[h=1]CLARITY, ONCE AND FOR ALL: TEMASEK HOLDINGS DID INVEST SINGAPOREANS’ CPF?[/h]

Post date:

24 Jul 2014 - 6:38pm

So, the golden question – did Temasek Holdings invest Singaporeans’ CPF?

In June this year, the government finally admitted for the very first time ever that the GIC does invest Singaporeans’ CPF.

But what about Temasek Holdings?

In this article, let’s find out once and for all if Temasek Holdings has ever taken our CPF to invest.

On Tuesday, at the IPS Forum on CPF and Retirement Adequacy, Roy Ngerng asked the Deputy Prime Minister and Finance Minister:

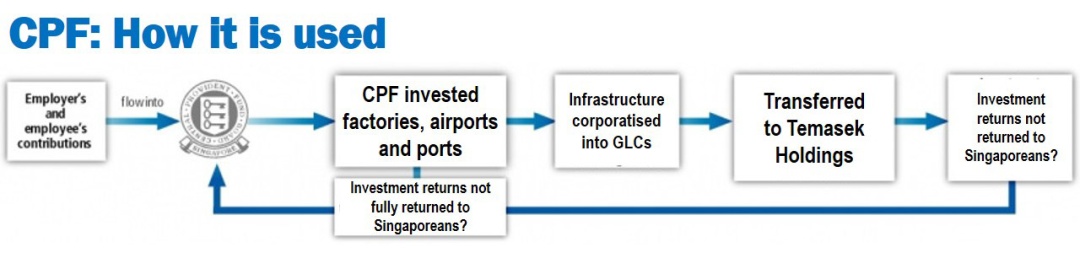

And we do seem to have the answer. According to a speech given by the Minister for Labour and Communications in 1982:

Let’s explore these in detail.

[h=3]CPF is Invested in the Temasek Holdings, via HDB[/h]According to the book, ‘Social Insecurity in the New Millennium’ by Linda Low and Aw Tar Choon, “the CPF became a de facto housing financier since the Housing and Development Board (HDB) was a heavy user of development funds”. It went on further to explain that, “In the initial years, before the government built up budgetary surpluses, it borrowed funds from the CPF for its development expenditure budget, one important user being the HDB.”

Indeed, according to the Innovation Policies in Singapore, and Applicability to New Zealand report, it also reaffirmed that, “The single largest item in the 1961-64 State Development Plan, and hence indirect beneficiary of CPF funds, was housing,” and that in this “CPF-HDB nexus”, “The CPF financed Singapore’s public housing program (where) In the 1960s and 1970s, the HDB was the largest borrower from the government’s development fund.”

Low and Aw also explained that, “The other way the CPF functions as a financing agent is when CPF members use their CPF savings to purchase HDB housing”.

