https://www.zdnet.com/article/apple-ceo-on-iphone-sales-drop-yes-i-do-think-that-price-is-a-factor/

Apple CEO on iPhone sales drop: 'Yes, I do think that price is a factor'

Apple CEO Tim Cook said that the company has started to cut iPhone prices in some territories in an attempt to boost falling sales.

By Adrian Kingsley-Hughes for Hardware 2.0 | January 30, 2019 -- 13:08 GMT (21:08 GMT+08:00) | Topic: Apple

Recommended Content:

Downloads: Top 20 Apple keyboard shortcuts for business users (free PDF)

Having a go-to set of Apple keyboard shortcuts can greatly boost your users' productivity. Here are some handy tricks worth remembering. From the list: For Apple users, proprietary keys can be daunting at first, but they offer a host of...

Download Now

Your video will resume in 24 seconds

2019: The Apple products you shouldn't b... SEE FULL GALLERY

1 - 5 of 10

NEXT

Outside of the iPhone, Q1'19 was a strong quarter for Apple. According to Apple, revenues from "Mac and Wearables, Home and Accessories also reached all-time highs, growing 9 percent and 33 percent, respectively, and revenue from iPad grew 17 percent." That's a staggeringly strong quarter.

At the same time, its Services business hit an all-time high of $10.9 billion, an increase of 19 percent compared to the year-ago quarter.

Featured stories

But one rotten apple can ruin an entire barrel of sweet, sweet fruits. And that rotten apple in this instance was the iPhone.

Revenue from the iPhone fell 15 percent compared to the year-ago quarter.

However, despite that, the global active installed base of iPhones also hit of 1.4 billion in the first quarter.

So where did the quarter go wrong?

In his introductory remarks for the earnings call, Cook had this to say:

Milunovich:

But there's also this realization: "So, yes, I do think that price is a factor."

Cook did go on to give this bit of insight in response to another question:

That could be quite a challenge.

https://www.tomsguide.com/us/apple-q1-2019-iphone-sales,news-29267.html

iPhone Sales Drop 15 Percent: So What Now?

Philip Michaels ·

Senior Editor

Updated Jan 29, 2019

For a company that just saw revenue from its most important business segment nose-dive by $9 billion dollars during its most important quarter, Apple looked to strike an optimistic note about its outlook when announcing its holiday quarter earnings today (Jan. 29).

But is Apple falling victim to its own famed reality distortion field?

Credit: ShutterstockCertainly, iPhone sales for the three months ended Dec. 29, 2019 look as grim as when Apple warned that phone sales had slowed down earlier this month. Apple reported just under $52 billion in revenue from its iPhone business, a 15 percent drop from the year-ago quarter. With iPhones accounting for more than 60 percent of Apple's business, it's easy to understand how Apple's overall sales were down 5 percent from last year to $84.3 billion.

MORE: iPhone 11 Rumors - Release Date, Leaks, Specs and More

Despite all that, CEO Tim Cook looked to put the best possible spin on Apple's results, noting the company saw record highs in revenue for its Mac and wearables business. iPad revenue was up 17 percent for the quarter, the best rate for its tablets in six years. And revenue from services — an increasing area of focus for Apple — topped $10.8 billion during the holiday quarter, a 19 percent gain from last year.

"We are as confident as ever in the fundamental strength of our business, and we have an exciting pipeline with announcements coming later this year," Cook told Wall Street analysts during a conference call today. "We’re not taking our foot off the gas."

Reasons for the iPhone slump

Those iPhone sales numbers are going to stick out, though, particularly since Apple stopped breaking out unit sales. And Cook outlined the reasons why Apple's phone sales took a big hit during the quarter.

Currency exchange rates were a big culprit, particularly with Apple's China business. According to Cook, the strength of the U.S. dollar made Apple's phones more expensive, hurting sales in emerging markets.

Apple was also stung by reduced subsidies from carriers that offset the cost of upgrading to a new iPhone in many markets. In Japan, for example, less than half the iPhones Apple sold during the quarter were subsidized by carriers, Cook said, compared to three-quarters of iPhones sold a year ago. Subsidies were also less than they have been in the past, according to Apple, further depressing sales.

