-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How GIC and Temasek are managing your money

- Thread starter LITTLEREDDOT

- Start date

Optus services restored across Australia after almost 14 hours; CEO apologises for outage

Optus is the Australian unit of Singtel and has more than 10 million customers. PHOTO: REUTERS

NOV 8, 2023

SYDNEY – Optus said its services have been restored after a major outage that affected millions of Australians earlier on Wednesday.

The blackout lasted almost 14 hours, The Sydney Morning Herald reported.

“We know that customers rely on our network, which is why the whole team at Optus has been working hard to fix this,” an Optus spokesperson told The Straits Times.

“The network has now been restored, and customers should now be able to be back online.”

Optus’ chief executive Kelly Bayer Rosmarin has apologised for the incident.

In an interview with ABC News, she said the cause was a “technical network issue”.

Ms Rosmarin added that a “thorough, root-cause analysis” would be conducted by the company. It will then provide further details.

“In my 3½ years as the CEO of Optus, we’ve never had an outage of this nature,” ABC News quoted her as saying.

“It’s a very rare occurrence, but unfortunately it does happen. It happens to telcos all around the world. It happens to other telcos in Australia.”

Optus is Australia’s second-largest telecommunications provider.

It has more than 10 million individual customers – about 40 per cent of Australia’s population – and hundreds of thousands of business customers.

Optus is also the Australian unit of Singapore telecoms company Singtel.

In an earlier interview with Melbourne radio station 3AW, Ms Rosmarin said the company has done all it can to provide “excellent service”.

“Nobody works harder to make sure our customers are looked after and trusted. All telcos occasionally have outages, and we hope our customers will understand how hard we’ve been working to restore services as a priority.”

During an interview with Sydney radio station 2GB, Ms Rosmarin was asked if she would step down from Optus following the second crisis at the company in over a year.

She said that her focus was on restoring services for customers.

Wednesday’s outage was reported at around 4am local time (1am Singapore time), the BBC said in a report.

The blackout crippled payment systems and online operations.

It also led to morning peak-hour chaos as train networks and ride-share services were down briefly in some cities.

Ms Rosmarin ruled out a cyber attack.

She said the telco’s customers may be entitled to compensation for the outage, according to a Sydney Morning Herald report.

“Of course we are looking at what we can do to thank customers for their patience,” she told 3AW.

Chaos

For one talkback radio caller, the first sign that something was wrong came when her cat’s Wi-Fi-powered food dispenser failed to serve breakfast at 6.10am and her pet woke her.For disability pensioner Chris Rogers, who needs painkillers for a knee injury that prevents him from working, the problem became apparent when he drove 30 minutes to the pharmacist and his electronic prescription could not be filled.

“Because of the outage, it won’t load,” Mr Rogers told Reuters, while waiting at the pharmacist for Internet services to return.

“Reception is flat out. It is crazy, I have never seen such chaos.”

Many took to X, the platform formerly known as Twitter, to express their frustration and disappointment.

“Without my phone, I pretty much can’t do anything. I’m looking for a bank, and when you can’t go onto your phone and Google, pretty much you are lost,” said Ms Angela Ican outside the Optus store in Sydney’s Central Business District.

Construction worker Kyle, who did not give his full name, said he wanted answers from Optus.

“I was running late for work and couldn’t let my boss know. When I got on-site, I couldn’t find my boss – it’s been a big day,” he told Reuters.

Small business owners told Reuters they either relied on regular customers to pay them back once Internet services were restored, or gave customers an option to pay cash or come back later.

“We are a A$4,000 (S$3,500) to A$5,000-a-day business, and we’ve lost about A$1,000 in coffee sales this morning,” said Mr Roderick Geddes, owner of Pirrama Park Kiosk in Sydney, which was unable to process electronic payments.

Online society

For millions of Australians who could not pay for goods, book rides, get medical care or even make phone calls, a near-total service blackout became a lesson in the risks of a society that has moved almost entirely online.In the three years to 2022, Australian cash transactions halved to 16 per cent as pandemic restrictions sped up a longer-term trend towards so-called contactless payments, according to the Reserve Bank of Australia.

One-quarter of the country’s appointments with doctors are made online or by phone, government data shows.

“We are now so very reliant, because of Covid-19, on telehealth and also electronic messaging systems,” said Mr Michael Clements, rural chair of the Royal Australian College of General Practitioners.

“The reality is many people have just missed out on care.”

Hospitals and emergency services across the country were hit by the outage.

Ramsay Health Care, which owns 70 hospitals and clinics in Australia, said its phone services were impacted.

