If 1mth need 6k to survive, how many sinki can retire?Family of four needs $6,426 a month for basic standard of living in S'pore, says study

The average wage per working parent needed to meet the basic standards of living is $2,906 per month. PHOTO: ST FILE

Tham Yuen-C

Senior Political Correspondent

PUBLISHED

OCT 8, 2021, 10:52 PM SGT

FacebookTwitter

SINGAPORE - A family of four, with parents, a pre-teen and a teenager, needs at least $6,426 a month to afford a basic standard of living, a study on household budgets has found.

A family of two, with a single parent and a toddler or pre-schooler, meanwhile, needs $3,218 a month.

But a substantial and concerning proportion of working households in Singapore - about 30 per cent - do not earn enough to meet these needs.

The study was done by National University of Singapore Lee Kuan Yew School of Public Policy (LKYSPP) and Nanyang Technological University (NTU).

Its findings were released in the report Minimum Income Standards For Households In Singapore (2021), and were disputed by the Ministry of Finance (MOF) in a statement on Friday (Oct 8).

LKYSPP senior research fellow Ng Kok Hoe and NTU head of sociology Teo You Yenn, two of the study's six authors, said that the study on how much people need to achieve a basic standard of living in Singapore has exposed some gaps in society.

Using the figures as a benchmark and comparing them against existing income data as well as public schemes show that some segments of the population are not able to meet their basic needs, added Dr Ng at an event presenting the study's findings held over videoconferencing platform Zoom.

Catch up on the news that everyone’s talking about

Sign up

By signing up, you agree to our Privacy Policy and T&Cs.

But the MOF said "the conclusions may not be an accurate reflection of basic needs largely due to assumptions used", pointing to the limitations of the Minimum Income Standards (MIS) approach used.

The study defined standard of living as one in which Singaporeans can afford housing, food and clothing, and also have opportunities for education, employment and work-life balance, as well as access to healthcare.

It should also enable a sense of belonging, respect, security and independence and afford the choice to participate in social activities and cultural and religious practices.

Based on this definition that emerged from focus group discussions, researchers then convened more focus groups for people to come up with lists of items people from different stages of life will need.

The researchers went to shops or websites mentioned by the participants to find out the real price of each item. These lists were then combined to form the budget of various configurations of households.

Dr Ng said a critical pillar of the MIS approach is to ensure that each focus group is economically diverse, so the budgets resulting from the discussions are not just for particular segments, say the rich or poor. Instead, these budgets apply universally for all Singaporeans, he added.

A total of 196 participants of different genders, ethnicity and socio-economic backgrounds took part in 24 focus group discussions.

This method differs from other methods of assessing needs, which typically depend on experts and household expenditure.

The MOF said the budgets arising from the study were in excess of the basic needs for an average household.

Report on minimum income standards not an accurate reflection of basic needs: Finance Ministry

Population census: Higher incomes in Singapore, but mind the job and wealth gap

The LKYSPP-NTU team had done a previous study in 2019, focusing on elderly households.

This time, it covered younger households, including those with a single parent with one child aged two to six, and those with parents with two children, one aged seven to 12 and the other aged 13 to 18.

It also updated its findings on households with a single elderly person, by accounting for inflation, among other things.

Adopting the household budgets as benchmarks and comparing them with data on actual income from work, the study found that after taking major taxes and benefits into account, workers earning the equivalent of the median wage in 2020, which stood at $4,534, will make more than enough to cover the needs of the single-parent and two-parent households.

Based on the study, the average wage per working parent needed to meet the basic standards of living is $2,906 per month.

The study's authors suggested that this can be a starting point for a socially acceptable living wage for Singapore, which will allow people to meet their basic needs.

However, the study found that some groups were at risk of falling below this minimum. The youngest workers, as well as those without tertiary education and those in certain low-wage sectors, would fall short if they belonged to these single-parent and two-parent households.

For example, cleaners and labourers take home a median monthly income of only $1,535, while salespeople make $2,345.

For elderly households with one person, basic needs will cost $1,421 a month. PHOTO: ST FILE

The Progressive Wage Model (PWM) and Workfare Income Supplement were also inadequate in helping to make up the difference, with wage levels under these schemes coming up to about 60 per cent of what the single-parent and two-parent households need.

"Clearly, interventions currently available are not enough for working households with children," said Dr Ng.

He added that if such households depend on employment in PWM sectors such as cleaning as their only source of income, they are likely to experience significant financial strain, calling for wage intervention to go further than the PWM currently does.

For elderly households with one person, basic needs will cost $1,421 a month.

Income data suggests that older workers would have just enough to cover this. Workers who are 60 years old and above make a median monthly wage of $2,330.

But elderly people depending on Central Provident Fund payouts may find themselves short, while those needing public assistance would be a long way from achieving a basic standard of living, the study found.

The CPF Basic Retirement Sum, which pays out $800 a month, covers only 56 per cent of what a single elderly person needs. The Silver Support Scheme covers only 11 per cent to 21 per cent, the study found.

Population decline raises issues around Singapore society, identity

Population census 2020: How S'pore has changed in 10 charts

While the study offers a scientific benchmark for policymakers to refer to, it does not prescribe a way to help close the gap, said Dr Ng.

He suggested that there were two options, either rebalance the private and public provision of public services such as education and healthcare, or improve wage interventions such as PWM.

The study found that housing, healthcare, education and childcare accounted for a significant proportion of spending for all household types - 28 per cent of the budget for two-parent households, and 39 per cent for single-parent households.