MORE: iPhone XS vs iPhone XS Max vs iPhone XR

Even in the U.S., where carrier subsidies for phones have been non-existent for several years, that's having an impact on iPhone upgrades, Cook said. "If you're a customer whose last purchase was an iPhone 6s, you have paid $199," he said. "Now, in an unbundled world, it's much more than that."

Apple also confirmed that its battery replacement program that let people pay $29 to upgrade their existing iPhone's battery also hurt sales. Instead of upgrading to a new iPhone during the quarter, current iPhone users opted for a less expensive battery replacement that would let them hold onto their older iPhone longer.

There's some good news in that for Apple, Cook pointed out. The company's active installed base ended 2018 at an all-time high, with 1.4 billion devices. That's up 100 million devices from where Apple started the year. And all those active users are spending money on things like Apple Pay, iTunes, the App Store and elsewhere, boosting Apple's service revenue.

"We're very happy not only with the growth but the breadth of our services revenue," Cook said.

But that optimistic outlook can only take Apple so far. In guidance for the current March quarter, Apple told analysts to expect $55 billion to $59 billion in revenue. That would be a drop-off from the $61.1 billion of revenue Apple reported for its March 2018 quarter.

How Apple reacts

Apple can take some comfort that other business segments are picking up some of the slack from the iPhone sales slump. But smartphones remain the engine driving Apple's business at the moment, and the company's going to have to find ways to turn that segment around.

Don't expect Apple to lay the blame on lackluster upgrades, at least not publicly. Despite lower than expected sales of the iPhone XS, XS Max and XR, Cook hailed those 2018 phones as "by far the best iPhones we've ever shipped."

MORE: iPhone 11 Will Kill Lightning for USB-C

Instead, Apple seemed to hint that it's going to get creative with how customers can pay for their phones. As iPhone sales failed to reach Apple's expectations during the holidays, the company turned to trade-in programs aimed at helping reduce the upfront cost of the iPhone. From the way Cook spoke during today's call, that sounds like a program will keep in place going froward.

Cook also said that Apple has made moves aimed at making it easier to buy your iPhone in installments. It plans to roll out those efforts to more countries.

While Apple no longer breaks out iPhone sales figures, chief financial officer Luca Maestri told analysts during the call that the iPhone XR was the most popular of Apple's iPhones during the quarter, followed by the iPhone XS Max. While Apple didn't comment on how that might impact its future iPhone strategy, those results might suggest there's a demand for both lower-priced iPhones as well as models with bigger screens that deliver more features.

https://www.bbc.com/news/business-47047297

Apple hints at lower iPhone prices as sales fall

Image copyright Getty Images Image caption The global smartphone market is contracting

Apple boss Tim Cook has hinted it could lower iPhone prices in some places in an attempt to boost falling sales.

Revenue from the iPhone, responsible for most of the firm's profits, fell 15% in its latest financial quarter.

Overall the firm's revenue was down 5% from a year ago to about $84.3bn (£64.5bn).

The slowdown had been expected after the tech giant warned investors earlier this month that revenue would be about $84bn, lower than expected.

The firm had blamed the issues partly on an economic slowdown in China.

But chief executive Tim Cook said customers were also struggling with the firm's high prices.

He said a strong dollar, which makes its products comparatively more expensive, had hurt its sales in emerging markets.

At the moment, according to Apple's official website, an iPhone Xs with a 5.8in display costs from $999 (£763) in the US compared with £999 in the UK and 8,699 Yuan (£989) in China.

Mr Cook said the tech giant had started this month to re-price its phones to shield customers from the impact of currency fluctuations.

"What we have done in January in some locations and [for] some products is essentially absorb part or all of the foreign currency move as compared to last year," he said.

Still, executives said they expected the firm's challenges to continue.

Apple predicted revenue for the three months to 31 March of $55bn-$59bn - suggesting a drop of at least 3.4% year-on-year.

"The macroeconomic environment, particularly in emerging markets, will continue to be there," Luca Maestri, the firm's chief financial officer, said.