Sydney’s Westmead Private Hospital also said its phone lines were down.

Emergency triple-zero calls did not work from Optus landlines.

Melbourne’s train networks were forced to shut down for about 30 minutes because of the outage, resulting in delays during the morning rush, the media reported.

Limited information

Federal Communications Minister Michelle Rowland said she had limited information about the outage.“What we do know is that this is a deep fault. It has occurred deep within the network. It has wide ramifications across mobile, fixed and broadband services for Optus customers,” she told reporters.

She added that she would be reluctant to speculate about a possible cyber attack.

“I think it has been a very anxious morning for many Australians so far,” she said.

The government has sought further information from Optus.

A data breach hit Optus in 2022, exposing personal details of millions of customers, including home addresses and driver’s licence and passport numbers.

AFP said more than nine million Optus customers had their personal data stolen then.

Other companies to report issues included health insurer Bupa, airline Virgin Australia and health and safety watchdog WorkSafe. REUTERS, AFP, BLOOMBERG

Sunday, September 29, 2019

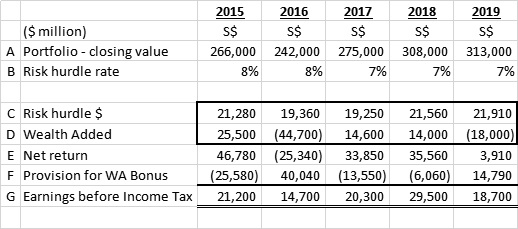

Is Temasek operating a slush fund?

A slush fund in an organisation is a reserve set aside for purposes at best to moderate accounts by keeping some earnings out of a good year (pay less tax) and fudge the earnings of a bad year. At worst, it is money set aside for illicit purposes, such as for bribery, and in the case of political parties, for hiding contributions received. At its nefarious worst, it is used to inflate earnings by crediting revenue account and hiding the debit side in some 'asset' account, hoping for future year profits to square out the losses. Enron Corporation famously cooked their books by using a derivative trader's slush fund to report false earning for many years.

Temasek measures their annual earnings against a targeted benchmark which is the risk-adjusted returns. A hurdle rate is first determined. This is the rate that management accepts as a reasonable return given the risk involved. The rate differs for each class of portfolio and aggregated over all investments. When the earnings are more than the hurdle rate, the difference is the Wealth Added (WA). Of course, in a bad year, the WA can be negative.

The WA is the basis for a special staff compensation scheme. It is called the WA Bonus scheme open only to 3 top levels of managerial staffers including the CEO. The coffee lady, the driver, the clerks and other 'mediocres' (in the eyes of ruling elites) do not participate in this.

Part of the WA is set aside for this bonus. It's a complicated system that incorporates a deferred payout and clawback mechanism. In a good year, a WA bonus is declared and the charge to earnings is by way of provision to a WA Bank A/c. The full sum is not paid out immediately as a certain portion is retained to meet clawbacks of future years. The max that can be paid is estimated to be about 50% of the declared sum. In a bad year when the WA is negative, there is a clawback on the deferred bonus of prior years. A provision has the effect of reducing the net earnings whilst a clawback is a provision written back to P&L which boosters the bottom line.

This adjustment to the WA Bonus scheme impacts the P&L. There is no transparency to this adjustment, which is not surprising as executive compensation has been top national secret ever since Ho Ching, the wife of the Prime Minister, and the most powerful woman in the land, was installed as CEO. Here is an attempt at quantifying this adjustment.

(A) Disclosed in the annual report.

(B) Disclosed in annual report. This is risk-adjusted, or hurdle rate. Basically it is a reasonable rate of return that management want given the risk. It is built bottom-up and aggregated over all investments.

(C) Estimated by applying the risk hurdle rate (B) over invested portfolio value (A).

(D) Disclosed in the annual report.

(E) Net earnings (C+D) before tax before provision for WA bonus.

(F) Computed based on Net return of (E) - EBIT (G).

(G) Disclosed in annual report.

What does the above computation show?

In 2015 the risk-adjusted return of 8% over portfolio of $266B was only $21.28B. With net return of $46.78B there was wealth added of $25.5B. Since there was WA, then a WA Bonus was computed. What is the basis and how much was due to the participating managers, the public cannot compute. A provision is then made which was $25.58B charged to the accounts. What was charged to the accounts each year need not necessarily be the provision for that year as it could involve adjustments of other years. By charging this provision, the net earnings went down from $46.78B to $21.2B.