More state funding for such public services, through universal subsidies or direct provision, would help lighten the financial burden on households, he noted.

"What we mustn't do is say we can't move on any of these fronts. If you don't move on any front then people will not have enough," he added.

The study's authors also said the MIS method of constructing household budgets, adopted by countries such as Britain, France, South Africa and Thailand, reflects the lived realities and ordinary habits of people and captures the values and principles that ordinary Singaporeans identify with.

For instance, participants agreed that money should be allocated for contributions at funeral wakes, or birthday presents, but rejected air-conditioners as a necessity.

Participants had agreed that landlines were not needed, since most people use their mobile phones nowadays. PHOTO: ST FILE

They also agreed that land lines were not needed, since most people use their mobile phones nowadays, and that taxi rides are a necessity a few times a week, though cars are not.

Associate Professor Teo said: "The spirit of this project is really about trying to capture how ordinary people think about the basic standard of living in a particular time and... many participants were very articulate in saying that it shouldn't just be about breathing and being alive.

"It's also about thriving, having respect and security and belonging."

The importance of this sense of belonging had come through especially strongly this time around, compared with the first study in 2019, as parents spoke about how children need to be able to do things other children do, so they feel they belong.

S'pore's social policies: New normal or still an exceptional system?

Drop middle-class judgment of low-income parenting

That is why the household budgets also included money for them to join their friends at outings outside of school, she added.

Dr Ng said: "It was very meaningful... that people can agree what basic needs in society mean, that people from very different backgrounds agree that there is such a thing called basic needs, agree what it means and looks like...

'This should urge all of us to think about how in policymaking and public deliberation and thinking, we should bring people into it and not think that answers are best produced by narrow groups of elites."

-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cost of living in Singapore

- Thread starter LITTLEREDDOT

- Start date

Real median income in Singapore falls 2.3% in 2023 on high inflation

The labour force participation rate among residents aged 15 and above declined from 70 per cent in 2022 to 68.6 per cent in 2023. ST PHOTO: LIM YAOHUI

Tay Hong Yi

Nov 30, 2023

SINGAPORE – Workers are feeling the pinch in 2023, as high inflation takes its toll on their wage growth.

In preliminary labour force data released on Nov 30, the Ministry of Manpower (MOM) said resident workers at the 20th-percentile salary level saw their real incomes fall 3 per cent year on year, while those drawing the median wage saw a 2.3 per cent decrease year on year.

“Residents” refers to Singaporeans and permanent residents.

Singapore’s employment rate for residents aged 15 and above also fell from 2022’s historic high of 67.5 per cent in an “exceptionally tight” labour market to 66.2 per cent, said the ministry.

MOM said the labour market remained tight in 2023, with unemployment and long-term unemployment rates declining for both PMETs (professionals, managers, executives and technicians) and those not in such roles.

MOM said the decline in employment rate over the year was due to more residents staying outside the labour force, and not because of difficulties with seeking employment.

The labour force participation rate among residents aged 15 and above declined from 70 per cent in 2022 to 68.6 per cent in 2023, it noted.

MOM also noted that labour demand is easing as the number of job vacancies fell for five consecutive quarters and the ratio of job vacancies to unemployed people “also dipped significantly” for the second consecutive quarter to 1.94 in June 2023.

Non-PMETs saw a larger decline in unemployment rate, from 4.4 per cent in 2022 to 3.6 per cent in 2023, compared with that for PMETs, which dropped from 2.6 per cent to 2.4 per cent over the same period, MOM said.

The long-term unemployment rate also fell more for non-PMETs, from 0.7 per cent to 0.5 per cent, compared with a 0.1 percentage point decline to 0.4 per cent for PMETs over the same period.

MOM added that indicators of labour under-utilisation improved as well.

For one, the time-related underemployment rate declined from 3 per cent in 2022 to 2.3 per cent in 2023, the lowest in over a decade.

“This indicates that more part-time workers in 2023, compared with 2022, were able to have the work hours they want,” MOM said.

Time-related underemployment rate is defined as the percentage of those aged 15 and above who normally work less than 35 hours a week, but are willing and available to engage in additional work, out of the entire pool of those employed.

Meanwhile, the incidence of discouraged workers remained stable and low at 0.4 per cent in 2023.

Discouraged workers are those outside the labour force who are not actively looking for a job because they believe their job search would not yield results.

Reasons workers cited for being discouraged include the beliefs that there is no suitable work available, that employers discriminate against them, and that they lack necessary qualifications, training, skills or experience, MOM said.

MOM added that the proportion of employees in permanent jobs rose to 90.5 per cent, the highest percentage since 2016.

Meanwhile, the number of own account workers, which refers to self-employed persons without employees, declined to pre-Covid-19 levels after four years of increases.

The category includes platform workers such as taxi and private-hire car drivers, as well as delivery workers who use matching platforms in their work.

The number of regular platform workers fell by about 20 per cent, with most of those who exited being delivery workers.

MOM said this is likely due to the easing in demand for deliveries compared to the immediate post-pandemic period.

“The increased job vacancies and job stability associated with employee jobs could have prompted these platform workers to take up salaried jobs,” it added.

MOM said nominal income, which does not take inflation into account, was higher in 2023 than in 2022.

At the 20th-percentile income level, workers earned $2,826 in 2023, up from 2022’s $2,779.

Even after accounting for Workfare Income Supplement (WIS) and related payments, real wages for those at the 20th-percentile wage level still declined by 2.1 per cent.

