a second time in Tokyo, according to people familiar with the matter. She explained her vision for Zilingo, but Mr Son never backed her. Neither did KKR & Co, which was considering investing in the start-up at the time, the people said.

In October 2019, Zilingo announced it would spend US$100 million to expand into the US, establishing offices in New York and Los Angeles. Ms Bose's idea was to take advantage of then President Donald Trump's trade war by offering American retailers a way to avoid tariffs by finding producers outside China. Less than a year later, the company shut its US operations.

By the end of 2019, Mr Singh and other directors had told Ms Bose several times to slow the cash burn. But Mr Singh was not getting regular financial reports from Ms Bose, and it was not till a board meeting in November that the directors learnt that the company was actually going through some US$7 million to US$8 million a month, more than they had expected. Mr Singh picked up the phone and had a tough conversation with Ms Bose, according to people with knowledge of the conversations.

Guzzling money

It turns out that the company was guzzling money. The US$226 million Zilingo had raised from investors in early 2019 was gone in less than two years.In 2020, the pandemic battered the business and Ms Bose saw an opportunity to supply personal protective equipment, inking a deal in April to supply 10 million KN-95 masks, valued at US$22.5 million, to India. Six months later, Zilingo was embroiled in a legal battle with the Indian government, which claimed the company had failed to deliver 3.2 million of the masks on time. The company did not comment on the lawsuit, which is still ongoing.

In September, Mr Perry left Zilingo to rejoin Citigroup.

Inside the company, former employees paint a picture of a boss who ruled by fear. She allegedly told some staff they would have no second chance in the start-up industry because of her powerful connections. She would publicly shame employees and declare that she had to do everything herself to save the company, one person said. Another described her as a narcissist who would throw anyone under the bus if it meant saving her own reputation.

Asked in an interview in Singapore before she was fired about the culture under her leadership, Ms Bose uncharacteristically paused and stared out of the window as the sun set over the city.

"I was 23 when I started the company," she said eventually. "I liked having control at the beginning. Of course, I made mistakes and learnt from them. By the time we got to the stage where we had all these senior people, I don't think I was a control freak."

In her most recent interview with Bloomberg in July, Ms Bose reiterated that she has not done anything wrong. "I'm going to be a lot calmer, a lot more empathetic and understanding of how people work together. That has been a big learning for me. Managing people, managing relationships, managing communications - I think all of this is coming down to that," she said.

By November 2020, Zilingo had barely enough cash to last a month. A group of existing investors, including Sequoia, EDBI, Sofina, Temasek and SIG, stepped in to rescue the company by purchasing US$25 million of convertible notes.

In January 2021, Mr Singh and Ms Bose met at the Four Seasons Hotel's alfresco cafe as they did from time to time to talk shop. Mr Singh suggested that Ms Bose consider stepping aside. He said Mr Ananth Narayanan, founder of brand-building service Mensa Brands and former CEO of fashion platform Myntra, could be a potential successor. The two men had met recently and, when Mr Narayanan said he was looking for a new opportunity, Mr Singh had thought of Zilingo.

Ms Bose was shocked. "Not yet," she said.

She went home and, that night, sent a series of emotional texts to Mr Singh, saying his suggestion was a gender-related issue and pouring her heart out. She said her departure would make her look bad, as though the firm needed to be saved by someone else. Mr Singh said it was just a preliminary idea and there was no need to discuss it again. He urged her instead to focus on improving metrics, finding a new CFO and fund raising, according to people familiar with the meeting and texts seen by Bloomberg.

Ms Bose ended the chat by saying they should work together towards the best possible outcome, and Mr Singh replied with two thumbs-up emojis. It was 2.29am.

The mounting pressure was also testing the relationship between Ms Bose and co-founder Mr Kapoor, the chief technology officer. They had clashed over the future of the company the previous month when the company was scrambling to stay afloat.

"I am scared honestly that we will not hit our goals," she texted Mr Kapoor several hours after the chat with Mr Singh. "When something is wrong, the blame falls on me, but everyone's there to take credit for the good," she wrote.