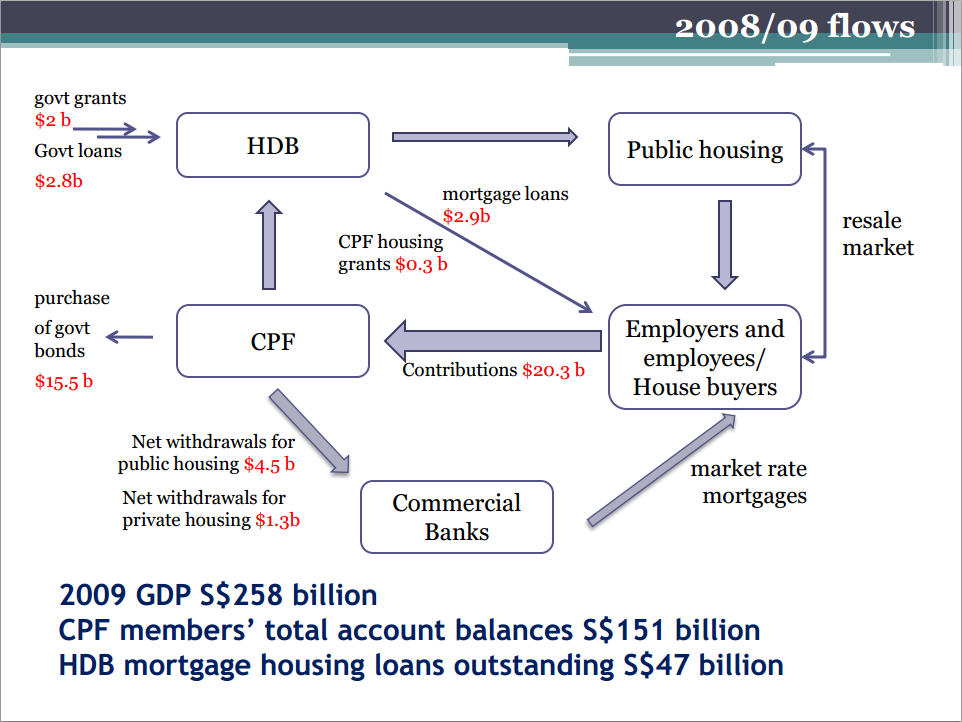

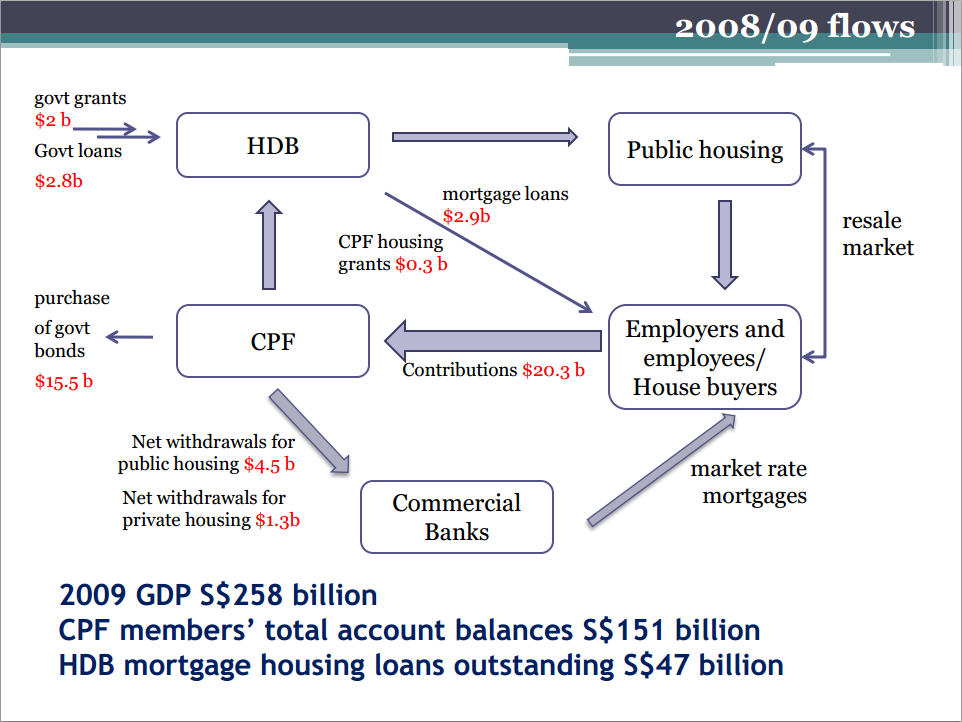

And how does this become problematic? You can see that the net flow in one year in this “CPF-HDB” nexus is that there is still a higher net inflow into HDB, where Singaporeans would lose more of our CPF into the HDB.

Chart: Lessons from Singapore’s Central Provident Fund

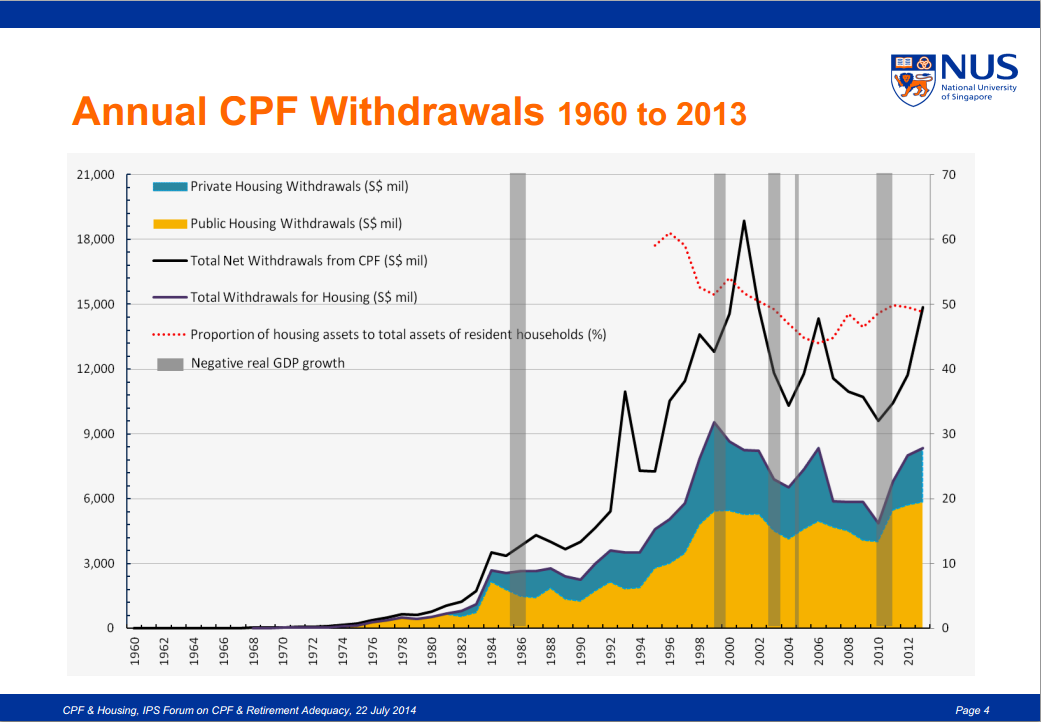

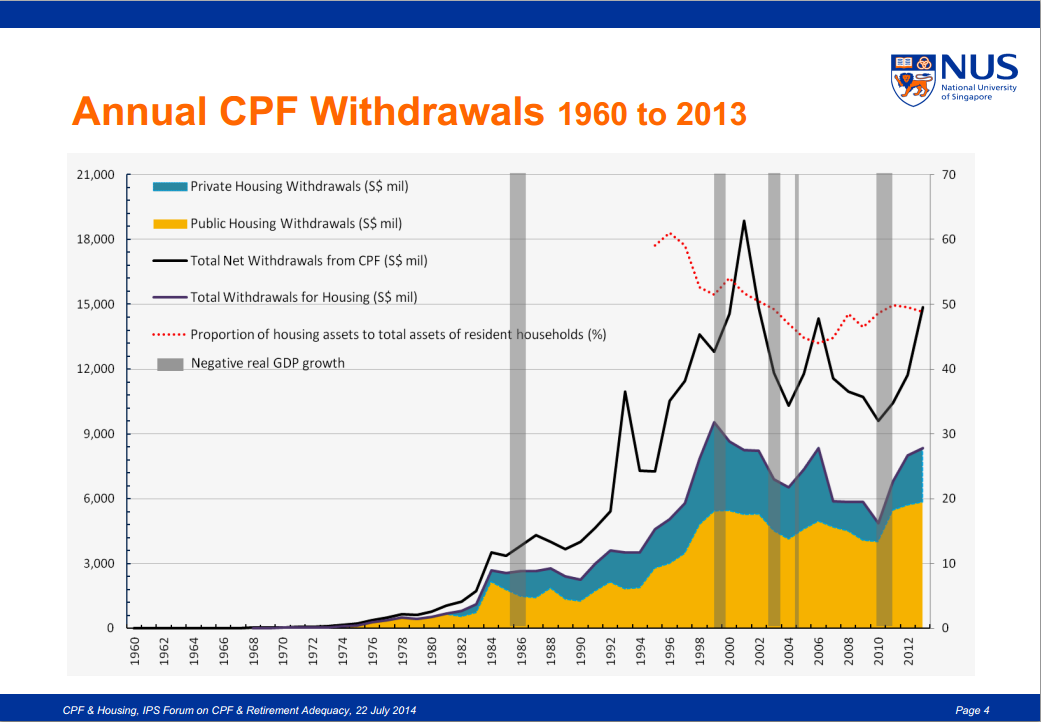

Take a look at how much has been withdrawn from our CPF for housing:

Chart: Housing and the CPF System

Thus in short, it is clear that Singaporeans’ CPF is invested in the HDB. Now, why is this important?

