- Joined

- Nov 29, 2016

- Messages

- 5,674

- Points

- 63

https://www.marketwatch.com/story/2...ng-bond-market-recession-indicator-2019-08-14

Get email alerts

U.S. Treasury yields fall sharply, 2-year/10-year yield curve inverts, triggering recession indicator

Published: Aug 14, 2019 3:24 p.m. ET

U.S. Treasury 10-year note yield briefly fell before the 2-year note yield

Getty Images

Getty Images

By

SunnyOh

U.S. Treasury yields fell sharply on Wednesday after a raft of weak economic data from China and Germany underlined a slowdown in global growth, offsetting hopes that U.S.-China trade talks were making progress.

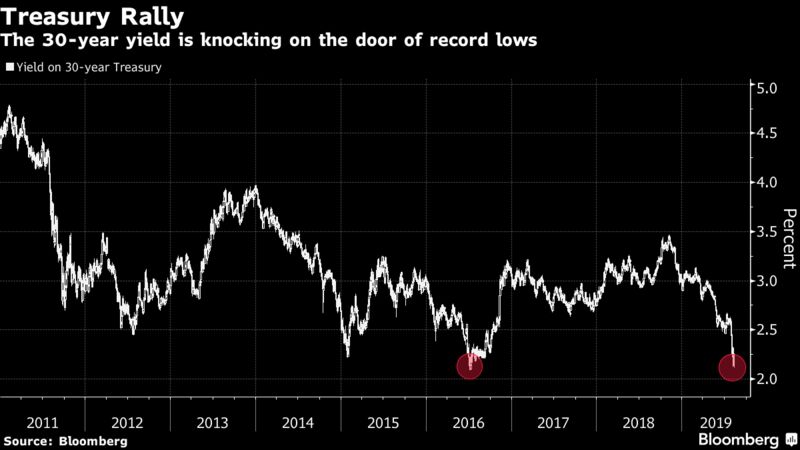

The sharp rally in long-term government bonds briefly inverted a key measure of the yield curve’s slope for the first time since June 2007.

How are Treasurys doing?

The 10-year Treasury note yield TMUBMUSD10Y, -1.28% plunged 8.2 basis points to 1.596%, its lowest since September 2016.

