GST rate linked property taxes for a progressive nation state.

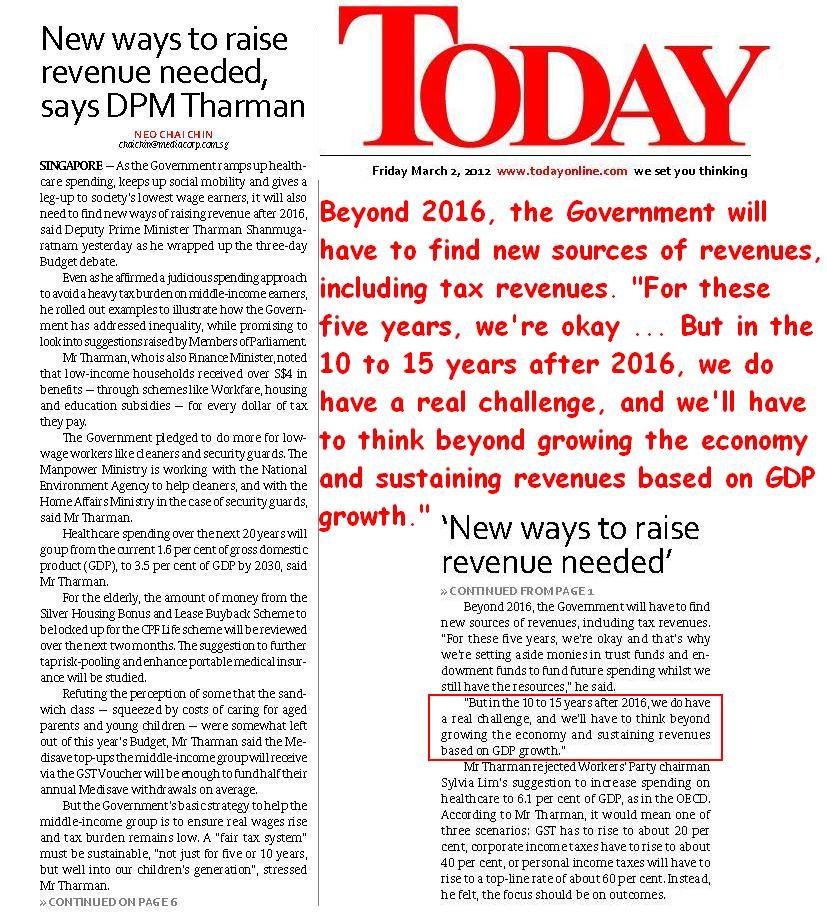

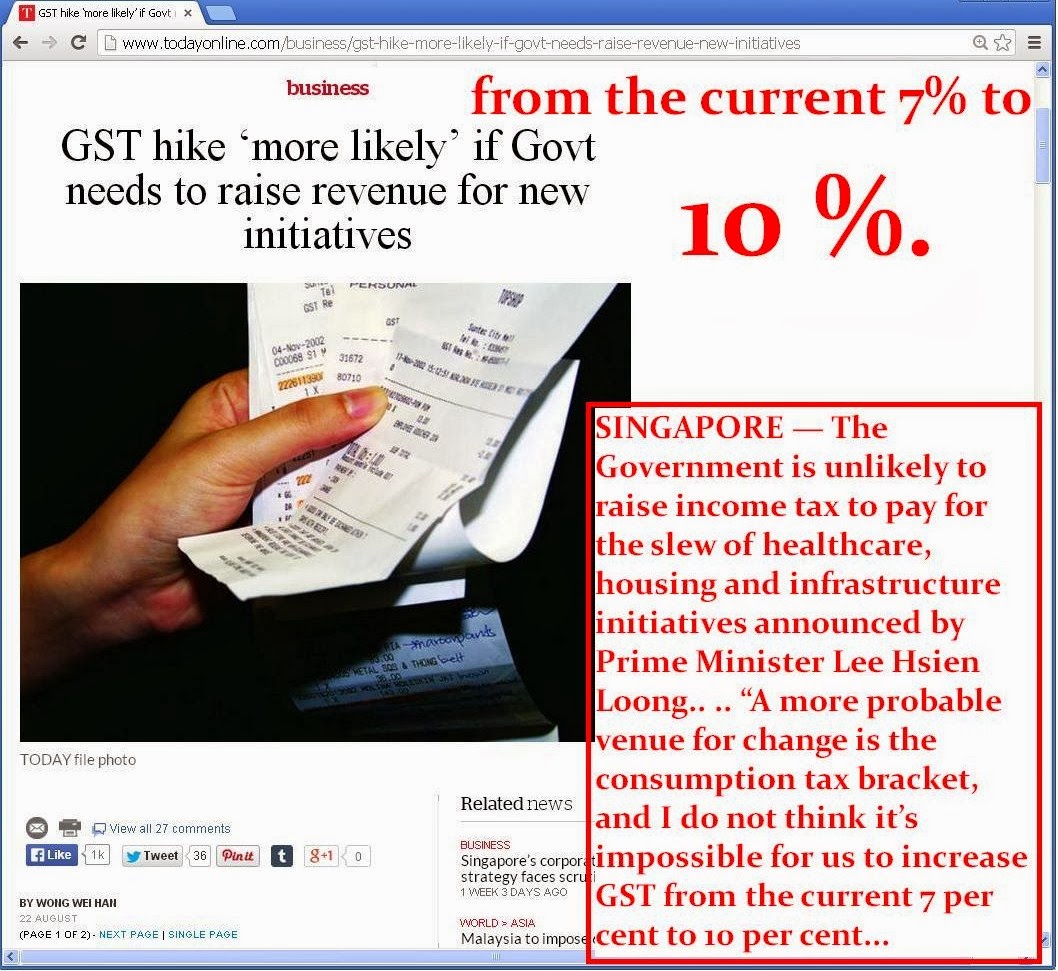

Increasing residential property tax across the board to MATCH GST will certainly go a long way to curb property price speculation.Pls charge property tax at EQUAL to the GST level but with rebates for Singaporeans. The Annual Value (AV) rebate should be S$6000 per annum per citizen (half for PRs)(based upon the median mkt price annual rental for single HDB room), so if U have a house with 10 Singaporeans staying and AV is $100K, the AV rebate would be S$60K, the consequent taxable amount will be S$40K, at 7% AV tax, the tax payable will be S$2.8K; (at 10%GST, it will be S$4K, p.a.(BOTH affordable even compared with current 2014 "discounted" rates)).

Of course, if the same house were solely tenanted by a foreigner family, then the AV property tax payable would be S$7K (@7%GST equivalent), S$10K (@10% GST equivalent)(foreigners are not entitled to property tax waivers unless they become citizens/ PRs).

Much more fair this way because some bigger families stay in big house NOT because they are rich, but because they have close knit families and enjoy the kampong spirit: they are equally important to Singapore, and thus shouldn't be taxed more just by virtue of their good family relationships.

Pls note that every Singaporean male does NS for pittance allowance, the $6K/ citizen (tenant/ otherwise) AV rebate should thus apply ACROSS THE BOARD to recognize every Singaporean as belonging to Singapore...

The SAF budget was SGD 12.08 billion (1 in every 4 dollars spent by government) (FY2011): property owners who are non Singaporean/ Singaporeans who live in excessively large properties should thus pay what is in excess of their entitlement of defence cost of Singapore.

Based on very nebulous IRAS Website: http://www.iras.gov.sg/irasHome/page04.aspx?id=2094

Example: AV of your house is $100,000 (Owner occupied), Property Tax payable (2014) is:

First $8,000 X 0% = $ 0

Next $47,000 X 4% = $1,880

Next $5,000 X 5% = $250

Next $10,000 X 6% = $600

Next $15,000 X 7% = $ 1050

Next $15,000 X 9% = $1350

Tax payable for 2014: = $5,130.