It should be noted that $25.58B is not bonus paid out. How much is paid out each year, the public will never know. Only a certain sum is paid out and the balance is deferred and retained in a pool (WA Bank A/c) available for clawback in future years. Take for example 2016 a negative net return of $25.34B caused a huge negative WA of $44.7B. A huge clawback of $40.04B from WA Bonus provision allowed Temasek to show a net proft before tax of $14.7B. Again in 2019 a low net return of $3.91B saw a negative WA of $18B. A clawback of $14.79 WA Bonus provision allowed Temasek to show a net profit before tax of $18.7B

Creative accounting is an ingenuous way of cooking the books by staying within the bounds of laws and regulations, and accounting standards, but actually straying from what was intended. It is left to the reader to form their own opinion, regardless of the legality, whether the WA Bonus scheme is a slush fund in a Rube Goldberg machine.

(Rube Goldberg machine is a contraption purposely engineered to handle a simple task into a very complicated process.)

Saturday, July 22, 2023

HIT BY S$7.3B LOSS, TEMASEK TURNS OUT THE LIGHT ON ITS FINANCIAL STATEMENTS

Santiago Principles is the generally accepted principles and practices (GAPP) that relate to the operation of sovereign wealth funds. Temasek has always boasted it maintains standards higher than Santiago. Well, it cannot say that anymore as far as financial statements are concerned. There is no audited statutory financial statements for y/e 31 Mar 2023, or at least we don’t get to see one. It is very telling this change happens in the year when it made its first loss in decades.

For y/e 31 Mar 2023, what is published and what we get to see is just the Group Summary Statement. This is an aggregated information with limited disclosure prepared by management. The auditor simply provides an opinion that the data is correctly aggregated from audited financial statements. Make no mistake, the accounts have been audited as usual since Temasek has to report to the shareholder, ie the government. Under Singapore Standard on Auditing SSA 810, a company that publishes a Group Summary Statement has to state clearly where audited statutory financial statements may be freely available. Temasek hides behind its private exempt status which does not require it to publish audited financial statements. The light just went out.

For decades, executive compensation of Temasek has been a state secret despite requirements of the Companies Act for full disclosure. Now it looks like audited statutory financial statements will also go the way of the dodo birds. It begs the question what is being concealed.

We have no idea of the performance of Temasek at company level for 2023. At group level, which includes operating subsidiaries such as Singtel, Singapore Airlines, PSA, ST Engineering, Mapletree, Singapore Power, etc, it lost S$7.3b after tax.

From group summary, the loss is just a hiccup.

The gross margin remained at 2022 level of 22%, suggesting there was no massive portfolio write down for the year as most would have worried given the tumultuous year in equities.

The P&L only shows a write down of S$22b on its Liquid & Sub-20% portfolio. This segment forms 27% of of the whole investment portfolio of S$382b. The segment is valued S$125b pre-write down and S$103b post write down. Cash, near-cash items, and listed equities comprise this segment. The S$22b loss is diminution in value from mark-to-market. The loss is 18% of this portfolio segment which is twice the loss in 2022.

20% or S$76b of Temasek’s portfolio is in listed equities where it owns more than 25% of the stock. We have no idea of any losses on mark-to-market.

53%.or S$202b of investment is in unlisted stocks. These are accounted for at cost less impairment. Valuation gains are only accounted for after IPO or on sales. Ordinarily this is the most non-transparent part of the portfolio. Even auditors would need to place a lot of faith on figures provided by management. This is where investments like FTX would be booked. So how do we know if the S$275m investment in FTX has been written off? How do we know the US$10m given to Mark Zuckerberg for the doomed (which I predicted from day1 that it will fail) fintech Libra project has also been written off? How do we know valuations are ‘on-the-ball’? We don’t.

MAS lost S$21.4b on forex losses due to appreciation of SGD. Temasek makes no mention of the impact of changing values on its book. Perhaps they did great hedging currency risks. We learn nothing from the Group Summary Statements.

Interest expenses increased by 29% to S$6.2b despite debt decreasing from S$90b to S$78.5b. Temasek is not spared from impact of rising interest rates. The rising cost of funds may perhaps put a dampener on leverage as a growth driver.

Total portfolio was S$382b, down slightly by 5%. Pretty resilient, considering the challenging global conditions.

Here’s food for thought.

A digression here on a personal experience to introduce my point. Some 25 years ago I had some relatives who started out manufacturing some products for the retail market. Wet behind the ears in business, they started a sales incentive scheme which I thought was way too generous and came with the risk of not having a cap. Sales hit the roof and soon sales girls were drawing crazy pay checques. Of course the scheme needed watering down, not without some HR discontent.