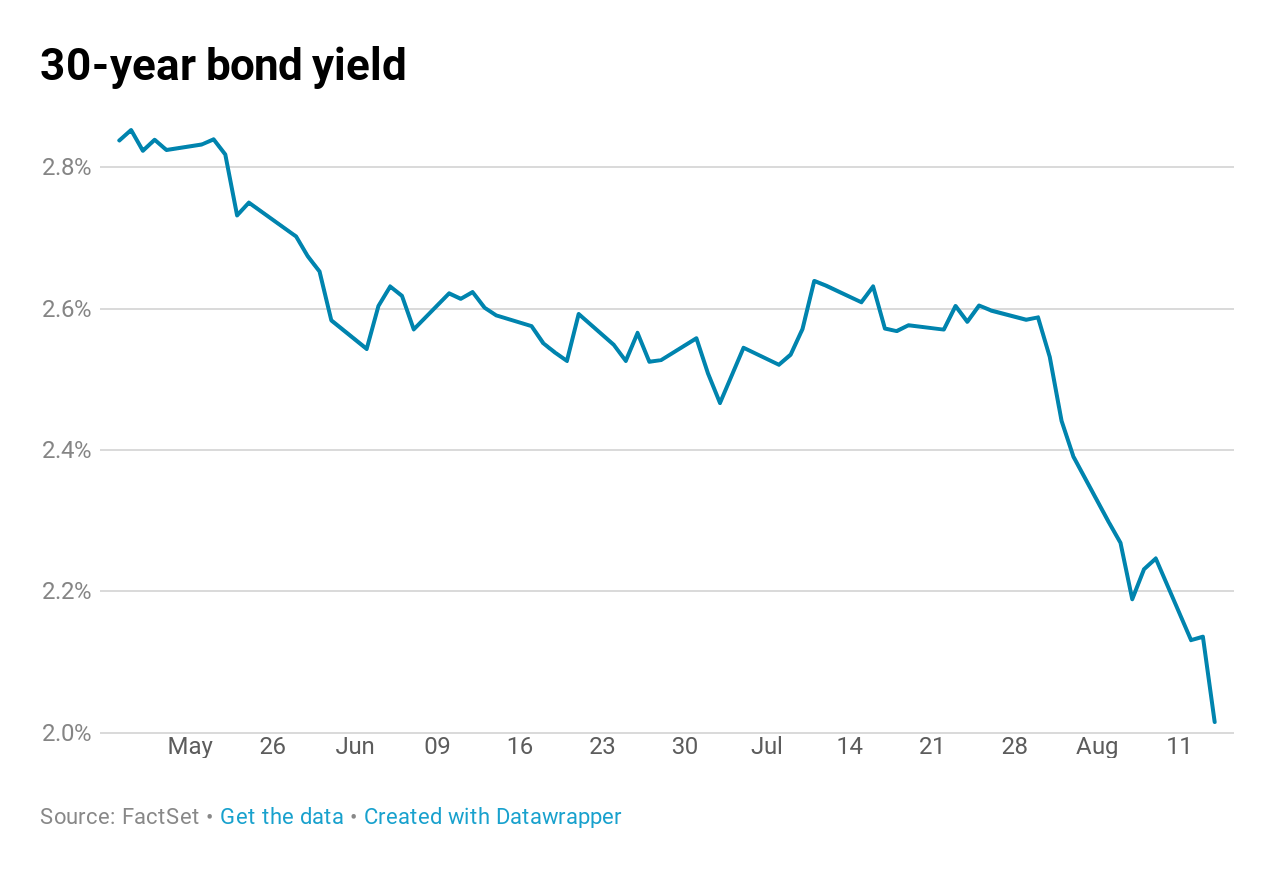

The 2-year note rate TMUBMUSD02Y, -1.81% retreated 7.5 basis points to 1.592%, while the 30-year bond yield TMUBMUSD30Y, -0.42% tumbled 9.3 basis points to 2.038%, an all-time closing low.

The spread between the 2-year note and the 10-year note temporarily fell to a negative 1 basis point. An inversion of this measure has often preceded an economic downturn. Investors say its powers as a recession indicator comes from its ability to reflect when tight monetary policy is capping growth and inflationary pressures.

See: The U.S. Treasury 2-10 year yield curve inverted and that means stocks are on ‘borrowed time,’ says BAML

What’s driving Treasurys?

The slowdown in China’s economy was highlighted by a rise in industrial production at its slowest pace since Jan. 2002, increasing 4.8% in July from a year earlier versus a 6.3% increase in June. Germany’s economy shrank 0.1% in the second quarter of 2019 as the U.S - China trade war hit global manufacturing supply lines and the country’s export-dependent industries.

See: What Germany’s dismal GDP number really means for Europe and interest rates

The raft of anemic data and the inversion of the U.S. yield curve weighed on investor sentiment, stirring demand for safe haven assets like Treasurys.

U.S. stocks saw a sharp selloff on Wednesday, with the S&P 500 SPX, +0.34% and the Dow Jones Industrial Average DJIA, +0.27% on track to end lower by more than 2%.

The surge of economic pessimism comes only a day after the U.S. Trade Representative announced it would winnow down the list of goods that are set to incur a 10% tariff on additional $300 billion of Chinese imports, measures which were publicized earlier in August 1.

Read: Fed not on red-alert after yield-curve inversion

What did market participants’ say?

“When I look at the data from today, there’s nothing that justifies the [flight to safety] we are having. Perhaps it’s the cumulative effect of a lot of issues the market has been grappling with. We keep piling on more issues. There’s only so much markets can bear,” said Gautam Khanna, senior portfolio manager at Insight Investment.

“At the moment, investors think bonds are the safest way to protect their portfolio. And some think there’s another shoe to drop and a bigger correction in equities must be waiting around the corner,” Robert Robis, chief fixed income strategist at BCA Research, told MarketWatch.

What else is on investors’ radar?

In the U.K., the spread between the 2-year yield TMBMKGB-02Y, +3.00% and the 10-year yield TMBMKGB-10Y, -3.04% for British government debt, or gilts, also inverted alongside the U.S. Treasurys market.

Sunny Oh

Sunny Oh is a MarketWatch fixed-income reporter based in New York.

https://www.cnbc.com/2019/08/15/bond-yields-are-tumbling-throughout-asia-pacific.html

Bond yields are tumbling throughout Asia Pacific

Published Wed, Aug 14 2019 11:39 PM EDTUpdated Thu, Aug 15 2019 2:57 AM EDT

Weizhen Tan@weizent

Key Points

Pedestrians are reflected on a window of a securities company in Tokyo on Aug. 30, 2017.

Toshifumi Kitamura | AFP | Getty Images

Yields for 10-year government bonds in major Asian markets have been dropping sharply as recession fears send investors pouring into the assets.

Bond prices move opposite yields, and as investors rush to buy them, prices surge and yields fall in tandem.