According to Surbana, “In July 2003, HDB’s Building and Development Division was corporatised as HDB Corporation Pte Ltd (HDBCorp) in a bid to export Singapore’s decades of urbanisation expertise and experience to other countries… A year later, the potential of HDB Corp was evident in its acquisition by Temasek Holdings, the Singapore Government’s investment vehicle and in 2005, the company was rebranded as Surbana Corporation Pte Ltd.” Also, “In April 2011, CapitaLand, one of the largest real estate developers in Singapore, acquired a 40% stake in Surbana, with the rest held by Temasek Holdings. Two years later, Surbana underwent a restructure and its township development arm, Surbana Land was integrated with CapitaLand China, leaving its consultancy as the core business for Surbana.”

Today, Surbana calls itself “A Singapore MNC, Temasek-Linked company” and CapitaLand is one of the major investments of Temasek Holdings.

By now, it would be clear to any reader that Singaporeans’ CPF was indeed invested in the HDB, which corporatised an arm, that was then absorbed into Temasek Holdings. So, is the CPF invested in Temasek Holdings? And when the HDB was corporatised and acquired by Temasek Holdings and CapitaLand, was Singaporeans’ CPF returned to Singaporeans, or were the earnings shared with Singaporeans?

In fact, this is so troubling that in 2009, it was reported in The Business Times, in the article, ‘Shouldn’t HDB deal be on commercial basis?’, that, “The sale of HDB Corp to Temasek Holdings has already begged several questions in the business community. Why was there no tender and no transparency on the transaction price? And why Temasek?” It added that, “While neither is a publicly listed company – so there is no mandatory requirement to disclose price details – the lack of disclosure runs counter, at least in spirit, to the growing emphasis on corporate governance.”

The Business Times reported that “So in effect, it’s a left to right hand deal – a reshuffling of assets and holding companies by the government,” and Leong Sze Hian had “said in a letter to BT that he is ‘puzzled’ by HDB’s explanation that calling a tender for the sale could have disrupted services to HDB residents subsequently.”

Finally, The Business Times emphasised that, “Nor do we know just how good a deal HDB Corp got from Temasek. And it seems reasonable to ask: would not a more equitable price have been achieved if there was a tender?”

And more importantly, how were Singaporeans compensated with our CPF?

[h=3]CPF is Invested in the Temasek Holdings, via POSB[/h]Apparently, this lack of openness in the “left to right hand deal” was not the first time it happened in 2009. According to The Business Times, “In 1998, POSBank was sold to DBS Bank, another Temasek-linked company, making DBS the largest bank in Singapore. Two years on, DBS sold its stake in DBS Land to Pidemco Land, also a government-linked company, to create property giant CapitaLand. Again, no other suitors were reportedly allowed.”

Today, DBS is one of the major investments of the Temasek Holdings.

Perhaps what would be revealing is from the book, ‘Housing a Healthy, Educated and Wealthy Nation through the CPF’ by Linda Low and T. C. Aw, the CPF funds were liberalised for investment after 1973/74. And so, “Having liberalized CPF for investment, the government seized on the opportunity to link (and tap) the large pool of CPF balances with the privatization of its government-linked companies (GLCs), beginning with the statutory boards. The privatization exercise was part of public sector reform, where the government began to scale back its activities in the economy after 1985, to make the private sector the engine of growth. Since the 1985 recession, a conscious recycling of CPF funds to avert possible “crowding-out” effects overall has been more distinct. Thus, in 1993, when Singapore Telecom was privatized through public flotation, there was a jump in CPF funds withdrawn.”

[h=3]CPF is Invested in the Temasek Holdings, via Singtel[/h]Thus according to Singtel:

The CPF Board also explained that, “SingTel had performed capital reduction on 1 September 2004 and 1 September 2006. In the 2004 capital reduction, SingTel had cancelled 1 in every 14 of its shares, with the resultant shareholding rounded-up to the nearest 10 shares, where applicable. SingTel had reimbursed you a cash distribution of S$2.36 for each cancelled share. In the 2006 capital reduction, SingTel had cancelled 1 in every 20 of its shares, with the resultant shareholding rounded-up to the nearest 10 shares, where applicable. SingTel had reimbursed you a cash distribution of $2.74 for each cancelled share. The cash distributions were credited into your CPF Ordinary Account and a letter was also sent to inform you of the capital reduction in September 2004 and September 2006 respectively.”

Where Singaporeans had bought Singtel shares with our CPF at $1.90, we were only reimbursed with cash distributions of $2.36 in 2004 and $2.74 in 2006.

(Note: Was the initial public offering price of $3.61 for Singtel, arguably so overpriced that it took about 20 years for the price to to go above $3.61 (after accounting for the capital reduction in 2004 and 2006), after the initial surge in the price in 1993?)

Perhaps the issue cannot be more simply put when Linda Low explained that the CPF investment scheme “assist(ed) with the government privatization program, as, for example, in the case of Singapore Telecom, which was privatized in 1993. A huge sum withdrawn from the CPF was invested into Singapore Telecom.”

Is something wrong here? Were the interest earned on our CPF returned to Singaporeans? Today, Singtel is one of the major investments of Temasek Holdings.