"I don't like being hated for busting my ass at all," she added.

Ms Bose spent most of the year trying to pull in more funds. In July 2021, the company took mezzanine debt of US$40 million from Indies Capital Partners and Varde Partners, but subsequent efforts to raise money from private equity and venture capital firms failed. One issue was a concern from potential investors that users were making fake transactions in key markets to bilk Zilingo's subsidies. Executives from two firms told Bloomberg News that they decided not to back Zilingo after they found evidence of merchant fraud in Indonesia, the country that accounted for more than half of Zilingo's gross merchandise volume in financial year 2021.

There was no suggestion that Zilingo was involved in the suspected fake transactions. Some existing investors, including Burda Principal Investments, Temasek and Sofina, questioned Ms Bose about the company's unaudited financial reports, according to people familiar with the matter. But Ms Bose was providing monthly financial updates to the board, and they were lenient as Zilingo was busy with fund raising at the time, one of the people said.

In March this year, Ms Bose received an ominous text on her phone: "Storm is coming your way."

A few days later, she was asked to join a meeting with investors at Burda's shophouse office in Singapore's Boat Quay, according to people familiar with the details of the meeting. There, Mr Singh and the two other shareholders dealt her a stunner. They said Zilingo's board had received complaints about alleged mismanagement and financial misrepresentation and they were suspending her during an investigation. Mr Singh urged her to be cooperative.

"We just want to save the company," he said, according to one of the people.

Ms Bose promised to help. As she left, she started running through the pouring rain.

"I think the tale is about what sometimes happens when you go into hyper-growth mode," said Ms Aliza Knox, senior adviser at Boston Consulting Group, who has held senior management positions at tech companies including Google and Twitter in Asia Pacific.

In these situations, start-ups need to think about adding independent board members beyond "founders and funders", she said. "Could some of the problems have been mitigated if there were a different kind of board a little bit earlier? That's an important question to ask."

Zilingo is not the only Sequoia-backed start-up embroiled in controversy. BharatPe's co-founder Ashneer Grover resigned from the fast-growing Indian fintech start-up in March after senior leadership accused him of misappropriation of funds. Mr Grover has denied the accusations against him, including that he stole company money to fund an extravagant lifestyle, which he said stem from "personal hatred and low thinking", he said on LinkedIn.

A forensic team from EY India has looked into Indian social commerce start-up Trell, another Sequoia-backed company, amid allegations of financial irregularities. Trell's three co-founders did not respond to requests for comment. Co-founder and CEO Pulkit Agrawal in March sent a note to investors, questioning the nature of the forensic audit, the Economic Times reported, citing its own review of the note.

Sequoia India and South-east Asia published a blog post in April, saying it would take "proactive steps" to drive corporate governance at start-ups it invests in.

Mr Singh is feeling the heat as he evolves from start-up cheerleader to champion of corporate governance. Increased scrutiny prompted some Sequoia-backed Indian founders to compare him to a forceful ruler from Indian history.

"There is art to setting up governance - the board, process and advisers - in such a way that brakes kick in automatically when something bad happens," said Mr Dmitry Levit, founder of Singapore-based VC firm Cento Ventures. He said many of Sequoia India's companies are like racing cars. "If somebody tries to run a Formula One car on off-road terrain in stormy weather, it cannot absorb the shocks."

Sequoia India said it has always cared about corporate governance.

"Building world-class companies requires first-rate governance," a Sequoia India spokesman said in a statement to Bloomberg. "There is always more we can do to work with founders so that their companies benefit from better, more robust standards of governance, such as stronger audit oversight, clear whistle-blower processes and the need to bring independent directors on board earlier."