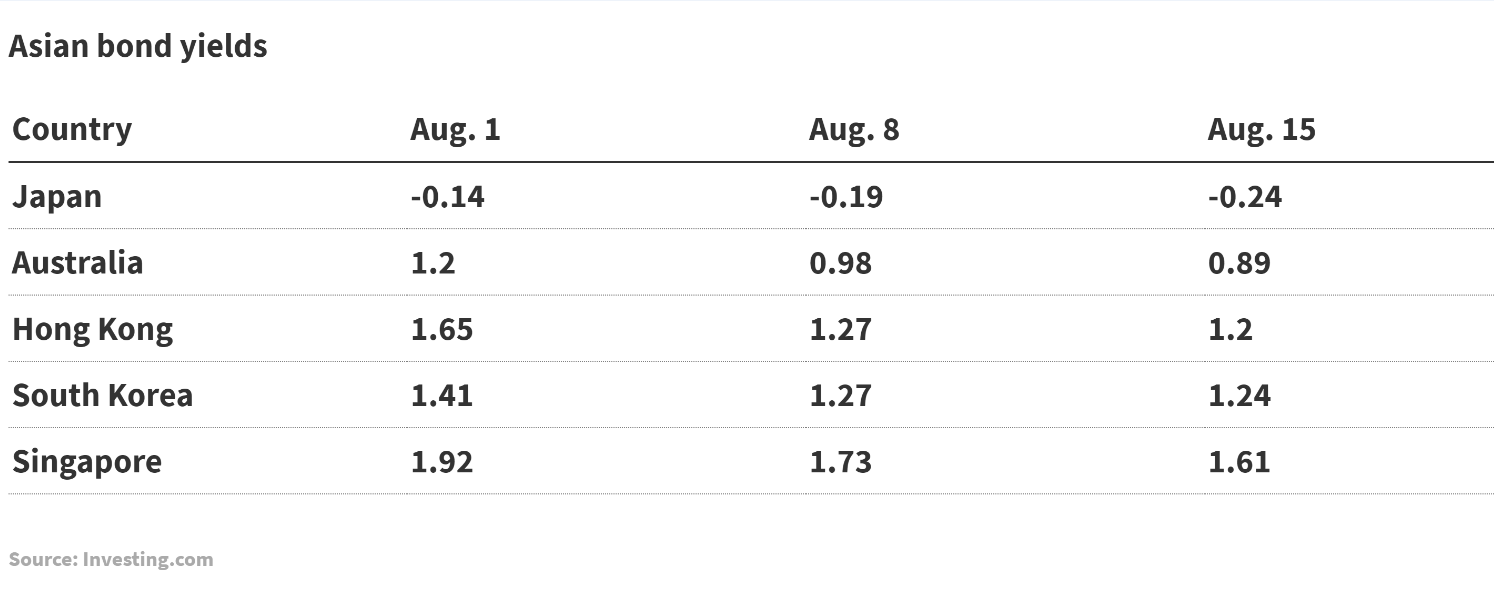

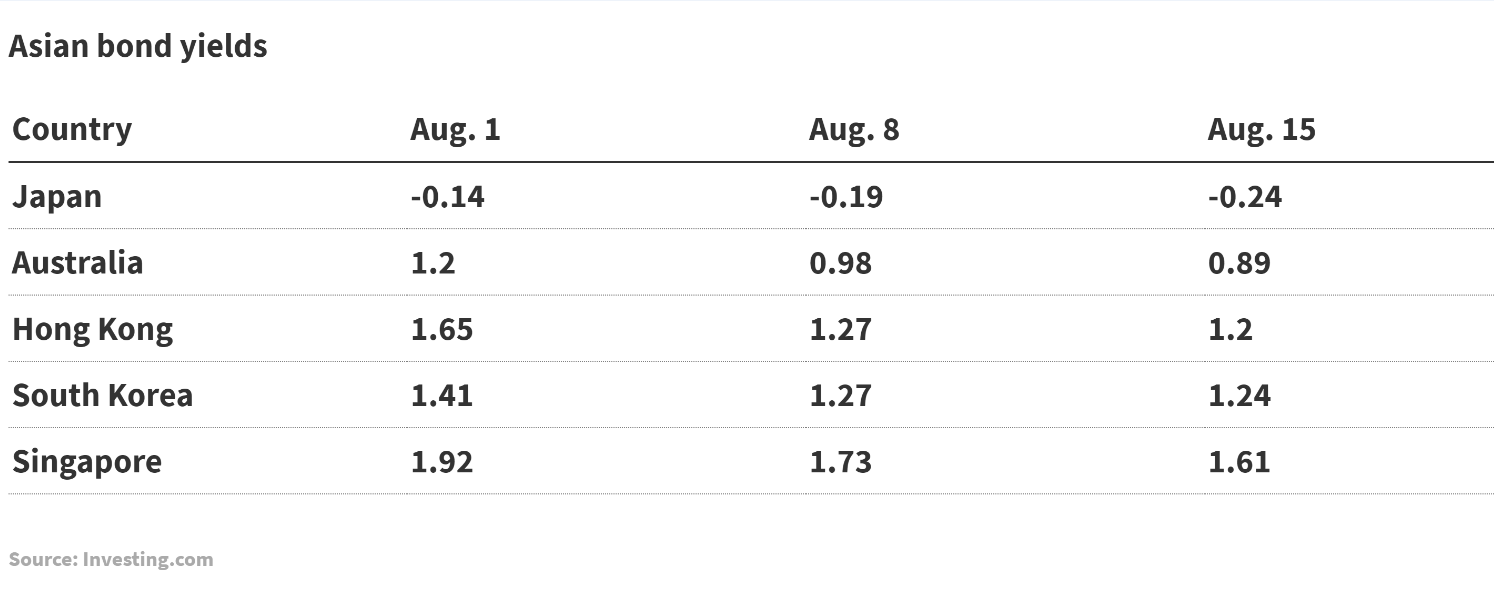

Here’s a look at how each market’s 10-year government bond yield has fallen by Thursday morning, versus a week ago and the beginning of the month.

In Japan, the 10-year yield dropped below the Bank of Japan’s preferred range for the first time last week — falling past -0.2%. Previously, the central bank has fixed the yield on the 10-year bond at around zero, which it pegged at a range of between 0.2% and -0.2%.

Recession fears have roiled markets. The yield on the benchmark 10-year Treasury note broke below the 2-year rate early Wednesday. That so-called yield curve is a bond market phenomenon that’s been a reliable, albeit early, indicator for economic recessions.

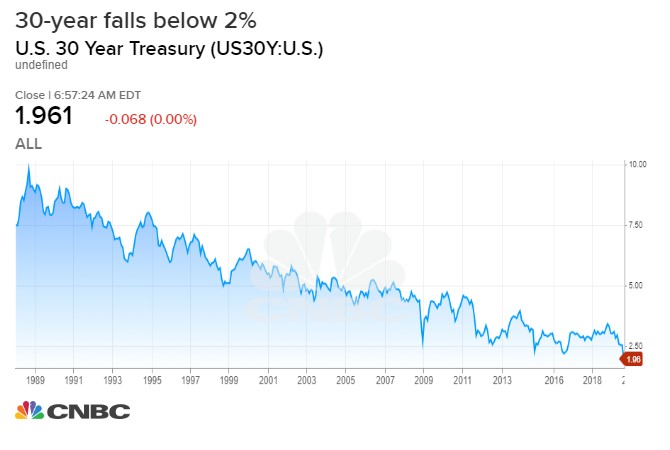

The yield on the U.S. 30-year bond also fell to a new low.

While lower-yielding markets, such as Hong Kong, South Korea and Singapore, and mid-yielding markets such as Malaysia and China, have seen rates drifting lower, one analyst told CNBC that investors are staying away from riskier markets — the high-yielding Asia bond markets such as India and Indonesia.

That’s causing the yields of those bonds to go up, said Julio Callegari, a fixed income portfolio manager at J.P. Morgan Asset Management.

“The main reason is that these bond markets are more sensitive to risk aversion — that usually causes depreciation in their currencies and pressure on the yield curve,” he said in an email. “Overall we expect this trend to continue for a while, since broadly speaking economic growth is still slowing in the region and central banks are likely to keep easing monetary policy.”

In the U.S., investors have also been rushing into bonds. The iShares 20+ Year Treasury Bond ETF, TLT jumped 2.1% on Monday, its biggest gain in a year.

Commenting on the recent main yield curve inversion in the U.S., former Federal Reserve Chair Janet Yellen said Wednesday that “it may be a less good signal ” this time around.

“The reason for that is there are a number of factors other than market expectations about the future path of interest rates that are pushing down long-term yields,” Yellen said on Fox Business Network.

— CNBC’s Eustance Huang, Thomas Franck and Patti Domm contributed to this report.

https://www.cnbc.com/2019/08/15/us-...falls-below-2percent-for-first-time-ever.html

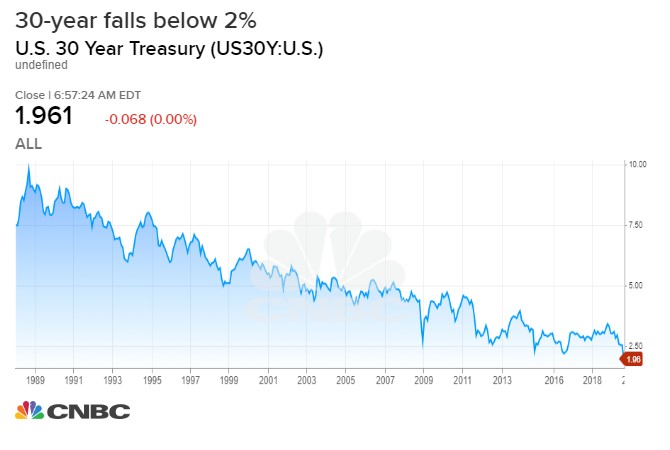

30-year Treasury yield falls below 2% for the first time ever

Published Thu, Aug 15 2019 2:38 AM EDTUpdated 18 min ago

Maggie Fitzgerald@mkmfitzgerald

Sam Meredith @smeredith19

Key Points

Around 9:15 a.m. ET, the yield on the benchmark 10-year Treasury note, which moves inversely to price, was at 1.589%, while the yield on the 30-year Treasury bond was at 2.031%, after earlier falling to 1.941% for the first time ever. The 2-year Treasury yield was 1.575%.

The historic drop in long-term U.S. bond yields comes shortly after interest rates on the closely watched 10-year and 2-year Treasurys inverted. The inversion of this key part of the yield curve has previously been a reliable indicator of economic recessions.

“The yield curve inverted which created a temporary ‘pile on’ effect in the bond markets,” wrote Tom Essaye of The Sevens Report. “We have absolutely not seen what we wanted to out of the Fed. We had hoped for a rally in the 10-year yield and a widening of the 10s-2s spread. The exact opposite has occurred, and at this point currency and bond markets are no longer flashing ‘caution’ signs on the U.S.-global economy and risk assets, they are flashing a ‘warning’ sign —loudly.”

That part of the curve was positively sloping again on Thursday but only slightly.

“The 30-year yield in itself is historic given that it is moving to massive lows but the curve inversion is typically the signal, one of the better signals you can get that there is increased risk of recession,” said Bank of America technical strategist Stephen Suttmeier.

U.S. Markets Overview: Treasurys chart

TICKER COMPANY YIELD CHANGE %CHANGE US 3-MOU.S. 3 Month Treasury1.918-0.0410.00US 1-YRU.S. 1 Year Treasury1.761-0.0240.00US 2-YRU.S. 2 Year Treasury1.548-0.0290.00US 5-YRU.S. 5 Year Treasury1.468-0.020.00US 10-YRU.S. 10 Year Treasury1.567-0.0140.00US 30-YRU.S. 30 Year Treasury2.012-0.0150.00

The stock market took a huge hit in the previous session, with the Dow plunging 800 points in its worst decline of the year and fourth-largest point drop ever to a two-month low. The sell-off exacerbated an extensive flight-to-safety into government securities.

However, markets rose on Friday after Hua Chunying, a spokesperson at China’s Ministry of Foreign Affairs, said China “hopes the U.S. will meet China halfway and implement the consensus reached by the two leaders during their meeting in Osaka.” This trade headline took pressure off bonds as the 10-year yield rose above the 2-year yield.

This is after China said Thursday it has to take necessary countermeasures to the latest U.S. tariffs on $300 billion of Chinese goods. The ministry also said the U.S. tariffs violate a consensus reached by leaders of two countries and get off the right track of resolving disputes via negotiation.

At times of market turbulence, investors tend to flee to assets expected to either retain or increase in value — such as gold, the Japanese yen and government bonds. These safe-haven assets are typically sought to limit one’s exposure to losses in the event of a sharp market downturn.

Following a yield curve inversion, its common that markets would top out before they start to enter a period of downturn months later. Suttmeier said the seasonality matches the cyclical data in this case.

“The seasonality and the inversion signals are aligned here. Meaning that, you get a dip after inversion into October, November and then a rally, we could be set up for a rally based on the inversion signals from November into January,” he said.

Recession fears

It comes at a time when market participants are worried about a protracted U.S.-China trade war, geopolitical tensions and uncertainty over Brexit. Economic data in China and Germany this week also suggested a faltering global economy.

However, strong economic data helped lift stocks. Retail sales rose solidly in July and beat expectations, which is a sign of consumer optimism. The U.S. productivity also grew a healthy 2.3% rate in the second quarter.

The number of Americans filing applications for unemployment benefits increased more than expected last week, but the trend continued to point to a strong labor market.

Initial claims for state unemployment benefits rose 9,000 to a seasonally adjusted 220,000 for the week ended Aug. 10, the Labor Department said on Thursday.

The U.S. Treasury is set to auction $55 billion in 4-week bills and $40 billion in 8-week bills on Thursday.

https://www.cnbc.com/quotes/?symbol=US10Y

U.S. 10 Year Treasury (US10Y:U.S.)

+ WATCHLIST

+ WATCHLIST

Real Time Quote | Exchange

Yield | 9:57:58 AM EDT 1.566 %

-0.015

1d

5d

1m

3m

6m

YTD

1y

5y

All

Comparison

1D 1 D 1 W 1 Mo

Display Chart Style Candle Bar Colored Bar Line Hollow Candle Mountain Baseline Volume Candle

Heikin Ashi

Kagi

Line Break

Renko

Range Bars

Point & Figure

Chart Preferences Extended Hours Timezone

Change Timezone

Studies

ADX/DMSATR BandsATR Trailing StopsAccumulation/DistributionAccumulative Swing IndexAlligatorAroonAroon OscillatorAverage True RangeAwesome OscillatorBalance of PowerBetaBollinger %bBollinger BandsBollinger BandwidthCenter Of GravityChaikin Money FlowChaikin VolatilityChande Forecast OscillatorChande Momentum OscillatorChoppiness IndexCommodity Channel IndexCoppock CurveCorrelation CoefficientDarvas BoxDetrended Price OscillatorDisparity IndexDonchian ChannelDonchian WidthEase of MovementEhler Fisher TransformElder Force IndexElder Impulse SystemElder Ray IndexFractal Chaos BandsFractal Chaos OscillatorGator OscillatorGopalakrishnan Range IndexHigh Low BandsHigh Minus LowHighest High ValueHistorical VolatilityIchimoku CloudsIntraday Momentum IndexKeltner ChannelKlinger Volume OscillatorLinear Reg ForecastLinear Reg InterceptLinear Reg R2Linear Reg SlopeLowest Low ValueMACDMarket Facilitation IndexMass IndexMedian PriceMomentum IndicatorMoney Flow IndexMoving AverageMoving Average DeviationMoving Average EnvelopeNegative Volume IndexOn Balance VolumeParabolic SARPerformance IndexPivot PointsPositive Volume IndexPretty Good OscillatorPrice Momentum OscillatorPrice OscillatorPrice Rate of ChangePrice RelativePrice Volume TrendPrime Number BandsPrime Number OscillatorPring's Know Sure ThingPring's Special KPsychological LineQStickRAVIRSIRainbow Moving AverageRainbow OscillatorRandom Walk IndexRelative Vigor IndexRelative VolatilitySTARC BandsSchaff Trend CycleShinohara Intensity RatioStandard DeviationStochastic Momentum IndexStochasticsSupertrendSwing IndexTRIXTime Series ForecastTrade Volume IndexTrend Intensity IndexTrue RangeTwiggs Money FlowTypical PriceUlcer IndexUltimate OscillatorVWAPValuation LinesVertical Horizontal FilterVolume ChartVolume OscillatorVolume ProfileVolume Rate of ChangeVolume UnderlayVortex IndicatorWeighted CloseWilliams %RZigZag

