6 years . ... I suspect if OCBC didn't start to make a sale to the Thai tycoon for UE, this scheme will last forever .

-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chitchat Ex VP cheats UE of millions for 6 years

- Thread starter Wunderfool

- Start date

6 years . ... I suspect if OCBC didn't start to make a sale to the Thai tycoon for UE, this scheme will last forever .

Ah Wonderful, as usual ... no head no tail. Typical. *sigh*

When the deal was announced that UE were to be sold to the Thai Tycoon, OCBC ordered an audit of the past accounts. The external auditors went in to do the check and as they dig deeper, they found a number of discrepancies.

That when the whistle was blown .

The deal has to be called off.

That when the whistle was blown .

The deal has to be called off.

Last edited:

Former asset management vice-president for UE ServiceCorp Singapore, Linda Lee, made personal gains totalling more than $5 million.ST PHOTO: WONG KWAI CHOW

Former vice-president jailed 14 years

for cheating offences involving more than $10 million

SINGAPORE - The former asset management vice-president for UE ServiceCorp Singapore, Linda Lee, was jailed for 14 years on Friday (Sept 8) over cheating offences involving more than $10 million.

The facilities management company is a subsidiary of United Engineers (UEL). Lee was terminated from her job in June 2015.

Lee, now 39, made personal gains totalling more than $5 million. She used some of the proceeds of her criminal activities to buy items such as multiple properties, luxury goods and a car.

On Friday, the court heard that only about $2.1 million could potentially be recovered.

Part of this amount is the $900,000 which was recovered by the Corrupt Practices Investigation Bureau's seizure and recovery efforts.

Deputy Public Prosecutor Jasmin Kaur told District Judge Tan Jen Tse that the amount which could potentially be recovered from the local properties Lee bought is about $1.2 million.

She added that the lawyers from Lee's former company are still in negotiations with banks and developers on the final amount.

Before handing out the sentence, Judge Tan said that

Lee should receive a "severe sentence", as her offences were serious and the amount involved was large.

On Aug 31, Lee pleaded guilty to 28 cheating charges and seven counts of converting the proceeds of her criminal activities by buying the big-ticket items.

Another 325 charges for similar offences were taken into consideration during sentencing.

Lee committed the offences between 2010 and 2015. According to court documents, she worked with four accomplices, whose cases are still pending.

Among her offences, Lee set up LT Engineering Consultancy in 2011 under the name of her unsuspecting father, Mr Lee Foo Wah.

She explained to him that the firm would be doing general works, when, in fact, her sole purpose for creating it was to siphon money from UEL.

Lee caused UEL to make payments to LT Engineering 25 times. The total amount paid was more than $1.7 million.

She also used false quotations to get UEL to pay for her own home renovations.

Lee, who had engaged the firm Pure Concept to work on her flat, created fictitious jobs in UEL's system, stating that work needed to be done at UE Square, which was developed by UEL.

By doing so, she caused UEL to make payment to Pure Concept on a total of 63 occasions, and the total amount it gave the renovation company was $220,000.

She also created fictitious jobs and submitted false quotations which were rigged for the jobs to be awarded to a construction firm known as Ying Xin Services.

After payment was made to Ying Xin Services, Tan Aik Gee, a manager with the firm and one of Lee's alleged accomplices, would keep half for himself and give the remainder to Lee.

She also used a similar method for jobs to be awarded to companies set up by another accomplice.

Offenders convicted of cheating can be jailed for up to 10 years and fined for each charge.

.

Linda Lee pleaded guilty to cheating offences involving more than $10 million dollars, on Aug 31, 2017.ST PHOTO: WONG KWAI CHOW

Ex-VP jailed 14 years for part in cheating her company of $10 million

She was a high-flying executive who abused her position to cheat her company of $10 million over six years with four other persons.

Of the amount, Linda Lee, a 39-year-old Singaporean, took almost $5 million and splurged on private homes in Singapore and Batam, home renovations, valuables like watches and handbags, two insurance policies and a car.

