S'pore couple tries to sell their old sofa for S$600, gets scammed S$45,000 instead

DBS Bank has offered to compensate them half of the amount lost.

Daniel Seow |

December 15, 2023, 10:51 PM

TelegramWhatsapp

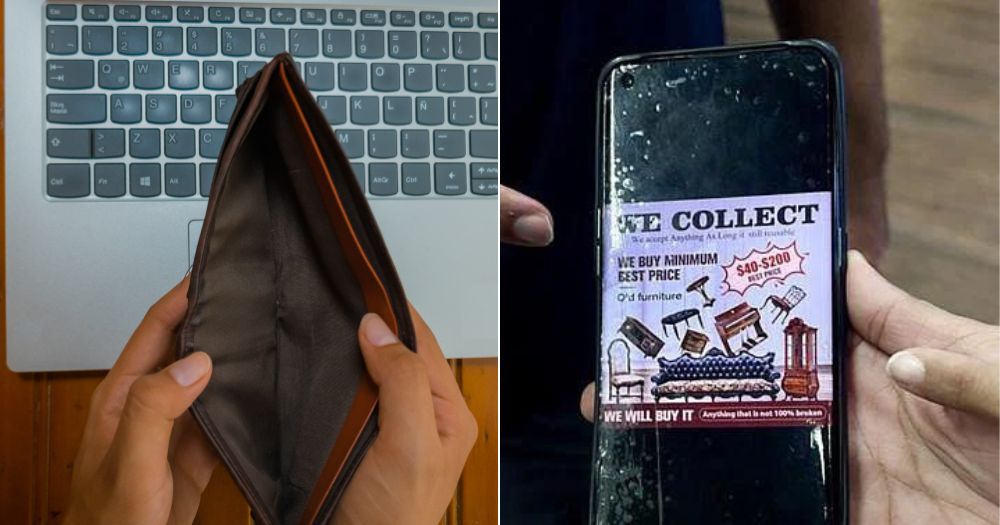

A couple in Singapore thought they were selling off their old sofa to a secondhand buyer, but the person turned out to be a scammer who siphoned S$45,000 from their bank accounts instead.

The couple subsequently reported the scam to DBS Bank, which in turn offered to reimburse them half of the funds lost, according to Lianhe Zaobao.

Asked to open a link to check "delivery invoice"

The husband, 35, who wished to be known only as Singh, told Zaobao that he had come across an advertisement looking to purchase secondhand items on Facebook in October.

Thinking of selling his old sofa, Singh reached out to the other party on Facebook to ask if he was interested.

They subsequently continued the conversation over WhatsApp.

After some back and forth, the scammer agreed to buy Singh's sofa for S$600.

During a follow-up call, the scammer sent Singh a link, and instructed him to open it in order to check the delivery invoice number.

He was told to show the invoice to the courier personnel upon collection of the sofa.

Singh followed the instruction and clicked into the link.

The scammer then informed Singh that he had made the payment of S$600, and asked him t0 login to his digibank app on his phone, to check if he had received it.

On hindsight, Singh admitted that the scammers had probably taken control of his phone by this point.

Scammers controlled his phone, siphoned S$45,000

In the evening of the same day, the scammers called Singh again to arrange for the collection of the sofa.

By this time, however, he had discovered that his phone had been compromised.

Singh realised that someone had used his personal details to open a new DBS Multiplier account and raise the transaction limits for his bank accounts.

Seeing this, his wife immediately notified DBS via the anti-scam hotline that Singh's phone had been infected by malware.

The staff told her to switch off the phone and make a police report.

However, it was too late.

Through a series of three transactions, Singh's personal account and the joint account with his wife, were wiped clean by the scammers.

They lost more than S$45,000 of their life savings in total.

Couple hopes DBS can compensate the full amount

The next day, the couple contacted DBS again, hoping to recover the lost funds.

After some discussion, the bank reportedly offered to compensate them half of the amount lost, as a goodwill gesture.

Singh, however, told Zaobao that he doesn't understand how such a large amount of money could be transferred without his authorisation.

He said the scammers had wiped out their savings, forcing them to rely on their monthly income to pay off their car loan, raise their two children, pay for a domestic helper and other expenses.

He and his wife are still hoping that the bank will compensate them the full amount that the scammers took.

"Accepting [this sum of'] money from the bank would be admitting that I made a mistake," he added.

Anti-malware tools have been rolled out on all customers' mobile apps: DBS

DBS said in response to Zaobao's enquiries that it had previously launched anti-malware tools to protect customers in September.

According to the DBS website, the tool would restrict the customer's access to the DBS/POSB digital banking app if malware, apps from unverified app stores, or ongoing screen-sharing or mirroring was detected on their device.

So far, the tool has been rolled out on all customers' mobile applications, the bank added.

Regarding scam cases, DBS said that the amount of compensation that the bank may provide as a goodwill gesture is determined on a case-by-case basis.

What customers can do in case of scams

DBS also highlighted a few ways that customers can protect themselves from a suspected scam.

One is to call the DBS 24-hour Lost Cards and Fraud Reporting hotline at 1800 339 6963 (from Singapore) or (+65) 6339 6963 (from overseas).

Alternatively, they can activate the safety switch function via digibank to temporarily block access to their funds.

Customers can also report the scam at any DBS branch counter, and a branch manager will assist them urgently, the bank said.

The Singapore Police Force confirmed with Zaobao that a report had been lodged and investigations are ongoing.

Top image from Canva and Lianhe Zaobao

Related story

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.