-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Serious GRAB - A Public Listed Company wef 2 Dec 2021

- Thread starter shiokalingam

- Start date

me guesstimate GRAB will start Trading below IPO price ...

https://sg.finance.yahoo.com/news/g...as-investors-approve-spac-deal-023440684.html

https://sg.finance.yahoo.com/news/g...as-investors-approve-spac-deal-023440684.html

(Bloomberg) — Investors voted to approve the merger of ride-hailing provider Grab Holdings Inc. and Altimeter Growth Corp., completing one of the largest special purpose acquisition company deals ever after a year of tumult for SPACs and the transaction itself.

The proposal passed at a special shareholder meeting Tuesday, setting the stage for Grab to become a publicly traded company, according to a statement. Shareholder redemptions, or investors opting out of the deal, were effectively 0%, at 0.02%. The combined entity will start trading on the Nasdaq on Dec. 2 under the ticker GRAB.

Singapore-based Grab, led by Chief Executive Officer Anthony Tan, had long been viewed as a marquee company in Southeast Asia and a promising candidate to go public. Tan and co-founder Hooi Ling Tan, backed by SoftBank Group Corp., fought off aggressive competition to become one of the largest ride-hailing and delivery companies in the region — and the most valuable startup.

But the road to public markets has been rocky. After Grab unveiled plans to merge with Altimeter Capital Management’s SPAC in a US$40 billion deal, they had to postpone the closing to work on an audit of the past three years’ accounts. Meanwhile, regulatory scrutiny of SPACs and a resurgence of fears about Covid-19 infections threatened to derail the listing.

In September, Grab cut its revenue projections for 2021 as Southeast Asia battled with the delta variant. In November, the company said its net loss widened to US$988 million for the third quarter, while revenue declined 9% to US$157 million. Later that month, Grab’s app suffered extensive disruptions.

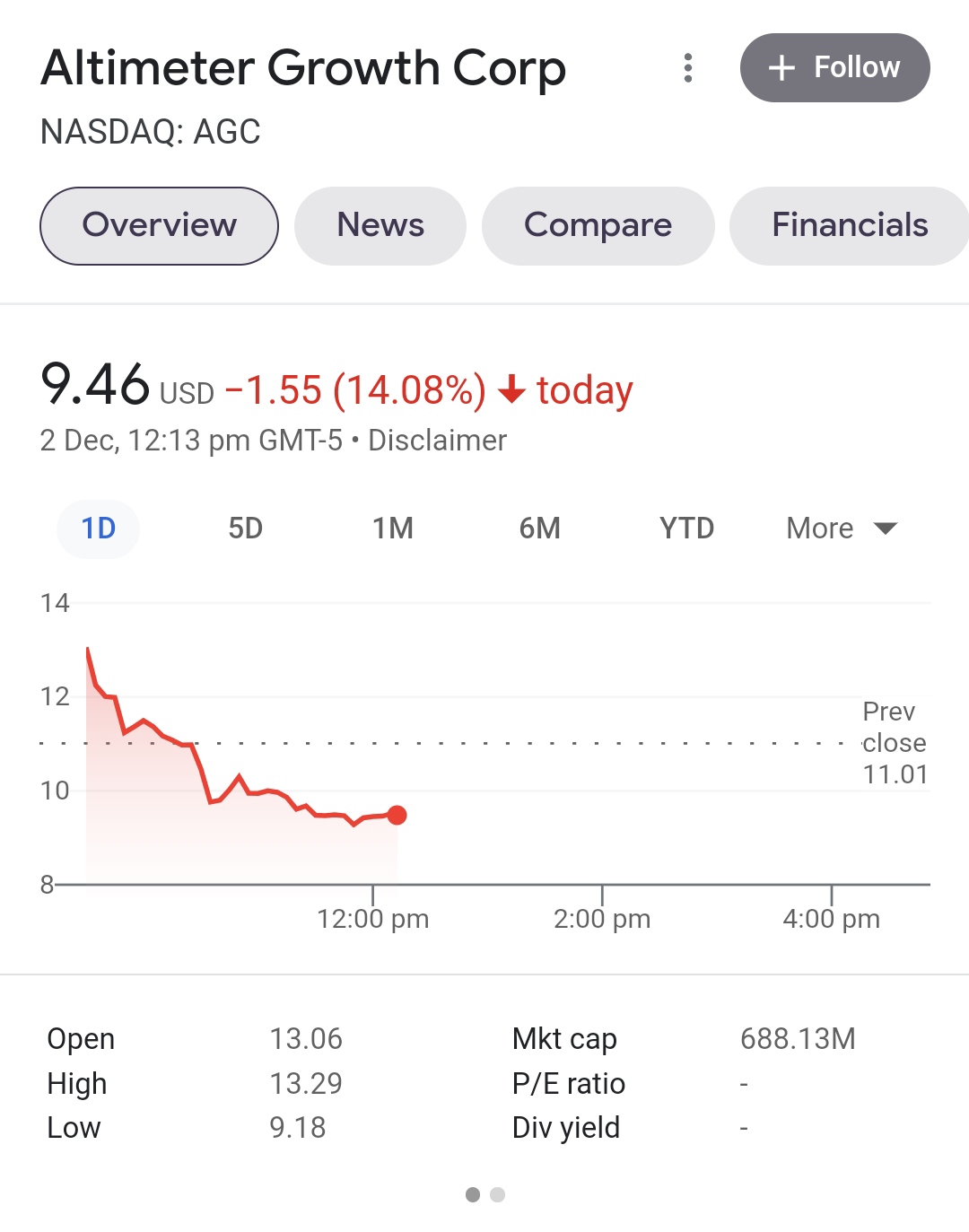

Altimeter Growth shares, originally sold at US$10 each, have had a tumultuous year. They closed at US$12.72 in U.S. trading Tuesday, down 5.8% as market indexes fell.

