- Joined

- Nov 29, 2016

- Messages

- 5,674

- Points

- 63

https://www.rt.com/business/415251-russia-china-gold-us/

Russia-China combined gold reserves could shake US dominance in global economy - expert tells RT

Published time: 8 Jan, 2018 07:19

Get short URL

Vladimir Putin holds a gold bar while visiting the Central Depository of the Bank of Russia © Alexsey Druginyn © AFP

Manly exclusively told RT that there is a shift occurring regarding the two countries building up their gold reserves, to perhaps returning to gold-backed currencies in the future and a move away from the global dominance of the US dollar, which is no longer supported by gold.

“China and Russia have both been aggressively accumulating their official gold reserves over the last 10 - 15 years,” he said, adding that only a decade ago each of them held around or less than 400 tons. “But now both these nations hold a combined 3670 tons of gold.”

“Interestingly, both Russia and China publicize and promote their accumulations of gold and publicly refer to gold as a strategic monetary asset. They make no secret of this. But on the flipside, the US does the opposite, and constantly downplays the strategic role of gold.”

According to Manly, for Russia and China gold is the only strategic monetary asset that could provide independence from the US dollar.

Manly said the sides could conceivably be holding a lot more gold than they declare in their official reserves due to many channels through which they could buy the precious metal.

“If China and Russia combined showed that they held more gold on a combined basis than the US, this would, even symbolically, be a blow to the US dollar and to the position of the US in the global economy,” the expert concluded.

https://www.rt.com/business/411700-russia-gold-reserves-putin/

HomeBusiness News

Russia continues stocking up on gold under Putin’s strategy

Published time: 2 Dec, 2017 06:34

Get short URL

© Pavel Lisitsyn © Sputnik

As of November, Russia had 1,801 tons of gold accounting for 17.3 percent of all reserves. Russia is the sixth largest gold owner after the United States, Germany, Italy, France, and China.

“Under the instruction by President Putin, the Bank of Russia has been implementing the program of increasing the absolute share of gold in the gold and currency reserves of Russia for many years," First Deputy Chairman of the Russian regulator Sergey Shvetsov said last week at a conference on precious metals in Moscow.

