- Joined

- Oct 19, 2012

- Messages

- 127

- Points

- 28

https://www.theonlinecitizen.com/20...s-safeguards-for-cryptocurrency-in-singapore/

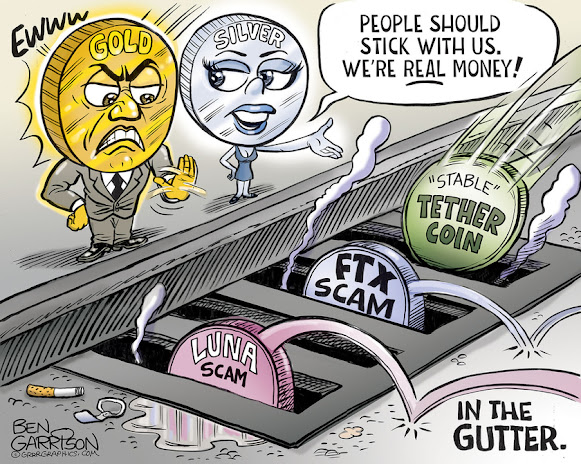

SINGAPORE — On Tuesday, Ms He Ting Ru and Mr Dennis Tan of the Workers’ Party (WP) filed parliamentary questions (PQs) surrounding the government’s control and safeguards on cryptocurrency, in light of the bankruptcy of cryptocurrency exchange FTX which has affected a number of Singaporean investors including Temasek Holdings.

These questions are on top of the other questions filed in regard to Singapore’s two Sovereign Wealth Funds (SWFs) by other WP MPs for the upcoming parliamentary sitting on 28 November.

Posting about the PQs filed by the WP MPs, Ms He noted that the cryptocurrency markets were rocked last week by the sudden collapse of FTX, once again drawing attention to the risks surrounding this relatively new instrument and market.

“Of concern too was the investments made by Temasek into the exchange, and the announcement that these were now being written down to zero.” said Ms He in her Facebook post and that the WP MPs look forward to the debate on these important topics.

Ms He who is the Member of Parliament for Seng Kang GRC, is asking the Prime Minister if the Monetary Authority of Singapore (MAS) will consider leading a specific study into the regulatory lessons to be learnt from the collapse of cryptocurrency exchanges such as Terra and FTX and whether is there a need for tighter requirements to ensure the stability of regulated cryptocurrency exchanges in Singapore.

She also asks if the various insolvencies of cryptocurrency exchanges and extreme volatility in the cryptocurrency markets in the last year will affect Singapore’s efforts to become a robust global blockchain and fintech hub and whether MAS will consider further regulatory measures to prevent any contagion into the wider cryptocurrency, fintech and financial markets.

As to the risk of cryptocurrency, Ms He asked about the MAS’s requirements as to the prudential treatment of Singapore banks’ crypto asset exposure and what are the riskweighting requirements applicable to crypto asset exposures in assessing Singapore banks’ capital adequacy.

Ms He further asks if there is an estimated number of Singapore investors who are affected by the insolvency of cryptocurrency trading platform FTX and what the estimated size of total investments is being affected and if there are any from retail investors.

Mr Dennis Tan Lip Fong, MP for Hougang SMC is asking if the Government intends to introduce further measures or safeguards to regulate cryptocurrency trading or investment, as well as to protect Singaporean retail investors in general.

It also noted that the reason why Binance was placed on the Investor Alert List (IAL) while FTX was not, is because Binance was actively soliciting users in Singapore while FTX was not.

MAS said Binance had, in fact, gone to the extent of offering listings in Singapore dollars and accepted Singapore-specific payment modes such as PayNow and PayLah.

It shared that it received several complaints about Binance between January and August 2021. There were also announcements in multiple jurisdictions of unlicensed solicitation of customers by Binance during the same period.

On the other hand, MAS claims that there was no evidence that FTX was soliciting Singapore users specifically and trades on FTX also could not be transacted in Singapore dollars. However, it also noted that Singapore users were still able to access FTX services online.