“While real income growth for the remainder of 2023 is likely to remain negative, we expect an improvement in real income growth in 2024 with inflation easing,” said the ministry.

It added: “Over a longer time horizon from 2013 to 2023, real income growth remained positive and wage dispersion narrowed between the (20th-percentile) worker and the median worker.”

In 2023, nominal income for workers at the 50th percentile, or median level, stood at $5,197, up from 2022’s $5,070.

The results in the 2023 advance labour force report are drawn from the annual Comprehensive Labour Force Survey, which is conducted on a representative sample of resident households. More than 27,900 households responded to the latest survey.

Mr Ang Boon Heng, director of MOM’s manpower research and statistics department, told reporters at a media briefing on Nov 30 that the 0.9 percentage point narrowing of the decline in real wages for 20th-percentile earners shows the significant impact made by the WIS and other payments.

“Considering that inflation is high... I think with inflation easing, we will be able to see positive impact on the lower-wage workers with all these policies,” he said.

He also said that Singapore still has one of the highest employment rates worldwide, despite its decline.

However, said Mr Ang, the ministry is looking into employment rates for specific age groups, with the rates for some groups, such as women aged 45 to 49, “not as high as we hope them to be”.

“These are pockets or groups where we can try to raise the employment rate, but there will always be that competing... downward pressure from the ageing population, so we will expect employment rates to stay at this level,” he said.

ComfortDelGro to raise cab fares from Dec 13; Prime Taxi to follow suit

The flag-down fares of ComfortDelGro taxis will increase by 50 cents from Dec 13. ST PHOTO: KUA CHEE SIONG

Kolette Lim

Dec 6, 2023

SINGAPORE - Singapore’s largest taxi operator ComfortDelGro will raise flag-down fares by 50 cents for its regular cabs, as well as distance and time-based charges by one cent, from Dec 13 at 6am.

This is to help drivers defray higher operating costs due to rising fuel prices, high inflation and the upcoming goods and service tax (GST) hike from 8 per cent to 9 per cent starting Jan 1, the company said in a statement on Dec 6.

As at October, ComfortDelGro ran a fleet of 8,841 Comfort and CityCab taxis, or about 64 per cent of the market, based on figures from the Land Transport Authority.

Another cab operator, Prime Taxi, told The Straits Times it also plans to raise its fares.

After the adjustments, the starting fare of a ComfortDelGro Hyundai i40 cab will increase from $3.90 to $4.40, while that for a Toyota Prius and a Hyundai Ioniq Hybrid taxi will climb from $4.10 to $4.60.

Flag-down fares for Hyundai Ioniq, Toyota Kona, Toyota Sienta Hybrid and BYD e6 taxis will increase from $4.30 to $4.80.

The increase in starting fares does not apply to limousine taxis, such as MaxiCab and Mercedes-Benz cabs. Flag-down fares for the limousine fleet will remain at $4.80, after an increase from $4.10 in November.

But charges for distance travelled and wait times will rise for all its fleets. For regular taxis, there will be a one-cent increase for distance rates to 26 cents for every 400m under 10km and every 350m after 10km, up from 25 cents (inclusive of a one-cent temporary fare tariff in effect till June 30, 2024).

For limousine cabs, a one-cent increase will be rolled out too, with distance and time-based fares increasing by intervals of 36 cents instead of 35 cents.

With the adjustment, the estimated fare for a 10km trip in a normal taxi during off-peak hours will increase by 6.8 per cent, or 94 cents, from $13.80 to $14.74.

The operator last raised its fares in March 2022, the first increase in a decade. That adjustment included a 20-cent increase in flag-down fares for both normal taxis and limousines.

On Dec 6, ComfortDelGro also announced that it would extend the period during which an evening peak-hour surcharge applies by an hour.

It will cover the period from 5pm to 11.59pm from Monday to Sunday, including public holidays. Right now, the peak-hour surcharge is in effect from 6pm to 11.59pm.

A new peak-hour surcharge will also be introduced from 10am to 1.59pm on weekends, including public holidays.

Mr Tommy Tan, chief executive of ComfortDelGro’s taxi business, said the increase ensures that its drivers receive fair earnings with the rising cost of operations.

“For the past few years, our cabbies’ earnings had been impacted first by the pandemic, and then by higher operating expenses due to an increase in fuel prices and high inflation,” he added.

The peak-hour surcharge changes also ensure that there are enough taxis on the road to meet rising commuter demand at peak hours, he said.

Since the outbreak of Covid-19 in April 2020, ComfortDelGro has provided its drivers with rental waivers and continues offering a waiver of 10 per cent.

Renting a Toyota Sienta cab from ComfortDelGro costs $118 daily for up to six days, and $98 per day for more than six days.

Rental for a Mercedes-Benz E-class taxi costs $388 a day for up to six days, and $368 daily for a longer rental period.

National Taxi Association adviser Yeo Wan Ling said the higher takings from the fare increase will help drivers support their families better.

“The impending increase in GST is also an additional cost on their operations, as it impacts their rental, food and parking expenses, among others,” she added.

ComfortDelGro cabby Chan Pak Kin, 70, told ST the increased fares do not go far enough to alleviate rising operating costs.

“The additional amount will be erased once I get a fine for speeding or a parking summons. The company should look at reducing the rental costs instead,” he said.

The higher fares could also turn potential customers away, he added. They might instead opt for ride-hailing trips with companies such as Grab if they offer lower fares.

Mr Neo Chee Yong, deputy general manager of motor group Prime, which operates Prime Taxi, said the company will also adjust its fares to help drivers cope with higher operating costs and inflation.