Apple's struggles are not unique. Global smart phone shipments contracted 5% in 2018, according to Canalys, a market analyst firm.

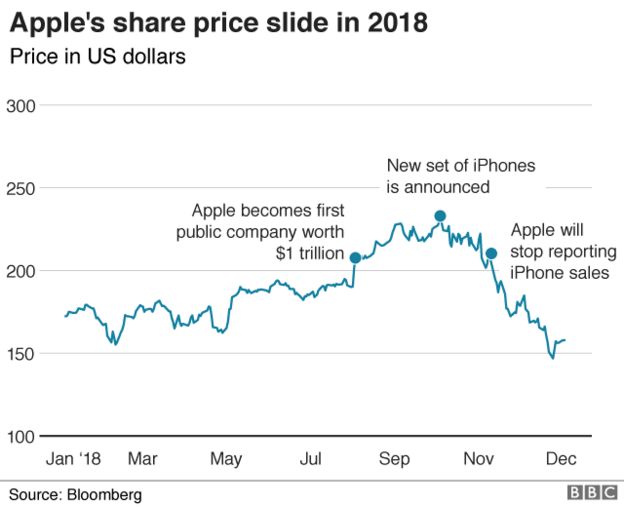

But the firm's share price has dropped by around one third since October, amid investor concerns that buyer appetite for iPhones is weakening.

Fears intensified after the firm said it would stop reporting the number of iPhones, iPads and Macs it sold each quarter.

However, Apple shares gained more than 4% in after-hours trade on Tuesday, as the firm proved more resilient than expected.

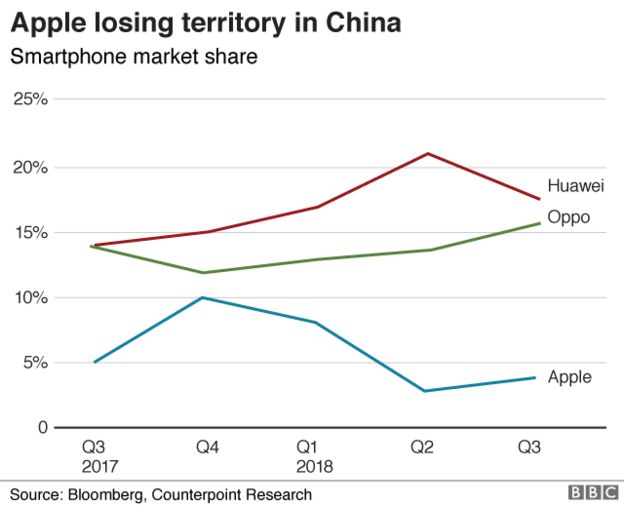

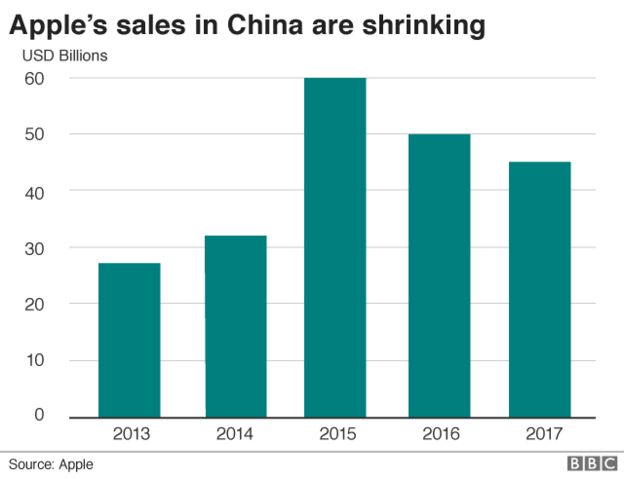

Quarterly sales revenue dropped by more than 25% in its Greater China region, which includes Hong Kong and Taiwan, compared to the year before.

Sales also slipped about 3% year-on-year in Europe.

But in the Americas - the firm's single biggest region - sales were up almost 5%.

Revenue from the services business also jumped 19% to a record $10.9bn in the quarter, which ended on the 31 December.

It's Apple's worst performing quarter for years, but that's not to say investors won't be mildly relieved.

After the firm's warning earlier this month that it would be posting earnings well below expectations for what is typically its blockbuster quarter, investors were well-prepared to see the drop in iPhone sales, and as a result, revenues overall.

That bad news was balanced out - perhaps even cancelled out - by the good news on services.

A big increase compared to this time last year - 19% - and a very healthy gross margin of 62.8%.

Apple is transitioning, slowly, into a different kind of company that isn't so reliant on hardware, and these numbers show that so far that transition is going well.

With $245bn cash in hand, it can afford to splash out and make investors even happier with a major acquisition or two in the entertainment space (but then, I've been saying that for a while now!).

Mr Cook said he remained confident in the business, pointing to strong sales of iPad and Macs, as well as growth in its services division, which includes Apple Pay.

Overall profit in the quarter fell less than 1% to $19.97bn.

"While it was disappointing to miss our revenue guidance, we manage Apple for the long term, and this quarter's results demonstrate that the underlying strength of our business runs deep and wide," he said.

View comments168

Apple CEO on iPhone sales drop: 'Yes, I do think that price is a factor'

Apple CEO Tim Cook said that the company has started to cut iPhone prices in some territories in an attempt to boost falling sales.

By Adrian Kingsley-Hughes for Hardware 2.0 | January 30, 2019 -- 13:08 GMT (21:08 GMT+08:00) | Topic: Apple

Recommended Content:

Downloads: Top 20 Apple keyboard shortcuts for business users (free PDF)

Having a go-to set of Apple keyboard shortcuts can greatly boost your users' productivity. Here are some handy tricks worth remembering. From the list: For Apple users, proprietary keys can be daunting at first, but they offer a host of...

Download Now

Your video will resume in 24 seconds

- playlist

- 0:05 / 0:29

- Autoplay: on

- share

- fullscreen

2019: The Apple products you shouldn't b... SEE FULL GALLERY

1 - 5 of 10

NEXT

Outside of the iPhone, Q1'19 was a strong quarter for Apple. According to Apple, revenues from "Mac and Wearables, Home and Accessories also reached all-time highs, growing 9 percent and 33 percent, respectively, and revenue from iPad grew 17 percent." That's a staggeringly strong quarter.

At the same time, its Services business hit an all-time high of $10.9 billion, an increase of 19 percent compared to the year-ago quarter.

Featured stories

- Why a high-tech border wall is as silly as a physical one

- The internet of human things: Implants for everybody and how we get there

- I'm a happy iPhone XR owner and this is how Apple should sell it

- Android Q: Rumors, features, and everything we know so far

But one rotten apple can ruin an entire barrel of sweet, sweet fruits. And that rotten apple in this instance was the iPhone.

Revenue from the iPhone fell 15 percent compared to the year-ago quarter.

However, despite that, the global active installed base of iPhones also hit of 1.4 billion in the first quarter.

So where did the quarter go wrong?

In his introductory remarks for the earnings call, Cook had this to say:

So, what's behind this? It's important to understand what's going on from the customer perspective at the point of purchase. We believe that it's the sum of several factors. First, foreign exchange. The relative strength of the U.S. dollar has made our products more expensive in many parts of the world.

Second, subsidies. For various reasons, iPhone subsidies are becoming increasingly less common. In Japan, for example, iPhone purchases were traditionally subsidized by carriers and bundled with service contracts. Competitive promotional activity frequently increase the amount of subsidy during key periods. Today, local regulations have significantly restricted those subsidies as well as related competition. As a result, we estimate that less than half of iPhones sold in Japan in Q1 of this year were subsidized compared to about three quarters a year ago and that the total value of those subsidies had come down as well.

Third, our battery replacement program. For millions of customers, we made it inexpensive and efficient to replace the battery and hold onto their existing iPhones a bit longer.

