Hamburger

INVESTING GLOBALLY AND PROFITABLY

Singapore economy set to bottom, may spark STI re-rating

GDP growth could rebound in six to 12 months, and spur a turn in investor sentiment

Published Tue, Jul 04, 2023 · 8:52 pm

Singapore's electronics exports are expected to rebound in the coming months, helping to lift the manufacturing sector.

PHOTO: BT FILE

FOLLOWING a relatively strong 2022, the current year has not been a great one for the Straits Times Index (STI) so far.

The STI has underperformed most other major markets and has been flat year to date, trading within the 3,100 to 3,350 range.

Heading into the second half of the year, Singapore equities may face headwinds due to slower economic growth amid weakening global macroeconomic conditions.

Financials, the largest STI component, may face challenges despite recording strong profits in recent earnings reports. Meanwhile, Singapore-listed real estate investment trusts (S-Reits) may benefit from renewed optimism as rates pause, but a re-rating can only occur as growth improves. Therefore, it is prudent for investors to be selective when investing in S-Reits.

Despite these near-term headwinds and challenges, we believe that Singapore’s economic growth will rebound in the next six to 12 months, fuelled by a pickup in export growth and recovery of the semiconductor industry. There are also merits to investing in the STI, due to its relatively high dividend yield, stability and resilience.

Slowing economy, but recovery at year-end

Based on the latest economic data, Singapore’s gross domestic product (GDP) contracted by 0.4 per cent quarter on quarter (qoq) in the first quarter of 2023, compared to growth of 0.1 per cent qoq in Q4 2022. In the near term, the outlook has weakened, dragged down by the electronics downcycle that is likely to be deeper and more prolonged than earlier projected, as well as an apparent slowdown in other advanced economies due to the lagged effects of monetary policy tightening.

SEE ALSO

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Sign Up

VIEW ALL

Your feedback is important to us

Tell us what you think. Email us at

[email protected]

Singapore’s manufacturing PMI (purchasing managers’ index) has also slumped back into contractionary territory for two successive months, as the global trade outlook worsens. Meanwhile, the electronics PMI contracted further to 49.2, continuing its nine-month run in contractionary territory.

Weakening economic growth momentum in the US and Europe has negatively impacted consumer demand for electronics, while the uneven recovery in China also contributed to the downturn in new orders. The electronics sector accounts for about 42 per cent of Singapore’s manufacturing output. Hence, a weak global outlook and slower-than-expected growth in China could cause the manufacturing sector to remain weak in the near term.

Fortunately, there is a silver lining. The growth outlook for the Republic’s aviation and tourism-related sectors remains positive, thanks to the ongoing recovery in international air travel and inbound tourism.

Why a cyclical trough is near

Despite this gloomy outlook, we are likely closer to a cyclical trough than before. A rebound may be in sight towards the later half of the year or early next year.