Lee was sentenced to 14 years’ jail in the State Courts on Friday (8 September) after she pleaded guilty to 35 cheating charges last week. A total of 326 other similar charges were taken into consideration during sentencing.

According to court documents, Lee joined UE ServiceCorp Singapore, a subsidiary of public-listed United Engineers Limited (UEL) as an assistant manager in 2009. Over the next five years, she was promoted several times and eventually became Vice President (Asset Management) in 2014.

Some time in 2009, Lee was approached by a co-accused, Tan Aik Gee, a manager at Ying Xin Services, a general contractor that had previously provided its services to UEL. Lee and Tan came up with a scheme to cheat UEL.

Tan would provide Lee with letterheads of various contractors. Using the letterheads, Lee would prepare false quotations to submit for fake job requests in a system.

The job requests would be done for properties that had sufficient or extra allocated funds. Due to her position, she was the requester, the first approving officer and the person responsible for ensuring that a job was completed.

As Lee rose in position, she was given more responsibilities at the company and as such, the scale of the cheating got bigger.

Tan then roped in Wong Weng Kong in 2011, with Wong providing the letterhead for TW Construction Engineering. Wong also set up five other companies with his wife and daughter’s names in 2013 and 2014 so that Lee can award jobs to those companies too.

Lee also used her father’s name to set up LT Engineering Consultancy to siphon money from UEL in 2011. This, however, was done without the knowledge of her father and the other co-accused persons.

Two other accused persons, Ng Shun Jun and Tan Kiam Boon, were brought into the conspiracy to help Lee in creating false quotations in 2013 and 2015, respectively. Lee bought a dot-matrix printer for the purpose of creating fake invoices, and also made fake company stamps based on the letterheads in her possession.

The orders for the fake jobs ranged from $292,000 to $498,000. Wong would take 10 per cent of each job that involved his companies, while the rest would be equally split between Lee and Tan Aik Gee.

Lee also made UEL pay a total of $220,000 for her home renovation by creating fake jobs to be done at UE Square, which is owned by UEL. To ensure that renovation company Pure Concept could be given the jobs, she created a false quotation and two supporting fake quotations. After UEL issued a cheque for each job, Lee would collect the payment and hand it to Pure Concept.

To date, only $910,224.36 of the $10.1 million amount siphoned from UEL has been recovered, mostly from the sale of Lee’s luxury goods at a loss. The company is trying to recover a further $1.2 million from her.

According to a mitigation document previously submitted by Lee’s lawyers, Lee came from a humble family and had cooperated with the Corrupt Practices Investigation Bureau (CPIB). In addition, Lee went to UEL’s internal auditors to admit to her misdeeds before she was called up by CPIB.

Lee also suffers from a mental disorder, which had caused her to indulge in compulsive purchases of luxury goods. Lee’s lawyers also claimed that UEL could have had a “higher standard of check and balance”.

Deputy Public Prosecutor Jasmin Kaur had pushed for a jail term of 14 years, given the astronomical sum involved in the cheating scheme.

By the time she comes out, she will be 53 years.

The authorities has so far recovered only $2.1m from her. There is still around $3m at large. When she comes out, she is still a multi-millionaire. May still worth it to sit and wait for the next 14 years.

The authorities has so far recovered only $2.1m from her. There is still around $3m at large. When she comes out, she is still a multi-millionaire. May still worth it to sit and wait for the next 14 years.

By the time she comes out, she will be 53 years.

The authorities has so far recovered only $2.1m from her. There is still around $3m at large. When she comes out, she is still a multi-millionaire. May still worth it to sit and wait for the next 14 years.

more than S$10 million involved :*::*::*:

S$20 M ??? :*::*::*:

By the time she comes out, she will be 53 years.