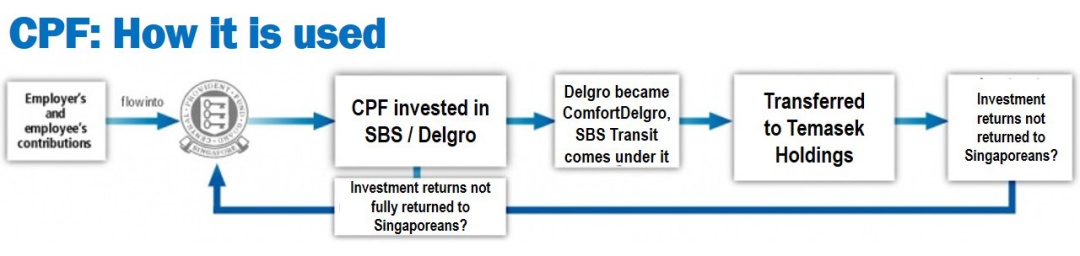

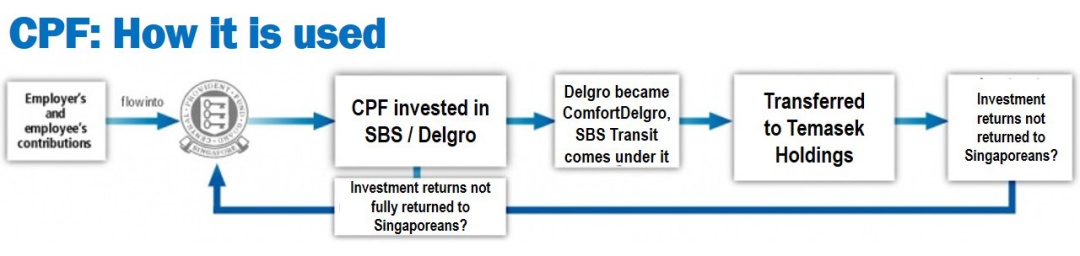

[h=3]CPF is Invested in the Temasek Holdings, via SBS Transit[/h]And this is not yet all! Low and Aw had also described how “On 26 April 1978, CPF members could start using their CPF savings for investment… (for) shares issued by Singapore Bus Service.” Later on, “Singapore Bus Service shares were renamed DelGro shares following the change in name of the bus company to DelGro Corporation.”

In 2003, Delgro Corporation and Comfort Group merged to become ComfortDelgro, where SBS Transit became part of the group. At one time, “Temasek owns more than 50% of the shares in … SBS Transit.“

[h=3]CPF is Invested in the Temasek Holdings, via Government-Linked Companies[/h]But SBS Transit wasn’t the only transport company to be acquired by the Temasek Holdings.

Leong Sze Hian wrote that, “Changi Airport Group (Singapore) Pte Ltd (CAG) was formed on 16 June 2009 and the corporatisation of Changi Airport followed on 1 July 2009,” where the airport was then “transferred to Temasek”.

Leong Sze Hian also asked:

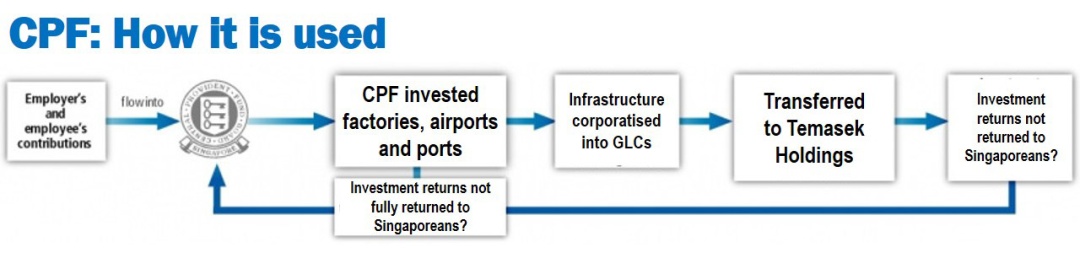

At the start of the article, we also found out that the CPF was invested in port infrastructure. Today, PSA and Neptune Orient Lines are also major investments of Temasek Holdings.

The CPF was also invested in the construction of factories. Today, Mapletree is also one of the major investments of Temasek Holdings.

Again, the question is, were Singaporeans reimbursed for the use of our CPF, and were the earnings on our CPF returned to Singaporeans?

[h=3]Exposed: The Government Did Take Singaporeans’ CPF To Invest In The Temasek Holdings[/h]So, did Temasek Holdings invest our CPF, or only GIC? The issue is very clear now. What we have shown you is only a cross-section of how our CPF is actually invested in Temasek Holdings. But how many more? And most importantly, was our CPF monies returned back to Singaporeans? Or did we, in a sense, lose them to Temasek Holdings?

Today, Temasek Holdings earns 16% in SGD terms since inception (1974). How much of their earnings is attributed to the CPF which has not been returned to Singaporeans?

Are we facing another roundabout explanation from the government again as to how even though the CPF is indeed invested in the GIC, the government would want to claim otherwise, until forced without a choice to submit to admission once again?

We now know that the CPF is indeed invested in the GIC, via a complicated routed process by the government, via government bonds and reserves.

Doesn’t it look quite similar to you that the CPF is also invested in Temasek Holdings, via a similarly complicated routed process, via the government-linked companies, and what the Deputy Prime Minister and Finance Minister had described as economic and social infrastructural investments?

Since June, the government has finally admitted to many issues and questions. We finally know our CPF is invested in the GIC. But Temasek Holdings? – the government is still reluctant to explain the full workings and mechanics behind how our CPF is invested in Temasek Holdings. However, by doing our own investigations, we are able to know the information for ourselves. So, will the government admit to this as well? Or will they continue to not be transparent?