(Updates with vote details from second paragraph)

© 2021 Bloomberg L.P.

ah jinx coy ...me guesstimate GRAB will start Trading below IPO price ...

ah jinx coy ...

contrary to talk about town

TLC me think and subject to ipo prospectus facts TLC actually a very small shareholder.

SoftBank the real owner .

Grab is a jibye company same like shopee

December 2, 2021 3:35 pm by Mercedes Ruehl in Singapore

Shares in Singapore-based Grab whipsawed in their Nasdaq debut on Thursday after the south-east Asian super app concluded a record $40bn merger deal with a blank cheque company.

Grab, one of the most valuable technology companies in the region, offers food delivery, ride-hailing and financial services. It drew backing from global investors including T Rowe Price, Temasek, BlackRock, Fidelity and Mubadala for the deal.

Shares opened at $13.06 on Thursday, up from the previous day’s close of $11.01, but then fell below $11 in early trading.

SINGAPORE - Super-app Grab Holdings made an encouraging market debut on Thursday (Dec 2), after completing its US$40 billion (S$54.7 billion) merger with special purpose acquisition company (Spac) Altimeter Growth Corp.

Shares of the combined entity opened at US$13.06 on its debut on the tech-heavy Nasdaq exchange on Thursday, up 18 per cent from the Altimeter Spac's closing price of US$11.01 on Wednesday.

The shares were trading at about US$11.40 around half an hour into its official listing.

us$13.06

dropped to a low of us$9.18

dropped to a low of us$9.18

Grab Holdings Ltd. ’s shares turned red after initially opening higher on their first day of trading in New York, after the Southeast Asian ride-hailing and delivery giant completed a record-breaking merger with a special-purpose acquisition company.

Shares recently fell 9.6% to $9.95, giving Grab a market capitalization of roughly $37.9 billion. The Singapore-headquartered firm in April agreed to combine with the SPAC Altimeter Growth Corp. in a deal that valued it at close to $40 billion, setting a high-water mark for transactions involving blank-check companies, which raise money with the purpose of seeking a target to merge with and take public.

Shares opened at $13.06 Thursday. The stock was up 19% from Wednesday, when it was trading as Altimeter Growth Corp.

The transaction also included a $4.5 billion fundraising for Grab, a nine-year-old company that has operations in eight countries, including Indonesia, Thailand, Malaysia and the Philippines.

The company is trading under the ticker GRAB on the Nasdaq Stock Market. Its backers include SoftBank Group Corp.’s Vision Fund, Chinese ride-hailing firm Didi Global Inc. and Toyota Motor Corp.

Shares recently fell 9.6% to $9.95, giving Grab a market capitalization of roughly $37.9 billion. The Singapore-headquartered firm in April agreed to combine with the SPAC Altimeter Growth Corp. in a deal that valued it at close to $40 billion, setting a high-water mark for transactions involving blank-check companies, which raise money with the purpose of seeking a target to merge with and take public.

Shares opened at $13.06 Thursday. The stock was up 19% from Wednesday, when it was trading as Altimeter Growth Corp.

The transaction also included a $4.5 billion fundraising for Grab, a nine-year-old company that has operations in eight countries, including Indonesia, Thailand, Malaysia and the Philippines.

The company is trading under the ticker GRAB on the Nasdaq Stock Market. Its backers include SoftBank Group Corp.’s Vision Fund, Chinese ride-hailing firm Didi Global Inc. and Toyota Motor Corp.

They are still bleeding S$500m a month. Only the management wins.

Several bank EDs and SVPs will lose their posts for their huge exposure to Grab.

They lost 20% on first day. Nasdaq's minimum listing price after IPO has to be sustained above US$1.

Several bank EDs and SVPs will lose their posts for their huge exposure to Grab.

They lost 20% on first day. Nasdaq's minimum listing price after IPO has to be sustained above US$1.

I switched back to Comfort SMRT etcGrab is a jibye company same like shopee

any trpt but Grab or Gojek or Tada

Same for my uncle just dial the lumber and pickup point always press 1 and very fast arrive paying extra booking fee $2.30 or even peak hours $3.30 and let uncle earn is better than letting these jibyes drivers and company earn.I switched back to Comfort SMRT etc

any trpt but Grab or Gojek or Tada

Similar threads

- Replies

- 4

- Views

- 402

- Replies

- 3

- Views

- 364

- Replies

- 20

- Views

- 2K

- Replies

- 3

- Views

- 707