Now this struck me. Nowhere did he mention a softening in the Chinese market. In fact, in his opening statement, he only had good things to say about China, pointing out that revenue from China grew over the year. However, Apple CFO Luca Maestri had no problem pointing the finger at the Chinese market:Second, subsidies. For various reasons, iPhone subsidies are becoming increasingly less common. In Japan, for example, iPhone purchases were traditionally subsidized by carriers and bundled with service contracts. Competitive promotional activity frequently increase the amount of subsidy during key periods. Today, local regulations have significantly restricted those subsidies as well as related competition. As a result, we estimate that less than half of iPhones sold in Japan in Q1 of this year were subsidized compared to about three quarters a year ago and that the total value of those subsidies had come down as well.

Third, our battery replacement program. For millions of customers, we made it inexpensive and efficient to replace the battery and hold onto their existing iPhones a bit longer.

On a geographic basis, most of the decline from last year came from Greater China and other emerging markets with difficult macro and foreign exchange conditions affected our results.

But the really interesting information came in an exchange between Cook and analyst Steve Milunovich.Milunovich:

Some have the perception that you priced the new products, the new iPhones too high, what have you learned about price elasticity? And do you feel that perhaps you pushed the envelope a little bit too far and might have to bring that down in the future?

Cook:Steve, this is Tim. If you look at what we did this past year, we priced the iPhone Xs in the U.S. the same as we priced the iPhone X a year ago. The iPhone Xs Max, which was new, was $100 more than the Xs. And then we priced the XR right in the middle of where the entry iPhone 8 and entry iPhone 8 Plus have been priced. So, it's actually a pretty small difference in the United States compared to last year.

However, the foreign exchange issue that Luca spoke of in the call, and made that difference or amplified that difference in international markets, in particular, the emerging markets, which tended to move much more significantly versus the dollar.

And so what we have done in January and in some locations and some products is essentially absorbed part or all of the foreign currency move as compared to last year and therefore get close or perhaps right on the local price from a year ago. So, yes, I do think that price is a factor. I think part of it is that the FX piece.

And then secondly in some markets as I had talked about in my prepared remarks, the subsidy is probably the bigger of the issues in the developed markets. I had mentioned Japan, but also even in this country even though the subsidy has gone away for a period of time. If you're a customer that your last purchase was a 6s or 6 or in some cases even a 7, you may have paid $199 for – and now in an unbundled world it's obviously much more than that. And so we are working through those and we've got a number of actions to address that including the trade-in and the installment payments, which I had mentioned as well.

There are a lot of factors here around price sensitivity. An acknowledgement that the newer iPhones were more expensive, that foreign exchange issues played a part, and that the withdrawal of subsidies in some territories resulted in some level of sticker shock for buyers.However, the foreign exchange issue that Luca spoke of in the call, and made that difference or amplified that difference in international markets, in particular, the emerging markets, which tended to move much more significantly versus the dollar.

And so what we have done in January and in some locations and some products is essentially absorbed part or all of the foreign currency move as compared to last year and therefore get close or perhaps right on the local price from a year ago. So, yes, I do think that price is a factor. I think part of it is that the FX piece.

And then secondly in some markets as I had talked about in my prepared remarks, the subsidy is probably the bigger of the issues in the developed markets. I had mentioned Japan, but also even in this country even though the subsidy has gone away for a period of time. If you're a customer that your last purchase was a 6s or 6 or in some cases even a 7, you may have paid $199 for – and now in an unbundled world it's obviously much more than that. And so we are working through those and we've got a number of actions to address that including the trade-in and the installment payments, which I had mentioned as well.

But there's also this realization: "So, yes, I do think that price is a factor."

Cook did go on to give this bit of insight in response to another question:

"To give you more color I would say that, the XR is our most popular model and it's followed by Xs Max and then the Xs."

So the most popular iPhone is the cheapest, with the most expensive in second place. That's an interesting split, because it means that Apple is faced with the task of cutting prices in some territories, while not devaluing the iPhone in countries where sales are still strong. That could be quite a challenge.

https://www.tomsguide.com/us/apple-q1-2019-iphone-sales,news-29267.html

iPhone Sales Drop 15 Percent: So What Now?

Philip Michaels ·

Senior Editor

Updated Jan 29, 2019

For a company that just saw revenue from its most important business segment nose-dive by $9 billion dollars during its most important quarter, Apple looked to strike an optimistic note about its outlook when announcing its holiday quarter earnings today (Jan. 29).