He declined to disclose the extent of the increase and when it would take effect.

At present, the flag-down rate for Prime, the smallest taxi operator here with 532 cabs as at October, ranges from $4.10 to $4.50.

Ms Jasmine Tan, general manager of taxi firm Trans-Cab, said the company will also roll out the same peak-hour surcharge adjustments as ComfortDelGro from Dec 13.

The company has not decided if fares should be increased, she added.

“Prices for everything, including housing and petrol, are rising, so we want to help our drivers cushion their operating costs,” said Ms Tan.

Right now, Trans-Cab, Singapore’s third-largest operator with about 2,100 cabs, imposes a surcharge of 25 per cent of the metered fare from 6am to 9.29am on weekdays, excluding public holidays, and 6pm to 11.59pm daily, including public holidays.

Strides Premier, Singapore’s second-largest operator with about 2,200 cabs, said it “will be monitoring the situation closely before making any decision” on fare adjustments.

SingPost to raise international postage rates by 5 cents from Jan 1

Exceptions to the rate hike include aerogrammes to Malaysia and Brunei, which will remain at 80 cents each. PHOTO: ST FILE

Michelle Zhu

Dec 7, 2023

SINGAPORE – The cost of sending most international airmail letters, printed papers, aerogrammes and postcards will go up by five cents from Jan 1, Singapore Post announced on Dec 7.

Exceptions include rates for aerogrammes to Malaysia and Brunei, which will remain at 80 cents each, as well as mail charges for additional weightage.

For aerogrammes to all countries except Malaysia and Brunei, the new rate will be 85 cents, up from 80 cents currently.

The postal services provider said its upcoming rate hike was the result of annual fee revisions made by the Universal Postal Union, which in turn led to a progressive increase of international postal settlement rates over the years.

This settlement fee is payable to postal organisations of destination countries for mail delivery.

SingPost’s five cent rate increase applies to zone 1 (Malaysia and Brunei), zone 2 (countries in Asia and the Pacific except Australia, Japan and New Zealand) and zone 3 (Australia, Japan, New Zealand and the rest of the world).

For mail – comprising letters and printed papers – to zone 1, the new rate will be raised to 85 cents from 80 cents for mail weighing up to 20g; $1.05 cents for mail up to 50g (from $1); and $1.45 for mail up to 100g (from $1.40).

The rate for every additional 100g of mail to zone 1 will remain unchanged at $1.10. Postcards to this zone will be charged at 75 cents apiece compared with 70 cents previously.

Rates for mail going to zone 2 will be raised to 95 cents from 90 cents for the first 20g, with charges for every additional 10g to remain unchanged at 25 cents. Postcards going to zone 2 will be charged 85 cents per piece as opposed to 80 cents previously.

A rate of $1.55 for the first 20g of mail will apply to zone 3 destinations, compared with $1.50 previously, with no change to the 35 cents charged for every additional 10g. A higher 85 cents rate will apply to postcards per piece to this zone, compared to 80 cents.

Weight limits stated for mail rates to all three zones are capped at 2kg.

In late 2022, SingPost announced it would raise its postage, package and doorstep parcel delivery rates from Jan 1, 2023 in line with earlier goods and services tax hikes.

From Oct 9, 2023, the group increased its standard regular mail rates by 20 cents, or 65 per cent, to 51 cents, from 31 cents. This marked the first significant rate increment introduced by SingPost since 2014.

Shares of SingPost were trading up 0.5 cent, or 1.1 per cent, at 45.5 cents as at 9.33am on Dec 7, after the rate hike announcement. THE BUSINESS TIMES

In the meantime, our leaders will continue to "monitor the situation" while drawing the highest salaries worldwide for politicians.

Household electricity bills set to rise as carbon taxes to increase in 2024

On average, the higher carbon tax could lead to an increase of $4 in monthly household utility bills for a four-room Housing Board flat. ST PHOTO: CHONG JUN LIANG

Lynda Hong

Senior Environment Correspondent

DEC 9, 2023

SINGAPORE – Electricity prices for households are poised to rise in 2024 as power generation companies will face a higher tax for their carbon emissions.

On average, the higher carbon tax could lead to an increase of $4 in monthly household utility bills for a four-room Housing Board flat, according to a forecast from the National Climate Change Secretariat (NCCS). This is assuming the full cost of the carbon tax is passed on to consumers.

Electricity retailers have not yet disclosed details of the price changes.

In 2024, Singapore’s carbon tax will rise to $25 per tonne of emissions, up from $5 per tonne now. This will be raised to $45 per tonne of emissions in 2026, and eventually to between $50 and $80 per tonne of emissions by 2030.

Introduced in 2019, the carbon tax was set at $5 per tonne for five years till 2023 to provide a transition period for facilities that directly emit at least 25,000 tonnes of emissions annually.

NCCS calculated that every increase of $5 in carbon tax could cause household electricity tariffs to rise by a corresponding 1 per cent. This means electricity bills could go up by about 4 per cent in 2024.

Households here can either choose a price plan from an electricity retailer or buy power from SP Group at the regulated tariff set by the Energy Market Authority.

Electricity retailers that spoke to The Straits Times were tight-lipped about the exact rate increase of electricity prices.

Leading electricity retailer Geneco, which has a market share of nearly 27 per cent, said: “Tariffs will be adjusted according to any development to carbon tax.”

Senoko Energy said: “While the carbon tax component is likely to make an impact on electricity prices, it could also encourage businesses and households to re-evaluate their electricity consumption in efforts to lower their energy usage and wastage.”

