No cheekon jiak.... Jiak Neighbour XMM Cheese pie?You want to buy also no one is selling.

You may have to go without food for a few days.

There may be food rationing.

-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Global US-Dollar Shortage - Are We Already in a Recession?

- Thread starter Byebye Penis

- Start date

Russians have been offloading yuan like crazy in the past 12 months

https://news.yahoo.com/russia-using-chinese-yuan-around-051945912.html

https://news.yahoo.com/russia-using-chinese-yuan-around-051945912.html

https://www.businesstimes.com.sg/co...ses-standards-purpose-bound-digital-money?amp

No worries, SG always smart wan, now have digital currency coming to solve all problems ler..

Swee swee Bo Run Water liao

Singapore even approved Ripple to aid money-laundering

https://www.kitco.com/news/2023-06-...igital-asset-payments-and-token-products.html

Cannot say like that we are world most balai nation lai deSingapore even approved Ripple to aid money-laundering

https://www.kitco.com/news/2023-06-...igital-asset-payments-and-token-products.html

what is balai??Cannot say like that we are world most balai nation lai de

Thanks to China cheap yuan, Encik Putin is able to maintain his economic engine running while fight a Ukraine war and surviving Global sanctionRussians have been offloading yuan like crazy in the past 12 months

https://news.yahoo.com/russia-using-chinese-yuan-around-051945912.html

Malay word for Smartwhat is balai??