But is Apple falling victim to its own famed reality distortion field?

Credit: ShutterstockCertainly, iPhone sales for the three months ended Dec. 29, 2019 look as grim as when Apple warned that phone sales had slowed down earlier this month. Apple reported just under $52 billion in revenue from its iPhone business, a 15 percent drop from the year-ago quarter. With iPhones accounting for more than 60 percent of Apple's business, it's easy to understand how Apple's overall sales were down 5 percent from last year to $84.3 billion.

MORE: iPhone 11 Rumors - Release Date, Leaks, Specs and More

Despite all that, CEO Tim Cook looked to put the best possible spin on Apple's results, noting the company saw record highs in revenue for its Mac and wearables business. iPad revenue was up 17 percent for the quarter, the best rate for its tablets in six years. And revenue from services — an increasing area of focus for Apple — topped $10.8 billion during the holiday quarter, a 19 percent gain from last year.

"We are as confident as ever in the fundamental strength of our business, and we have an exciting pipeline with announcements coming later this year," Cook told Wall Street analysts during a conference call today. "We’re not taking our foot off the gas."

Reasons for the iPhone slump

Those iPhone sales numbers are going to stick out, though, particularly since Apple stopped breaking out unit sales. And Cook outlined the reasons why Apple's phone sales took a big hit during the quarter.

Currency exchange rates were a big culprit, particularly with Apple's China business. According to Cook, the strength of the U.S. dollar made Apple's phones more expensive, hurting sales in emerging markets.

Apple was also stung by reduced subsidies from carriers that offset the cost of upgrading to a new iPhone in many markets. In Japan, for example, less than half the iPhones Apple sold during the quarter were subsidized by carriers, Cook said, compared to three-quarters of iPhones sold a year ago. Subsidies were also less than they have been in the past, according to Apple, further depressing sales.

MORE: iPhone XS vs iPhone XS Max vs iPhone XR

Even in the U.S., where carrier subsidies for phones have been non-existent for several years, that's having an impact on iPhone upgrades, Cook said. "If you're a customer whose last purchase was an iPhone 6s, you have paid $199," he said. "Now, in an unbundled world, it's much more than that."

Apple also confirmed that its battery replacement program that let people pay $29 to upgrade their existing iPhone's battery also hurt sales. Instead of upgrading to a new iPhone during the quarter, current iPhone users opted for a less expensive battery replacement that would let them hold onto their older iPhone longer.

There's some good news in that for Apple, Cook pointed out. The company's active installed base ended 2018 at an all-time high, with 1.4 billion devices. That's up 100 million devices from where Apple started the year. And all those active users are spending money on things like Apple Pay, iTunes, the App Store and elsewhere, boosting Apple's service revenue.

"We're very happy not only with the growth but the breadth of our services revenue," Cook said.

But that optimistic outlook can only take Apple so far. In guidance for the current March quarter, Apple told analysts to expect $55 billion to $59 billion in revenue. That would be a drop-off from the $61.1 billion of revenue Apple reported for its March 2018 quarter.

How Apple reacts

Apple can take some comfort that other business segments are picking up some of the slack from the iPhone sales slump. But smartphones remain the engine driving Apple's business at the moment, and the company's going to have to find ways to turn that segment around.

Don't expect Apple to lay the blame on lackluster upgrades, at least not publicly. Despite lower than expected sales of the iPhone XS, XS Max and XR, Cook hailed those 2018 phones as "by far the best iPhones we've ever shipped."

MORE: iPhone 11 Will Kill Lightning for USB-C

Instead, Apple seemed to hint that it's going to get creative with how customers can pay for their phones. As iPhone sales failed to reach Apple's expectations during the holidays, the company turned to trade-in programs aimed at helping reduce the upfront cost of the iPhone. From the way Cook spoke during today's call, that sounds like a program will keep in place going froward.

Cook also said that Apple has made moves aimed at making it easier to buy your iPhone in installments. It plans to roll out those efforts to more countries.