The authorities has so far recovered only $2.1m from her. There is still around $3m at large. When she comes out, she is still a multi-millionaire. May still worth it to sit and wait for the next 14 years.

only 48 y.o. to be exact :(

14 years with 1/3 discount = 9 years only :(

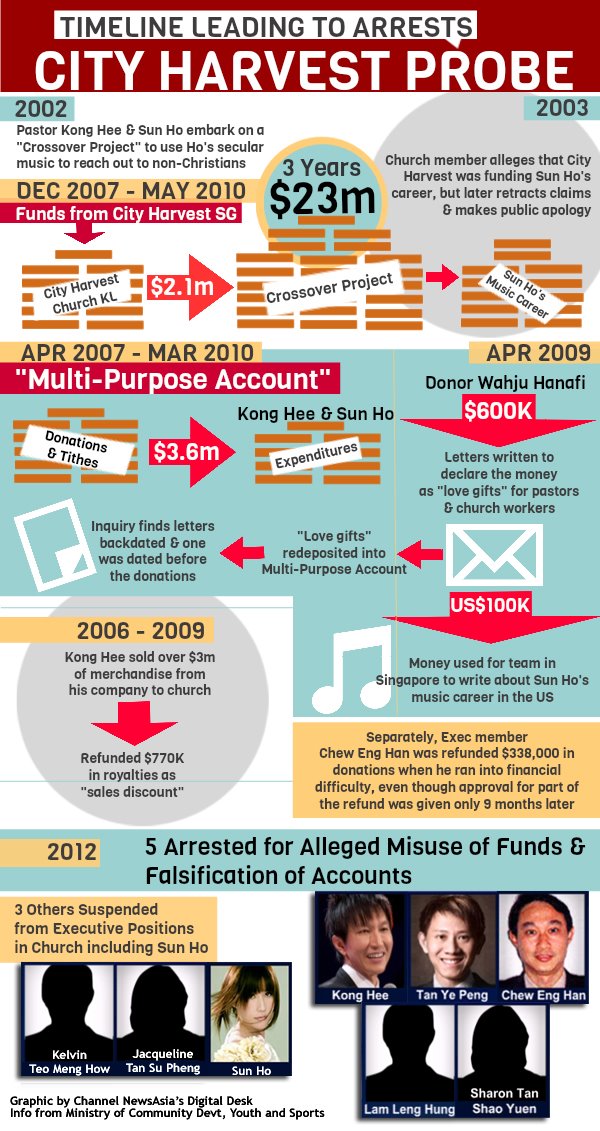

Now the $50 millions question is how come she got 14 years jail term and Hong Kee only got 3.5 years.

6 years . ... I suspect if OCBC didn't start to make a sale to the Thai tycoon for UE, this scheme will last forever .

Are u retarded ? Start a thread with no head no tail and expect people to fill in the info for u. Fuck u Cheebye!

Are u retarded ? Start a thread with no head no tail and expect people to fill in the info for u. Fuck u Cheebye!

Don't you ever read the news ?

Now the $50 millions question is how come she got 14 years jail term and Hong Kee only got 3.5 years.

Pastor Kong Hee ( not Hong Kee )...

Pastor Kong Hee ( not Hong Kee )...

Pastor Kong Hee Fatt Choy & China sWINE..

Now the $50 millions question is how come she got 14 years jail term and Hong Kee only got 3.5 years.

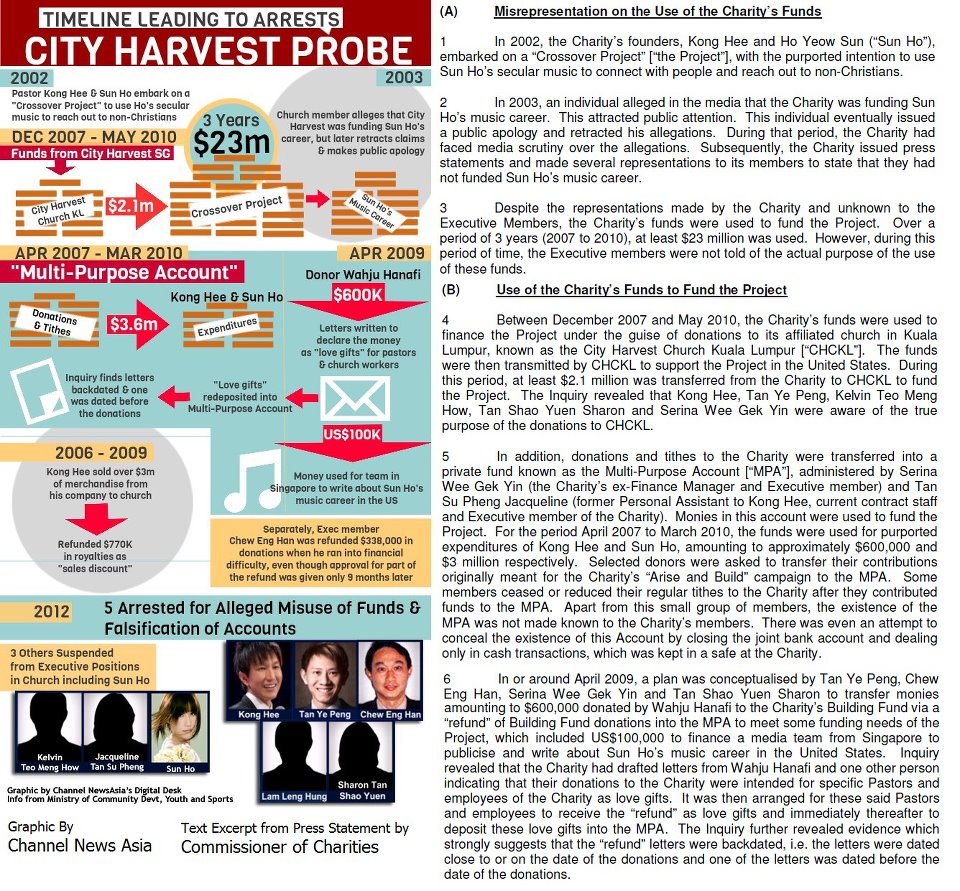

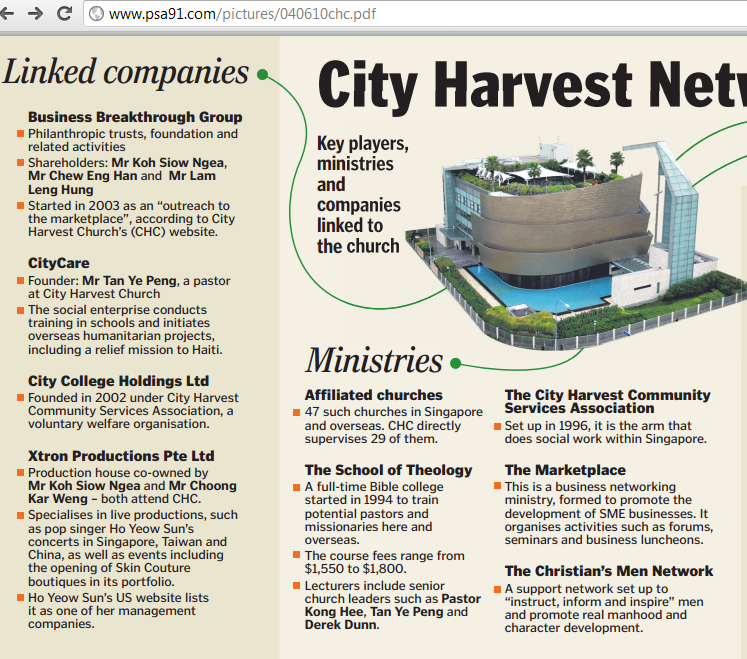

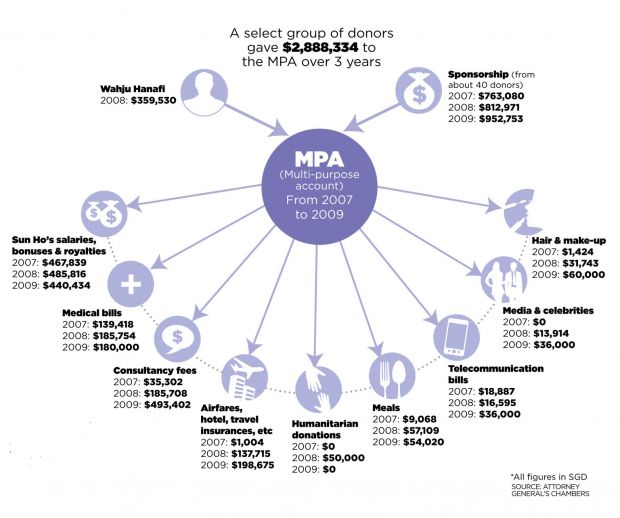

What Pastor Kong Hee and Team did is called "Round Tripping "

VS

What Linda Lee did - " Single Trip " to Father's bank accounts :o:o:o:o

.