In my May 2019 blog "Temasek - The Shocking S$3.61b (est'd) Executive Bonus" I described the company’s executive scheme and tried to re-engineer what the bonus for y/e 31 Mar 2018 based on parameters described in Annual Reports. I found it was a shocking unbelievable S$.3.6b. .

For y/e 31 Mar 2019 I worked on determining what was the provision for executive bonus carried in the books. The figures were mind-boggling. If my computation is correct, it is tantamount to bank robbery. I blogged about this in Sep 2019 “Is Temasek operating a slush fund?”. I explained what a slush fund is. The figures for provision for executive bonus is so humongous that movements in this account can impact P&L seriously. It can be used to manipulate the accounts. I am not saying it has been done, but if my computation is correct, it represents a critical financial risk.

Singaporeans never picked up on such important revelations (most prefer gossipy stuff like current illicit love affairs of members of parliament) and also my blog outreach is small, my stories had no traction. The red flags I raised ought to set alarm bells ringing in every accountant’s brain to get up on their butts to prove me wrong. And I sincerely hope I am wrong.

What Temasek has is an incentive scheme without a cap. For a company that can hit double digit billions in a good year, imagine what the payout can be. Such a scheme makes it the employer to die for.

To bring this story back to the blog focus on Temasek turning the lights off financial information, the audited accounts for years 2020, 2021, and 2022 no longer carry the information that made it possible to compute the executive bonus and the provision figures the way I did for 2018 and 2019. Is that just coincidence or tightening up loopholes? Perchance someone saw the red flags I raised?

So here we are 2023, Temasek has not only done away with publishing audited statutory accounts, it has retroactively replaced past years audited financials in their website with group summary statements. There’s some revisionism going on. History has taught us it is always worrisome when a regime practices revisionism.

The devil is in the details. With Temasek now shy on publishing audited statutory accounts, are there any devils that are concealed? One can only wonder, especially in a climate where trust has run low, very low.

Saturday, July 30, 2022

THREE BIG LIES ABOUT THE NATIONAL RESERVES THAT YOU SHOULD KNOW ABOUT

"The national reserves must not be disclosed. If this is made public, the SGD can be subject to attacks by currency speculators" is the mantra of the Singapore government. Enough of this nonsense.

Speculative attacks happen during a currency crisis. A currency crisis is a consequence of chronic balance of payments deficits (it's also called a balance of payments crisis). This is how it goes. Due to trade imbalances ie a chronic deficit, the domestic currency of the country is weakened. Its central bank either refuses or is unable to allow the exchange rate to fall. To maintain the rate, the central bank has to keep buying its domestic currency. It continues the buying policy till it runs out of foreign reserves. This leads to a financial crisis as the value of foreign debt rises in relation to the weakened domestic currency. Foreign currency liquidity freezes because no one's going to sell the foreign currency to you if the exchange rate is forcibly maintained at unrealistic levels. Eventually the central bank capitulates because no one can go against the market in the long run. It is forced to devalue the domestic currency to bring it back to equilibrium. This type of scenario happens when the market anticipates that domestic policies will not be adjusted sufficiently to devalue the domestic currency. So they attack the currency by selling (shorting it) at the unrealistic high rate controlled by the central bank. Sooner or later when the government is forced to devalue, speculators buy back the currency at lower rates and make a killing.

From the above scenario, you should already know of 2 things:

(1). First BIG LIE. Currency crisis happens when the exchange rate does not respond to market conditions. There is sufficient empirical evidence that such scenarios happen in cases of a pegged currency, ie the rate is fixed to some other currencies. In the case of Singapore, MAS manages on the basis of a floating rate, using an official band to control daily volatility only. Should chronic trade deficits force the rate down, MAS will loosen the band to allow the SGD to devalue. So the above illustrated currency crisis scenario won't happen in Singapore.

(2). Second BIG LIE. If the SGD is weakened and the MAS wants to cushion the devaluation, it is forced to intervene in the market to buy up as much of the domestic currency as possible. To do this, MAS makes use of its foreign reserves. Thus, the more forex reserves it holds, the stronger the MAS is to support the SGD. So here's the rub. Like all central banks in the world, the holdings of forex reserves of the MAS are all in the open for the world to see. It is currently about SGD427 billion. There is nothing secretive about it, and it has nothing to do with national reserves.

Currency speculators aren't watching your reserves. There are watching the market. If the market sees the currency as over-valued, they know sooner or later the central bank has to devalue. Just like a poker player, if he sees he has a winning hand, he continues raising the stakes.