Crosshair Draw Expand

Date/Time: 11-06-2018 Close 3.214 Open3.201High3.224Low3.189Volume0

key stats

Yield High Today 1.59% Yield Low Today 1.51%

latest news

More ›

Get email alerts

U.S. Treasury yields fall sharply, 2-year/10-year yield curve inverts, triggering recession indicator

Published: Aug 14, 2019 3:24 p.m. ET

U.S. Treasury 10-year note yield briefly fell before the 2-year note yield

By

SunnyOh

U.S. Treasury yields fell sharply on Wednesday after a raft of weak economic data from China and Germany underlined a slowdown in global growth, offsetting hopes that U.S.-China trade talks were making progress.

The sharp rally in long-term government bonds briefly inverted a key measure of the yield curve’s slope for the first time since June 2007.

How are Treasurys doing?

The 10-year Treasury note yield TMUBMUSD10Y, -1.28% plunged 8.2 basis points to 1.596%, its lowest since September 2016.

The 2-year note rate TMUBMUSD02Y, -1.81% retreated 7.5 basis points to 1.592%, while the 30-year bond yield TMUBMUSD30Y, -0.42% tumbled 9.3 basis points to 2.038%, an all-time closing low.

The spread between the 2-year note and the 10-year note temporarily fell to a negative 1 basis point. An inversion of this measure has often preceded an economic downturn. Investors say its powers as a recession indicator comes from its ability to reflect when tight monetary policy is capping growth and inflationary pressures.

See: The U.S. Treasury 2-10 year yield curve inverted and that means stocks are on ‘borrowed time,’ says BAML

What’s driving Treasurys?

The slowdown in China’s economy was highlighted by a rise in industrial production at its slowest pace since Jan. 2002, increasing 4.8% in July from a year earlier versus a 6.3% increase in June. Germany’s economy shrank 0.1% in the second quarter of 2019 as the U.S - China trade war hit global manufacturing supply lines and the country’s export-dependent industries.

See: What Germany’s dismal GDP number really means for Europe and interest rates

The raft of anemic data and the inversion of the U.S. yield curve weighed on investor sentiment, stirring demand for safe haven assets like Treasurys.

U.S. stocks saw a sharp selloff on Wednesday, with the S&P 500 SPX, +0.34% and the Dow Jones Industrial Average DJIA, +0.27% on track to end lower by more than 2%.

The surge of economic pessimism comes only a day after the U.S. Trade Representative announced it would winnow down the list of goods that are set to incur a 10% tariff on additional $300 billion of Chinese imports, measures which were publicized earlier in August 1.

Read: Fed not on red-alert after yield-curve inversion

What did market participants’ say?

“When I look at the data from today, there’s nothing that justifies the [flight to safety] we are having. Perhaps it’s the cumulative effect of a lot of issues the market has been grappling with. We keep piling on more issues. There’s only so much markets can bear,” said Gautam Khanna, senior portfolio manager at Insight Investment.

“At the moment, investors think bonds are the safest way to protect their portfolio. And some think there’s another shoe to drop and a bigger correction in equities must be waiting around the corner,” Robert Robis, chief fixed income strategist at BCA Research, told MarketWatch.

What else is on investors’ radar?

In the U.K., the spread between the 2-year yield TMBMKGB-02Y, +3.00% and the 10-year yield TMBMKGB-10Y, -3.04% for British government debt, or gilts, also inverted alongside the U.S. Treasurys market.

Sunny Oh

Sunny Oh is a MarketWatch fixed-income reporter based in New York.

https://www.cnbc.com/2019/08/15/bond-yields-are-tumbling-throughout-asia-pacific.html

Bond yields are tumbling throughout Asia Pacific

Published Wed, Aug 14 2019 11:39 PM EDTUpdated Thu, Aug 15 2019 2:57 AM EDT

Weizhen Tan@weizent

Key Points

- In Japan, Australia, South Korea, Hong Kong and Singapore, yields on 10-year government bonds have been dropping sharply.

- Recession fears have sent investors pouring into the assets.

- But investors are staying away from riskier markets — the high-yielding Asia bond markets such as India and Indonesia.

- The yield on the benchmark 10-year Treasury note broke below the 2-year rate early Wednesday.

Pedestrians are reflected on a window of a securities company in Tokyo on Aug. 30, 2017.

Toshifumi Kitamura | AFP | Getty Images

Yields for 10-year government bonds in major Asian markets have been dropping sharply as recession fears send investors pouring into the assets.

Bond prices move opposite yields, and as investors rush to buy them, prices surge and yields fall in tandem.

