- Joined

- Apr 9, 2009

- Messages

- 3,070

- Points

- 0

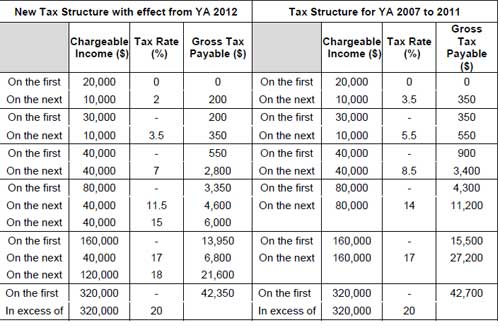

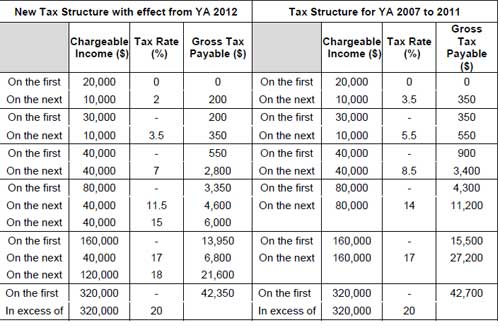

Singaporeans and permanent residents who earn less than $120,000 a year will see a reduction in their income taxes this year.

This reduction will help middle income earners to cut back on paying more taxes.

The previous tax rate of 3.5 per cent for the first $30,000 chargeable annual income has been reduced to 2 per cent. This means the gross tax payable will be $200, instead of the previous $350.

The next tier of $40,000 chargeable income will have a tax rate of 3.5 per cent, compared to the previous 5.5 per cent, making the total amount of gross tax payable to be $550 instead of $900.

Those who earn up to $80,000 a year will also see a 1.5 per cent reduction in their taxes from 8.5 per cent down to 7 per cent, or a gross tax of $3,350, instead of the previous tax rate of 8.5 per cent, or $4,300.

The tax reductions are capped at an annual income of $120,000. These income earners will see a reduction of 3.5 per cent in their tax rate, reducing the gross tax payable from $11,200 to $4,600.

Those who earn an annual income of $120,000 and above are not entitled to income tax reductions.

The public is reminded to file their income tax returns online by April 18, or send in paper returns by April 15.

For enquiries, taxpayers may call 1800-252 5011 or 1800-356 8300 or email IRAS via Contact Info at www.iras.gov.sg.

This reduction will help middle income earners to cut back on paying more taxes.

The previous tax rate of 3.5 per cent for the first $30,000 chargeable annual income has been reduced to 2 per cent. This means the gross tax payable will be $200, instead of the previous $350.

The next tier of $40,000 chargeable income will have a tax rate of 3.5 per cent, compared to the previous 5.5 per cent, making the total amount of gross tax payable to be $550 instead of $900.

Those who earn up to $80,000 a year will also see a 1.5 per cent reduction in their taxes from 8.5 per cent down to 7 per cent, or a gross tax of $3,350, instead of the previous tax rate of 8.5 per cent, or $4,300.

The tax reductions are capped at an annual income of $120,000. These income earners will see a reduction of 3.5 per cent in their tax rate, reducing the gross tax payable from $11,200 to $4,600.

Those who earn an annual income of $120,000 and above are not entitled to income tax reductions.

The public is reminded to file their income tax returns online by April 18, or send in paper returns by April 15.

For enquiries, taxpayers may call 1800-252 5011 or 1800-356 8300 or email IRAS via Contact Info at www.iras.gov.sg.