The Third BIG LIE is the increase in asset portfolio of the sovereign wealth funds. The numbers are impressive, but they don't explain how the growth happened. In 2022 Temasek portfolio value grew by S$22b to S$403b, GIC grew by S$280b. Asset growth can come in a number of ways:

Note that GIC and Temasek make annual contributions to the government of NIR (net income return) based on 50% of a computed 20-year annualised rate on their 'Net Relevant Assets', in basic terms, assets less debts. This means that in a given year, the NIRC (net income return contribution) has no relation to the actual profit or loss. In 2022, the NIRC was S$21.6b but it's not known how much came from GIC and how much from Temasek. We know MAS was unable to contribute due to its S$7.1b losses.Internal growth (earnings ploughed back into the business): This is well and good and a pat on the shoulders.

Currency translation : Not good. It suggests lack of hedging strategies which could have gone one way or the other way. I mentioned in a previous blog the MAS, as a central bank, has to take on market risks which was why they got hit with a S$8.7b revaluation loss in 2022. Unlike MAS, GIC and Temasek can make hedging strategies to minimise translation risks.

Valuation : Good picks or bad picks, investing expertise or pure luck, we can't criticise from hindsight. CIO has to make a call. But generally, the last 2 decades have been good to investors who ride along with the massive liquidity pumped out by central banks all over which pushed markets to record heights. But what we should be concerned is the vast amount of holdings in unquoted equities, in both Temasek and GIC. The valuation is anybody's guess.

Capital injection : Any idiot could have increased portfolio value with fresh funds. This is not an insult but an aphorism.

Leverage (funded by more loans): This is not bad per se, but it means increased risks. Debts for operational purposes are fine. Temasek has often spoken of taking advantage of cheap funds to leverage and it is creeping into the realm of private equity fund management business. Are they investing savings, or running a private equity business? We would prefer hard-nosed risk-averse managers, not Wall Street cowboys.

Read : An increase in the government's assets is not an increase in national reserves which is assets net of national debt, and Singapore has one of the highest national debt in the world.

Where did Temasek's S$22b asset growth come from? :

- Was it from its operations? Temasek's net profits in 2022 was S$10.6b. After deducting it's share of the NIRC (how much ???), it did not generate much to increase the asset portfolio.

- Did it come from currency translation? It's porfolio geographical distribution showed Singapore 27%, US 21%, but the currency distribution showed SGD 49%, USD 34%, HKD 7%. This shows there were currency hedges. USD appreciated 1% and HKD gained 0.3% over SGD. That means translation gains were not significant. Although CNY gained 3.7% over SGD and Temasek had substantial Chinese assets, these are in American Depository Receipts, which are basically USD assets.

- Did asset growth come from debts? Temasek had been taking on debt since 2014, rising from S$9b to S$90b as at 31 Mar 2022. In 2022 debt increased by S$8.5b.

- Did it come from capital injection? There was no fresh capital injection, in fact equity decreased by S$4.6b in 2022.

So where did the increase in S$22b in asset value come from? It came from a mix of operating gains (???), translation gains (???), and debt (S$8.5b) -- shared more or less equally.

Where did GIC's S$280b asset growth come from?:

- Did it come from profits? Who the heck knows. Checking out GIC performance is like looking into a black hole. We can only speculate. I'm betting my right arm GIC profits for 2022 wasn't anything to crow about for the simple reason that if it were so, the state media would have celebrated the current year ROI instead of hiding behind a 20 year annualised rate and about returns beating inflation rate.

- Did it come from currency translation? We are looking at a black hole. But this much I can say. In terms of currencies, GIC has 2 sources of funds. One is from forex reserves from MAS. It is likely that these funds would be invested in the relevant countries so there is no asset-liability mismatch, no translation losses. Two is about S$1 trillion of SGD debt + land sales + budget surpluses which are subject to translation risks if invested overseas without a hedging strategy.

- Did it come from valuation? Again, no way to tell. But note that GIC had 37% portfolio in bonds and cash. The bonds should be bleeding heavy losses in the current rising interest rate scenario and was a significant dampener on profits.

- Did it come from injection of fresh funds? Aha, this, I have plenty to talk about.

GIC gained a fabulous S$280b in portfolio value in 2022. PAP uno numero fan Singapore resident Polish blogger Critical Spectator could not help but to write with glee. His Facebook echo chamber of fawning supporters and opposition haters asked with unabashed sarcasm where are the critics now? Sadly lacking is the independent brain power to stop and ask where did the increase come from.

Well, a substantial part of the increase came from fresh funds injected :

- S$108b from net increase in securities issued (issuance less redemptions)

- S$75b new RMGS issued (for MAS forex reserves transferred to GIC)

- S$13b from sales of land.

