http://www.bloomberg.com/news/artic...to-ready-larger-bank-notes-as-inflation-soars

Venezuela Is Adding More Zeroes to Its Currency to Deal With Hyperinflation

Noris Soto and Nathan Crooks

August 26, 2015 — 12:17 PM EDT

Updated on August 26, 2015 — 1:44 PM EDT

Share on FacebookShare on Twitter

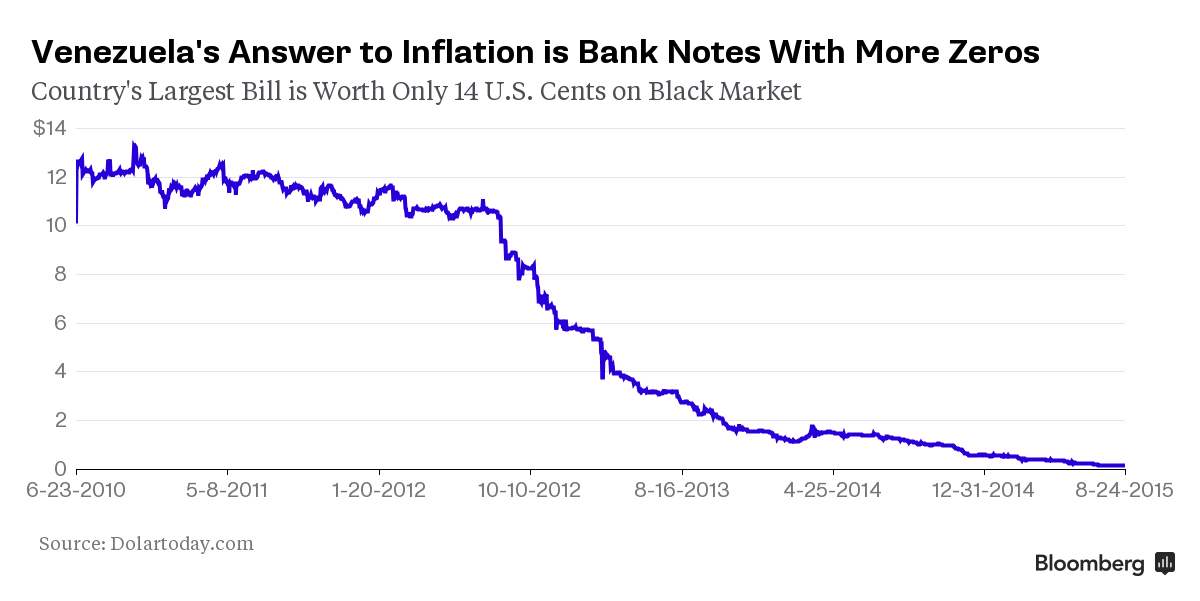

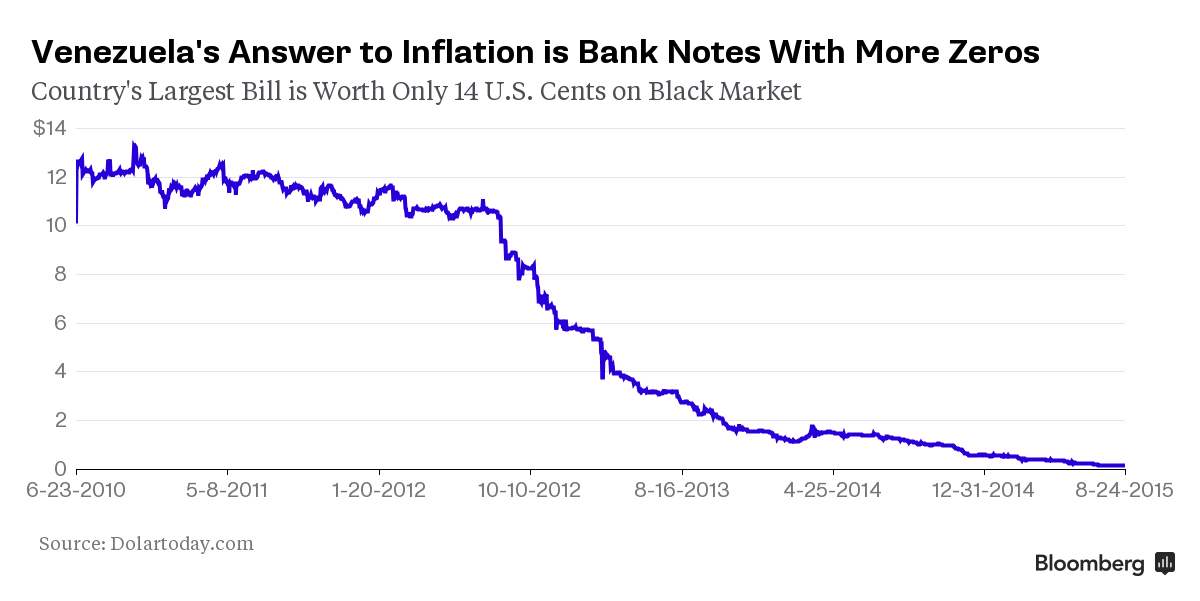

CHART: Venezuela's Declining Currency

Share on Facebook

Share on Twitter

Share on LinkedIn

Share on Reddit

Share on Google+

E-mail

Venezuela is preparing to issue bank notes in higher denominations next year as rampant inflation reduces the value of a 100-bolivar bill to just 14 cents on the black market.