Apart from carbon tax, other significant costs that determine the pricing of electricity plans include the prevailing fuel price, said PacificLight.

The power-generation company and electricity retailer is developing a project on Pulau Bulan in Indonesia to import electricity from solar power.

It has also spent more than $30 million to improve efficiencies at its Jurong Island plant, including upgrading its turbine, which would reduce an overall 40,000 tonnes of emissions annually when the improvements are completed in 2024.

Increasing the energy efficiency of power plants is one strategy to reduce the impact of carbon tax on retailers that are also generation companies.

Tuas Power’s chief operating officer Michael Wong told ST that its power station is being upgraded to improve efficiency, to reduce the gas used and amount of emissions per megawatt hour of energy generated.

Tuas Power is also moving towards using lower carbon-emission sources of energy such as solar and biomass to generate electricity, added Mr Wong.

Sembcorp Power did not respond to ST’s queries, while Keppel Electric declined to comment.

Apart from power stations, the water sector will also be impacted by the higher carbon tax from 2024.

Water in Singapore requires electricity to produce. For instance, desalination, one of the processes involved in providing the Republic’s water supply, requires energy to remove salt from seawater.

From January 2024 to December 2025, eligible Singaporean HDB households will receive an additional $20 per quarter in U-Save rebates – $80 a year in total – to cushion the impact of the increases in carbon tax and water price in 2024 and 2025.

On average, the additional U-Save rebates should fully offset the increase in utility bills for one- to two-room flats over the next two years, by about 80 per cent for three- to four-room flats, and by about 65 per cent for larger flats.

As part of its international commitment to tackling climate change, Singapore has a target of reducing greenhouse gas emissions to about 60 million tonnes in 2030.

Singapore’s emissions are expected to peak at around 65 million tonnes between 2025 and 2028, before they are reduced so as to reach net-zero emissions by 2050.

The latest figures show that Singapore’s greenhouse gas emissions in 2021 reached the highest levels yet at 57.7 million tonnes – representing an increase of around 9 per cent from 2020 levels.

One strategy to meet the net-zero target is raising the carbon tax.

According to the Ministry of Sustainability and the Environment, carbon tax provides a broad-based price signal across the economy to encourage companies to reduce their emissions and, at the same time, gives them the flexibility to act where it makes the most economic sense.

Dr David Broadstock, a senior research fellow and lead of energy transition at the National University of Singapore’s Sustainable and Green Finance Institute, said: “We are beginning to see prices which will be noticeable – which is important, since the carbon tax is necessary to achieve a timely energy transition, and reach our net-zero aspirations.

“It also is a timely juncture to think about how impactful high carbon prices will be. With a future price of $50 to $80 (per tonne of emissions) by 2030, Singaporeans will feel the effect more strongly still.”

Gas, electricity prices to rise in next quarter with higher GST, carbon tax and energy costs

Consumers who have standard fixed price plans with electricity retailers will not see any change in their electricity tariffs until they renew their contracts. ST PHOTO: CHONG JUN LIANG

Cheryl Tan

Correspondent

DEC 29, 2023

SINGAPORE - Gas and electricity prices will go up for the next three months as a result of higher carbon tax, a scheduled increase in the goods and services tax (GST) and rising energy costs.

From Jan 1 to March 31, 2024, households supplied by SP Group will see a 5 per cent increase in electricity tariffs to 32.58 cents per kilowatt-hour (kWh) after GST, up from 31 cents currently.

After GST, town gas tariffs will also increase by about 4 per cent, to 25.23 cents per kWh, up from 24.21 cents per kWh currently, according to City Energy, the producer and retailer of piped gas.

Consumers who have standard fixed price plans with electricity retailers will not see any change in their electricity tariffs until they renew their contracts, said the Energy Market Authority (EMA) on Dec 29.

From 2024, the GST will increase to 9 per cent, up from 8 per cent currently, while the carbon tax will be raised to $25 per tonne of emissions, up from $5 per tonne of emissions currently.

“The carbon tax is part of a suite of measures to support Singapore’s transition to a low-carbon economy, by steering consumers and producers away from carbon-intensive goods and services, holding businesses accountable for their emissions, and enhancing the business case for the development of low-carbon solutions,” said EMA’s spokesman.

Power generation companies levied the carbon tax are expected to pass on some of the cost to electricity retailers like SP Group, which could then pass on these additional costs to customers.

The National Climate Change Secretariat had in December forecast that the carbon tax hike would bring about a $4 increase in monthly household utility bills for a four-room Housing Board flat, assuming that the full cost of the tax is passed on to consumers.

EMA said in response to queries that the revised electricity tariff incorporates higher energy costs, and factors in the full carbon tax.

Approximately 60 per cent of households buy electricity from SP Group, it noted.

Retailers are not allowed to change the fixed rate for electricity under standard price plans during the contract tenure.

The average gas price used to calculate the electricity tariff for Jan 1 to March 31, 2024, has also increased vis-a-vis the previous quarter, said EMA.

It noted that around 95 per cent of Singapore’s electricity comes from imported natural gas, which means Singapore cannot be fully insulated from developments in the global energy market.

“As we continue in our energy transition, natural gas, which is the cleanest form of fossil fuel, is expected to remain the dominant fuel for Singapore in the medium term,” said EMA.

Natural gas will remain the country’s main source of energy for the next decade, accounting for more than 50 per cent of Singapore’s energy mix by 2035, even as the Republic turns to cleaner technology to decarbonise the energy sector.

