Manager jailed 4 weeks, fined $594k for under-declaring values of 47 imported cars

For under-declaring the values of 47 cars, a manager of a car import company was sentenced to four weeks' jail and fined $594,399.60.

Thursday, Jun 2, 2016

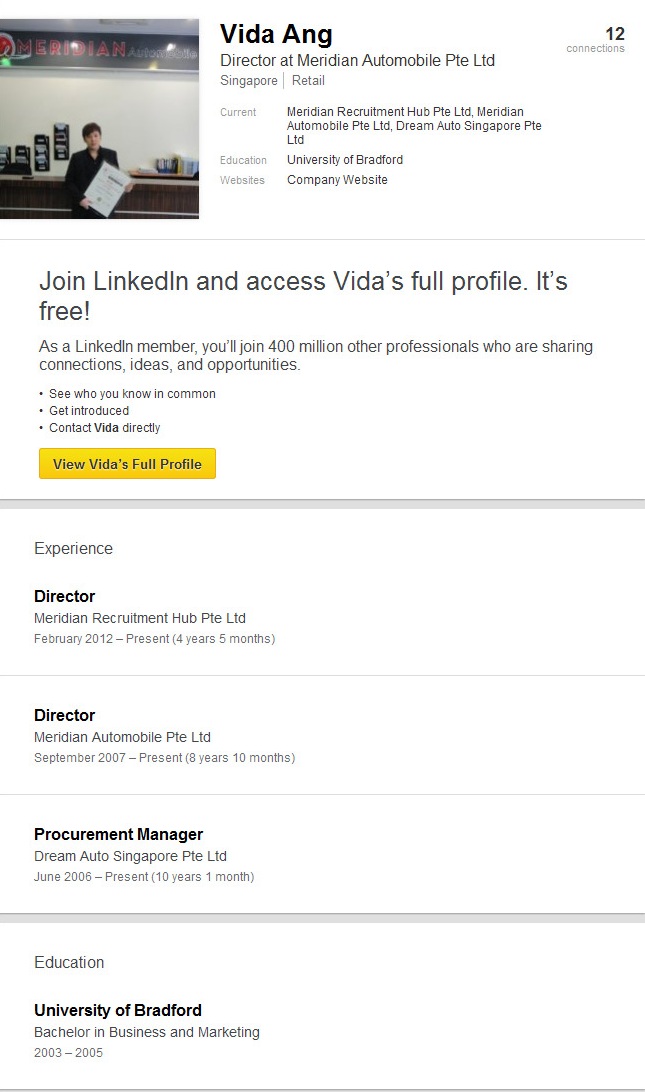

Ang Wee Tat Vida, 35, pleaded guilty to 28 charges of incorrect declarations, said a joint statement by Singapore Customs and the Land Transport Authority. Another 52 similar charges were taken into consideration in the sentencing on May 27.

Ang also pleaded guilty to 15 charges under the Road Traffic Act for providing incorrect information on the open market values of the cars. Another 32 charges were taken into account.

Ang was also ordered by the court to pay the shortfall in the Additional Registration Fees (ARF) shortfall for the 47 cars to the Land Transport Authority (LTA).

Singapore Customs and the LTA began investigating Dream Auto Pte Ltd in July 2013 and found that Ang had asked his suppliers from Japan, the United Kingdom and Hong Kong to split the value of each vehicle into two invoices, one of which was submitted to Singapore Customs for the assessment of duty and Goods and Services Tax (GST).

In some cases, Ang asked the exporters to create fictitious invoices with lower values.

Between January 2012 and June 2013, Ang submitted to Singapore Customs incomplete or fictitious invoices for 47 imported cars.

The total duty, GST and ARF that he evaded amounted to more than $74,000, $31,000, and $370,000 respectively.

Fraudulent evasion of duty and GST on the import of goods is a serious offence under the Customs Act, said the statement.

Anyone found guilty can be fined up to 20 times the amount of tax evaded and/or be jailed for up to two years.

Providing incorrect information which affects the amount of tax chargeable on the registration of a vehicle in Singapore is similarly a serious offence under the Road Traffic Act.

Anyone found guilty can be fined not more than $10,000 or jailed for a term not exceeding six months. The court can also order the convicted person to pay up the undercharged tax amount.

[email protected]