The new notes -- of 500 and possibly 1,000 bolivars -- are expected to be released sometime after congressional elections are held on Dec. 6, said a senior government official who isn’t authorized to talk about the plans publicly.

Many Venezuelans have to carry wads of cash in bags instead of wallets as soaring inflation and a declining currency increase the number of bills needed for everyday purchases. The situation is set to get worse. Inflation, already the fastest in the world, could end the year at 150 percent, said the official.

The government stopped releasing regular economic statistics in December, when it reported inflation had reached 69 percent.

A customer would need at least 1,280 bank notes to purchase a 24-inch Samsung television on sale at a mall in eastern Caracas for 128,000 bolivars. Some banks, meanwhile, have reduced daily withdrawal limits at ATMs because of shortages of the highest denominated notes.

Exchange Rates

The country is not planning to change it’s three-tiered exchange rate system in the short term, said the official, adding that the government is working on plans to increase dollar revenue by developing mining and petrochemical projects and reduce its dependence on oil.

One dollar is currently worth 725 bolivars on the black market, which Venezuelans use when they can’t get government approval to purchase foreign currency at the three official exchange rates of 6.3, 12.8 and 200.

Venezuela’s monthly minimum wage of 7,422 bolivars equates to about $37 at the weakest legal exchange rate and is only $10 at the black market rate.

A unified exchange rate would not be possible until the economy becomes more diversified and domestic production rises, said the official.

Press officials at the central bank and finance ministry declined to comment when contacted by telephone Wednesday.

Market Manipulation

The black market rate is being manipulated by traders in Cucuta, Colombia and the Miami-based website dolartoday.com, the official added. While the rate has become a reference for some minor sectors of the economy, it’s a small market and not representative of the overall economy, the official said.

Venezuela maintains its willingness to pay foreign debt and is buying back bonds when it can, said the official, adding that the government could consider selling or swapping gold reserves if it needed to. Gold currently held in Caracas could easily be transported abroad if the need arose, the official said.

The country’s foreign reserves fell to a 12-year low of $15.4 billion on July 27 and have since rebounded to about $16.5 billion, according to data compiled by Bloomberg.

New loans from China will slowly be reflected in the country’s reserves, the official said.

Venezuela Is Adding More Zeroes to Its Currency to Deal With Hyperinflation

Noris Soto and Nathan Crooks

August 26, 2015 — 12:17 PM EDT

Updated on August 26, 2015 — 1:44 PM EDT

Share on FacebookShare on Twitter

CHART: Venezuela's Declining Currency

Share on Facebook

Share on Twitter

Share on LinkedIn

Share on Reddit

Share on Google+

Venezuela is preparing to issue bank notes in higher denominations next year as rampant inflation reduces the value of a 100-bolivar bill to just 14 cents on the black market.

The new notes -- of 500 and possibly 1,000 bolivars -- are expected to be released sometime after congressional elections are held on Dec. 6, said a senior government official who isn’t authorized to talk about the plans publicly.

Many Venezuelans have to carry wads of cash in bags instead of wallets as soaring inflation and a declining currency increase the number of bills needed for everyday purchases. The situation is set to get worse. Inflation, already the fastest in the world, could end the year at 150 percent, said the official.

The government stopped releasing regular economic statistics in December, when it reported inflation had reached 69 percent.

A customer would need at least 1,280 bank notes to purchase a 24-inch Samsung television on sale at a mall in eastern Caracas for 128,000 bolivars. Some banks, meanwhile, have reduced daily withdrawal limits at ATMs because of shortages of the highest denominated notes.

Exchange Rates

The country is not planning to change it’s three-tiered exchange rate system in the short term, said the official, adding that the government is working on plans to increase dollar revenue by developing mining and petrochemical projects and reduce its dependence on oil.

One dollar is currently worth 725 bolivars on the black market, which Venezuelans use when they can’t get government approval to purchase foreign currency at the three official exchange rates of 6.3, 12.8 and 200.

Venezuela’s monthly minimum wage of 7,422 bolivars equates to about $37 at the weakest legal exchange rate and is only $10 at the black market rate.

A unified exchange rate would not be possible until the economy becomes more diversified and domestic production rises, said the official.

Press officials at the central bank and finance ministry declined to comment when contacted by telephone Wednesday.

Market Manipulation

The black market rate is being manipulated by traders in Cucuta, Colombia and the Miami-based website dolartoday.com, the official added. While the rate has become a reference for some minor sectors of the economy, it’s a small market and not representative of the overall economy, the official said.

Venezuela maintains its willingness to pay foreign debt and is buying back bonds when it can, said the official, adding that the government could consider selling or swapping gold reserves if it needed to. Gold currently held in Caracas could easily be transported abroad if the need arose, the official said.

The country’s foreign reserves fell to a 12-year low of $15.4 billion on July 27 and have since rebounded to about $16.5 billion, according to data compiled by Bloomberg.

New loans from China will slowly be reflected in the country’s reserves, the official said.