https://sg.yahoo.com/finance/news/singaporeans-overtake-us-biggest-group-020000903.html

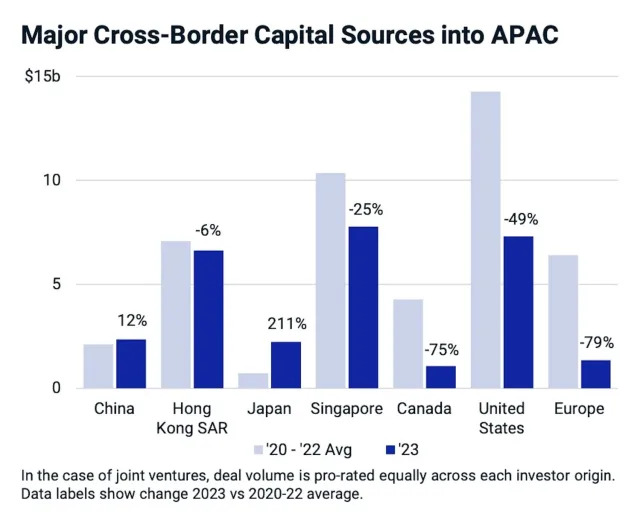

Investors from North America and Europe reduced their spending in Asia Pacific by more than 50% in 2023 compared with the year before. Investment from Canada and Europe plunged by 75% and 79%, respectively. An exception to this retreat was capital bound for Japan.

Investors from North America and Europe reduced their spending in Asia Pacific by more than 50% in 2023 compared with the year before. Investment from Canada and Europe plunged by 75% and 79%, respectively. An exception to this retreat was capital bound for Japan.