So S$196b fresh funds were provided to GIC to invest., of which S$183b was from government debt. And what did I say about capital injection? Any idiot can increase asset portfolio - it's not an insult but an aphorism.

The more important question to ask is where did the increase of the balance of S$84b (S$280b-S$196b) of GIC's asset increase come from? I have no idea and nobody's talking.

Don't we all know a narrative can be spin in several ways. GIC and Temasek squirmed in word salad instead of telling it as it is. GIC lectured about high falutin 'Rolling 20 Year Annualised Rate Of Return' that cannot be measured against anything. They will not plain speak about current year ROI. Temasek talked about their participation in Singapore Airlines' mandatory convertible bonds issue "enabling the airline to strengthen its balance sheet and to position it for the resumption of global travel" and Sembcorp Marine's rights issues "which strengthened its balance sheet and liquidity position, accelerating its strategic pivot to high-growth renewable and clean energy segments" when the whole world knows Santa Claus was bailing out two troubled companies.

GIC among funds that bought Signa’s equity-like securities

According to an insolvency filing from Signa Prime Selection, GIC owns €85 million of profit participation securities known as genussrechte or genussscheine. PHOTO: GIC

Jan 8, 2023

LONDON – Saudi Arabia’s Public Investment Fund (PIF) and Singapore’s GIC are among the investors listed as holders of riskier equity-like instruments issued by Signa’s luxury real estate unit, now caught up in insolvency proceedings in Austria.

PIF owns €287 million (S$417.6 million) of the profit participation securities, known as genussrechte or genussscheine, while the Singapore sovereign wealth fund owns €85 million, according to the insolvency filing from Signa Prime Selection, dated Dec 28, seen by Bloomberg News.

Profit participation rights are subordinated securities that grant holders a share of the issuer’s profits. Bloomberg News previously reported that PIF had exposure to the ailing Austrian real estate group’s junior debt.

Representatives of PIF and GIC declined to comment. A spokesperson for Signa did not respond to a request for comment.

How much these investors will be able to recoup from these investments during the insolvency process remains unclear.

The two main property units of Austrian retail and real estate entrepreneur Rene Benko’s Signa group, Signa Prime and Signa Development Selection, filed for court-supervised self-administration proceedings in December.

Signa Prime and Signa Development are looking to raise €350 million in total via new profit participation securities as part of their insolvency plan, according to filings seen by Bloomberg News.

Unlike the existing profit participation rights, the new funding would not be part of the claims treated under Signa’s restructuring arrangement, but would rather help fund it.

Close ties

The insolvency filings highlight how Mr Benko was able to tap deep-pocketed and far-flung investors through a variety of financing.Take for example Signa’s Bahnhofplatz 7 project in Munich, which was to renovate the Hermann Tietz department store and construct the new Corbinian office building. Signa Prime guaranteed €117 million of financing from PIF to the firm that ran the development, according to the insolvency filing. Corporate filings show how PIF bought €187 million of profit participation certificates linked to that project, guaranteed by Signa Prime, back in March 2022.

PIF is not the only Middle East investor listed. The insolvency filing also shows €93 million in guaranteed financing from Sign Holdings RSC, a special purpose vehicle registered in Abu Dhabi.

AC, a prominent Dubai investment fund, is shown as linked to the vehicle in the insolvency filing. About a third of funding went to the five-star Bauer Hotel in Venice. A spokesperson for AC did not immediately respond to requests for comment.

The insolvency filing also discloses a €200 million corporate loan granted by a company with directors from Germany’s Schoeller Group, founded by the industrial family of that name. The financing was granted to Signa Prime Capital Invest, a subsidiary of Signa Prime Selection, according to the filing.

Signa Prime’s and Signa Development’s insolvency filings did not give a comprehensive breakdown of total exposure, meaning that specific creditors could have larger holdings than indicated.

New funds

Whether existing investors will be tempted to plough fresh cash into the business to protect their positions is still an open question. If secured, the fresh financing will allow the Signa units to remain in an insolvency proceeding known as self-administration, where management remains in place.Signa Prime is seeking at least €300 million, while Signa Development is seeking €50 million, according to the insolvency filings.

Signa Development is offering to issue profit participation certificates at an interest rate of 9 per cent, as stated in a separate document seen by Bloomberg. The unit is looking to issue them as soon as January, and they will mature in December 2025, although it may have extension options.

On top of paying out interest, 33 per cent of the liquidity surplus at the end of 2024 will also be allocated to the holders of these instruments. There is a maximum cap, though, set at 70 per cent of the profit participation rights’ nominal amount. The instruments come with no collateral, according to the document.