Ankiti Bose was a celebrity who crisscrossed the globe to speak at tech gatherings from Hong Kong to California. PHOTO: ZILINGO

Salary questions

The zeal for governance may have come too late for Zilingo. About a week after Ms Bose was suspended, a board director and an adviser to another shareholder questioned her about why she was drawing a monthly salary of $50,000. Her employment contract five years ago stated it as $8,500 and the adviser had just discovered she had been making considerably more since 2019, according to people with knowledge of the matter. Ms Bose said the numbers are inaccurate but did not provide her salary information.Investigators hired by the board also questioned her about three sets of revenue numbers for financial year 2021 that Zilingo had shared with external parties: US$190 million, US$164 million and US$140 million. Ms Bose explained to them that the US$190 million had been circulated before the year closed and before the cancellation of masks and other orders. The US$140 million was used in a due diligence report for fund raising, while the US$164 million included uninvoiced revenue, according to a document seen by Bloomberg.

But another document the company shared with a potential investor, seen by Bloomberg News, showed that Zilingo's net revenue for the year was about US$40 million. A representative for Kroll, the firm that conducted the probe, declined to comment.

Ms Bose said in an interview with Bloomberg News in May that Zilingo has used aggressive methods for recognising revenue, but that the calculations are standard practice for the industry and that all of its investors were fully aware of them. "These matters are well understood by all investors," Ms Bose said in the interview.

Zilingo "went through a tough time during Covid-19", said Mr Rohit Sipahimalani, Temasek's chief investment officer. "There were clearly some things the board was unaware of, and when there were complaints made, they investigated into it and actions have been taken subsequently."

Now, the company is in turmoil and some employees say they are worried about their future. The board in June was considering liquidating the company. After her suspension in March, Ms Bose herself filed a formal complaint to the board, asking it to also suspend Mr Kapoor and then chief operating officer Aadi Vaidya, a friend from college, for their poor work performance and lack of leadership. A representative of the company, Mr Kapoor and Mr Vaidya declined to comment. Mr Vaidya resigned last week after seven years with Zilingo, explaining "now is the time to move on, clear my head and reset priorities".

It is a steep fall for Zilingo from just five months ago, when Ms Bose's fund-raising efforts valued the company at US$1.2 billion.

Noble Group fined $12.6 million for misleading financial statements after 4-year probe

MAS imposed the $12.6 million civil penalty on Noble Group for publishing misleading information and breaching the Securities and Futures Act. ST PHOTO: DESMOND WEE

Ovais Subhani

Senior Business Correspondent

Aug 24, 2022

SINGAPORE - Noble Group Limited (NGL) has been fined $12.6 million by the Singapore authorities, capping a nearly four-year probe into what was once Asia's largest commodity trader before its collapse amid accusations of improper accounting and billions of dollars in losses.

The joint investigations by the Monetary Authority of Singapore (MAS), Accounting and Corporate Regulatory Authority (Acra) and the Commercial Affairs Department, which began in November 2018, "involved complex accounting issues and required assistance from overseas authorities", the agencies said in a joint statement on Wednesday (Aug 24).

MAS imposed the $12.6 million civil penalty on the firm for publishing misleading information in its financial statements in a breach of the Securities and Futures Act.

In addition, Acra issued "stern warnings" to two former directors of its then subsidiary Noble Resources International (NRI) for failing to prepare and table annual financial statements that complied with local accounting standards in a breach of the Companies Act.

The Public Accountants Oversight Committee also issued orders against the auditors of NRI from Ernst and Young in relation to the financial statements for 2012 to 2016.

The joint investigations revealed that NGL and NRI had applied an incorrect accounting treatment to some marketing agreements with mine owners and coal producers by classifying them as financial instruments instead of service contracts.

This inflated their reported profits and net assets, the statement said, NGL's publication of materially misleading financial statements from 2016 to 2018 was likely to have induced the sale or purchase by investors of NGL's securities listed on the Singapore Exchange.

Noble, which once had a market value of more than US$10 billion (S$13.9 billion) and was seen as a challenger to global commodity giants such as Glencore, embarked on a US$2 billion spending spree in 2009-2010.

As its debt burden ballooned in the following years and losses piled up, an unknown analyst group called Iceberg Research published in 2015 a scathing critique of Noble’s accounting practices, which the firm denied.

In 2018, the firm collapsed into insolvency with US$1.5 billion in debt and was forced to restructure. Investors took fright and short sellers including Muddy Waters took aim at its shares.

The Nobel saga left many of its investors, including those in Singapore, with hefty losses.

Assistant chief executive of Acra, Ms Kuldip Gill, said: "Acra expects financial statements to reflect a true and fair view of the financial position and performance of the company.

"Acra will continue to enforce accounting standards and take those involved in the financial reporting chain to task for unreliable information and/or non-compliance with the prescribed accounting and auditing standards."

Noble Resources Trading Holdings (NRTH), which emerged after Noble Group’s restructuring, welcomed the conclusion of the Singapore investigation.

Its executive chairman Matt Hinds noted that NRTH, which has been under new ownership and management since December 2018, is now a separate business unrelated to Noble Group, with different owners, directors, senior management and external auditors.

“We are looking forward to continuing to work with our suppliers and serve our customers, building on the strong start to 2022,” said Mr Hinds in a statement on Wednesday.

Noble was one of several high-profile financial cases under investigation by the Singapore authorities in the past few years. Cases are ongoing for Hyflux, Eagle Hospitality Trust, and Hui Xun Asset Management along with Vickers Venture Partners.

Ms Loo Siew Yee, MAS' assistant managing director for policy, payments and financial crime, said materially false or misleading statements by listed entities have no place in Singapore's capital markets.

"If left unchecked, they will erode investors' trust in the quality of information released by issuers and have an adverse impact on the integrity of our capital markets. The present action demonstrates that MAS takes breaches of disclosure obligations seriously and will take firm action against persons found to have fallen short," she said.

Police warn of property agent scam after close to 1,000 people lose $3.9 million

The scammers impersonate legitimate property agents, asking victims for payment to secure rental of a unit before viewing it. ST PHOTO: NG SOR LUAN

Aug 26, 2022

SINGAPORE - At least 997 people here have lost a total of $3.9 million since January after they fell victim to scammers posing as property agents, the police said on Friday (Aug 26).

There has been a resurgence of scammers impersonating legitimate property agents and asking victims for payment to secure the rental of a unit before viewing the property, according to the police advisory.

The police said victims would typically respond to online property listings and initiate a conversation with the scammers via WhatsApp using the contact numbers in the fake listings.

During the conversation, the scammer posing as a registered property agent would convince the victim of his credentials by sending a photo of the agent's business card and pictures or videos of the property to be leased.

The scammer would then ask for the victim's personal details to prepare the lease agreement.

When the victims asked if they could view the property, the scammers would claim that the landlord was unavailable. To add an air of legitimacy, the scammers would send a copy of the lease agreement with the name and NRIC of the purported owner of the unit to the victims for them to sign.

After signing, the victims would be instructed to make payment for various reasons such as rental deposits, stamp duty, or other fees to secure the rental.

They would discover that they had been cheated only after the scammers ceased contact with them, or when they reached out to the legitimate property agents through other means.

The police advised members of the public to adopt precautionary measures such as verifying the legitimacy of a property listing.

They can do so by liaising with a property agent using only the agent's phone number registered on the Council for Estate Agencies' (CEA) public register. Members of the public may check whether a property agent is registered with the CEA by searching for the agent's phone number on the register.

If the search does not lead to the property agent's profile page, it means the agent has not registered that phone number with the CEA and the listing may be fake.

The public can also contact the agent's property agency to verify the authenticity of the listing.

Members of the public are also urged to beware of calls with the "+" prefix that originate from overseas, not to make any payments before a property viewing, and not to disclose personal information, credit card and bank details or passwords, including one-time passwords, to anyone.

Anyone with information related to such scams can call the police hotline at 1800-255-0000, or submit an online report at this website.

Forum: Time to set up Ombudsman Office to seek recourse for aggrieved investors

Aug 27, 2022The Monetary Authority of Singapore (MAS) has imposed a civil penalty of $12.6 million on Noble Group for publishing misleading information in its financial statements for the fiscal years ended December 2012 to 2016 (Noble Group fined $12.6 million for misleading financial statements after 4-year probe, Aug 24).

The penalty looks like a substantial amount but in reality, it is only a minuscule percentage compared with its once market value of more than $13 billion.

More importantly, how will the aggrieved investors seek recourse, especially the retail investors, who have neither the resources nor legal expertise to do so?

Thousands of investors have lost substantial amounts of money and some even their life savings, and are suffering in silence.

Noble, when it was listed on the Singapore Exchange, used to be a top volume counter, resulting in many investors involved in it and who are now bearing the brunt of this failed investment due to no fault of their own.

It is now more critical than ever for the MAS to institute processes or set up an Ombudsman Office with some urgency to hear investor grievances and seek recourse for aggrieved investors.

There are many other companies listed in the Singapore Exchange that have been suspended and under investigation for a long time, with no indication of when investigations will be concluded.

Meanwhile, the investors are waiting patiently for the outcome of these investigations and whether they will be able to recoup at least some of their money.

It is about time the MAS addressed this critical issue of trust in our capital markets and rebuild the much-needed investor confidence, the lack of which has been plaguing our markets for some time.

S. Nallakaruppan

President

The Society of Remisiers (Singapore)

SGX disciplinary committee raps Aspen, directors over Honeywell announcements

The committee found that the company and its directors had failed to promptly disclose material information to its investors. PHOTO: ASPEN

Yong Jun Yuan

AUG 28, 2022

SINGAPORE (THE BUSINESS TIMES) - The Singapore Exchange's (SGX) listings disciplinary committee has reprimanded property developer Aspen (Group) Holdings for false and misleading statements it made about a purported deal to supply Honeywell International with gloves.

In a regulatory statement on Friday (Aug 26), the committee also reprimanded Aspen's chief executive and executive director Murly Manokharan, and two other executive directors: executive deputy chairman Nazir Ariff and group managing director Ir Anilarasu Amaranazan.

Mr Murly has to agree not to take any position in any other SGX-listed company for six months beginning July 20 this year. He also has to undergo a training programme on listing rule obligations. The two other executive directors will also have to undergo such a programme.

Aspen had on April 13 last year announced a US$210 million (S292.9 million) two-year master supply agreement (MSA) with multinational conglomerate Honeywell.

But this statement turned out to be false. At the time it was made, the company did not have any executed copy of the agreement or confirmation that it had been officially executed.

News of the agreement was picked up by the media, including The Straits Times and The Business Times.

Honeywell subsequently contacted Aspen to stop circulating the announcement and asked that the company retract press statements it had issued.

Instead of issuing a retraction on the SGXNet immediately, Aspen made attempts to ask media outlets to take down their articles about the announcement.

According to a statement by the committee, Aspen believed "once it removed the press releases in the media, it would then have clarity as to whether an agreement between Aspen and Honeywell would eventually be signed, and thus be able to make an appropriate announcement at that stage".

It was not till April 24 that the announcement was retracted.

Honeywell indicated on May 8 that it would not proceed with the MSA with Aspen.

While Aspen indicated that it accepted the decision to terminate negotiations on May 11 last year, it did not inform investors of the development in its business update on May 17. Instead, Aspen only said that it would update shareholders via SGXNet when there were any material developments.

It was only on June 4 last year, after further queries from SGX, that the company announced to investors that the deal was called off and the MSA was not consummated by Honeywell.

Aspen's shares later fell 8.3 per cent between June 4 and 7, to 19 cents. This was also 23.3 per cent lower than its share price of 24.5 cents on April 13, when the initial MSA announcement was made.

In the committee's grounds for its decision, it laid out two charges against Aspen, Mr Murly, its executive directors and other relevant non-executive directors for not promptly disclosing that MSA negotiations had been officially terminated, and for failing to have in place adequate and effective systems of internal controls and risk management systems.