Here’s a look at how each market’s 10-year government bond yield has fallen by Thursday morning, versus a week ago and the beginning of the month.

In Japan, the 10-year yield dropped below the Bank of Japan’s preferred range for the first time last week — falling past -0.2%. Previously, the central bank has fixed the yield on the 10-year bond at around zero, which it pegged at a range of between 0.2% and -0.2%.

Recession fears have roiled markets. The yield on the benchmark 10-year Treasury note broke below the 2-year rate early Wednesday. That so-called yield curve is a bond market phenomenon that’s been a reliable, albeit early, indicator for economic recessions.

The yield on the U.S. 30-year bond also fell to a new low.

While lower-yielding markets, such as Hong Kong, South Korea and Singapore, and mid-yielding markets such as Malaysia and China, have seen rates drifting lower, one analyst told CNBC that investors are staying away from riskier markets — the high-yielding Asia bond markets such as India and Indonesia.

That’s causing the yields of those bonds to go up, said Julio Callegari, a fixed income portfolio manager at J.P. Morgan Asset Management.

“The main reason is that these bond markets are more sensitive to risk aversion — that usually causes depreciation in their currencies and pressure on the yield curve,” he said in an email. “Overall we expect this trend to continue for a while, since broadly speaking economic growth is still slowing in the region and central banks are likely to keep easing monetary policy.”

In the U.S., investors have also been rushing into bonds. The iShares 20+ Year Treasury Bond ETF, TLT jumped 2.1% on Monday, its biggest gain in a year.

Commenting on the recent main yield curve inversion in the U.S., former Federal Reserve Chair Janet Yellen said Wednesday that “it may be a less good signal ” this time around.

“The reason for that is there are a number of factors other than market expectations about the future path of interest rates that are pushing down long-term yields,” Yellen said on Fox Business Network.

— CNBC’s Eustance Huang, Thomas Franck and Patti Domm contributed to this report.

https://www.cnbc.com/2019/08/15/us-...falls-below-2percent-for-first-time-ever.html

30-year Treasury yield falls below 2% for the first time ever

Published Thu, Aug 15 2019 2:38 AM EDTUpdated 18 min ago

Maggie Fitzgerald@mkmfitzgerald

Sam Meredith @smeredith19

Key Points

- Around 9:15 a.m. ET, the yield on the benchmark 10-year Treasury note, which moves inversely to price, was at 1.589%, while the yield on the 30-year Treasury bond was at 2.031%, after earlier falling to 1.941% for the first time ever. The 2-year Treasury yield was 1.575%.

- The historic drop in long-term U.S. bond yields comes shortly after interest rates on the closely watched 10-year and 2-year Treasurys inverted.

- At times of market turbulence, investors tend to flee to assets expected to either retain or increase in value — such as gold, the Japanese yen and government bonds.

Around 9:15 a.m. ET, the yield on the benchmark 10-year Treasury note, which moves inversely to price, was at 1.589%, while the yield on the 30-year Treasury bond was at 2.031%, after earlier falling to 1.941% for the first time ever. The 2-year Treasury yield was 1.575%.

The historic drop in long-term U.S. bond yields comes shortly after interest rates on the closely watched 10-year and 2-year Treasurys inverted. The inversion of this key part of the yield curve has previously been a reliable indicator of economic recessions.

“The yield curve inverted which created a temporary ‘pile on’ effect in the bond markets,” wrote Tom Essaye of The Sevens Report. “We have absolutely not seen what we wanted to out of the Fed. We had hoped for a rally in the 10-year yield and a widening of the 10s-2s spread. The exact opposite has occurred, and at this point currency and bond markets are no longer flashing ‘caution’ signs on the U.S.-global economy and risk assets, they are flashing a ‘warning’ sign —loudly.”

That part of the curve was positively sloping again on Thursday but only slightly.

“The 30-year yield in itself is historic given that it is moving to massive lows but the curve inversion is typically the signal, one of the better signals you can get that there is increased risk of recession,” said Bank of America technical strategist Stephen Suttmeier.

U.S. Markets Overview: Treasurys chart

TICKER COMPANY YIELD CHANGE %CHANGE US 3-MOU.S. 3 Month Treasury1.918-0.0410.00US 1-YRU.S. 1 Year Treasury1.761-0.0240.00US 2-YRU.S. 2 Year Treasury1.548-0.0290.00US 5-YRU.S. 5 Year Treasury1.468-0.020.00US 10-YRU.S. 10 Year Treasury1.567-0.0140.00US 30-YRU.S. 30 Year Treasury2.012-0.0150.00

The stock market took a huge hit in the previous session, with the Dow plunging 800 points in its worst decline of the year and fourth-largest point drop ever to a two-month low. The sell-off exacerbated an extensive flight-to-safety into government securities.

However, markets rose on Friday after Hua Chunying, a spokesperson at China’s Ministry of Foreign Affairs, said China “hopes the U.S. will meet China halfway and implement the consensus reached by the two leaders during their meeting in Osaka.” This trade headline took pressure off bonds as the 10-year yield rose above the 2-year yield.

This is after China said Thursday it has to take necessary countermeasures to the latest U.S. tariffs on $300 billion of Chinese goods. The ministry also said the U.S. tariffs violate a consensus reached by leaders of two countries and get off the right track of resolving disputes via negotiation.