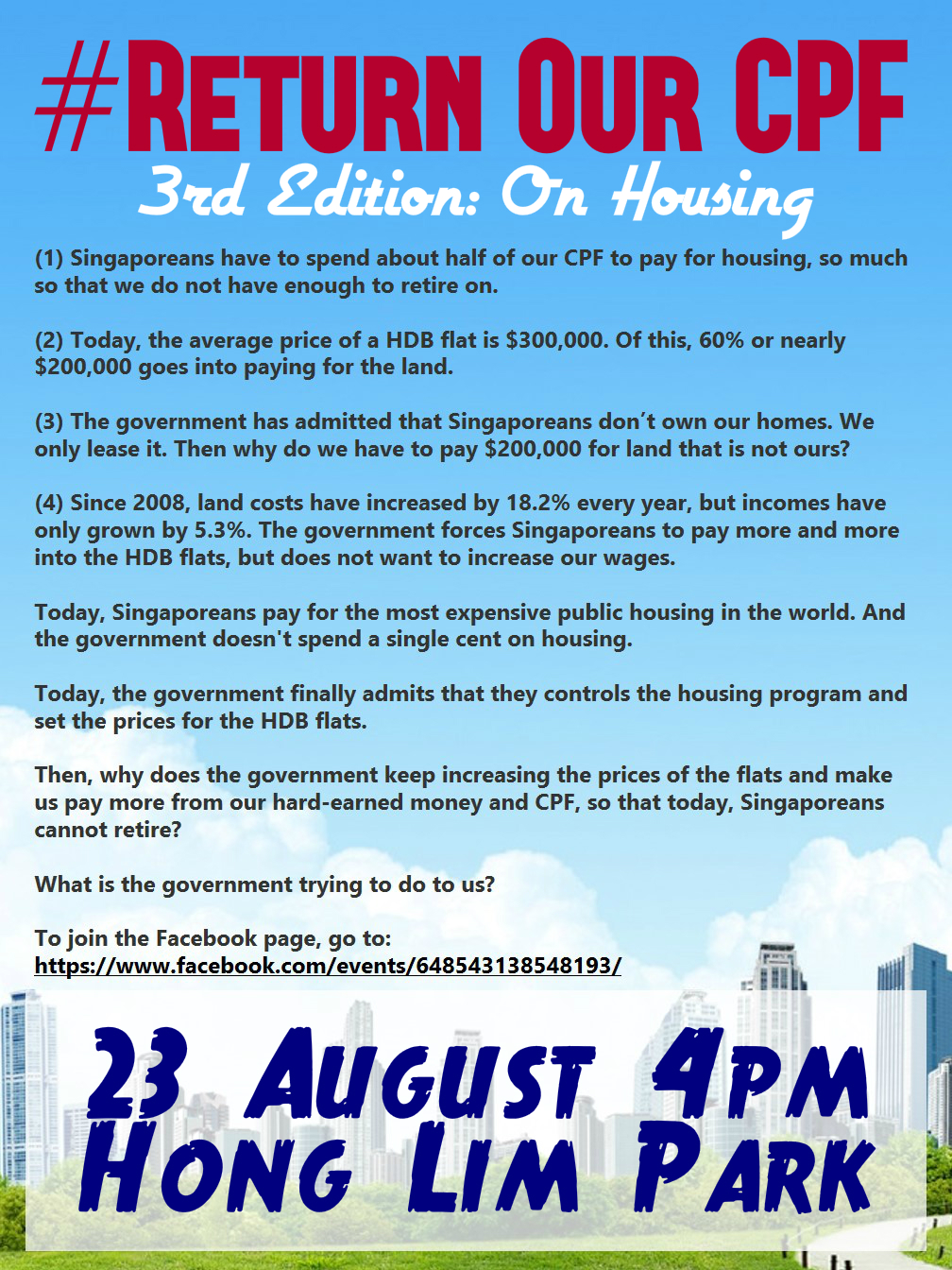

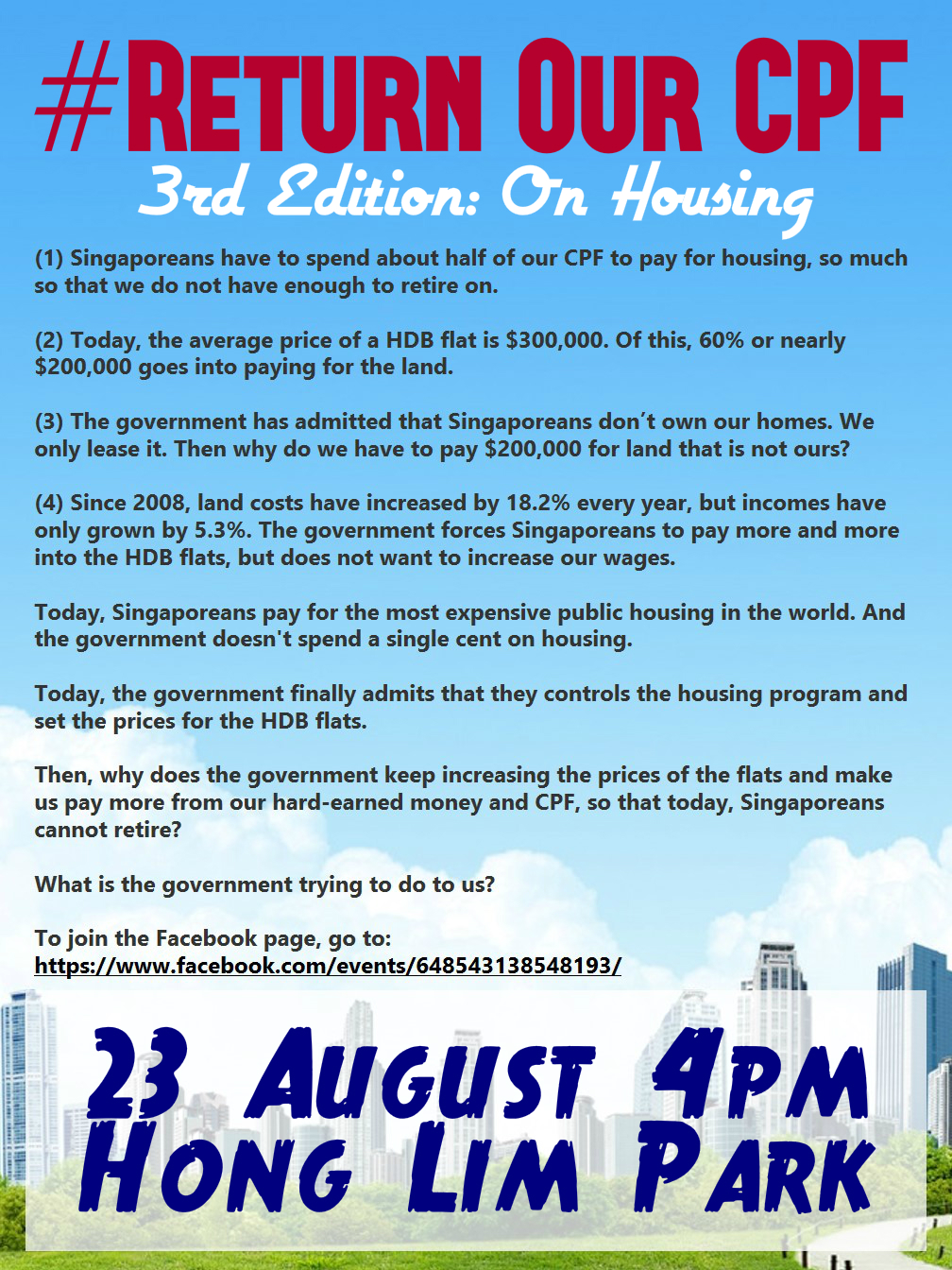

[h=3]3rd Edition Of The #ReturnOurCPF Event: Why Singaporeans Cannot Retire Because Of The HDB[/h]We cannot let up on our fight to demand to the government to be transparent and accountable to Singaporeans on what exactly they are doing with our CPF. The facts need to be known to Singaporeans. If today we cannot retire because we do not have enough in our CPF, we need to know the facts about what the government has been doing with it.

On 23 August, there will be the third edition of the #ReturnOurCPF event. In the first edition on June 7, the speakers revealed to you the facts that the government has finally admitted to how they are using our CPF to invest in the GIC. In the second edition on 12 July, we exposed further information about the estimated number of Singaporeans who were not able to meet the CPF Minimum Sum.

Join us at the third edition as we reveal even more glaring facts about how our CPF is being used by the HDB and for housing, and find out why Singaporeans are not able to retire adequately, because of the HDB.

You can join the Facebook event page here.

(Note: Also, Roy Ngerng’s first court case hearing will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.)

Roy Ngerng and Leong Sze Hian

*The writer blogs at http://thehearttruths.com/

Post date:

24 Jul 2014 - 6:38pm

So, the golden question – did Temasek Holdings invest Singaporeans’ CPF?

In June this year, the government finally admitted for the very first time ever that the GIC does invest Singaporeans’ CPF.

But what about Temasek Holdings?

In this article, let’s find out once and for all if Temasek Holdings has ever taken our CPF to invest.

On Tuesday, at the IPS Forum on CPF and Retirement Adequacy, Roy Ngerng asked the Deputy Prime Minister and Finance Minister:

Temasek Holdings has said that they do not invest our CPF, is it possible to know if in the past Temasek Holdings had invested our CPF? Because the GIC was only set up in 1981, so prior to 1981, how was the CPF used and otherwise was it invested in Temasek Holdings?

The Deputy Prime Minister and Finance Minister replied:

Did Temasek manage the CPF funds in the past? No. It has never managed CPF funds. Temasek started off with a set of assets which were transferred by the Government at time of inception. I don’t have the exact figure in my head – but about $400 million dollars worth of assets in the form of a set of companies. It has never received CPF monies to invest.

What was the case in the early days, before we amended the constitution in 1992, is that CPF monies, which were invested in Special Singapore Government Securities (SSGS), could be used by the Government to finance infrastructure – such as road infrastructure, Singapore’s economic infrastructure and social infrastructure. Just like (other) Singapore Government Securities (SGS), the Government was allowed to use borrowings in addition to the revenues it got in its budget, to finance infrastructural investments. That was the old system.