In an interview on Jan 5 with German business newspaper Handelsblatt, Austrian construction magnate Hans Peter Haselsteiner – who is a shareholder in Signa Holding and Development – said he can “picture” signing participation rights to provide new cash and support the firm’s insolvency proceedings. BLOOMBERG

Singtel’s Optus fined $1.3 million by Australian government on public safety rule breach

Optus failed to upload the information of close to 200,000 customers to a database used by emergency services. PHOTO: OPTUS

Mia Pei

MAR 06, 2024

SINGAPORE - Singtel’s Australian unit Optus was fined A$1.5 million (S$1.3 million) by the Australian authorities for breaching public safety rules.

The fine came after the Australian Communications and Media Authority (Acma) found that Optus failed to upload the information of close to 200,000 customers between January 2021 and September 2023 to a database used by emergency services, based on media reports on March 6.

Optus failed to upload the data via its outsourced supplier Prvidr to the Integrated Public Number Database (IPND), said Acma member Samantha Yorke.

The database is used by emergency services to provide location information and emergency alerts to the police, ambulance and fire brigade. Failure to provide the needed information may hinder emergency services, posing public safety concerns.

“While we are not aware of anyone being directly harmed due to the non-compliance in this case, it’s alarming that Optus placed so many customers in this position for so long.

“Optus cannot outsource its obligations, even if part of the process is being undertaken by a third party,” Ms Yorke added.

The Australian media watchdog has accepted a court-enforceable undertaking from Optus that requires an independent review of its IPND compliance.

Optus apologised for the non-compliance and accepted that proper audits and checks were not in place to ensure IPND obligations.

“Optus accepts the Acma’s findings and has agreed to an enforceable undertaking to complete an independent review of the processes used to manage compliance with our IPND obligations for these partner brands and make any further improvements if required,” said a spokesperson.

Singtel’s shares closed at $2.34 on March 6, three cents or 1.3 per cent higher. THE BUSINESS TIMES

Singtel Australian unit’s appeal in tax case dismissed by court again

Both entities – Singapore Telecom Australia Investments and Singtel Australia Investments – are entirely owned by Singtel. ST PHOTO: KUA CHEE SIONG

Mia Pei

MAR 08, 2024

SINGAPORE – The appeal of Singtel’s Australian subsidiary, Singapore Telecom Australia Investments (STAI), against the Commissioner of Taxation was dismissed by the Full Federal Court of Australia on March 8.

This was the second time STAI’s appeal on the case has been dismissed, which is related to Singtel’s intra-group cross-border financing to acquire Optus in 2001.

After the acquisition, domestically incorporated STAI issued shares and loan notes under a loan-note issuance agreement to British Virgin Islands-registered subsidiary Singtel Australia Investments (SAI). STAI then became a unit under SAI in 2002, issuing loans and later paying interest to SAI, which is a tax resident in Singapore.

Both entities are entirely owned by Singtel.

The loan agreements put in place during the purchase process set interest rates due on loans between the two entities.

The Australian Tax Office (ATO) took issue with the agreements in 2016, when STAI received amended assessments from the ATO, comprising primary tax of A$268 million (S$237 million), interest of A$58 million and penalties of A$67 million.

This assessment meant STAI would owe just under A$895 million in additional taxable income. In December 2016, STAI lodged objections to the amended assessments, which the commissioner disallowed in 2019.

Singtel said STAI’s holding company, SAI, would be entitled to a corresponding refund of withholding tax estimated at A$89 million in relation to the amended assessments.

The telco giant also noted that STAI paid a minimum amount of 50 per cent of the assessed primary tax in November 2016, in accordance with ATO administrative practice.

“STAI will review the details of the judgment, explore available options and determine next steps...

“STAI will also review and consider its position on applying for relief as to the penalties,” said Singtel, adding that the net tax exposure and related interest and penalties have been “fully provided” in its financial statements.

Shares of Singtel closed one cent, or 0.42 per cent, higher at $2.38 on March 8.

Former Sembcorp Marine CEO and ex-Jurong Shipyard senior GM charged with bribing Brazil officials

Tan Nai LunMAR 28, 2024

Lee Fook Kang and Wong Weng Sun at the State Courts on Mar 28, 2024. (Photos: CNA/Eugene Goh)

SINGAPORE - Two individuals related to Seatrium, formerly Sembcorp Marine, have been charged with corruption offences involving the payment of bribes for the benefit of persons in Brazil.

The public prosecutor is also in discussions with Seatrium on a deferred prosecution agreement (DPA) that will require the company to pay a financial penalty for the alleged corruption offences, said the Corrupt Practices Investigation Bureau (CPIB) and the Attorney-General’s Chambers (AGC) in a joint statement on March 28.