While Apple no longer breaks out iPhone sales figures, chief financial officer Luca Maestri told analysts during the call that the iPhone XR was the most popular of Apple's iPhones during the quarter, followed by the iPhone XS Max. While Apple didn't comment on how that might impact its future iPhone strategy, those results might suggest there's a demand for both lower-priced iPhones as well as models with bigger screens that deliver more features.

- The Best iOS Apps You're Not Using (But Should Be)

- 5 Things the iPhone 11 Really, Really Needs

- iPhone XS or iPhone XR? Here's Your Cheat Sheet

https://www.bbc.com/news/business-47047297

Apple hints at lower iPhone prices as sales fall

- 5 hours ago

- 168 comments

-

Share this with Facebook

Share this with Facebook -

Share this with Messenger

Share this with Messenger -

Share this with Twitter

Share this with Twitter - Share this with Email

Image copyright Getty Images Image caption The global smartphone market is contracting

Apple boss Tim Cook has hinted it could lower iPhone prices in some places in an attempt to boost falling sales.

Revenue from the iPhone, responsible for most of the firm's profits, fell 15% in its latest financial quarter.

Overall the firm's revenue was down 5% from a year ago to about $84.3bn (£64.5bn).

The slowdown had been expected after the tech giant warned investors earlier this month that revenue would be about $84bn, lower than expected.

The firm had blamed the issues partly on an economic slowdown in China.

But chief executive Tim Cook said customers were also struggling with the firm's high prices.

He said a strong dollar, which makes its products comparatively more expensive, had hurt its sales in emerging markets.

At the moment, according to Apple's official website, an iPhone Xs with a 5.8in display costs from $999 (£763) in the US compared with £999 in the UK and 8,699 Yuan (£989) in China.

Mr Cook said the tech giant had started this month to re-price its phones to shield customers from the impact of currency fluctuations.

"What we have done in January in some locations and [for] some products is essentially absorb part or all of the foreign currency move as compared to last year," he said.

Still, executives said they expected the firm's challenges to continue.

Apple predicted revenue for the three months to 31 March of $55bn-$59bn - suggesting a drop of at least 3.4% year-on-year.

"The macroeconomic environment, particularly in emerging markets, will continue to be there," Luca Maestri, the firm's chief financial officer, said.

Apple's struggles are not unique. Global smart phone shipments contracted 5% in 2018, according to Canalys, a market analyst firm.

But the firm's share price has dropped by around one third since October, amid investor concerns that buyer appetite for iPhones is weakening.

Fears intensified after the firm said it would stop reporting the number of iPhones, iPads and Macs it sold each quarter.

However, Apple shares gained more than 4% in after-hours trade on Tuesday, as the firm proved more resilient than expected.

Quarterly sales revenue dropped by more than 25% in its Greater China region, which includes Hong Kong and Taiwan, compared to the year before.

Sales also slipped about 3% year-on-year in Europe.

But in the Americas - the firm's single biggest region - sales were up almost 5%.

Revenue from the services business also jumped 19% to a record $10.9bn in the quarter, which ended on the 31 December.

It's Apple's worst performing quarter for years, but that's not to say investors won't be mildly relieved.

After the firm's warning earlier this month that it would be posting earnings well below expectations for what is typically its blockbuster quarter, investors were well-prepared to see the drop in iPhone sales, and as a result, revenues overall.

That bad news was balanced out - perhaps even cancelled out - by the good news on services.

A big increase compared to this time last year - 19% - and a very healthy gross margin of 62.8%.

Apple is transitioning, slowly, into a different kind of company that isn't so reliant on hardware, and these numbers show that so far that transition is going well.

With $245bn cash in hand, it can afford to splash out and make investors even happier with a major acquisition or two in the entertainment space (but then, I've been saying that for a while now!).

Mr Cook said he remained confident in the business, pointing to strong sales of iPad and Macs, as well as growth in its services division, which includes Apple Pay.

Overall profit in the quarter fell less than 1% to $19.97bn.

"While it was disappointing to miss our revenue guidance, we manage Apple for the long term, and this quarter's results demonstrate that the underlying strength of our business runs deep and wide," he said.

View comments168