Argentina accuses HSBC in US$3b tax evasion cases

“HSBC Argentina emphatically rejects its participation in any illegal association, including any organization that allows capital flight aimed at evading taxes”

PUBLISHED : Friday, 28 November, 2014, 9:56am

UPDATED : Saturday, 29 November, 2014, 2:43am

Don Weinland

AFIP head Ricardo Echegaray (centre) said AFIP charged the local branch of HSBC and its executives in an Argentine federal court. Photo: Ricardo Echegaray's official website

HSBC Holdings on Friday strongly denied charges from Argentina’s tax bureau that the bank had helped citizens in the South American country evade some US$3 billion in taxes.

“HSBC emphatically denies its participation in any illegal association, including any organisation that allows depositing capital outside Argentina to evade taxes,” a spokesperson in Hong Kong said in an email.

The country’s AFIP tax agency on Thursday charged the local branch of HSBC and its executives in an Argentine federal court.

AFIP head Ricardo Echegaray said Argentine citizens evaded about $3 billion in taxes that were handled by intermediaries through a network of offshore accounts.

Echegaray alleged that some of those accounts in Geneva are owned by HSBC Argentina’s president and other bank executives. He did not say if the bank’s operations had been suspended in Argentina.

“There’s no doubt that the AFIP will keep cracking down on tax havens because our objective is to collect taxes and to avoid harming those who have less,” he said.

HSBC’s share price fell 0.71 per cent to HK$77 in morning trading in Hong Kong on Friday. The Hang Seng Index fell 0.11 per cent to 23,978.

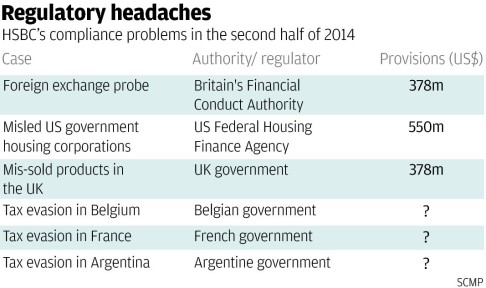

The charges are the latest regulatory headache for the bank, which has come under fire in several jurisdictions on a wide range of accusations.

AFIP said it got its information from France, where HSBC was placed under formal investigation last week for possibly aiding tax evasion. The banking company has also been charged in Belgium with organised fiscal fraud.

Provisions for the third quarter totalled US$1.69 billion, a 115 per cent spike year on year, the bank said early this month. The bank marked out US$378 million for a foreign exchange probe launched by Britain’s Financial Conduct Authority.

HSBC also prepared to pay out US$701 million in the third quarter to compensate customers under British consumer redress programmes, a continuing cost for the bank.

In mid-September, HSBC agreed to pay US$550 million to resolve claims that it misled US government housing corporations Fannie Mae and Freddie Mac about mortgage securities it sold them before the 2007 collapse of the US housing market.

"There will continue to be redress and fines that come through," chief executive Stuart Gulliver said during a conference call in early November.

Argentina’s government has denounced several foreign companies in its fight to curb capital flight. The left-leaning government recently accused Procter & Gamble of tax fraud and said it had suspended the operations of the US household goods giant in this South American country.

In a statement to the Associated Press, the bank said that HSBC Argentina did not have an account in HSBC Switzerland.

The high provisions and the potential for new regulatory problems clouded HSBC’s return to positive profit growth in the third quarter.

Pre-tax profit climbed 2 per cent to US$4.61 billion from the same period last year after tumbling 12 per cent in the first half. Analysts had expected up to 16 per cent growth.

Underlying profit before tax for the third quarter fell 12 per cent to US$4.41 billion year on year and pre-tax profit for the first nine months of the year fell 9 per cent, also below analysts’ expectations.

With reporting from the Associated Press