- Joined

- Apr 14, 2011

- Messages

- 20,616

- Points

- 113

NoonTalk Media's IPO covered, to start trading on Nov 22

The Edge Singapore

Mon, 21 November 2022 at 4:56 am·2-min read

NoonTalk Media shares will start trading on Nov 22.

The IPO order book of NoonTalk Media, which is in artistes’ management, has been covered for both public and placement tranches, raising gross proceeds of $4.8 million.

Of the 4.5 million public tranche shares available, there were valid applications for 5.3 million shares, which makes it 1.2 times subscribed.

The 17.5 million placement shares available were fully spoken for too.

The shares were priced at 22 cents each, giving the company a market value of $43.6 million.

Lim Hock Leng, better known as the managing director of Sheng Siong Group, was one of the anchor investors. He took up 4.4 million shares.

Union Energy Corp, known for selling LNG, took up 2 million shares.

Qilin Wealth Fund, a Singapore-based family office, and Chong Weng Chiew, a former member of parliament, took up 1.35 million shares each. Chong is now an executive director of CITIC Envirotech.

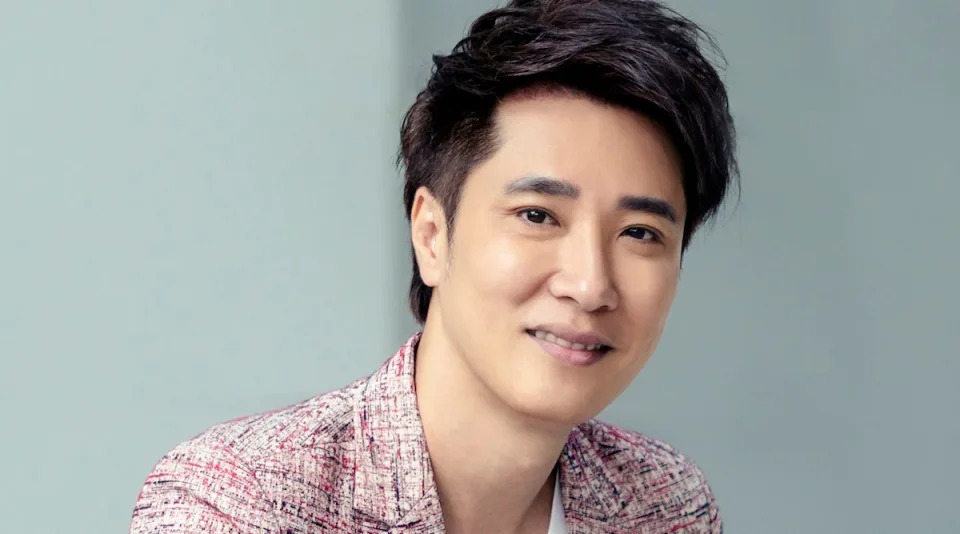

Dasmond Koh, NoonTalk Media’s executive director and CEO says he is “incredibly grateful” for the “overwhelming support” of the IPO.

“We believe their warm reception underscores the strength of our business fundamentals and the belief in our big dream in this industry,” he adds.

“Listing on SGX serves as a platform to enhance our exposure and allows us to gain access to the capital markets to extend our regional footprint,” says Koh.

Between FY2020 and FY2022, NoonTalk Media reported revenue of $3.04 million, $3.83 million and $6.37 million respectively.

Earnings in the same period were $73,939, $189,244 and $22,407 respectively.

This IPO, the eighth Catalist on the Singapore Exchange this year, is managed by Evolve Capital Advisory, playing the roles of sponsor, issue manager and co-placement agent. CGS-CIMB Securities (Singapore), on the other hand, is the underwriter and co-placement agent.

NoonTalk Media shares will start trading on Nov 22.