Well, exactly what “economic infrastructure and social infrastructure” investments is the government referring to?What was the case in the early days, before we amended the constitution in 1992, is that CPF monies, which were invested in Special Singapore Government Securities (SSGS), could be used by the Government to finance infrastructure – such as road infrastructure, Singapore’s economic infrastructure and social infrastructure. Just like (other) Singapore Government Securities (SGS), the Government was allowed to use borrowings in addition to the revenues it got in its budget, to finance infrastructural investments. That was the old system.

And we do seem to have the answer. According to a speech given by the Minister for Labour and Communications in 1982:

CPF savings form a large portion of Singapore’s savings. These savings are used for capital formation which means the construction of new factories, installation of new plant and equipment, expansion of infrastructure such as roads,’ ports and telecommunications, the building of houses and so on. These facilities coupled with Singapore’s economic and political stability have in turn attracted large amounts of investments each year. These again go into the setting up of more businesses, factories and enterprises.

So, there you have it. Our CPF was used to invest in, among others, factories, ports and telecommunications, the building of houses and so on. So, who currently owns this?

Let’s explore these in detail.

[h=3]CPF is Invested in the Temasek Holdings, via HDB[/h]According to the book, ‘Social Insecurity in the New Millennium’ by Linda Low and Aw Tar Choon, “the CPF became a de facto housing financier since the Housing and Development Board (HDB) was a heavy user of development funds”. It went on further to explain that, “In the initial years, before the government built up budgetary surpluses, it borrowed funds from the CPF for its development expenditure budget, one important user being the HDB.”

Indeed, according to the Innovation Policies in Singapore, and Applicability to New Zealand report, it also reaffirmed that, “The single largest item in the 1961-64 State Development Plan, and hence indirect beneficiary of CPF funds, was housing,” and that in this “CPF-HDB nexus”, “The CPF financed Singapore’s public housing program (where) In the 1960s and 1970s, the HDB was the largest borrower from the government’s development fund.”

Low and Aw also explained that, “The other way the CPF functions as a financing agent is when CPF members use their CPF savings to purchase HDB housing”.

And how does this become problematic? You can see that the net flow in one year in this “CPF-HDB” nexus is that there is still a higher net inflow into HDB, where Singaporeans would lose more of our CPF into the HDB.

Chart: Lessons from Singapore’s Central Provident Fund

Take a look at how much has been withdrawn from our CPF for housing:

Chart: Housing and the CPF System

Thus in short, it is clear that Singaporeans’ CPF is invested in the HDB. Now, why is this important?

According to Surbana, “In July 2003, HDB’s Building and Development Division was corporatised as HDB Corporation Pte Ltd (HDBCorp) in a bid to export Singapore’s decades of urbanisation expertise and experience to other countries… A year later, the potential of HDB Corp was evident in its acquisition by Temasek Holdings, the Singapore Government’s investment vehicle and in 2005, the company was rebranded as Surbana Corporation Pte Ltd.” Also, “In April 2011, CapitaLand, one of the largest real estate developers in Singapore, acquired a 40% stake in Surbana, with the rest held by Temasek Holdings. Two years later, Surbana underwent a restructure and its township development arm, Surbana Land was integrated with CapitaLand China, leaving its consultancy as the core business for Surbana.”

Today, Surbana calls itself “A Singapore MNC, Temasek-Linked company” and CapitaLand is one of the major investments of Temasek Holdings.

By now, it would be clear to any reader that Singaporeans’ CPF was indeed invested in the HDB, which corporatised an arm, that was then absorbed into Temasek Holdings. So, is the CPF invested in Temasek Holdings? And when the HDB was corporatised and acquired by Temasek Holdings and CapitaLand, was Singaporeans’ CPF returned to Singaporeans, or were the earnings shared with Singaporeans?

In fact, this is so troubling that in 2009, it was reported in The Business Times, in the article, ‘Shouldn’t HDB deal be on commercial basis?’, that, “The sale of HDB Corp to Temasek Holdings has already begged several questions in the business community. Why was there no tender and no transparency on the transaction price? And why Temasek?” It added that, “While neither is a publicly listed company – so there is no mandatory requirement to disclose price details – the lack of disclosure runs counter, at least in spirit, to the growing emphasis on corporate governance.”

The Business Times reported that “So in effect, it’s a left to right hand deal – a reshuffling of assets and holding companies by the government,” and Leong Sze Hian had “said in a letter to BT that he is ‘puzzled’ by HDB’s explanation that calling a tender for the sale could have disrupted services to HDB residents subsequently.”

Finally, The Business Times emphasised that, “Nor do we know just how good a deal HDB Corp got from Temasek. And it seems reasonable to ask: would not a more equitable price have been achieved if there was a tender?”

And more importantly, how were Singaporeans compensated with our CPF?

[h=3]CPF is Invested in the Temasek Holdings, via POSB[/h]Apparently, this lack of openness in the “left to right hand deal” was not the first time it happened in 2009. According to The Business Times, “In 1998, POSBank was sold to DBS Bank, another Temasek-linked company, making DBS the largest bank in Singapore. Two years on, DBS sold its stake in DBS Land to Pidemco Land, also a government-linked company, to create property giant CapitaLand. Again, no other suitors were reportedly allowed.”

Today, DBS is one of the major investments of the Temasek Holdings.

Perhaps what would be revealing is from the book, ‘Housing a Healthy, Educated and Wealthy Nation through the CPF’ by Linda Low and T. C. Aw, the CPF funds were liberalised for investment after 1973/74. And so, “Having liberalized CPF for investment, the government seized on the opportunity to link (and tap) the large pool of CPF balances with the privatization of its government-linked companies (GLCs), beginning with the statutory boards. The privatization exercise was part of public sector reform, where the government began to scale back its activities in the economy after 1985, to make the private sector the engine of growth. Since the 1985 recession, a conscious recycling of CPF funds to avert possible “crowding-out” effects overall has been more distinct. Thus, in 1993, when Singapore Telecom was privatized through public flotation, there was a jump in CPF funds withdrawn.”

[h=3]CPF is Invested in the Temasek Holdings, via Singtel[/h]Thus according to Singtel:

In October 1993, SingTel became a public company. Shares were traded for the first time on the Stock Exchange of Singapore (now known as the Singapore Exchange or SGX) on 1 November 1993. The IPO in 1993 represented 11 per cent of SingTel shares, with the rest held by Temasek Holdings… Singapore Citizens were able to purchase Group A shares (via using our CPF) at a discounted price as part of the Singapore Government’s effort to share the nation’s wealth and to enlarge the base of share-owning Singaporeans.

In 1996, Temasek Holdings offered a second tranche of SingTel shares (ST-2) to Singaporeans at a discounted price, reducing its shareholding in SingTel to about 82 per cent.

The National Library Board further reported that:In 1996, Temasek Holdings offered a second tranche of SingTel shares (ST-2) to Singaporeans at a discounted price, reducing its shareholding in SingTel to about 82 per cent.

In October 1993, SingTel announced its Initial Public Offering (IPO). The government, through state investment company Temasek Holdings, initially offered 1.1 billion shares for sale to Singaporeans, with a series of discounts and loyalty bonuses. This issue was subscribed by 4.1 times, and Temasek added another 587 million shares to help meet demand. After the float, the government still held around 89% of SingTel through Temasek.

On 1 November, SingTel debuted on the Stock Exchange of Singapore, with more than 1.4 million Singaporeans and foreign and local institutions acquiring shares in the company. With a share capital of 15.25 billion shares and a market capitalisation of S$60 billion at the time, SingTel became the largest company on the Exchange. Further tranches of SingTel shares were released for public sale in subsequent years, including 804 million shares in 1996.

According to the CPF Board Annual Report in 2004, “Singaporean CPF members were able to buy discounted SingTel shares in 1993 (ST “A” shares) and 1996 (ST2 shares). SingTel declared a ?nal dividend of 6.4 cents a share for its ?nancial year ended 31 March 2004.”On 1 November, SingTel debuted on the Stock Exchange of Singapore, with more than 1.4 million Singaporeans and foreign and local institutions acquiring shares in the company. With a share capital of 15.25 billion shares and a market capitalisation of S$60 billion at the time, SingTel became the largest company on the Exchange. Further tranches of SingTel shares were released for public sale in subsequent years, including 804 million shares in 1996.