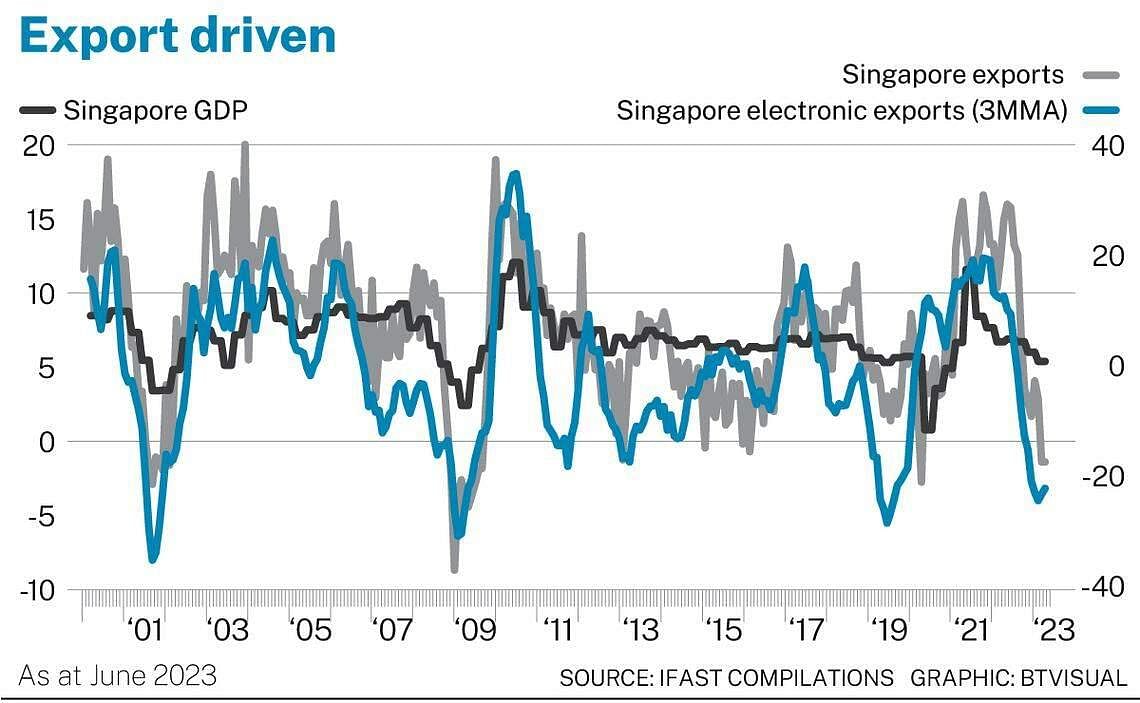

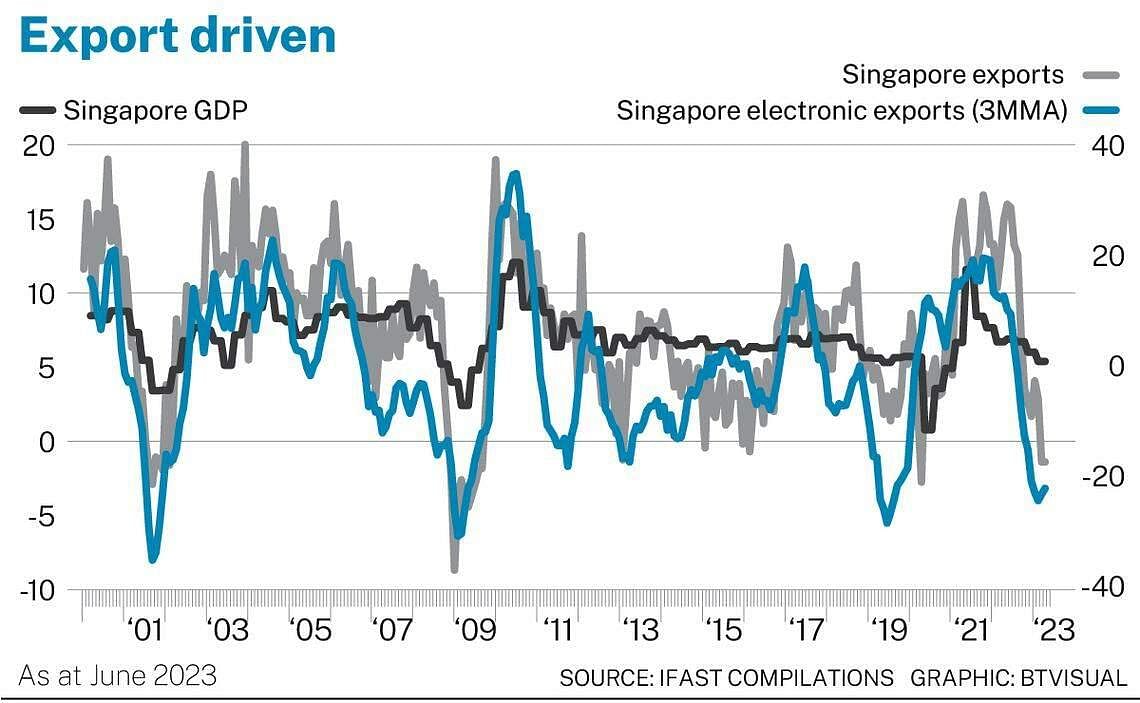

As a small and open economy, Singapore’s fortunes – in particular, export growth – are largely dictated by global macroeconomic conditions. Slower exports tend to coincide with weaker GDP growth. Furthermore, growth in electronics exports may also serve as a leading indicator for the overall export outlook by a few months.

