Genting inheritance saga gets murkier with new RM1.6bil lawsuit

www.freemalaysiatoday.com

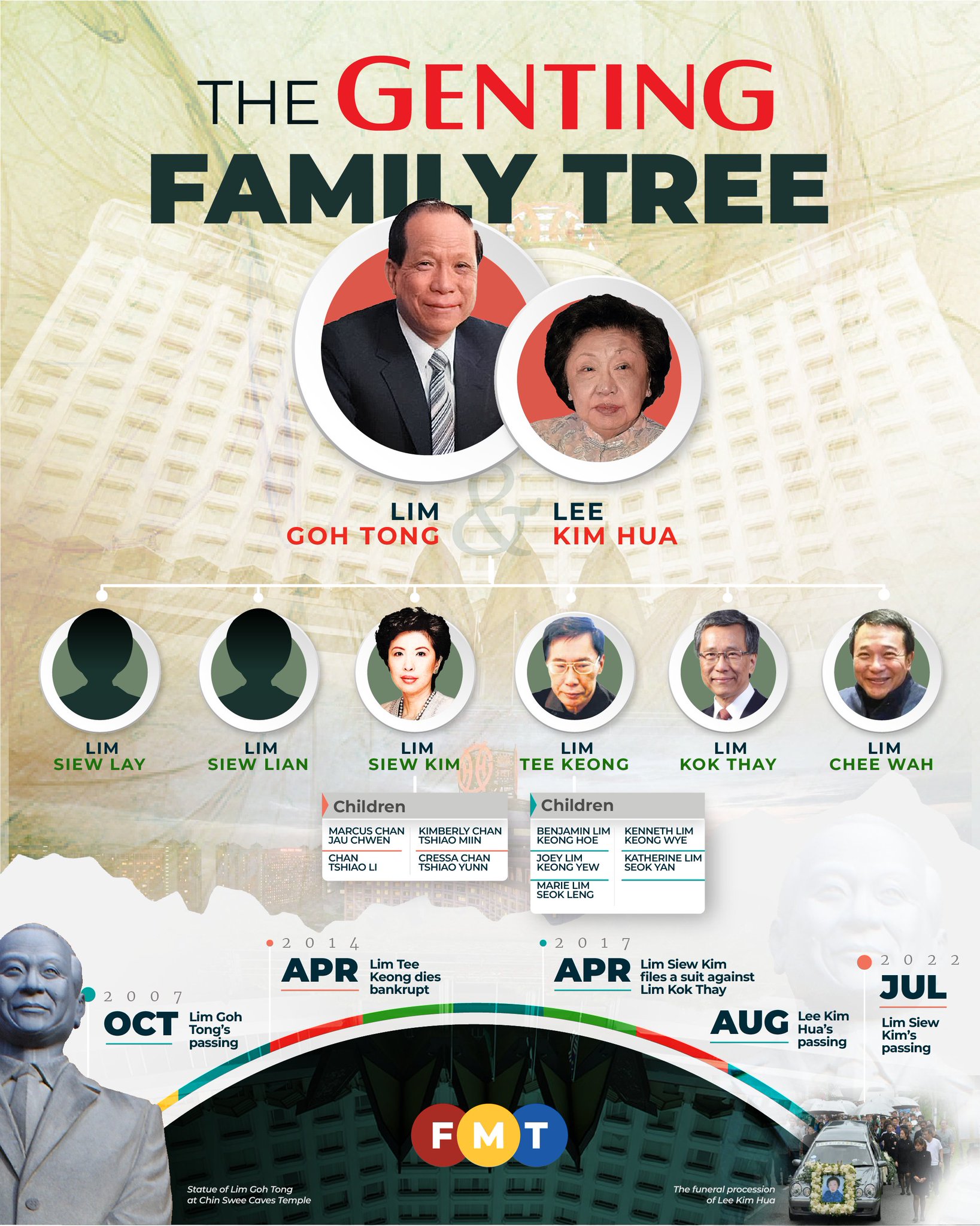

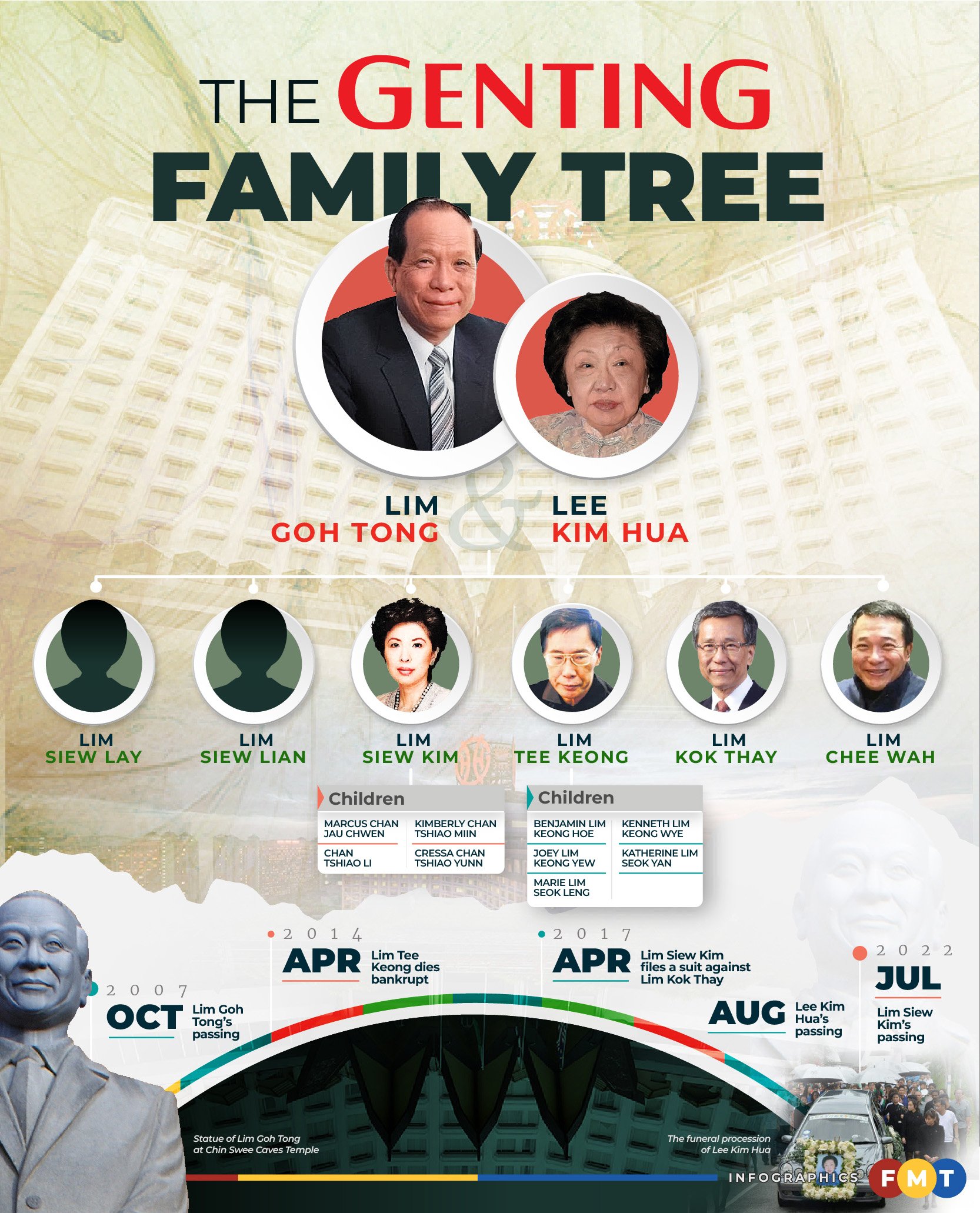

PETALING JAYA: Arriving in Malaya penniless and illiterate in the 1930s from Fujian, China, Lim Goh Tong could not have imagined that he would one day become the founder of the Genting gaming empire.

In life, he was one of the most prominent and richest tycoons in Malaysia, but since his passing on Oct 23, 2007, his legacy has been diminished by the widely publicised inheritance feuding that continues to the present day.

The Genting family inheritance saga has become even more convoluted with two of his grandchildren disputing the will of their late mother, Lim Siew Kim – Goh Tong’s youngest daughter.

The third child of the late gaming mogul, Siew Kim passed away, aged 73, on July 14, 2022, after battling ovarian cancer, leaving behind assets estimated to be worth RM1.6 billion.

In a suit brought against the executors of Siew Kim’s estate, plaintiffs Chan Tshiao Li and Kimberly Chan, are alleging fraud in the execution of their mother’s will and are challenging its validity.

The sisters say Siew Kim was “coerced” into signing the will while under the influence of a drug – morphine – which she took as part of her treatment.

The drug, they claim, disoriented and rendered her unable to understand or approve the contents of the will.

That, they say renders the will “null and void”, meaning Siew Kim died intestate (without a will).

The statement of claim further says that the duo “are the true and rightful beneficiaries” of their mother’s wealth, according to court documents sighted by The Edge.