Households will receive help for rising bills.

From January 2024 to December 2025, eligible Singaporean HDB households will receive an additional $20 per quarter in U-Save rebates – $80 a year in total – to cushion the impact of the increases in carbon tax and water prices in 2024 and 2025.

Water will soon cost consumers an additional 50 cents per cubic m, starting with a 20-cent increase in April 2024 and a 30-cent rise in April 2025.

U-Save rebates are part of the GST Voucher scheme, which provides lower- and middle-income HDB households with quarterly rebates of $220 to $380 to offset their utility bills.

On average, the additional U-Save rebates should fully offset the increase in utility bills for one- and two-room flats over the next two years, by about 80 per cent for three- and four-room flats, and by about 65 per cent for larger flats.

Dr David Broadstock, senior research fellow and lead for energy transition at the National University of Singapore, noted that the electricity tariff rate that consumers will pay after GST will be the highest since 2008 – which was 32.64 cents per kWh at the time.

“Singapore’s electricity consumers will certainly notice the price increase.

“At a time when international gas prices have been fairly stable and domestic power markets have considerably lower price volatility than in recent years, we can attribute most of the price revision to the rising carbon tax,” he added.

He expects that most electricity generation companies will likely pass on the carbon tax burden to their retailers, and it will subsequently be passed on to end-consumers, in a bid to protect the companies’ financial viability.

However, the rising cost from the carbon tax could encourage innovation among companies to reduce the carbon content of the fuel used, for instance, said Dr Broadstock.

At the same time, having more clean energy imports in the future could also have a bearing on the influence of carbon tax on future electricity tariffs, he added.

With that said, Dr Broadstock expects global natural gas prices to continue to rise over the next three to four years.

This is due to geopolitical uncertainties like the Israeli-Hamas conflict affecting energy supply chains, and the increased pressure to avoid classifying natural gas as a clean transition fuel, which will lower future demand for natural gas and place an upward pressure on prices.

The Sinkies who may retire early are our Ministers who earn an annual salary that is sufficient to feed the average S'porean family for a lifetime.If 1mth need 6k to survive, how many sinki can retire?

Households to pay more for waste disposal from July 1 due to rising costs

Monthly household refuse collection fees for HDB flats and non-landed private housing will rise from $9.81 to $10.20. ST PHOTO: KELVIN CHNG

Ang Qing

APR 01, 2024

SINGAPORE - From July 1, residents will need to pay more for public waste collection due to rising operational and manpower costs.

The National Environment Agency (NEA) said in a statement on March 28 that monthly household refuse collection fees for Housing Board flats and non-landed private housing will rise from $9.81 to $10.20, an increase of 39 cents.

The monthly fee for those living in landed homes will go up from $32.67 to $34, an increase of $1.33.

NEA said: “The revised fees ensure that Singapore’s overall waste management system can operate sustainably.”

Household refuse collection fees are reviewed biennially, or once every two years, it added, noting that average charges by public waste collectors have increased over the past few years in tandem with rising operational and manpower costs.

Every month, each household pays one of Singapore’s three public waste collectors a refuse collection fee through its monthly utility bill. These public waste collectors – 800 Super Waste Management, Alba W&H Smart City and SembWaste – were appointed through open competitive tenders, NEA said.

NEA said those living in HDB flats can offset their refuse collection fees through U-Save rebates, which are given quarterly. The rebates for the 2024 financial year will be credited in April, July, October and January 2025.

The rebates are credited directly to eligible households’ utilities accounts managed by utility provider SP Services.

Worldwide Cost of Living: Singapore and Zurich top the ranking as the world’s most expensive cities

Thu, 30th Nov 2023- EIU’s Worldwide Cost of Living survey found that, on average, prices rose by 7.4% year on year in local-currency terms. Price growth has slowed from the 8.1% reported in last year’s survey, but remains significantly above the trend in 2017-21.

- Singapore maintained its pole position as the world’s most expensive city for the ninth time in the last eleven years, tying with Zurich (Switzerland) and overtaking New York (US), which fell to third place this year.

- Although three US cities (New York, Los Angeles, and San Francisco) are among the top ten, North American cities have, on average, slipped down our cost-of-living ranking.

- Western Europe accounts for four of the top ten most expensive cities in our ranking, owing to sticky inflation in groceries and clothing along with appreciation of the region’s currencies.

- The Russian cities of Moscow and St Petersburg experienced the biggest drop in the ranking as sanctions weakened the rouble.

- Of the ten categories in our price index, utility prices rose the most slowly over the past year, reflecting the waning impact of Russia’s invasion of Ukraine in 2022. Grocery prices, however, continue to rise strongly.

Singapore and Zurich were the most expensive cities in this year’s survey. Zurich moved up from sixth place to join Singapore at the top, bumping New York (which tied with Singapore for first place last year) down to third place. Zurich, which is back at the top after three years, moved up due to the strength of the Swiss franc, as well as high prices for groceries, household goods and recreation. Overall, our top ten this year consists of two Asian cities (Singapore and Hong Kong), four European cities (Zurich, Geneva, Paris and Copenhagen), three US cities (New York, Los Angeles and San Francisco) and Tel Aviv in Israel. Our survey was conducted before the start of the Israel-Hamas war, which has affected the exchange rates in Israel and may have made it harder to procure some goods in Tel Aviv, thereby affecting prices.

