-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Local Savings Interest-Rates War Exploded on 1st Sept 2022 among banks - loan interest-rates expected to raise further

- Thread starter Byebye Penis

- Start date

very trueThen i also fear that WORSE if he may get it right, and then don't study anymore.

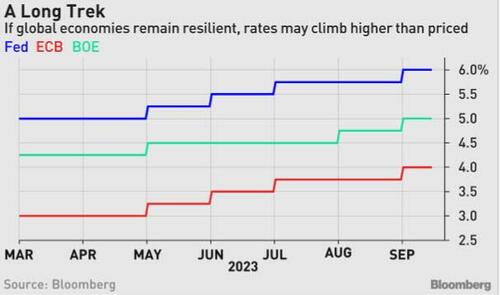

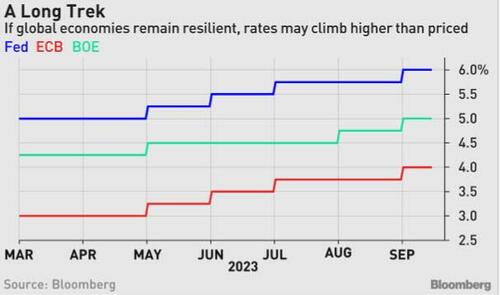

singapore's home loan is 4.2-4.5% for fixed and float at this moment

looks like it will cross 5% soon

looks like it will cross 5% soon

OCBC 4.18%pa for 8-mths for richer clients like @glockmanFD rates dropping though, wont see much higher than 4% anymore

lol premier bankingOCBC 4.18%pa for 8-mths for richer clients like @glockman

at least 200k fund lor

he orang atas???

different league, SOS is owe bank money for his home loan.lol premier banking

at least 200k fund lor

he orang atas???

If you are not those richer bank clients, you get lower interests for Fixed Deposits, the poor eats expensive rice, it's like that.

Last edited:

i thinking of shifting some to short FD to take advantage of the high interest.... but seems like it's dropping insteaddifferent league, SOS is owe bank money for his home loan.

If you are now richer bank clients, you get lower interests for Fixed Deposits, the poor eats expensive rice, it's like that.

i thinking of shifting some to short FD to take advantage of the high interest.... but seems like it's dropping instead

For short-term:

- If your quantum is below $75000, you can consider the risky malaysian banks which SDIC guarantees for up to $75000 (max exposure per person per bank, accounts combined)

- if your quantum is larger, I project 6-mths T-bills to hit 4%pa again. You can consider that.

my friend gai siao SBI, say their rates not bad also actuallyFor short-term:

- If your quantum is below $75000, you can consider the risky malaysian banks which SDIC guarantees for up to $75000 (max exposure per person per bank, accounts combined)

- if your quantum is larger, I project 6-mths T-bills to hit 4%pa again. You can consider that.

even ICBC also

tbills drop quite abit since, and not bao tio leh

my friend gai siao SBI, say their rates not bad also actually

even ICBC also

SBI is Indian

ICBC is China

15-20 years ago, SOS worked for a local Indian boss, so he had fixed deposits with BOI and ICICI

- When boss deposited notes with the BOI (very common those days) for fixed deposit promotion, the foreign-neh auntie clerk in BOI Singapore branch stole his notes and claimed that my boss didn't bring the amount that he claimed. SOS learned that you cannot give Indian banks cash.

- When boss tried to withdraw his payout with ICICI bank when his fixed deposit matured, ICICI manager told him to come back a few days later.

BOI is not gay, it is bank of india

ICICI is not ask you to die, it is Industrial Credit and Investment Corporation of India.

Banking is about Trust, both incidents taught SOS that cannot trust Indian banks in Singapore.

As for China banks, they are as risky as Malaysian banks, so I still recommend that your friend keep to within the $75000 threshold, per person's combined account in the bank.

tbills drop quite abit since, and not bao tio leh

T Bills almost full allocation this year because the yield is below 4%pa.

I think will go above 4%pa again very soon.

lol even for banks, there's high risk high returns???? local banks lower interest but surely its more secure it seemsSBI is Indian

ICBC is China

15-20 years ago, SOS worked for a local Indian boss, so he had fixed deposits with BOI and ICICI

- When boss deposited notes with the BOI (very common those days) for fixed deposit promotion, the foreign-neh auntie clerk in BOI Singapore branch stole his notes and claimed that my boss didn't bring the amount that he claimed. SOS learned that you cannot give Indian banks cash.

- When boss tried to withdraw his payout with ICICI bank when his fixed deposit matured, ICICI manager told him to come back a few days later.

BOI is not gay, it is bank of india

ICICI is not ask you to die, it is Industrial Credit and Investment Corporation of India.

Banking is about Trust, both incidents taught SOS that cannot trust Indian banks in Singapore.

As for China banks, they are as risky as Malaysian banks, so I still recommend that your friend keep to within the $75000 threshold, per person's combined account in the bank.

maybe bring to hong leong lah, lol theres one near my place

if go above 4% again can try againT Bills almost full allocation this year because the yield is below 4%pa.

I think will go above 4%pa again very soon.

my wife's buddy everyday update my wife, ask her to beo and chiong

your wife's buddy chio?if go above 4% again can try again

my wife's buddy everyday update my wife, ask her to beo and chiong

hong leong need to queue, cannot do onlinelol even for banks, there's high risk high returns???? local banks lower interest but surely its more secure it seems

maybe bring to hong leong lah, lol theres one near my place

T-bills don't need if your DBS/OCBC/UOB linked to CDP

single but nope, hahahahahahyour wife's buddy chio?

tbills bo bao tio mah.... lolhong leong need to queue, cannot do online

T-bills don't need if your DBS/OCBC/UOB linked to CDP

hong leong just below my house

no wonder u never let her advise usingle but nope, hahahahahah

Sovereign bond yields spiked

Similar threads

- Replies

- 15

- Views

- 1K

- Replies

- 0

- Views

- 942

- Replies

- 7

- Views

- 1K

- Replies

- 5

- Views

- 883