Under the disputed will, a large portion of Siew Kim’s assets was bequeathed to Dikim Foundation, which she founded in 1983 together with husband Dick Chan (co-founder of accounting firm Kassim Chan & Co, now Deloitte) to provide education scholarships and aid to those in need.

In their statement of defence, the executors said: “This claim is frivolous and vexatious and an abuse of process. It is brought with ulterior intent and is an attempt to extract money from the deceased’s (Siew Kim’s) estate.”

Disputed inheritance

Court documents suggest that, under the will, the plaintiffs are entitled to a much smaller portion of Siew Kim’s estate compared to their other siblings, Marcus and Cressa Chan, and Dikim Foundation.

The foundation received 70% of the residuary estate, including property in Pearl Hill, Tanjung Bungah, Penang, and shareholding and property in Suria Waras Development Sdn Bhd.

The remaining 30% went to Marcus. He is also set to get property in Jalan Ampang, Kuala Lumpur, shareholding in Mantap Awana Sdn Bhd and the contents of safe deposit boxes kept with Public Bank Bhd.

Meanwhile, Cressa is set to receive RM10 million, and a property in Ampang Hilir, Kuala Lumpur, while with her daughter Jasmine will get RM50,000 a month.

In stark contrast, the two plaintiffs, Tshiao Li and Kimberly, were left with a mere RM900,000 and RM100,000, respectively.

Interestingly, potentially the largest chunk of Siew Kim’s estate – a whopping RM2.06 billion – is still being contested in court.

Reports from 2017 show that Siew Kim had filed a suit against her brother Lim Kok Thay (chairman and CEO of Genting Bhd) for shares in Genting Bhd.

Genting wars

As the patriarch of one of Malaysia’s most famous billionaire families, Goh Tong probably anticipated that disputes over inheritance would ensue upon his demise.

The wily tycoon devised an “inheritance system” based on separate trust entities for each of his children and their families.

However, despite best efforts, his carefully constructed inheritance scheme went awry even while he was still alive.

The 2003 bankruptcy of his eldest son Lim Tee Keong – who failed to repay some RM200 million of debt – threw a spanner into the works.

It forced Goh Tong to transfer ownership of Tee Keong’s trust to his younger brothers, Lim Chee Wah and Lim Kok Thay, throwing things into a spin and laying the foundation for a spate of inheritance disputes in later years.

Sadly for Tee Keong, the trust ownership never reverted to him, and he died a bankrupt in April 2014.

Here is a brief overview of the key legal battles involving Goh Tong’s family members.

Feud 1: Lee Kim Hua’s POA

When Goh Tong’s wife Lee Kim Hua passed away in 2017, her power of attorney (PA) was passed on to her to surviving sons, Kok Thay and Chee Wah.

Made irrevocable, the PA applies worldwide, giving them wide-ranging powers over her assets.

However, Tee Keong’s children – Joey, Benjamin and Marie Lim – dispute the PA, saying it was created to gain custody over their father’s family trust.

Benjamin has taken the dispute to court, claiming that the PA was made two years after his late grandmother suffered a stroke.

The POA was transferred for a mere RM10 via a document that bore her thumbprint instead of her signature.

Feud 2: Lim Tee Keong’s will

According to Tee Keong’s final will, his sons Joey and Benjamin were to be “excluded from any entitlement to his inheritance”.

Wife Agnes Tan and daughter Marie Lim were given 20% interest. The remaining 80% went to the two children he fathered with Joanne Fok – son Kenneth and daughter Katherine Lim.

Joey and Benjamin are challenging the validity of this will, alleging Tee Keong’s signature on the will was forged.

The brothers believe it was made under suspicious circumstances, just one month before their father’s death. Furthermore, they question why Chee Wah and Kok Thay were named trustees in the will.

In a separate suit, the brothers, this time with their sister Marie, have taken legal action against their two uncles over the removal of their names as beneficiaries of Tee Keong’s family trust.

Reports in 2019 indicated the inheritance feud that spurred nine ongoing suits was set to end amicably between the two factions, after both parties came to an agreement. However, no public statements have been issued on the matter.

Feud 3: Kok Thay vs Siew Kim for 800,000 Genting shares

The final case is between Kok Thay, Malaysia’s seventh richest billionaire, and Siew Kim, which brings us back to where we started.

Siew Kim alleges that she is the beneficial owner of 796,250 shares in Genting Bhd.

In a suit filed in 2017, she sought to have the shares transferred to her within 14 days, failing which, she says, Kok Thay and Kien Huat Realty, Goh Tong’s flagship company and majority stakeholder in Genting Bhd, must pay her RM2.06 billion.

The case is now at the Court of Appeal.

https://www.freemalaysiatoday.com/c...-saga-gets-murkier-with-new-rm1-6bil-lawsuit/