Globally, utility prices (household energy and water bills) witnessed the slowest inflation of the ten categories covered in our survey. This was the fastest-rising category in 2022 and the moderation suggests an easing of the energy price shocks caused by Russia’s invasion of Ukraine. Grocery, on the other hand, saw the fastest pace of price growth. Food inflation has been sticky across the world as many manufacturers and retailers have passed on higher costs to consumers and the increasing frequency of extreme weather events continues to keep supply-side risks elevated.

A free summary report can be downloaded here.

EIU’s Worldwide Cost of Living 2023 survey compares the prices of more than 200 goods and services in 173 major cities.

Besides easing supply-side tensions, the hawkish monetary policy stance adopted by the US Federal Reserve has helped moderate inflation in the country by our calculations. Moreover, several foreign currencies have appreciated against the US dollar in 2023. Both these factors have led to the majority of the 22 US cities covered in our survey falling down the ranks. Even then three US cities (New York, Los Angeles, and San Francisco) are among the top ten. In New York prices were up by 1.9%. Although some grocery items, such as eggs and beef, and recreational activities saw increases, prices remained subdued for others, including petrol and clothing.

On the other hand, cities in Latin America and western Europe have moved up. The Mexican cities of Santiago de Querétaro and Aguascalientes were the biggest movers up the ranking, with the peso proving to be one of the strongest emerging market currencies in 2023, on the back of interest-rate rises and strong inward investment. European cities, in general, have moved up the ranks amid sticky inflation as well as appreciation in the euro and other local currencies in the region. Asia continues to see relatively low price increases on average. Four Chinese cities (Nanjing, Wuxi, Dalian and Beijing) and two Japanese ones (Osaka and Tokyo) were among the biggest movers down the ranking this year.

A free summary report can be downloaded here.“The supply-side shocks that drove price increases in 2021-22 have reduced since China lifted its covid-19 restrictions in late 2022, while the spike in energy prices seen after Russia invaded Ukraine in February 2022 has also eased. However, the cost-of-living crisis is hardly over and price levels remain much above historical trends. We expect inflation to continue to decelerate in 2024, as the lagged impact of interest-rate rises starts affecting economic activity, and in turn, consumer demand. But upside risks remain—further escalations of the Israel-Hamas war would drive up energy prices, while a greater than expected impact from El Niño would push up food prices even further.”

UPASANA DUTT, HEAD OF WORLDWIDE COST OF LIVING AT EIU

Forum: Is it fair to charge more for kopi-o gao?

APR 11, 2024I can understand coffee shops charging more for takeaway cups as these cost money and it is a business decision (Coffee shops should avoid exploitation in the name of sustainability, April 6).

However, I have come across stalls which charge 10 cents more for kopi-o gao (strong black coffee) just because of a little more coffee and less water. By the same token, what about customers who ask for kopi-o pok (light black coffee)? Shouldn’t they charge less?

While iced coffee costs more because it needs to be more concentrated as the ice melts and dilutes the drink, it makes no sense to charge more for strong coffee.

There are also shops that charge 10 cents more for coffee, citing the recent increase in potable water prices. The increase is 50 cents per cubic metre (1,000 litres) of water, implemented over two phases, with an increase of 20 cents per cubic metre from April 1.

You can get about 5,000 cups of coffee from 1,000 litres of water, so the increase of 10 cents a cup, in just the first phase of the water price hike, amounts to profiteering. The authorities need not form an anti-profiteering committee to look into this, but they can work with coffee shop associations to rein in such profiteering.

Meanwhile, coffee drinkers should just buy from shops with competitive prices or, better still, make their own coffee with instant powder.

Richard Cheng

I think we can't complain , especially considering the level of salaries, right? I do a medium paid job and can't say that my family is missing out on something. I also can afford services from https://academized.com/custom-essay which help me a lot wit my work assignments these days. It is very useful in my case, cause i don't need to spend my evenings, preparing for the next working days.

Last edited:

How the high cost of living is hitting Singapore's poor

31 January 2022By Mariko Oi,Asia business correspondent

Chicken rice stalls have seen higher costs of ingredients, electricity and labour

In South East Asia you don't get much more of a staple food than chicken rice. Found in almost every food court and hawker centre, it is considered one of Singapore's national dishes.

Daniel Tan, who owns six chicken rice stalls, has previously charged $2.20 (£1.60) for a small portion. But Covid has seen the cost of his ingredients rise sharply.

The price of chicken has gone up by 50% and vegetable costs have more than doubled since January 2020, he says.

"We've been absorbing the costs for a significant period of time," he tells me as we meet at one of his OK Chicken Rice stalls in the north of Singapore.

"When the pandemic hit our first thought was this was a short-term emergency - six months, maybe a year - so we held [prices] for as long as we can because we were hoping for the whole thing to be over."

Lower rice prices mean that inflation has been more muted across Asia than elsewhere in the world

But when his electricity bills also jumped, Mr Tan decided it was time to raise prices. "A thousand dollar electrical bill for a chicken rice store really is not sustainable," he says.

"If I go on any further, either my staff are not paid or I have to close down some stores and that's not what we want to do."

Due to border closures and new employment regulations, Mr Tan has faced staff shortages and higher salaries, which all feed into rising costs for his business.

The Food and Agriculture Organization (FAO) says global food prices rose 28% in 2021.

"The last time food prices were this high was in 2011, when policymakers were actually warning about a global food crisis," says Dr Abdul Abiad of the Asian Development Bank (ADB).

These latest price rises are due to higher energy costs, which affect food and fertiliser production, with global supply chain issues compounding the problem.

Even in a wealthy nation like Singapore, it means that the number of families seeking help has increased.

