Oh well

-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PM Lee becomes teary when talking about his promise to help middle age Singaporeans claiming ‘Don’t worry, we’ll walk with you’

- Thread starter Hightech88

- Start date

https://theindependent.sg/singapore...ian-doctor-whos-been-in-sg-for-26-years-says/

Many many talents love SG - but why they did not convert to Sinki sia???????

Only jlb sinki dun appreciate

SINGAPORE: In an interview with YouTube personality Mr Max Chernov, Dr Brian James Tracey said, “I really feel Singapore is an incredible land of opportunity. It actually provides an Asian equivalent of the original American dream.”

He was nearly all praises for the land he has called home for 26 years, saying that the “so-called draconian laws” don’t bother him and praising Singaporean authorities for the daily order and efficiency he encounters.

Many many talents love SG - but why they did not convert to Sinki sia???????

Only jlb sinki dun appreciate

SINGAPORE: In an interview with YouTube personality Mr Max Chernov, Dr Brian James Tracey said, “I really feel Singapore is an incredible land of opportunity. It actually provides an Asian equivalent of the original American dream.”

He was nearly all praises for the land he has called home for 26 years, saying that the “so-called draconian laws” don’t bother him and praising Singaporean authorities for the daily order and efficiency he encounters.

SINGAPORE: In an interview with YouTube personality Mr Max Chernov, Dr Brian James Tracey said, “I really feel Singapore is an incredible land of opportunity. It actually provides an Asian equivalent of the original American dream.”

He was nearly all praises for the land he has called home for 26 years, saying that the “so-called draconian laws” don’t bother him and praising Singaporean authorities for the daily order and efficiency he encounters.

He was nearly all praises for the land he has called home for 26 years, saying that the “so-called draconian laws” don’t bother him and praising Singaporean authorities for the daily order and efficiency he encounters.

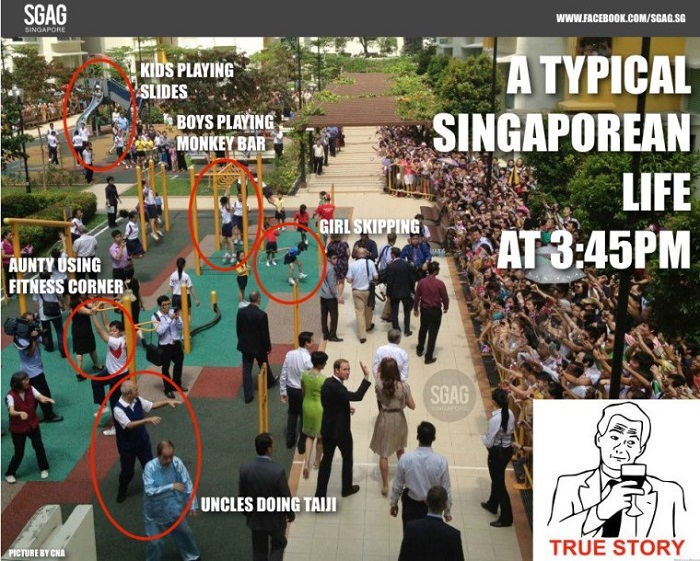

back then Induanee was yummy. Now just an old clamCorrect. This HDB playground scene at Queenstown during Prince William's visit in 2012 is the most Fakery Act of the Century created by PAP. It's such a joke and most bizarre and xia suay that it should be in Guinness Book of World Records for staged scene to fool the royalties and the world, LOL.

.

.

Reality...

.

.

With Bloomberg Television

Watch

Opinion

Daniel Moss, Columnist

May 13, 2024 at 4:00 AM GMT+8

By Daniel Moss

Daniel Moss is a Bloomberg Opinion columnist covering Asian economies. Previously, he was executive editor for economics at Bloomberg News.

The heydays are over.

Photographer: Ore Huiying/Bloomberg

Singapore is undergoing a rare transition in leadership, the third since independence in 1965.

More frequent have been the accolades directed at its economy to the point where they have entered the folklore of modern capitalism: poverty to prosperity narrative, stability in a region prone to upheaval, the lure as a hub for transport and finance.

Laudable as the attributes are, they didn’t just happen magically — and they are wrapped with significant caveats.

Pragmatism, a powerful state that can back winners, and being in the right place at the right time have been vital ingredients in the city-state’s success.

Being considered exceptional gets more difficult as the decades pass. Lawrence Wong, who becomes premier on Wednesday, will do well to bear this in mind.

Watch

Opinion

Daniel Moss, Columnist

Singapore’s New PM Faces Some Economic Headwinds

Lawrence Wong takes the reins of a prosperous country, but the incoming leader will confront no shortage of challenges.May 13, 2024 at 4:00 AM GMT+8

By Daniel Moss

Daniel Moss is a Bloomberg Opinion columnist covering Asian economies. Previously, he was executive editor for economics at Bloomberg News.

The heydays are over.

Photographer: Ore Huiying/Bloomberg

Singapore is undergoing a rare transition in leadership, the third since independence in 1965.

More frequent have been the accolades directed at its economy to the point where they have entered the folklore of modern capitalism: poverty to prosperity narrative, stability in a region prone to upheaval, the lure as a hub for transport and finance.

Laudable as the attributes are, they didn’t just happen magically — and they are wrapped with significant caveats.

Pragmatism, a powerful state that can back winners, and being in the right place at the right time have been vital ingredients in the city-state’s success.