At times of market turbulence, investors tend to flee to assets expected to either retain or increase in value — such as gold, the Japanese yen and government bonds. These safe-haven assets are typically sought to limit one’s exposure to losses in the event of a sharp market downturn.

Following a yield curve inversion, its common that markets would top out before they start to enter a period of downturn months later. Suttmeier said the seasonality matches the cyclical data in this case.

“The seasonality and the inversion signals are aligned here. Meaning that, you get a dip after inversion into October, November and then a rally, we could be set up for a rally based on the inversion signals from November into January,” he said.

Recession fears

It comes at a time when market participants are worried about a protracted U.S.-China trade war, geopolitical tensions and uncertainty over Brexit. Economic data in China and Germany this week also suggested a faltering global economy.

However, strong economic data helped lift stocks. Retail sales rose solidly in July and beat expectations, which is a sign of consumer optimism. The U.S. productivity also grew a healthy 2.3% rate in the second quarter.

The number of Americans filing applications for unemployment benefits increased more than expected last week, but the trend continued to point to a strong labor market.

Initial claims for state unemployment benefits rose 9,000 to a seasonally adjusted 220,000 for the week ended Aug. 10, the Labor Department said on Thursday.

The U.S. Treasury is set to auction $55 billion in 4-week bills and $40 billion in 8-week bills on Thursday.

https://www.cnbc.com/quotes/?symbol=US10Y

U.S. 10 Year Treasury (US10Y:U.S.)

+ WATCHLIST

+ WATCHLIST Real Time Quote | Exchange

Yield | 9:57:58 AM EDT 1.566 %

-0.015

1d

5d

1m

3m

6m

YTD

1y

5y

All

Comparison

1D 1 D 1 W 1 Mo

Display Chart Style Candle Bar Colored Bar Line Hollow Candle Mountain Baseline Volume Candle

Heikin Ashi

Kagi

Line Break

Renko

Range Bars

Point & Figure

Chart Preferences Extended Hours Timezone

Change Timezone

Studies

ADX/DMSATR BandsATR Trailing StopsAccumulation/DistributionAccumulative Swing IndexAlligatorAroonAroon OscillatorAverage True RangeAwesome OscillatorBalance of PowerBetaBollinger %bBollinger BandsBollinger BandwidthCenter Of GravityChaikin Money FlowChaikin VolatilityChande Forecast OscillatorChande Momentum OscillatorChoppiness IndexCommodity Channel IndexCoppock CurveCorrelation CoefficientDarvas BoxDetrended Price OscillatorDisparity IndexDonchian ChannelDonchian WidthEase of MovementEhler Fisher TransformElder Force IndexElder Impulse SystemElder Ray IndexFractal Chaos BandsFractal Chaos OscillatorGator OscillatorGopalakrishnan Range IndexHigh Low BandsHigh Minus LowHighest High ValueHistorical VolatilityIchimoku CloudsIntraday Momentum IndexKeltner ChannelKlinger Volume OscillatorLinear Reg ForecastLinear Reg InterceptLinear Reg R2Linear Reg SlopeLowest Low ValueMACDMarket Facilitation IndexMass IndexMedian PriceMomentum IndicatorMoney Flow IndexMoving AverageMoving Average DeviationMoving Average EnvelopeNegative Volume IndexOn Balance VolumeParabolic SARPerformance IndexPivot PointsPositive Volume IndexPretty Good OscillatorPrice Momentum OscillatorPrice OscillatorPrice Rate of ChangePrice RelativePrice Volume TrendPrime Number BandsPrime Number OscillatorPring's Know Sure ThingPring's Special KPsychological LineQStickRAVIRSIRainbow Moving AverageRainbow OscillatorRandom Walk IndexRelative Vigor IndexRelative VolatilitySTARC BandsSchaff Trend CycleShinohara Intensity RatioStandard DeviationStochastic Momentum IndexStochasticsSupertrendSwing IndexTRIXTime Series ForecastTrade Volume IndexTrend Intensity IndexTrue RangeTwiggs Money FlowTypical PriceUlcer IndexUltimate OscillatorVWAPValuation LinesVertical Horizontal FilterVolume ChartVolume OscillatorVolume ProfileVolume Rate of ChangeVolume UnderlayVortex IndicatorWeighted CloseWilliams %RZigZag

Crosshair Draw Expand

Date/Time: 11-06-2018 Close 3.214 Open3.201High3.224Low3.189Volume0

key stats

Yield High Today 1.59% Yield Low Today 1.51%

latest news

- Investors should be more worried when the yield curve steepens again 39 mins ago - CNBC.com

- Bond market's recession signal reflects US-China trade war damage, Asia expert Stephen Roach says 1 hrs ago - CNBC.com

- Bond markets are reflecting 'strange times,' not an economic reality: strategist 4 hrs ago - CNBC.com

- Dollar recovers vs the yen as US data soothes market nerves 5 hrs ago - Reuters

- Trump is the market agitator and he won't want to stir the pot right now, investor says 5 hrs ago - CNBC.com

More ›