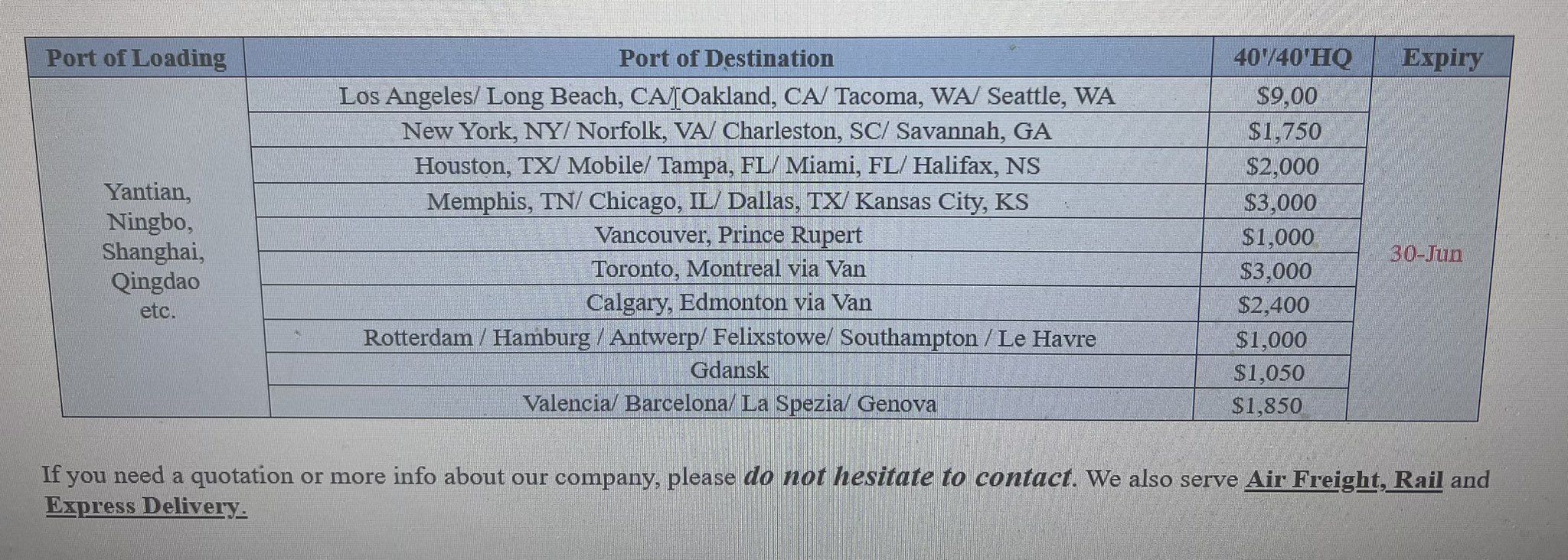

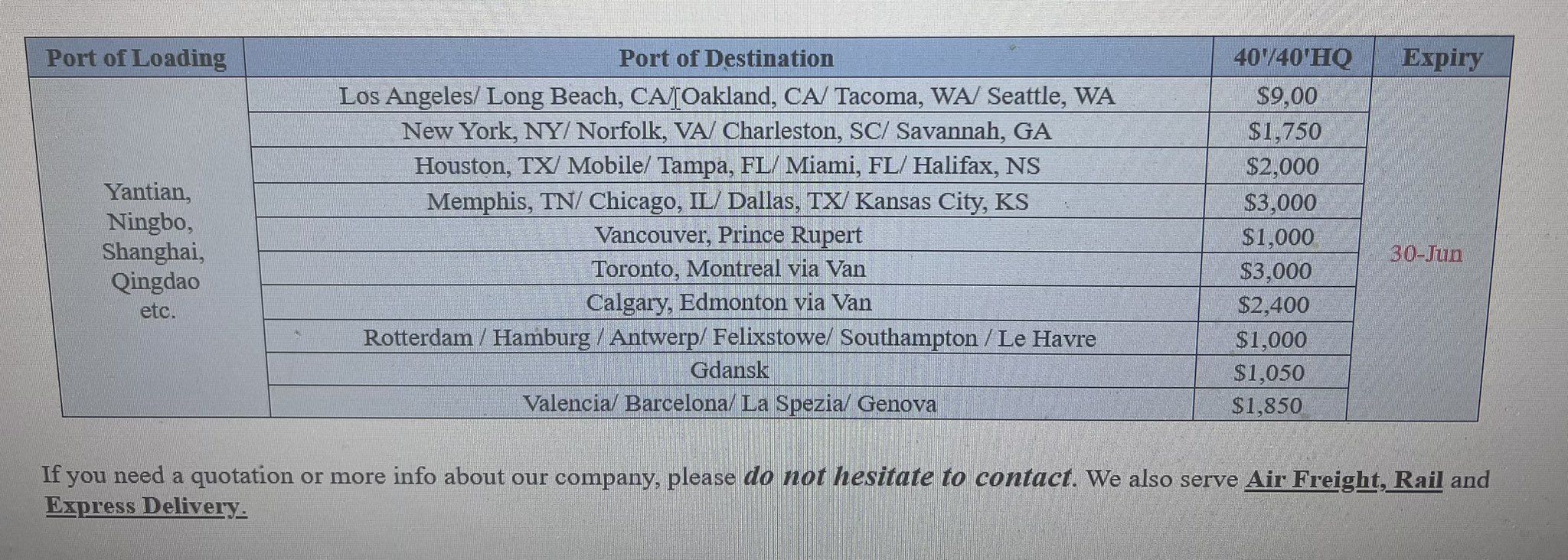

Container Shipping Cost From China To West Coast US Has Dropped 90% From US$18,000 To US$1800 average

We were in recession during lockdowns.

Massive US handouts delayed it.

No way can anyone escape recession if economies were forced to shut.

How fed bank got its economic data is a mystery as as it indicate US economy is overheating when on the ground, everyone knows its not.

Massive US handouts delayed it.

No way can anyone escape recession if economies were forced to shut.

How fed bank got its economic data is a mystery as as it indicate US economy is overheating when on the ground, everyone knows its not.

Bank for International Settlements (BIS), called on Sunday for more interest rate hikesWe were in recession during lockdowns.

Massive US handouts delayed it.

No way can anyone escape recession if economies were forced to shut.

How fed bank got its economic data is a mystery as as it indicate US economy is overheating when on the ground, everyone knows its not.

https://finance.yahoo.com/news/bis-warns-world-economy-critical-090517941.html

"De-risk" and "Friend Shoring" is happening nowContainer Shipping Cost From China To West Coast US Has Dropped 90% From US$18,000 To US$1800 average

All based on "Lim Peh Ka Li Kong" technology aka "weaponization of USD"

We were in recession during lockdowns.

Massive US handouts delayed it.

No way can anyone escape recession if economies were forced to shut.

How fed bank got its economic data is a mystery as as it indicate US economy is overheating when on the ground, everyone knows its not.

Like that Balance Sheet Recession will go global De woh, countries with debt above 100% sure tioBank for International Settlements (BIS), called on Sunday for more interest rate hikes

https://finance.yahoo.com/news/bis-warns-world-economy-critical-090517941.html

we are thankful to Japan for resisting the rate-hikes.Like that Balance Sheet Recession will go global De woh, countries with debt above 100% sure tio

Because Nippon also try to cut down it's debt as well...we are thankful to Japan for resisting the rate-hikes.

Last 20yrs, they have managed to reduce a lot debt in the Ultra Low Interest Rate era.

Nippon not only have high debt issue, it's population aged rapidly as well. So nippon may be running out of time to defuse their debt bomb

Big bosses from Singapore’s GIC, HSBC, Ares and Blackstone have met with China’s wealth-fund managers as markets go from red-hot to losers

- Top guns from BNP Paribas, Allianz and JCDecaux also called on their counterparts at China Investment Corp this year as the stakes get higher in a wobbly economy

- Chinese assets are hurting global investors as state-led crackdown and geopolitical factors undermine confidence, fundamental analysis

In those meetings, CIC Chairman Peng Chun and President Ju Weimin discussed local and global economic outlooks and capital-market landscapes with their visitors, all of them with a growing investment footprint in China and the region. They also shared information and pledged deeper cooperation on investment opportunities, CIC said.

their stock market benefiting from the weak yen, highest in decades.Because Nippon also try to cut down it's debt as well...

Last 20yrs, they have managed to reduce a lot debt in the Ultra Low Interest Rate era.

Nippon not only have high debt issue, it's population aged rapidly as well. So nippon may be running out of time to defuse their debt bomb

https://www.channelnewsasia.com/singapore/more-art-spaces-malls-budding-creatives-3583206

Suddenly, we really become very artful De woh... So muchempty mall space has been use for Art Exhibitation..

Suddenly, we really become very artful De woh... So much

Similar threads

- Replies

- 1

- Views

- 665

- Replies

- 13

- Views

- 2K

- Replies

- 2

- Views

- 997

- Replies

- 14

- Views

- 1K