Being considered exceptional gets more difficult as the decades pass. Lawrence Wong, who becomes premier on Wednesday, will do well to bear this in mind.

.

AMDK is struggling with 40yrs loan

Will you still be paying for it with your state pension?

Photographer: Chris Ratcliffe/Bloomberg

By John Stepek

May 13, 2024 at 8:16 PM GMT+8

Save

Welcome to Money Distilled. I’m John Stepek. Every week day I look at the biggest stories in markets and economics, and explain what it all means for your money.

Like it or not, Gen Z whippersnappers can teach asset managers a thing or two about investing, says Merryn Somerset Webb.

According to a freedom of information request made by Steve Webb, the former pensions minister and now partner at pension consultancy LCP, data from the Bank of England shows that in the last quarter of 2023, 42% of new mortgages had terms going out beyond the state pension age.

In other words, if you kept the same mortgage for your entire life, then you’d still be paying it off after you’d started collecting your state pension.

AMDK is struggling with 40yrs loan

Rise of 40-Year Loans Indicates a Flawed Housing Market

Hard-pushed first-time buyers have replaced interest-only loans with ultra-long mortgages.

Will you still be paying for it with your state pension?

Photographer: Chris Ratcliffe/Bloomberg

By John Stepek

May 13, 2024 at 8:16 PM GMT+8

Save

Welcome to Money Distilled. I’m John Stepek. Every week day I look at the biggest stories in markets and economics, and explain what it all means for your money.

Like it or not, Gen Z whippersnappers can teach asset managers a thing or two about investing, says Merryn Somerset Webb.

First-time buyers have always overstretched

There’s a bit of concern in the papers this morning about the rise of “ultra-long term mortgages” in the UK.According to a freedom of information request made by Steve Webb, the former pensions minister and now partner at pension consultancy LCP, data from the Bank of England shows that in the last quarter of 2023, 42% of new mortgages had terms going out beyond the state pension age.

In other words, if you kept the same mortgage for your entire life, then you’d still be paying it off after you’d started collecting your state pension.

About two thirds of these loans were taken out by the under-49s, and the rest by those aged 50 and over. That said, the number of loans to those aged 40 and over had shrunk since the last quarter of 2021. So the fastest growth in these loans has come from the under-40s.

This reflects a phenomenon that trade body UK Finance has already highlighted. In the last quarter of 2023, it found more than half of all new first-time buyers had borrowed for at least 30 years. Nearly a fifth had terms of more than 35 years.

Clearly, whether this takes you to state pension age or not depends on when you took the loan out. But overall, the point is that mortgage terms are lengthening, and it risks more people spending most of their working lives pumping even more of their hard-earned capital into the roof over their heads, rather than saving for their retirement.

This reflects a phenomenon that trade body UK Finance has already highlighted. In the last quarter of 2023, it found more than half of all new first-time buyers had borrowed for at least 30 years. Nearly a fifth had terms of more than 35 years.

Clearly, whether this takes you to state pension age or not depends on when you took the loan out. But overall, the point is that mortgage terms are lengthening, and it risks more people spending most of their working lives pumping even more of their hard-earned capital into the roof over their heads, rather than saving for their retirement.

This sounds dramatic. And to be clear, it isn’t ideal. But this is not a “new” phenomenon. Prior to the 2008 financial crisis and the tighter mortgage regulation that followed, the equivalent to this was first-time buyers taking out interest-only mortgages.

As with interest-only loans back then, most buyers taking out long mortgages intend to change the loan in time. Those buying in 2006 would have planned to go onto repayment loans eventually, while those buying on 40-year terms today will plan to reduce those terms.

After all, these are starter households. They should earn significantly more in future. And you can’t blame them. Long-term renting is not really an option in the UK and rents have been rocketing in the same areas where buying is hardest. So what may look like a risky option is more like a case of feeling you have no choice.

So this is nothing new. Webb himself very kindly replied, agreeing with me on X/Twitter when I raised this point: “I’m sure that what we’re seeing is that when one part of the system is tightened up we simply see another part expanding — in this case, super-long mortgages.”

In short, this is a symptom of our not-very-efficient housing market and its ongoing tendency to occupy an outsized role in our financial lives. In the longer term, we need to address this by making housing more like a consumer good and less like an investable asset.

As with interest-only loans back then, most buyers taking out long mortgages intend to change the loan in time. Those buying in 2006 would have planned to go onto repayment loans eventually, while those buying on 40-year terms today will plan to reduce those terms.

After all, these are starter households. They should earn significantly more in future. And you can’t blame them. Long-term renting is not really an option in the UK and rents have been rocketing in the same areas where buying is hardest. So what may look like a risky option is more like a case of feeling you have no choice.

So this is nothing new. Webb himself very kindly replied, agreeing with me on X/Twitter when I raised this point: “I’m sure that what we’re seeing is that when one part of the system is tightened up we simply see another part expanding — in this case, super-long mortgages.”

In short, this is a symptom of our not-very-efficient housing market and its ongoing tendency to occupy an outsized role in our financial lives. In the longer term, we need to address this by making housing more like a consumer good and less like an investable asset.

omgYes he will walk you to your death.

He did not leave you behind, CECA sneak in and leave us behindThis sort of promised is worth fuck all. She made such promise when she was inaugurated...didn't she say ' no one will be left behind? ' n now still say same thing?

And how did Shitcas come in to singkieland?He did not leave you behind, CECA sneak in and leave us behind