Pastor Kong Hee Fatt Choy & China sWINE..

The Moral of The Story ???

Linda Lee should have done "Kong Hee Fatt Choy 's Round Tripping " :*::*::*:

Round tripping or single tripping . In the eyes of the law, it should be the same. The higher the amount , the higher the penalty. Let's say hypothetically speaking instead of $24M and $26M round tripping, the amount is double or triple ($100M or $200M ) , would the penalty be the same 3.5 years ? How does this correlate to single tripping ?

My maths is not very good, but I can understand simple arithmetics

$50M = 3.5 years jail

$1M = 3.5 years x 365 days divided by 50M

= 25.6 days

Therefore $10m = 246 days or 0.7 years

My maths is not very good, but I can understand simple arithmetics

$50M = 3.5 years jail

$1M = 3.5 years x 365 days divided by 50M

= 25.6 days

Therefore $10m = 246 days or 0.7 years

Round tripping or single tripping . In the eyes of the law, it should be the same. The higher the amount , the higher the penalty. Let's say hypothetically speaking instead of $24M and $26M round tripping, the amount is double or triple ($100M or $200M ) , would the penalty be the same 3.5 years ? How does this correlate to single tripping ?

My maths is not very good, but I can understand simple arithmetics

$50M = 3.5 years jail

$1M = 3.5 years x 365 days divided by 50M

= 25.6 days

Therefore $10m = 246 days or 0.7 years

lets wait for the results of the latest AGC appeal ...

Kong and Team was very lucky ( all they have it figure out)

the Round Tripping thing a Sure Winner.

even the DPP said they were lucky Church Funds S$50M suffer no lossess.

.

http://www.todayonline.com/city-harvest-court-case-be-heard-five-judge-panel-aug-1

SINGAPORE — The six former City Harvest Church (CHC) leaders will appear before the highest court of the land on Aug 1, for the hearing on the criminal reference prosecutors filed to clarify the law under which the church leaders were convicted.

The case will be heard in the Court of Appeal before a panel of five judges - Judges of Appeal Andrew Phang and Judith Prakash, and Justices Belinda Ang, Quentin Loh and Chua Lee Ming - a Supreme Court spokesperson said in response to queries from TODAY.

A criminal reference is a type of legal hearing before the apex court, which is limited to criminal cases in which a question of law of public interest arises in a High Court decision on an appeal. Such cases are held in open court and the decision of the Court of Appeal on the matter is final.

On April 7, a High Court decision had significantly cut the leaders’ jail terms for criminal breach of trust. Their sentences now range from seven months to three years and six months’ jail.

Back to the original thread, this Linda Lee started out as only an assistant manager , but within 5 years, she rose to the rank of Vice-President of Asset Management in UEL. That's a very important title. Isn't that rise phenomenal ? And she is only in her thirties.

Is there more that meets the eyes ?

Is there more that meets the eyes ?

By the time she comes out, she will be 53 years.

The authorities has so far recovered only $2.1m from her. There is still around $3m at large. When she comes out, she is still a multi-millionaire. May still worth it to sit and wait for the next 14 years.

14 years dun mean sit 14 years la.

9 years or so she'll be out. If money invested wisely she come out even richer

The scheme has both inside and outside protection . I am not surprised if it is not uncovered for the last 5 years.

All you need to look is at the infamous brewery bribery case. .

All you need to look is at the infamous brewery bribery case. .

Similar threads

- Replies

- 12

- Views

- 549

- Replies

- 4

- Views

- 416

- Replies

- 3

- Views

- 409

- Replies

- 0

- Views

- 554