The CPF Board also explained that, “SingTel had performed capital reduction on 1 September 2004 and 1 September 2006. In the 2004 capital reduction, SingTel had cancelled 1 in every 14 of its shares, with the resultant shareholding rounded-up to the nearest 10 shares, where applicable. SingTel had reimbursed you a cash distribution of S$2.36 for each cancelled share. In the 2006 capital reduction, SingTel had cancelled 1 in every 20 of its shares, with the resultant shareholding rounded-up to the nearest 10 shares, where applicable. SingTel had reimbursed you a cash distribution of $2.74 for each cancelled share. The cash distributions were credited into your CPF Ordinary Account and a letter was also sent to inform you of the capital reduction in September 2004 and September 2006 respectively.”

Where Singaporeans had bought Singtel shares with our CPF at $1.90, we were only reimbursed with cash distributions of $2.36 in 2004 and $2.74 in 2006.

(Note: Was the initial public offering price of $3.61 for Singtel, arguably so overpriced that it took about 20 years for the price to to go above $3.61 (after accounting for the capital reduction in 2004 and 2006), after the initial surge in the price in 1993?)

Perhaps the issue cannot be more simply put when Linda Low explained that the CPF investment scheme “assist(ed) with the government privatization program, as, for example, in the case of Singapore Telecom, which was privatized in 1993. A huge sum withdrawn from the CPF was invested into Singapore Telecom.”

Is something wrong here? Were the interest earned on our CPF returned to Singaporeans? Today, Singtel is one of the major investments of Temasek Holdings.

[h=3]CPF is Invested in the Temasek Holdings, via SBS Transit[/h]And this is not yet all! Low and Aw had also described how “On 26 April 1978, CPF members could start using their CPF savings for investment… (for) shares issued by Singapore Bus Service.” Later on, “Singapore Bus Service shares were renamed DelGro shares following the change in name of the bus company to DelGro Corporation.”

In 2003, Delgro Corporation and Comfort Group merged to become ComfortDelgro, where SBS Transit became part of the group. At one time, “Temasek owns more than 50% of the shares in … SBS Transit.“

[h=3]CPF is Invested in the Temasek Holdings, via Government-Linked Companies[/h]But SBS Transit wasn’t the only transport company to be acquired by the Temasek Holdings.

Leong Sze Hian wrote that, “Changi Airport Group (Singapore) Pte Ltd (CAG) was formed on 16 June 2009 and the corporatisation of Changi Airport followed on 1 July 2009,” where the airport was then “transferred to Temasek”.

Leong Sze Hian also asked:

In this connection, to what extent has the 1990′s corporatisation and transfer of state entities like SingPower and PSA, and the biggest single-year jncrease in its portfolio value with the listing of SingTel in 1993, contributed to its phenomenal 17 per cent annualised returns from Temasek’s inception?

Who benefits from the transaction when a state entity is corporatised? If an entity is sold, what is the price? How do Singaporeans benefit?

It may seem quite odd to debate and approve in Parliament the sale of a strategic state asset, like Chang Airport, when the price was still not known.

Today, SATS and Singapore Airlines are also one of the major investments of Temasek Holdings.Who benefits from the transaction when a state entity is corporatised? If an entity is sold, what is the price? How do Singaporeans benefit?

It may seem quite odd to debate and approve in Parliament the sale of a strategic state asset, like Chang Airport, when the price was still not known.

At the start of the article, we also found out that the CPF was invested in port infrastructure. Today, PSA and Neptune Orient Lines are also major investments of Temasek Holdings.

The CPF was also invested in the construction of factories. Today, Mapletree is also one of the major investments of Temasek Holdings.

Again, the question is, were Singaporeans reimbursed for the use of our CPF, and were the earnings on our CPF returned to Singaporeans?

[h=3]Exposed: The Government Did Take Singaporeans’ CPF To Invest In The Temasek Holdings[/h]So, did Temasek Holdings invest our CPF, or only GIC? The issue is very clear now. What we have shown you is only a cross-section of how our CPF is actually invested in Temasek Holdings. But how many more? And most importantly, was our CPF monies returned back to Singaporeans? Or did we, in a sense, lose them to Temasek Holdings?

Today, Temasek Holdings earns 16% in SGD terms since inception (1974). How much of their earnings is attributed to the CPF which has not been returned to Singaporeans?

Are we facing another roundabout explanation from the government again as to how even though the CPF is indeed invested in the GIC, the government would want to claim otherwise, until forced without a choice to submit to admission once again?

We now know that the CPF is indeed invested in the GIC, via a complicated routed process by the government, via government bonds and reserves.

Doesn’t it look quite similar to you that the CPF is also invested in Temasek Holdings, via a similarly complicated routed process, via the government-linked companies, and what the Deputy Prime Minister and Finance Minister had described as economic and social infrastructural investments?

Since June, the government has finally admitted to many issues and questions. We finally know our CPF is invested in the GIC. But Temasek Holdings? – the government is still reluctant to explain the full workings and mechanics behind how our CPF is invested in Temasek Holdings. However, by doing our own investigations, we are able to know the information for ourselves. So, will the government admit to this as well? Or will they continue to not be transparent?

[h=3]3rd Edition Of The #ReturnOurCPF Event: Why Singaporeans Cannot Retire Because Of The HDB[/h]We cannot let up on our fight to demand to the government to be transparent and accountable to Singaporeans on what exactly they are doing with our CPF. The facts need to be known to Singaporeans. If today we cannot retire because we do not have enough in our CPF, we need to know the facts about what the government has been doing with it.

On 23 August, there will be the third edition of the #ReturnOurCPF event. In the first edition on June 7, the speakers revealed to you the facts that the government has finally admitted to how they are using our CPF to invest in the GIC. In the second edition on 12 July, we exposed further information about the estimated number of Singaporeans who were not able to meet the CPF Minimum Sum.

Join us at the third edition as we reveal even more glaring facts about how our CPF is being used by the HDB and for housing, and find out why Singaporeans are not able to retire adequately, because of the HDB.

You can join the Facebook event page here.

(Note: Also, Roy Ngerng’s first court case hearing will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.)

*The writer blogs at http://thehearttruths.com/