"What we have seen when we make the door-to-door deliveries is that young families [with] both husband and wife working a part-time job or in the gig economy - these were the families that got impacted when Covid hit and all the part-time work dried up," says Nichol Ng, co-founder of Food Bank Singapore.

It is not just the poorest 10% of the population who now need help, she says: "It has slowly crept to maybe 20% of the population including middle income families that might not even know where to get help in the first place."

And it is also not just higher food prices that are affecting those in need. "Due to Covid, everybody's self-awareness about looking after themselves in terms of hygiene has increased," says Ms Ng.

Nichol Ng of the Food Bank Singapore says she has seen a rise in people asking for help

But higher palm oil prices mean that shampoos, hand soaps and sanitisers have also become a lot more expensive.

"Up to 20% of our requests thus far, especially starting from the second half of last year, has been pivoting towards personal hygiene products," she adds.

Ms Ng is also concerned that the current wave of inflation does not seem to be temporary. "In the past, at certain times of the year, you might see these price surges but it seems that this inflation is going to be persistent - and none of us really have that crystal ball to understand when it is going to end," she says.

Elsewhere in the region the impact of higher prices is even more severe. The latest FAO report shows more than 375 million people in Asia faced hunger in 2020, an increase of 54 million from the previous year.

In 2020, the Global Food Banking Network saw the number of people needing help increase by more than 130% to 40m, with half of them living in Asia.

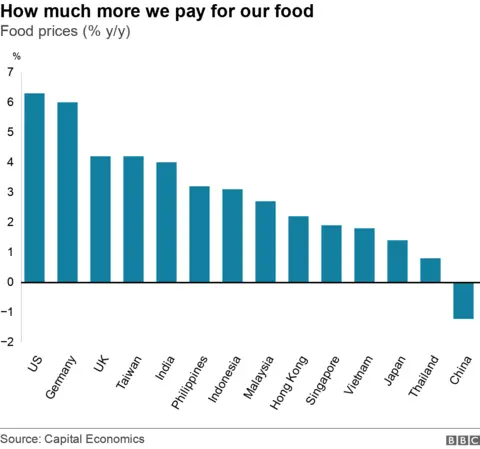

This is despite the fact that food price increases in Asia have been more muted than in the US or Europe, where inflation has soared to levels not seen in decades.

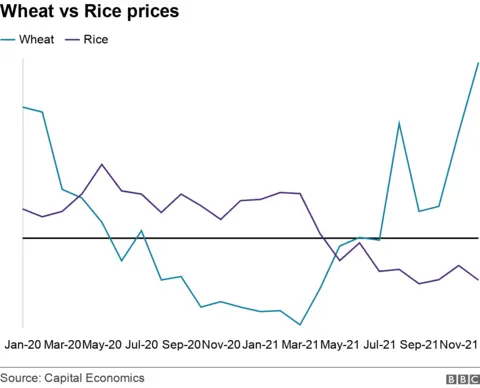

There are several reasons for this, including a good rice harvest in 2021, says the ADB's Dr Abiad. While maize prices rose 44% last year and wheat by 31% , rice prices dropped 4% . "So rice being the main staple in many Asian economies contributed to a food price inflation being lower in the region," he says.

Asian nations also produce a lot of their own food, which has been sold in domestic markets rather than being exported. Governments have also been working to ensure that food supplies have been stable, says Dr Abiad.

In the Philippines, for example, liberalisation of rice imports has allowed the supply of rice to improve which has kept prices low.

Meanwhile, China has been stockpiling various important food products, which has resulted in it bucking the trend, with the country's food prices falling in 2021.

But it has also led to criticism that the world's second biggest economy, which accounts for 20% of global population, is hoarding supplies as it is estimated to hold 69% of the world's corn reserves, 60% of its rice and 51% of its wheat by mid-2022, according to the US Department of Agriculture.

Global food prices are expected to remain high in 2022

Singapore imports the majority of its foodstuffs, but so far big supermarket chains like NTUC FairPrice have decided not to pass on higher prices to consumers.

To keep the prices of key products stable, the firm says it is employing various strategies including "stockpiling of daily essentials, forward buying and diversifying our import sources to over 100 countries".

NTUC FairPrice also has more than 2,000 own-brand products such as rice, oil, toiletries and cleaning products that it says are at least 10% cheaper than comparable popular brands.

Mr Tan of OK Chicken Rice, who also owns three mini supermarkets, says smaller retailers tend to take their cue from larger rivals when pricing goods.

"They act like a central bank to the rest of the grocery players in Singapore. The good thing about it is that inflation doesn't spike up as much during a crisis but the bad side effect is that entrepreneurship is stifled and only semi-government players can survive," he says.

Daniel Tan also owns minimarts which have also seen higher costs

"The question is, after the whole thing is over how many smaller players are left?" asks Mr Tan.

Global food prices are expected to remain high this year and the FAO's David Dawe says this is of concern for Asian governments because price hikes have not yet worked their way through the system.

"If global prices continue to rise, there will be an impact, especially for lower income families who spend bigger proportion of their income on food."

Economists like Mr Dawe and Dr Abiad remain optimistic that Asian countries will continue to be shielded from double-digit food inflation.

But for those on the ground, like Mr Tan and Ms Ng, the issue feels more acute. They wonder whether higher prices, rather than being transitory, will linger on just as the pandemic has.

Similar threads

- Replies

- 17

- Views

- 285

- Replies

- 25

- Views

- 1K

- Replies

- 22

- Views

- 318

- Replies

- 2

- Views

- 577