Re: A Singaporean's guide to living in Thailand ? Feasible?

Farking Tiongs only scared of US and Russia in this current geopolitical environment, any other passport is useless if the CCP really wants to get you, so get either of these two passports .......... for US passport, do some real sophisticated tax planning beforehand ............ Russian passport is worst than Chinese passport ......... so effectively only one choice if you die die want to offend the CCP ..........

Few in Thailand are talking about the ongoing mystery of Gui Minhai. That’s understandable, with the relatively little media attention given to the case of the mainland-born bookseller who is a Swedish citizen, and who went missing from his condominium in the city of Pattaya. As widely reported elsewhere, however, Gui and four colleagues disappeared – one from the streets of Hong Kong, the others in mainland China – over the past few months.

Yet, authorities in Thailand, and Hong Kong, should pay heed to the long-term economic consequences should there be any truth to the rumours that Gui and his co-workers were whisked away by Chinese agents as part of an effort to keep them silent. Business thrives under rule of law, and any threat to it could drive companies and entrepreneurs elsewhere.

Gui has since reappeared, not in Thailand but on China’s state-owned television, saying in a tearful confession that he had decided to return to China to face justice for his involvement in a 2003 fatal hit-and-run car accident in Ningbo (寧波). The filmed statement may have been coerced, and questions have arisen over whether Thai immigration officials have evidence of how and when he left Thailand.

Gui’s mysterious disappearance and reappearance may well stem from his publishing company Mighty Current’s track record of publishing controversial books, often highly critical of China’s communist leadership. The Hong Kong media has reported that Gui and his colleagues, including British passport holder Lee Po, were working on a tell-all book about President Xi Jinping (習近平) and his alleged affairs.

For Hong Kong’s leadership, the challenge and constraints are obvious: “one country, two systems” is under increasing strain and the city’s leaders have struggled to balance growing demands for democracy with the economic and political realities that Beijing is the ultimate master.

For Thailand, however, China’s influence may have been more subtle and indirect if Chinese security agents have been, or are still, operating on Thai soil. As in so many situations, economics and politics are intertwined. Thailand has increasingly looked to Chinese investment and visitors as a source of growth. Upsetting China over Gui’s case may be seen as not in either nation’s interests, particularly at a time of slowing economies.

Sino-Thai relations in fact remain solid. Despite China’s slowing growth, it overtook Japan in August to become, for the first time, the source of the largest amount of foreign direct investment in Thailand, when Chinese investments via Singapore are included, according to Thailand’s Board of Investment.

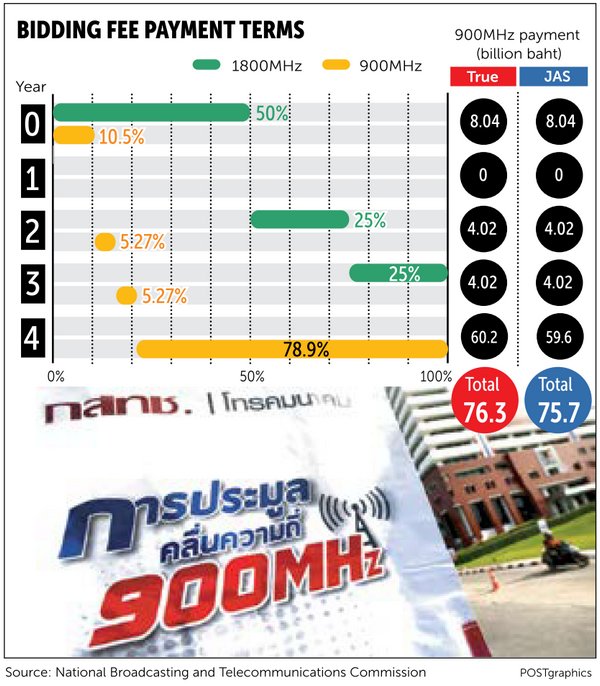

An on-again, off-again 530 billion baht (HK$115 billion) joint railway infrastructure project is also slowly moving forward despite disagreements over financing and shareholding. And Chinese tourists have increasingly come to dominate visitor numbers.

As a further indicator of the close relationship, the Thai government, despite an international outcry, deported back to China more than 100 Uygur Muslims in July and, more recently, two Chinese dissidents awaiting UN repatriation to a third country.

Steve Herman, a long-time Asia reporter now resident in Bangkok, said of Gui’s case: “A critical unanswered question is whether there was collusion between the Chinese government and Thai authorities. The lack of concern expressed by the ruling military junta is notable.”

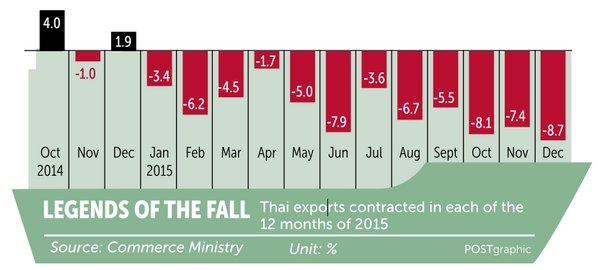

A climate of fear may well pervade society should it be confirmed that Chinese security forces abducted people from the streets of Hong Kong and Thailand. But, until then – and perhaps even then – business goes on. More so than any alleged abduction, the impact of China’s slowing economic growth is likely to garner greater daily concern in Thailand, still the second-largest economy in Southeast Asia after Indonesia.

Leaders everywhere, however, should recognise that looking the other way in cases of “enforced disappearances” can never be good for business and economic growth in the long run.

Curtis S. Chin, a former US ambassador to the Asian Development Bank, is managing director of advisory firm RiverPeak Group. Follow him on Twitter at @CurtisSChin

http://www.scmp.com/comment/insight...ok-choose-look-other-way-abduction-gui-minhai