Philippng :

Hi guys - my friend sent this message when he visited CPF - am glad to share as follows:

I went to CPF this afternoon to check out CPF Life. My advice is DO NOT opt for it. There is a fine print in the scheme that is unfair to us. Let me explain: For instance if you have 150k in your RA now and getting 1K payout every month. The RA sum taking into account the annual 4% interest will give you 1K per month till you are 85 years old.

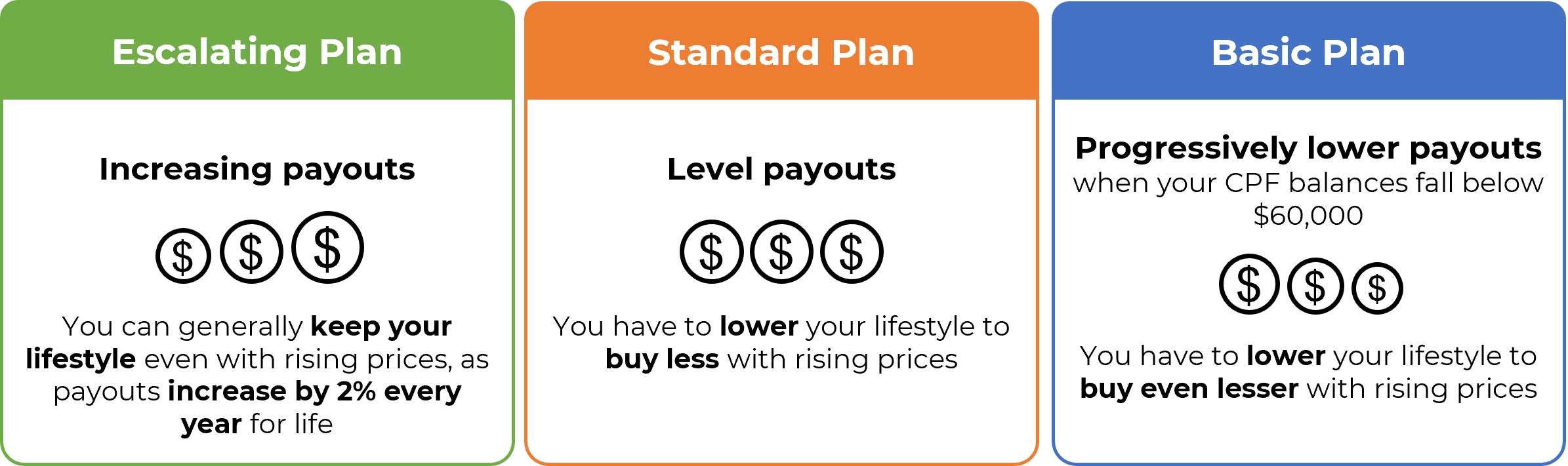

The government promotes CPF Life saying CPF Life will pay you for life at a lower monthly payout of about 700. Any balance left when you die is paid to your beneficiaries.

Many people think $300 less but can get payout for life looks ok.

What CPF did not highlight to you in the fine print is once you opt for CPF Life say the Standard Plan your whole 150k in RA will be transferred to the CPF Life Pool. The reduced monthly payout of 700 will come from the 150k. BUT the annual 4% interest on the 150k will NOT go to your beneficiaries when you die. Only the remaining balance of the 150k principal go to your beneficiaries. Under CPF Life scheme the annual 4% interest on the 150k goes to the CPF Life Pool. It’s not yours. It’s the risk sharing feature of an annuity.

Using the same example: 150k at 4% gives 6k interest per year.

Over 15 years and on the reducing principal as you draw down, the average interest for 15 years is about $40k Your beneficiaries will lose this 40k when you die. They only get the remaining balance of the original 150k. I am upset that they don’t highlight this to members who opt for CPF Life.

I found out only when I asked many questions and go through the details with the officer.

Many people don’t ask and are short changed.