The two individuals charged are Wong Weng Sun – who was Sembcorp Marine’s president, executive director and chief executive officer, and managing director of subsidiary Jurong Shipyard at the time of the alleged offences; and Lee Fook Kang – senior general manager of Jurong Shipyard at the time of the alleged offences.

Wong, 62, and Lee, 75, each faces five charges of conspiring to corruptly give gratification to Guilherme Esteves de Jesus (GDJ), a former consultant with Seatrium, for the benefit of persons in Brazil, to advance the business interests of the company’s subsidiaries in Brazil.

The alleged offences took place between 2009 and 2014, where a total sum of around US$44 million (S$59.3 million) was handed to GDJ.

Wong has also been charged with obstruction of justice.

He allegedly instructed two employees of Seatrium in 2014 to remove an email sent by GDJ containing evidence of bribes that GDJ had given or would be giving to other persons.

As for the proposed DPA, the company will likely be required to pay a financial penalty of US$110 million (S$148 million). Up to US$53 million of the amount may be used to offset the settlement payment totalling 670,699,731.73 Brazilian real, which are under the in-principle settlement agreements that the company has reached with the authorities in Brazil.

This is a settlement under which the prosecution agrees to defer criminal charges against a corporate offender, in exchange for the corporation’s agreement to comply with various conditions, such as admission of wrongdoing, payment of financial penalties, and implementation of corporate reform.

Contents and terms of the DPA remain to be worked out and agreed upon. It will also have to be approved by the General Division of the High Court before it comes into force.

The AGC said it considered all the relevant factors in this case, including the available evidence, and assessed that there was sufficient evidence to mount a prosecution.

This is unlike the Keppel Offshore & Marine case where there were evidentiary difficulties, it added.

In May 2023, the CPIB said it was “acting on information received” and investigating Seatrium, and individuals from the company for alleged corruption offences in Brazil.

This comes after Seatrium in March 2023 issued a notice that its wholly owned subsidiary, Estaleiro Jurong Aracruz, was being investigated for “alleged irregularities” in its practices.

Any person convicted of a corruption offence can be imprisoned for up to five years and/or fined up to $100,000. Any person convicted of an offence of obstruction of justice can be imprisoned for up to seven years and/or fined.

Last edited:

Seatrium defends director fees hike amid record loss

Company would not say when it expects to return to profitability

Seatrium chief executive Chris Ong.Photo: SEATRIUM

Asia Bureau ChiefSingapore

23 April 2024

Singapore’s leading offshore and marine engineering company Seatrium has defended a significant increase in its director fees this year despite a record net loss of almost S$2 billion (US$1.47 billion) in 2023, its third consecutive annual loss.

Seatrium on Monday responded to shareholder questions about a 23% increase in director fees, to S$2.9 million, despite the company not being profitable and not paying dividends for several years.

The contractor countered that it had appointed four additional directors “to create a world-class board capable of steering the company through a period of integration, strategic renewal and business turnaround”.

“A diverse and international board is vital to lead and guide the company as it aims to transform itself into becoming a premier global player with world-class talent and engineering capabilities,” stated Seatrium.

The company added that the enlarged board has highly experienced directors who are familiar with the industry and Seatrium’s international clientele.

However, the contractor would not be drawn on when it expected to turn a profit or pay a dividend.

“We do not provide forecasts on profitability. With the successful completion of the integration [of Sembcorp Marine and Keppel Offshore & Marine] and strategic review, Seatrium is expected to benefit from an enlarged business footprint, operational scale and enhanced capabilities,” said Seatrium.

“The board and the management team are focused on the company’s strategic directions and business operations to deliver an improved financial performance and build a profitable and resilient business over time.”

The company is targeting consistent earnings before interest, tax, depreciation and amortisation of at least S$1 billion, and to achieve a return on equity of 8% or more and net leverage of two to three times or lower through cycle from 2028 or earlier.

Seatrium added it is implementing S$300 million of savings initiatives, which it expects to fully realise on a recurring basis by the end of 2025.

The savings were identified across a range of items such as standardised pricing terms with customers, reduction in overheads, volume pooling, more efficient processes and asset rationalisation.

It has also additionally identified procurement savings of S$200 million from existing projects to be realised progressively as projects are executed over the next four years. These savings are driven by centralised procurement and improved supply chain management.

Similar threads

- Replies

- 3

- Views

- 859

- Replies

- 1

- Views

- 676

- Replies

- 12

- Views

- 855