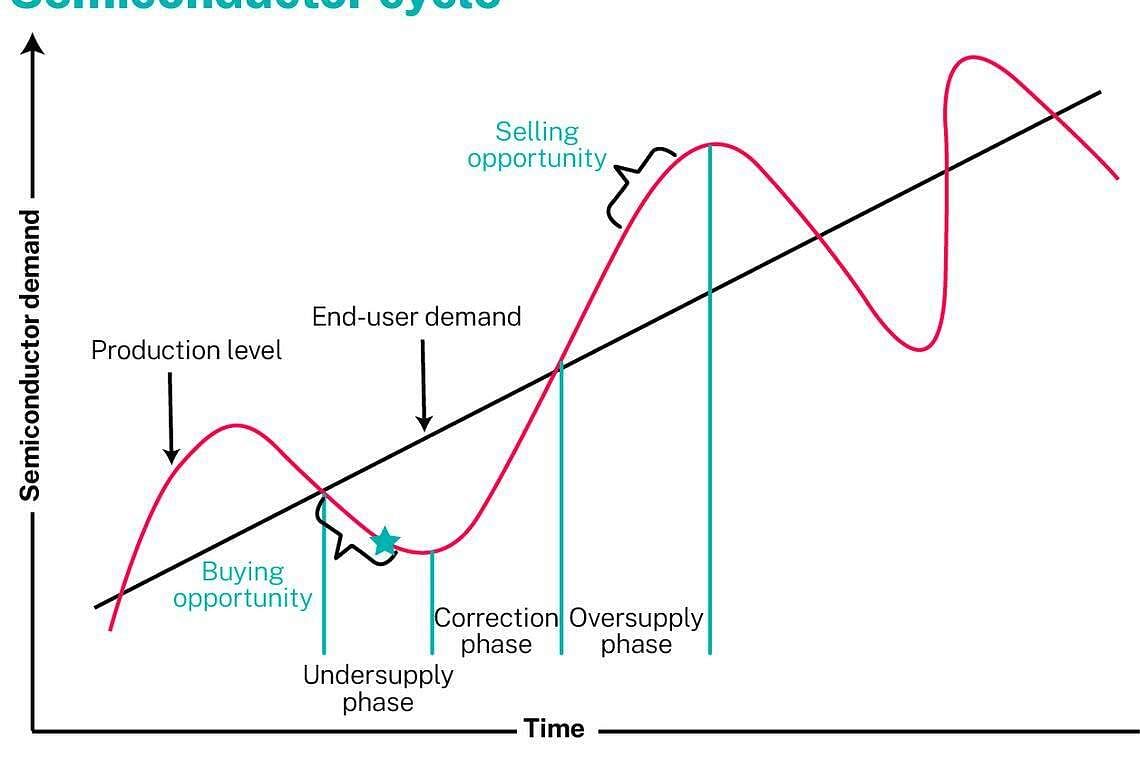

As semiconductors comprise a large part of electronics exports, it is important to examine where it is in its cycle. Generally, a peak-to-trough cycle takes about five to six quarters. As the world is now around 22 months into the current downcycle since peaking in mid-2021, it will likely take another few months before it bottoms out.

We expect demand to pick up in the coming months as inventory is gradually digested. Therefore, we also expect electronics exports to rebound as the supply-demand dynamics of the semiconductor industry readjust. Accordingly, GDP growth for Singapore is also set to recover.

Furthermore, across the medium to long term, there are several positive factors supporting the Republic’s manufacturing sector. Global demand for semiconductors continues to be favourable and is set to recover to higher levels, driven by an increase in applications as well as a rise in silicon content.

Demand for industrial electronics is also expected to grow, due to increasing adoption of industrial automation and the Internet of Things. Furthermore, Singapore remains an attractive hub for supply chain diversification for higher value-added segments within the electronics sector. This may spur new foreign direct investments in the coming years.

In the context of these trends, Singapore may avoid a technical recession. Growth appears to be weak in the short term, but tough times will pass and Singapore is poised to benefit from a recovery in manufacturing and export growth, while continuing to benefit from secular growth in the services sector.

We believe economic growth will return within six to 12 months. Our expectation of a trough in Singapore’s GDP suggests investor sentiment could rebound and spark a re-rating. According to our fair price-to-earnings multiple of 14 times for the STI, we arrive at a target index level of 4,070 by end-2025. This translates to an upside potential of approximately 27 per cent.

Those keen to invest in the local market may consider the SPDR Straits Times Index ETF or the Nikko AM Singapore Dividend Equity Fund.

The writer is a research analyst of the research and portfolio management team at FSMOne.com