A contributor to TOC noted that FTX does have a Singapore-registered subsidiary, Quoine PTE LTD which received an exemption for a MAS license and has been actively soliciting Singaporean users.

He notes that Quoine allows Singaporean users to register using their SingPass and that it has recently halted withdrawal on its Liquid exchange platform, blaming FTX’s bankruptcy in the United States.

He asked whether MAS should have required Quoine to ringfence its Singaporean customers’ funds as a condition for its MAS license application.

SINGAPORE — On Tuesday, Ms He Ting Ru and Mr Dennis Tan of the Workers’ Party (WP) filed parliamentary questions (PQs) surrounding the government’s control and safeguards on cryptocurrency, in light of the bankruptcy of cryptocurrency exchange FTX which has affected a number of Singaporean investors including Temasek Holdings.

These questions are on top of the other questions filed in regard to Singapore’s two Sovereign Wealth Funds (SWFs) by other WP MPs for the upcoming parliamentary sitting on 28 November.

Posting about the PQs filed by the WP MPs, Ms He noted that the cryptocurrency markets were rocked last week by the sudden collapse of FTX, once again drawing attention to the risks surrounding this relatively new instrument and market.

“Of concern too was the investments made by Temasek into the exchange, and the announcement that these were now being written down to zero.” said Ms He in her Facebook post and that the WP MPs look forward to the debate on these important topics.

Ms He who is the Member of Parliament for Seng Kang GRC, is asking the Prime Minister if the Monetary Authority of Singapore (MAS) will consider leading a specific study into the regulatory lessons to be learnt from the collapse of cryptocurrency exchanges such as Terra and FTX and whether is there a need for tighter requirements to ensure the stability of regulated cryptocurrency exchanges in Singapore.

She also asks if the various insolvencies of cryptocurrency exchanges and extreme volatility in the cryptocurrency markets in the last year will affect Singapore’s efforts to become a robust global blockchain and fintech hub and whether MAS will consider further regulatory measures to prevent any contagion into the wider cryptocurrency, fintech and financial markets.

As to the risk of cryptocurrency, Ms He asked about the MAS’s requirements as to the prudential treatment of Singapore banks’ crypto asset exposure and what are the riskweighting requirements applicable to crypto asset exposures in assessing Singapore banks’ capital adequacy.

Ms He further asks if there is an estimated number of Singapore investors who are affected by the insolvency of cryptocurrency trading platform FTX and what the estimated size of total investments is being affected and if there are any from retail investors.

Mr Dennis Tan Lip Fong, MP for Hougang SMC is asking if the Government intends to introduce further measures or safeguards to regulate cryptocurrency trading or investment, as well as to protect Singaporean retail investors in general.

MAS’ Actions On Cryptocurrency

In a press release on Monday (21 Nov), MAS said that it is a misconception that it could protect local users who dealt with the cryptocurrency exchange, such as by ringfencing their assets or ensuring that FTX backed its assets with reserves, as it did not license FTX and the exchange operates offshore.It also noted that the reason why Binance was placed on the Investor Alert List (IAL) while FTX was not, is because Binance was actively soliciting users in Singapore while FTX was not.

MAS said Binance had, in fact, gone to the extent of offering listings in Singapore dollars and accepted Singapore-specific payment modes such as PayNow and PayLah.

It shared that it received several complaints about Binance between January and August 2021. There were also announcements in multiple jurisdictions of unlicensed solicitation of customers by Binance during the same period.

On the other hand, MAS claims that there was no evidence that FTX was soliciting Singapore users specifically and trades on FTX also could not be transacted in Singapore dollars. However, it also noted that Singapore users were still able to access FTX services online.

A contributor to TOC noted that FTX does have a Singapore-registered subsidiary, Quoine PTE LTD which received an exemption for a MAS license and has been actively soliciting Singaporean users.

He notes that Quoine allows Singaporean users to register using their SingPass and that it has recently halted withdrawal on its Liquid exchange platform, blaming FTX’s bankruptcy in the United States.

He asked whether MAS should have required Quoine to ringfence its Singaporean customers’ funds as a condition for its MAS license application.