An additional charge of failing to promptly disclose the non-consummation of the MSA was laid on Aspen, Mr Murly and the executive directors.

Furthermore, the company and Mr Murly received a further charge for releasing the MSA announcement, which was non-factual, false and misleading.

Shares of Aspen fell 0.5 cent, or 9.8 per cent, to 4.6 cents on Friday, after the regulatory statement was released.

Popular Thai YouTuber flees abroad after alleged $77 million forex scam

Ms Natthamon Khongchak, better known as Nutty the YouTuber, defrauded over 6,000 victims. PHOTOS: NUTTY.SUCHATAA/INSTAGRAM

Aug 29, 2022

BANGKOK (THE NATION/ASIA NEWS NETWORK) - A popular Thai YouTuber who claimed to be a successful forex trader has reportedly fled abroad after allegedly cheating thousands of investors out of two billion baht (S$77 million).

Ms Natthamon Khongchak, better known as Nutty the YouTuber, defrauded over 6,000 victims, according to Phaisal Ruangrit, a lawyer who campaigns to help fraud victims.

Mr Phaisal said one victim had deposited about 18 baht million with her.

On Aug 24, the lawyer led some 30 people to file complaints against Ms Natthamon with the Economic Crime Suppression Division.

He said the YouTuber had used her popularity to lure victims with the promise of high returns in a short time.

Ms Natthamon's YouTube account, which is titled Nutty's Diary, has over 800,000 followers but the last clip was posted some five months ago.

She invited people to deposit money in her account, promising 25 per cent returns for three-month contracts, 30 per cent for six-month contracts and 35 per cent for 12-month contracts. She pledged to pay returns every month.

However, in April, her customers began complaining that they had not received the payments as promised.

In a May 25 Instagram post, Ms Natthamon said she had made a mistake in trading and lost all the money but promised to repay to her investors.

On June 24, she announced she was being sued in two cases and would not be able to repay other investors if she was jailed.

On Sunday (Aug 28), popular Facebook page Drama-addict posted that Ms Natthamon had fled abroad. It added that one of her alleged victims, identified only as Nok, had offered a reward of one million baht to anyone who could provide information that led to her arrest.

The page said it received information that Ms Natthamon had fled to Malaysia

1,098 people lose at least $4.5 million to scammers pretending to be friends

The police said there has been a persistent trend of scammers pretending to be victims' friends while asking for financial assistance. ST PHOTO: KUA CHEE SIONG

Aug 29, 2022

SINGAPORE - At least 1,098 people have fallen prey since January to scams involving fraudsters pretending to be the victims' friends, with total losses of around $4.5 million.

In a statement on Monday (Aug 29), the police said there has been a persistent trend of scammers contacting victims through phone calls, pretending to be their friends while asking for financial assistance.

Police said the victim would receive phone calls from unknown numbers with the "+" prefix.

When the calls are answered, the caller would not identify themselves and instead mislead victims with questions such as "Guess who am I?" or "You can't remember me?".

Thinking they are acquainted, the victims would reply with the name of a friend who they think sound similar to the caller, said the police.

The caller will then assume the identify of the friend while claiming to have lost his mobile phone or changed his contact number.

He will then ask the victim to update his number in the victim's contact list.

After a few days, the caller would contact the victim and ask for loans due to financial difficulties or troubles with the law.

He would provide bank account numbers or phone numbers to transfer money to.

"Victims would discover that they have been scammed only after contacting their actual friends whom the scammers have impersonated," said the police.

People are advised to beware of calls with the "+" prefix, especially if they are not expecting an international call.

The police also urged the public to be wary of unusual requests received via phone calls or messages even if they appear to be from family or friends.

The public is also advised to verify the legitimacy of the request by checking with family and friends through alternative means, such as physical meet-ups or using previously established contact details.

Those with information related to such scams are advised to call the police hotline on 1800-255-0000 or submit it online at their website.