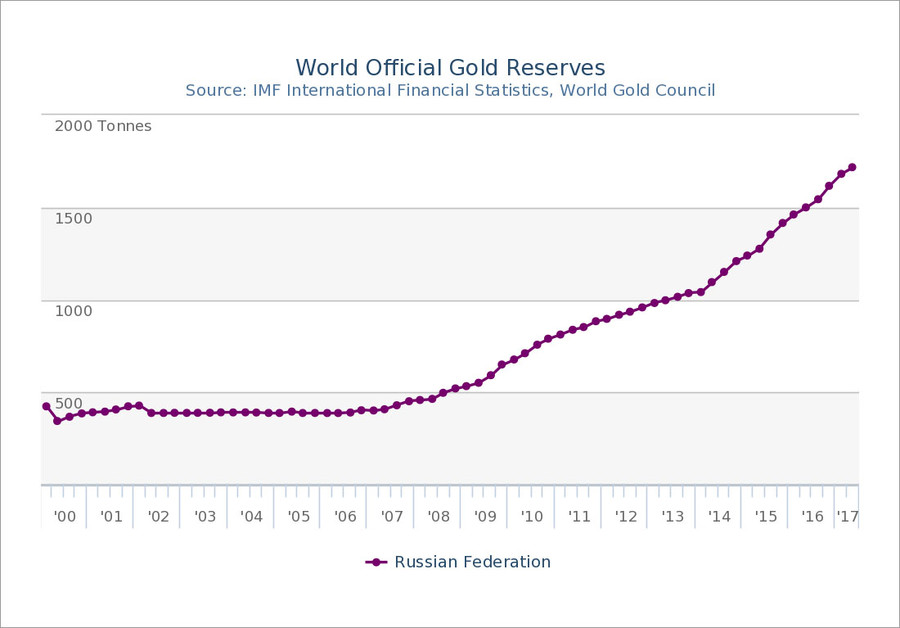

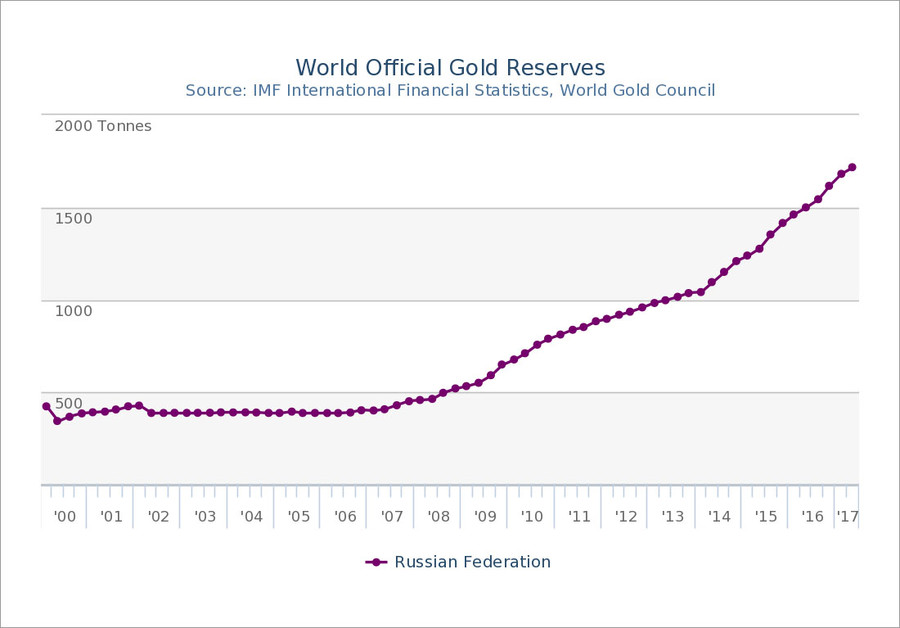

Since Putin’s election as president, Russian gold reserves have increased more than 500 percent from 343 tons, according to Gold.org data.

© gold.org

Buying gold makes a country less vulnerable to geopolitics. After the Crimea referendum in the first quarter of 2014, Russia increased its gold reserves by almost 75 percent.

"I will not dwell on the geopolitical situation. Every smart person understands the value of gold in ensuring financial and economic security of the country," Shvetsov said at the conference.

As Goldcore reports, the CBR has more than doubled the pace of gold purchases. In the second quarter of the year, Russia accounted for 38 percent of all gold purchased by central banks.

“Gold is an asset that is independent of any government, and in effect given what is usually held in reserves, any Western government,” said Matthew Turner, metals analyst at Macquarie Group in London, as quoted by Bloomberg. “This might appeal given Russia has faced financial sanctions.”

Russia-China combined gold reserves could shake US dominance in global economy - expert tells RT

Published time: 8 Jan, 2018 07:19

Get short URL

Vladimir Putin holds a gold bar while visiting the Central Depository of the Bank of Russia © Alexsey Druginyn © AFP

Manly exclusively told RT that there is a shift occurring regarding the two countries building up their gold reserves, to perhaps returning to gold-backed currencies in the future and a move away from the global dominance of the US dollar, which is no longer supported by gold.

“China and Russia have both been aggressively accumulating their official gold reserves over the last 10 - 15 years,” he said, adding that only a decade ago each of them held around or less than 400 tons. “But now both these nations hold a combined 3670 tons of gold.”

“Interestingly, both Russia and China publicize and promote their accumulations of gold and publicly refer to gold as a strategic monetary asset. They make no secret of this. But on the flipside, the US does the opposite, and constantly downplays the strategic role of gold.”

According to Manly, for Russia and China gold is the only strategic monetary asset that could provide independence from the US dollar.

Manly said the sides could conceivably be holding a lot more gold than they declare in their official reserves due to many channels through which they could buy the precious metal.

“If China and Russia combined showed that they held more gold on a combined basis than the US, this would, even symbolically, be a blow to the US dollar and to the position of the US in the global economy,” the expert concluded.

https://www.rt.com/business/411700-russia-gold-reserves-putin/

HomeBusiness News

Russia continues stocking up on gold under Putin’s strategy

Published time: 2 Dec, 2017 06:34

Get short URL

© Pavel Lisitsyn © Sputnik

As of November, Russia had 1,801 tons of gold accounting for 17.3 percent of all reserves. Russia is the sixth largest gold owner after the United States, Germany, Italy, France, and China.

“Under the instruction by President Putin, the Bank of Russia has been implementing the program of increasing the absolute share of gold in the gold and currency reserves of Russia for many years," First Deputy Chairman of the Russian regulator Sergey Shvetsov said last week at a conference on precious metals in Moscow.

Since Putin’s election as president, Russian gold reserves have increased more than 500 percent from 343 tons, according to Gold.org data.

© gold.org

Buying gold makes a country less vulnerable to geopolitics. After the Crimea referendum in the first quarter of 2014, Russia increased its gold reserves by almost 75 percent.

"I will not dwell on the geopolitical situation. Every smart person understands the value of gold in ensuring financial and economic security of the country," Shvetsov said at the conference.

As Goldcore reports, the CBR has more than doubled the pace of gold purchases. In the second quarter of the year, Russia accounted for 38 percent of all gold purchased by central banks.

“Gold is an asset that is independent of any government, and in effect given what is usually held in reserves, any Western government,” said Matthew Turner, metals analyst at Macquarie Group in London, as quoted by Bloomberg. “This might appeal given Russia has faced financial sanctions.”

‘Gold price will explode & dollar get wiped out’ – warns investor Peter Schiff

‘Gold price will explode & dollar get wiped out’ – warns investor Peter Schiff  Russia & China could set international gold price based on physical gold trading

Russia & China could set international gold price based on physical gold trading  Russia continues stocking up on gold under Putin’s strategy

Russia continues stocking up on gold under Putin’s strategy

China's launch of 'petro-yuan' in two months sounds death knell for dollar's dominance

China's launch of 'petro-yuan' in two months sounds death knell for dollar's dominance