Large Singapore families ['We're the Tan family - 80 under one roof']:

PS: Author is no relation to the 80 member Tan family, just thought GST linking would be a fairer way to of rent seeking amongst property owners, Singaporean or otherwise: destroying the fabric of a cohesive Singapore bringing light to the world.

Tags:

GST, property, taxes, progressive, economics, government, Singapore, poverty, wealth, defense spending, budget,

Increasing residential property tax across the board to MATCH GST will certainly go a long way to curb property price speculation.Pls charge property tax at EQUAL to the GST level but with rebates for Singaporeans. The Annual Value (AV) rebate should be S$6000 per annum per citizen (half for PRs)(based upon the median mkt price annual rental for single HDB room), so if U have a house with 10 Singaporeans staying and AV is $100K, the AV rebate would be S$60K, the consequent taxable amount will be S$40K, at 7% AV tax, the tax payable will be S$2.8K; (at 10%GST, it will be S$4K, p.a.(BOTH affordable even compared with current 2014 "discounted" rates)).

Of course, if the same house were solely tenanted by a foreigner family, then the AV property tax payable would be S$7K (@7%GST equivalent), S$10K (@10% GST equivalent)(foreigners are not entitled to property tax waivers unless they become citizens/ PRs).

Much more fair this way because some bigger families stay in big house NOT because they are rich, but because they have close knit families and enjoy the kampong spirit: they are equally important to Singapore, and thus shouldn't be taxed more just by virtue of their good family relationships.

Pls note that every Singaporean male does NS for pittance allowance, the $6K/ citizen (tenant/ otherwise) AV rebate should thus apply ACROSS THE BOARD to recognize every Singaporean as belonging to Singapore...

The SAF budget was SGD 12.08 billion (1 in every 4 dollars spent by government) (FY2011): property owners who are non Singaporean/ Singaporeans who live in excessively large properties should thus pay what is in excess of their entitlement of defence cost of Singapore.

Based on very nebulous IRAS Website: http://www.iras.gov.sg/irasHome/page04.aspx?id=2094

Example: AV of your house is $100,000 (Owner occupied), Property Tax payable (2014) is:

First $8,000 X 0% = $ 0

Next $47,000 X 4% = $1,880

Next $5,000 X 5% = $250

Next $10,000 X 6% = $600

Next $15,000 X 7% = $ 1050

Next $15,000 X 9% = $1350

Tax payable for 2014: = $5,130.

Large Singapore families ['We're the Tan family - 80 under one roof']:

The Straits Times, Published on Feb 13, 2014

PROPERTY COOLING MEASURES

Rent-seeking culture dampens entrepreneurial spirit

PROPERTY developers and agents should refrain from using words and phrases like "unnerving" and "not sustainable" when referring to the current state of the property market ("CDL chief calls for review of property cooling measures"; last Saturday).

Did they use the same terms when property prices spiralled out of control and Singaporeans found themselves mired in lifelong mortgage debt?

The Government should examine Singaporeans' longstanding love affair with real estate investment and its impact on our competitiveness and entrepreneurship.

If one can buy property and collect rent while waiting for the inevitable price appreciation, what incentive is there for one to be entrepreneurial and make money from activities that generate real value for the economy?

This rent-seeking culture is detrimental to Singapore's long-term social and economic development.

It took seven rounds of cooling measures to tame the property beast.

We should not let it loose until sanity has been restored to the market.

Lim Yiak Tiam

Rent-seeking culture dampens entrepreneurial spirit

Copyright © 2014 Singapore Press Holdings. All rights reserved.

PS: Author is no relation to the 80 member Tan family, just thought GST linking would be a fairer way to of rent seeking amongst property owners, Singaporean or otherwise: destroying the fabric of a cohesive Singapore bringing light to the world.

Tags:

GST, property, taxes, progressive, economics, government, Singapore, poverty, wealth, defense spending, budget,

Last edited: