Instead of increase GST, what other more progressive wealth tax options (e.g. Replacement for Inheritance taxes) can be considered?

E.g. More progressive property taxes so that for annual value above $20k onwards until $300,000, maybe the top tier annual value of property can be taxed at 60% of annual value?

Please discuss.

E.g. There are some good class bungalows in Singapore worth $230,000,000. https://www.mansionglobal.com/artic...atest-in-a-string-of-blockbuster-sales-206018

Annual value of the property is likely to be at least, minimum $4.5 million dollars to rent p.a.

Government ought to tax such a rich property owner up to S$2.5 million so that the ordinary, poor folks do not have to pay excessive taxes (so they won't riot/ protest as they do in France, Hong Kong, Indonesia etc). And anyway, the art pieces and decorative antiques kept inside the property are likely to be worth more than the property itself and for which the SAF and police force is on alert 24/7 to defend the property and its contents (SAF costs S$14+ billion to maintain). So $2.5 million in taxes p.a. shouldn't be too much to protect and uphold the value of a property that is probably worth $460 million in all.

or

[YOUTUBE]ZQ-YX-5bAs0[/YouTube]

==========

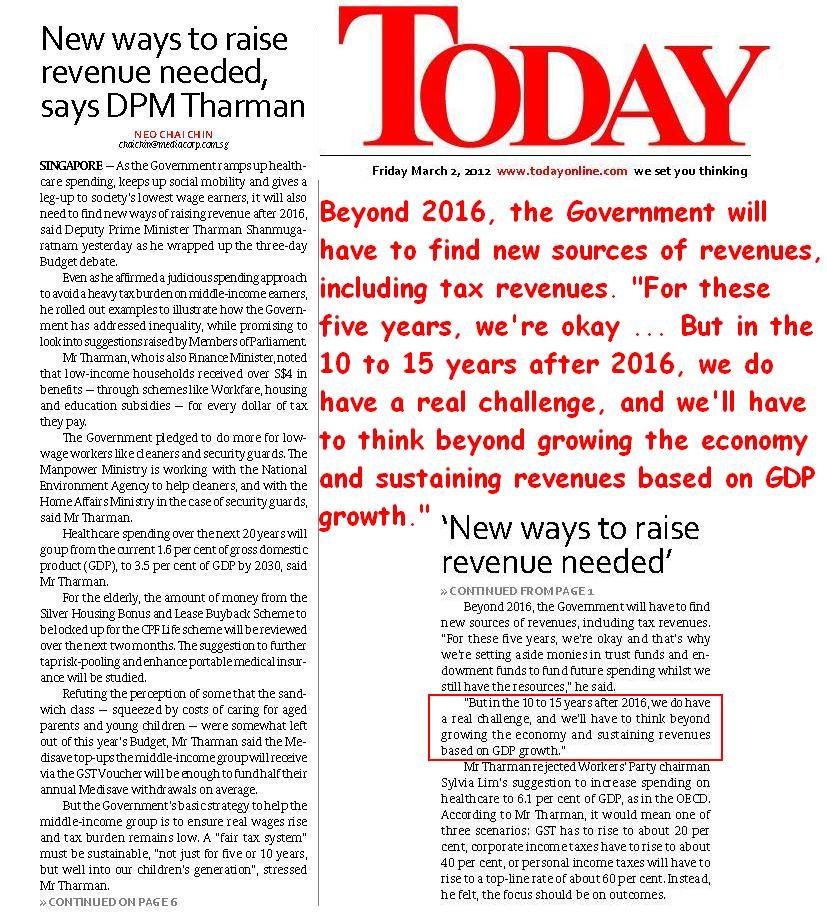

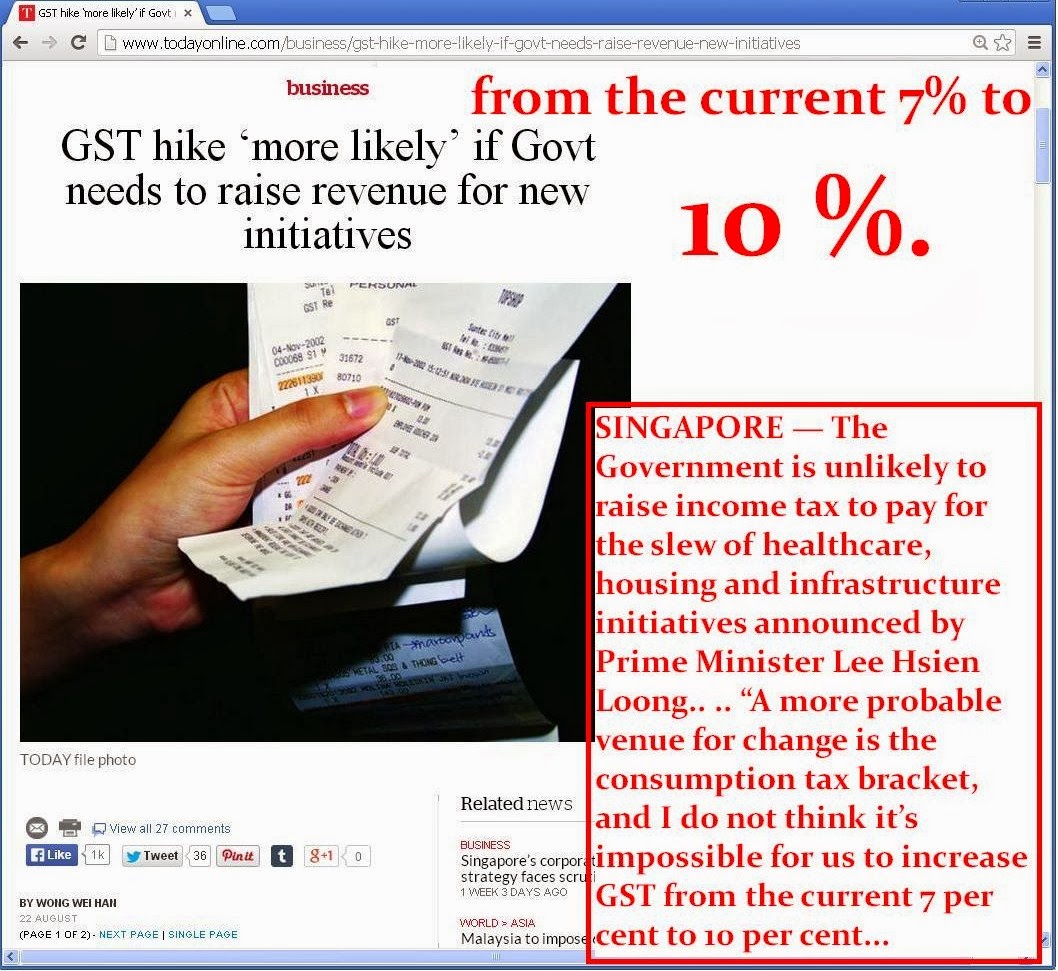

GST increase in 2021:

E.g. More progressive property taxes so that for annual value above $20k onwards until $300,000, maybe the top tier annual value of property can be taxed at 60% of annual value?

Please discuss.

E.g. There are some good class bungalows in Singapore worth $230,000,000. https://www.mansionglobal.com/artic...atest-in-a-string-of-blockbuster-sales-206018

Annual value of the property is likely to be at least, minimum $4.5 million dollars to rent p.a.

Government ought to tax such a rich property owner up to S$2.5 million so that the ordinary, poor folks do not have to pay excessive taxes (so they won't riot/ protest as they do in France, Hong Kong, Indonesia etc). And anyway, the art pieces and decorative antiques kept inside the property are likely to be worth more than the property itself and for which the SAF and police force is on alert 24/7 to defend the property and its contents (SAF costs S$14+ billion to maintain). So $2.5 million in taxes p.a. shouldn't be too much to protect and uphold the value of a property that is probably worth $460 million in all.

or

[YOUTUBE]ZQ-YX-5bAs0[/YouTube]

==========

GST increase in 2021:

Last edited: