http://www.sohu.com/a/311551468_115479?spm=smpc.home.top-news3.4.1556861982607ejnqiha

27万块金条运到了德国,120多吨黄金运到了荷兰欧洲怎么了?

2019-05-03 08:53 欧盟 /条约 /德国

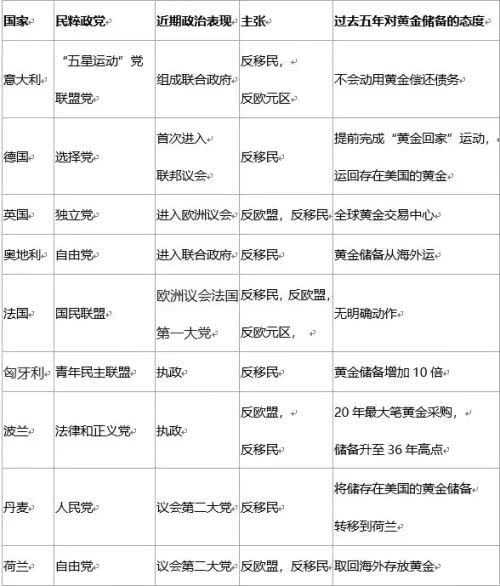

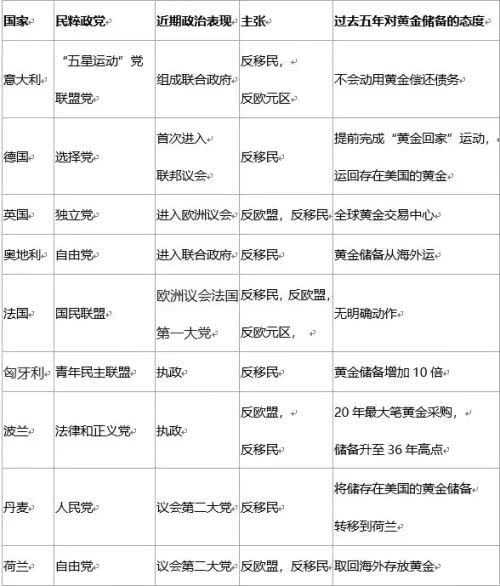

随着2019年5月下旬欧洲议会选举的日益临近,不少国家的建制派都在为民粹主义力量的再度抬头感到担心。因为这次选举结果被普遍视为欧洲民粹主义影响力的重要指针。

虽然民粹主义至今仍是政治学中界定最含糊的概念之一,但却不影响其近年来在欧洲大行其道。民粹主义经常和民族主义、威权主义还有自由主义等更为实质性的意识形态相结合。

在政治方面,欧洲各国的民粹主义者经常拿欧盟当靶子,而在经济方面,民粹主义势力却不约而同地选择了黄金,将其当作迎合民众信心的最佳切入点。

王亚宏

编辑

蒲海燕 瞭望智库

本文为瞭望智库原创文章,如需转载请在文前注明来源瞭望智库(zhcz)及作者信息,否则将严格追究法律责任。

欧洲各国央行坐拥金山

据世界黄金协会统计,全世界的中央银行等公共机构去年的黄金购买量为651.5吨,比前一年增加74%,是1971年废除美元兑换黄金制度以来的最高水平。目前在全球黄金市场中,央行成为一个重要的大买家,目前各国央行持有的黄金储备超过3.33万吨。

在这3.33万吨的黄金储备中,如果将欧元区当作一个整体的话,共计持有约1.08万吨黄金,超越拥有8133吨黄金储备的美国,成为全球最大的黄金储备持有方。

如果将国家范围扩大到整个欧盟的话,那么其官方黄金储备量会进一步提高到1.12万吨以上,超过全球央行黄金储备的三分之一还多。

欧洲各国央行“坐拥金山”,但如何使用这些巨额黄金储备是个问题。2月下旬背负沉重债务包袱的意大利传来消息,考虑出售部分黄金储备,以缓解债务压力。持欧洲怀疑论的意大利议会议员克劳迪奥·博尔吉提出《黄金所有权法案》,该法案的核心内容为,意大利的黄金储备为政府所有,而非央行,因此政府有权出售黄金。此前,组成意大利联合政府之一的“五星运动党”发起人格里洛曾建议在2019年第四季度尝试出售500到600吨黄金,此举能为政府带来多至200亿欧元(约合1534亿元人民币)的现金,这样意大利政府至少在未来4到5年内不用再纠结预算问题了。

在全球不少新兴市场央行纷纷增持黄金的大背景下,意大利考虑出售黄金让人感到惊诧。

而这股推动出售黄金力量的背后,则是近年来兴起的欧洲民粹主义势力。

欧洲民粹主义从本世纪初已逐渐抬头,但在最初数年影响力有限。欧洲民粹主义支持度大增,是2008年全球性金融危机后的事,尤其是2010年的欧元区主权债务危机后,民粹主义在欧洲盛行。2016年英国脱欧和2017年右翼势力在欧洲一系列大选中获得突破,标志着欧洲民粹主义力量达到顶峰。2018年欧洲民粹势力已有所缓和,今年5月举行的欧洲议会选举的结果,将成为衡量民粹主义发展趋势的重要指标。

欧洲民粹主义兴起是欧盟内各国民众反抗本国政治经济精英阶层的结果,其实质是欧洲一体化带来的利益在社会各阶层间和欧盟各国间分配不均而遭遇抵触,各国民粹势力则成为修正这种不均的代言力量。经过20年的发展,民粹政党在欧洲的支持率增长了两倍,目前每4个欧洲人中就有1个支持民粹主义,民粹政党领袖已经在11个欧洲国家政府中担任要职。

在民粹势力进入公共领域后,黄金储备则越来越多地成为他们达到政策目的的工具。

声势浩大的“黄金回家”运动

陷入债务泥潭的意大利才需要考虑用黄金家底还债,作为欧洲经济引擎的德国则完全没有这方面的顾虑。但德国央行在民粹主义力量的推动下也同样在对黄金储备下手,表现形式为声势浩大的“黄金回家”运动。

德国虽然是全球黄金储备第二多的国家,但由于历史的原因,其储备中的绝大部分都存在美国。

“黄金回家”运动从2013年开始,具体诉求就是将海外的黄金储备从纽约和巴黎运回到德国央行的金库中。

“黄金回家”运动的发起人彼得·柏林格是德国民粹主义政党新选择党的成员,该党就成立于“黄金回家”运动开始的同一年。在短短的六年里,凭借反欧盟和反移民的主张,新选择党几乎在全德国各地都确立了地盘。如果把柏林算进来的话,该党在德国16个地区议会中拥有10个席位,并在2017年的德国联邦议院全国选举中赢得席位,得票率为12.6%,成为德国自第二次世界大战结束以来首个进入议会的右翼民粹主义政党。

借着“黄金回家”运动积累起的巨大声望,柏林格在德国大选中顺利进入议会,成为议员。柏林格坚信黄金储备是国家对抗风险的基石,尤其是在欧元风雨飘摇的情况下更是如此。因此他还批评德国央行至今没有公布黄金储备的金条编号完全名录,也没有提供照片或视频来证明法兰克福金库里目前存有12.5万块金条。

在柏林格的推动下,德国“黄金回家”运动提前完成。从2013年起的五年里,德国将存在美国和法国的大约27万块金条运回了法兰克福金库中。为了向关心此事的民众做出交代,2018年德国央行还办了一个展览,向公众展示黄金储备,让他们对德国的黄金家底放心。以黄金为主题的特展使德国公众第一次有机会看到德国央行丰富的黄金藏品,其中最引人瞩目的就是储备金条。

那些金条都是上世纪五六十年代的积累,当时出口激增导致德国与其他国家出现了大笔贸易顺差,在布雷顿森林体系下德国将那些贸易盈余转化为黄金。特展解释了金条在货币和外汇政策中所起的作用,并说明了它们是如何储存在德国央行里的,但没有说明的一点是,兴起的民粹主义推动了这些金条出现在特展中。

除了德国外,还有一些欧洲国家也陆续加入了“黄金回家”运动的行列。比如荷兰央行宣布运回了在纽约联邦储备银行的122.5吨黄金,奥地利也计划召回海外的黄金储备。在这两个国家,民粹主义势力同样高涨。2017年3月的大选中,荷兰民粹主义政党自由党获得的议席虽没有预想的多,但仍比之前增加了4个席位,成为议会中的第二大党。2017年10月举行的奥地利大选中,民粹主义政党自由党更是成为联合政府中的一员。

民粹力量选择用黄金反欧元

黄金是最古老的价值尺度和衡量手段, 新近兴起的欧民粹力量之所以会这样“返古”地寻求拥抱黄金,背后是他们反欧元、反全球化的诉求。

德国新选择党坚定地反对欧元,反对“德国纳税人”拯救欧元区的负债国。尽管该政党的主要宣传口径均对准难民问题,但是其党章中仍然有一旦执政将发动全民公投决定是否保留欧元。德国新选择党的崛起利用了 德国民间充斥着对欧盟、欧元区未来缺乏信心的思潮,也对迫使德国人为欧元区负债国“埋单”非常不满,德国新选择党充分利用民间这种思潮而崛起,柏林格(新选择党议员)发起的“黄金回家”运动也正是这股风潮的产物。

2018年,匈牙利的黄金购买行为尤其引人注目,在黄金市场蛰伏多年后,匈牙利央行将黄金储备增加了10倍。该央行称黄金“在极端市场条件下或国际金融体系结构变化或地缘政治危机深化时,起着主要的防御线作用”。匈牙利提到的极端条件很容易让人联想起欧盟对该国险些进行的制裁。

由于民粹主义政党青年民主联盟在匈牙利执政,欧盟发布报告称"匈牙利的民主、法治和基本权利受到系统地威胁"。2018年9月欧洲议会通过决议,同意援引《欧盟条约》第七条展开对匈牙利“破坏民主制度”的调查,必要时将停止匈牙利在欧盟的投票权。那是欧洲议会第一次投票决定对一个欧盟成员国展开援引自《欧盟条约》第七条的惩罚措施。

在被欧盟调查前,匈牙利的黄金储备长期停留在3.1吨的水平上,在受到制裁威胁后,仅仅在10月份的前两周,匈牙利的黄金储备就增加了28.4吨,使得其黄金储备总量达到31.5吨。结合匈牙利央行提到的“国际金融体系结构变化或地缘政治危机深化时,起着主要的防御线的作用”的说法,市场普遍认为这种防御就是针对欧盟。

欧洲不少民粹主义政党都有反欧盟的诉求,欧元区国家更是直接将矛头指向了欧元。而要取代欧元的话,能成为最后支付手段的黄金就成了现实选择。相比匈牙利央行需要紧急增持黄金,欧洲其他民粹主义盛行的国家就要从容得多,因为那些国家本身拥有大量的黄金储备,而这些黄金储备也让那些国家可以更有底气地说出反欧盟和反欧元的言论。

当然,尽管欧洲的民粹主义政党将黄金当作实现其政治目标的工具, 黄金储备本身是价值中立的,和民粹主义没有直接联系。

国际

Observer network

70,000 articles

18.3 billion total reading

View TA's article >

78

share to

270,000 gold bars were shipped to Germany, and more than 120 tons of gold were shipped to the Netherlands and Europe.

2019-05-03 08:53 EU / Treaty / Germany

With the approaching of the European Parliament elections in late May 2019, many state-owned factions are worried about the resurgence of populist forces. Because the results of this election are widely regarded as an important indicator of the influence of European populism.

Although populism is still one of the most vague concepts in political science, it does not affect its popularity in Europe in recent years. Populism is often combined with more substantial ideologies such as nationalism, authoritarianism, and liberalism.

On the political front, populists in European countries often take the EU as a target, while on the economic front, populist forces have chosen gold in the same place as the best entry point to meet the confidence of the people.

Text

Wang Yahong

edit

Pu Haiyan

This article is the original article of the think tank. If you need to reprint, please indicate the source of the think tank (zhcz) and the author's information before the text, otherwise the legal responsibility will be strictly investigated.

1

European central banks sit on Jinshan

According to the World Gold Council, the amount of gold purchased by public institutions such as the Central Bank of the world last year was 651.5 tons, an increase of 74% over the previous year. It was the highest level since the abolition of the US dollar to the gold system in 1971. At present, in the global gold market, the central bank has become an important big buyer. At present, central banks hold more than 33,300 tons of gold reserves.

In this 33,300 tons of gold reserves, if the euro zone is considered as a whole, it will hold about 10,800 tons of gold, surpassing the United States with 8133 tons of gold reserves, becoming the world's largest gold reserve holder.

If the country is extended to the entire EU, then its official gold reserves will further increase to more than 112,000 tons, more than one-third of the global central bank's gold reserves.

Central banks in Europe are “sitting in Jinshan”, but how to use these huge gold reserves is a problem. In late February, Italy, carrying heavy debt burdens, came to the news and considered selling some gold reserves to ease debt pressure. Claudio Bolgi, a member of the Italian skeptical European Parliament, proposed the "Golden Ownership Act", the core of which is that Italy's gold reserves are owned by the government, not the central bank, so the government has the right to sell gold. Prior to this, Grilo, the founder of the "Five Star Movement Party", one of the Italian coalition governments, had suggested trying to sell 500 to 600 tons of gold in the fourth quarter of 2019, which could bring the government up to 20 billion euros (about 1534). The cash of 100 million yuan, so the Italian government will not have to worry about budgeting at least in the next 4 to 5 years.

In the context of many central banks in the world that have increased their holdings of gold, Italy is surprised to consider selling gold.

Behind this push to sell gold is the European populist forces that have emerged in recent years.

European populism has gradually risen from the beginning of this century, but its influence in the first few years is limited. The increase in European populist support was after the global financial crisis in 2008, especially after the Eurozone sovereign debt crisis in 2010, populism prevailed in Europe. In 2016, Brexit and the 2017 right-wing forces made breakthroughs in a series of European elections, marking the peak of European populist forces. The European populist forces have eased in 2018, and the results of the European Parliament elections held in May this year will be an important indicator for measuring the development trend of populism.

The rise of European populism is the result of the people of the European Union who are against the political and economic elites of the country. The essence of this is that the benefits brought about by European integration are in conflict with the uneven distribution among the various strata of the society and the EU countries. This unevenness of endorsement power. After 20 years of development, the support rate of populist parties in Europe has tripled. Currently, one out of every four Europeans supports populism, and populist party leaders have held important positions in 11 European governments.

After the populist forces entered the public sphere, gold reserves have increasingly become their tools for policy purposes.

2

The majestic "Golden Home" campaign

Italy, which has fallen into debt, needs to consider repaying its debts with gold. Germany, the engine of the European economy, has no such concerns at all. But the Bundesbank, also driven by populist forces, is also starting to deal with gold reserves, in the form of a massive “golden home” campaign.

Although Germany is the second largest country in terms of global gold reserves, due to historical reasons, most of its reserves exist in the United States.

The “Golden Home” campaign began in 2013 with the specific appeal of transporting overseas gold reserves from New York and Paris back to the Bank of Germany’s vault.

Peter Berger, the founder of the "Golden Home" campaign, is a member of the German Populist Party's New Choice Party, which was founded in the same year as the "Golden Home" campaign. In the short span of six years, with the anti-EU and anti-immigration claims, the New Choice Party has established sites in almost all parts of Germany. If Berlin is included, the party has 10 seats in 16 regional councils in Germany and won seats in the 2017 German Bundestag national election, with a 12.6% vote, becoming Germany since the end of the Second World War. The first right-wing populist party to enter the parliament.

With the great reputation accumulated by the "Golden Home" campaign, Berliner successfully entered the parliament in the German general election and became a member of parliament. Berliner believes that gold reserves are the cornerstone of the country's fight against risks, especially in the case of the euro. Therefore, he also criticized the Bundesbank for not publishing the full list of the gold bars of the gold reserves, and did not provide photos or videos to prove that there are currently 125,000 gold bars in Frankfurt.

Under the impetus of Berliner, the German “Golden Home” campaign was completed ahead of schedule. In the five years from 2013, Germany has shipped about 270,000 gold bars from the United States and France back to the Frankfurt vault. In order to explain to the people concerned about this matter, the Bundesbank also organized an exhibition in 2018 to show the public the gold reserves, so that they can rest assured that the German gold home. The special exhibition on the theme of gold gave the German public the opportunity to see the rich gold collection of the Bundesbank for the first time, the most striking of which was the reserve of gold bars.

Those gold bars were accumulated in the 1950s and 1960s, when the surge in exports led to a large trade surplus between Germany and other countries. Under the Bretton Woods system, Germany turned those trade surpluses into gold. The special exhibition explains the role of gold bars in monetary and foreign exchange policies and explains how they are stored in the Bundesbank, but it is not stated that the rise of populism has prompted these gold bars to appear in special exhibitions.

In addition to Germany, there are also some European countries that have joined the ranks of the “Golden Home” campaign. For example, the Dutch central bank announced that it had shipped 122.5 tons of gold at the Federal Reserve Bank of New York, and Austria also plans to recall overseas gold reserves. In both countries, populist forces are equally high. In the March 2017 general election, the Dutch populist party Liberal Party won no more seats than expected, but it still increased its four seats and became the second largest party in the parliament. In the Austrian general election held in October 2017, the populist party Liberal Party became a member of the coalition government.

3

Populist forces choose to use gold against the euro

Gold is the oldest value scale and measure. The reason why the newly emerging European populist forces seek to embrace gold in such a “returning ancient” is behind their anti-Euro and anti-globalization demands.

The German New Choice Party firmly opposes the euro and opposes "German taxpayers" to save the debtor countries of the euro zone. Although the main propaganda of the party is aimed at the refugee issue, there is still a party constitution that will decide whether to reserve the euro once the ruling will launch a referendum. The rise of Germany's new choice party has taken advantage of the German people's ideological trend of lacking confidence in the future of the EU and the Eurozone. It is also very dissatisfied with forcing the Germans to "pay the bill" for the euro zone debtor countries. The German New Choice Party has fully used the folks to rise up. The "Golden Home" campaign initiated by Berliner (the newly elected party member) is also the product of this trend.

In 2018, Hungary’s gold purchases were particularly striking. After years of stagnation in the gold market, the Hungarian central bank increased its gold reserves by a factor of 10. The central bank said that gold "has played a major defensive role in extreme market conditions or when the international financial system changes or the geopolitical crisis deepens." The extreme conditions mentioned by Hungary are easily reminiscent of the EU’s almost dangerous sanctions against the country.

Since the populist political youth alliance in Hungary is in power, the EU issued a report saying that "Hungarian democracy, the rule of law and basic rights are systematically threatened." In September 2018, the European Parliament passed a resolution agreeing to invoke the Article 7 of the EU Treaty to launch an investigation into Hungary’s “destruction of democracy” and, if necessary, to stop Hungary’s voting rights in the EU. That was the first time the European Parliament voted to punish an EU member state for citing Article 7 of the EU Treaty.

Before being investigated by the EU, Hungary's gold reserves stayed at the level of 3.1 tons for a long time. After the threat of sanctions, Hungary's gold reserves increased by 28.4 tons in the first two weeks of October, making its total gold reserves. It reached 31.5 tons. In light of the Hungarian central bank’s statement that “the international financial system changes or the geopolitical crisis deepens and plays a major role as a defensive line”, the market generally believes that this defense is aimed at the EU.

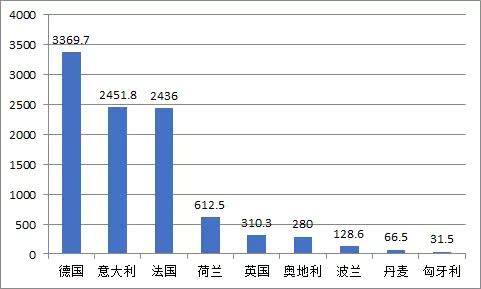

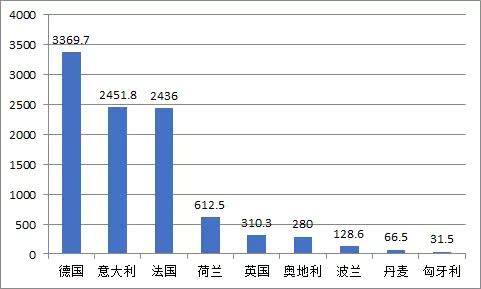

European populism prevails in the official gold reserves of the nine countries (Source: International Monetary Fund, unit: tons)

Many populist parties in Europe have anti-EU demands, and the euro zone countries have directly pointed the finger at the euro. To replace the euro, gold, which can be the last means of payment, becomes a realistic choice. Compared with the Hungarian central bank's need to urgently increase its holdings of gold, other populist countries in Europe will be much more comfortable, because those countries have a large amount of gold reserves, and these gold reserves allow those countries to speak more anti-EU. And anti-Euro remarks.

Of course, although populist parties in Europe use gold as a tool to achieve their political goals, gold reserves are inherently value-neutral and not directly related to populism.

http://www.informationclearinghouse.info/49298.htm

=====

https://www.ft.com/content/4edf00ee-a43c-11e7-8d56-98a09be71849

How Germany got its gold back

It was kept abroad to escape the Soviet Union. But then Germany decided to bring it home

Claire Jones in Frankfurt

November 11, 2017

Print this page 94

When Carl-Ludwig Thiele was 11, his aunt gave him a 21-carat gold coin as a gift. “It was an incredible feeling to own it. I still have it now and can picture it. There is an image of Pope John XXIII on one side, and on the reverse an image of the Holy Ghost floating above the bishops.”

In the five decades since receiving that coin, Mr Thiele — tall and forthright with a liveliness in his face when the subject switches to bullion — has risen high in Germany’s state bureaucracy. He served 20 years in parliament before making the switch from Berlin to Frankfurt to sit on the executive board of the Bundesbank, the country’s central bank and custodian of its gold.

Today, Germany is one of the biggest holders of gold in the world: it owns 3,378 tonnes, worth €119bn, second only to the US. But until recently, most of that gold was stored in New York, London and Paris. When the country decided to bring half of its gold back home, Mr Thiele was put in charge.

Over the past five years, he has masterminded the transportation of almost 54,000 gold bars — each with a value of just under $510,000 — to Frankfurt, Germany’s financial capital, moving $27bn (in today’s prices) from the vaults of the US Federal Reserve and the Banque de France. The last bars arrived at the Bundesbank’s headquarters, a few kilometres north of Frankfurt’s city centre, in August. But how Germany’s gold came to be abroad is a story that goes back to the second world war and beyond.

Germany has a stronger relationship with gold than most nations. The country’s experience with hyperinflation between 1919 and 1923, during the years of the Weimar Republic, is ingrained in the national consciousness. Gold, above all, stands for stability.

Carl-Ludwig Thiele masterminded the transportation of almost 54,000 gold bars — worth $27bn — to Frankfurt © Martin Leissl for the FT

During the second world war, Nazi Germany looted gold from central banks across Europe. The Reichsbank stored more than 3,700kg (4.1t) of this stolen gold through the Bank for International Settlements in Switzerland. By the time the Allies, through the Tripartite Commission for the Restitution of Monetary Gold, recovered it in 1948, Germany’s state coffers were bare.

It was during the Wirtschaftswunder — the economic miracle of the 1950s and 1960s — that West Germany began to stockpile large amounts of gold. The country’s export surpluses meant businesses were flush with dollars, which were swapped at the central bank — initially the Bank deutscher Länder, then, from 1957, its successor the Bundesbank — in return for Deutschmarks. Under the Bretton Woods system of fixed exchange rates that then underpinned global finance, the Bundesbank could use the dollars to purchase gold at the rate of $35 an ounce, storing most of its holdings in the New York Fed’s underground stores on Liberty Street. In 2012, just before the move began, just over 1,500 tonnes of German gold was stored there.

Frankfurt was not much more than 100km from the border with Soviet-controlled East Germany, so with the threat of Russian invasion, West Germany kept bullion built up before the collapse of Bretton Woods in the early 1970s abroad. “During the cold war, the threat came from the east, so it made sense to store it further west, in Paris, London or New York,” says Mr Thiele. After the fall of the Berlin Wall in 1989 and the collapse of the Soviet Union in 1991, that rationale disappeared.

Germany has brought gold back from the Bank of England © Getty Images

Mr Thiele masterminded the transportation of almost 54,000 gold bars — worth $27bn — to Frankfurt

It was another decade before the Bundesbank began to repatriate its gold, however. In the early years of the new millennium, it moved 930 tonnes, worth about $40bn today, from the vaults beneath the Bank of England’s Threadneedle Street base in the City of London back to Frankfurt, after the Bank increased its rents. That move, shrouded in secrecy owing to security concerns, came as pressure mounted on the Bundesbank to reveal more about the nation’s reserves.

Ten years later, the Bundesrechnungshof, Germany’s federal accounting office, and members of the German parliament, the Bundestag, began asking questions about the country’s gold. Lawmakers wanted to know where the gold was stored, calling on the central bank to provide an inventory of the bars in its possession.

More controversial was a public campaign spearheaded by Peter Boehringer, a former asset manager who earlier this year became a member of parliament representing the Eurosceptic Alternative for Germany (AfD) party. “Initially we weren’t taken seriously. We wrote to the Bundesbank, but we got standardised, worthless answers. We didn’t get any answers, so we had to go public,” Mr Boehringer says. “We had attention from online media, then the international media. We are the owners; we’re talking about €100bn of public assets.”

Mr Boehringer believes that Germany needs its gold back for more than symbolic reasons. The European Central Bank’s aggressive response to the global financial crisis has, he says, made cash worthless. “People are always interested in gold, but we live in a time when central banks are running amok. In 1971, all currencies were linked to gold. That’s no longer the case, and the behaviour of central banks is ridiculous. More and more people can see that.”

The Bundesbank denies that Mr Boehringer’s campaign spurred its decision to bring the gold home. It also denies accusations by gold bugs (those bullish on gold as a commodity) that the German gold has disappeared from the New York Fed’s vaults. Mr Thiele says he has seen it twice, in 2012 and 2014. “It is there. And it was never a problem to see it or have it transported to Germany.”

Gold on display at the Frankfurt headquarters of the Bundesbank. Repatriation of German gold began in the early years of the 21st century © Martin Leissl for the FT

Gold’s appeal has risen in tandem with turmoil throughout history. Many economists agree with John Maynard Keynes’ attack on linking gold and paper money as a “barbarous relic” of a bygone era. The link was abandoned in the 1970s, when the Bretton Woods system ended. Some nations have sold much of their gold since.

Yet when markets become choppy or heads of state turn warmongers, bullion lures back investors. During the most recent global financial crisis, the price rose from around $650 an ounce in the spring of 2007 to a peak of more than $1,800 in summer 2011.

Other central banks have reacted to unrest by storing gold abroad, too, although their methods of transportation have, in many instances, created considerable risk. During the first week of July 1940, the Bank of England had gold worth £200m ($18bn in today’s prices, according to the World Gold Council) on liners in transit over the Atlantic. If any of those ships had sunk, the Bank would not have received a penny in return for the loss of almost 41,000 bars, because the shipments were irreplaceable and thus uninsurable.

A Bundesbank employee piles up bars of gold during a press conference announcing the planned repatriation of German gold reserves © Frank Rumpenhorst/DPA/PA Images

In January 2013, the Bundesbank revealed where its gold was stored and announced the plan to move half of it home. The bank has refused to divulge how the 53,780 bars were transferred, but bullion transportation has moved on from the era of ocean liners.

People familiar with the field say it was most likely that the gold was flown from Paris and New York back to Frankfurt. Road transportation may have been tried but is unlikely to have been used frequently. Moving the gold 600km from the Banque de France’s vaults in the middle of Paris to the Bundesbank would put drivers at risk, and the bars are often too heavy to be moved in substantial volumes. While a bar of gold takes up less space than a litre of liquid, each weighs about 12.5kg.

Once the Bundesbank had decided to move its gold, lawyers then had to scour contracts to insure it against being lost in transit. Many insurers pay out only in dollars, rather than the precious metal, potentially leaving the central bank on the hook if the price of gold were to rise between the contract being signed and the bullion arriving safely in the Bundesbank’s vaults.

More than 4,400 bars transferred from New York were taken to Switzerland, where two smelters remoulded the bullion into bars that meet London Good Delivery standards for ease of handling. The London market requires gold bars to look as they do on the silver screen — the technical name for the shape is a trapezoid prism — as their sloping edges make the bars easier to pick up than New York bars, which are shaped like simpler-to-store bricks.

Germany has brought gold back from the New York Federal Reserve © National Geographic Creative / Alamy Stock Photo

The whole exercise cost €7.6m. All of the bars returned from both New York and Paris were checked by an in-house team of between five and eight people. The team assessed the purity using X-ray techniques, and by weighing the bars. In October 2015, the bank published a list (since updated annually) with specific details of all of the gold it held. The gold still abroad is in London — the world’s biggest bullion market — and New York, which remains an important location because of the US dollar’s status as a global reserve currency. Germany currently has no plans to repatriate it.

It is a sunny day in late October and light streams through the large windows of a room on the Bundesbank’s executive floor. The views stretch across the city’s skyline and beyond to the forests that surround the south of the city. But my attention is fixed on the five gold bars before me.

Together they are worth €2.2m, and I imagine all the fun — the exquisite food, the plush properties, the lavish holidays — one could buy with that or the jewellery one could make. It seems a shame to keep the wealth locked up, out of sight, in a form no one will use. Yet these bars — each with slight differences in shape and weight, some dating back to the 1950s — hold an allure.

In August 2017, Carl-Ludwig Thiele announced the repatriation of German gold reserves from Paris and New York © ARNE DEDERT/AFP/Getty Images

Mr Thiele remarks on the attention that surrounded the operation. When the move was completed earlier this year, it made front-page headlines and filled prime slots on evening news broadcasts. “There is a lot of public interest,” he says, with some understatement.

It is a strange sensation to pick up gold for the first time. The surfaces of the Bundesbank’s bars are unpolished, each with its own distinct branding and scratches — signs of the metal’s malleability. Its colour gives it a certain appeal, but it is not until you feel the weight of it — the bars are hard to hold for more than a few seconds — that you begin to understand why.

According to the pictures, the walls and shelves of the Bundesbank’s vaults are grey, in keeping with the design of the headquarters, a Brutalist 13-storey concrete slab built long and narrow like a ship. But we are denied access and the gold will remain out of public view — a decision that Mr Thiele acknowledges will fuel suspicions about whether half of Germany’s gold has really come home.

“We’re the most transparent of all the central banks about our holdings of gold and there are still more questions. With gold there are always more questions.”

Main image: Nils Thies/Deutsche Bundesbank

Get alerts on Gold when a new story is published

Copyright The Financial Times Limited 2019. All rights reserved.

27万块金条运到了德国,120多吨黄金运到了荷兰欧洲怎么了?

2019-05-03 08:53 欧盟 /条约 /德国

随着2019年5月下旬欧洲议会选举的日益临近,不少国家的建制派都在为民粹主义力量的再度抬头感到担心。因为这次选举结果被普遍视为欧洲民粹主义影响力的重要指针。

虽然民粹主义至今仍是政治学中界定最含糊的概念之一,但却不影响其近年来在欧洲大行其道。民粹主义经常和民族主义、威权主义还有自由主义等更为实质性的意识形态相结合。

在政治方面,欧洲各国的民粹主义者经常拿欧盟当靶子,而在经济方面,民粹主义势力却不约而同地选择了黄金,将其当作迎合民众信心的最佳切入点。

文

王亚宏

编辑

蒲海燕 瞭望智库

本文为瞭望智库原创文章,如需转载请在文前注明来源瞭望智库(zhcz)及作者信息,否则将严格追究法律责任。

1

欧洲各国央行坐拥金山

据世界黄金协会统计,全世界的中央银行等公共机构去年的黄金购买量为651.5吨,比前一年增加74%,是1971年废除美元兑换黄金制度以来的最高水平。目前在全球黄金市场中,央行成为一个重要的大买家,目前各国央行持有的黄金储备超过3.33万吨。

在这3.33万吨的黄金储备中,如果将欧元区当作一个整体的话,共计持有约1.08万吨黄金,超越拥有8133吨黄金储备的美国,成为全球最大的黄金储备持有方。

如果将国家范围扩大到整个欧盟的话,那么其官方黄金储备量会进一步提高到1.12万吨以上,超过全球央行黄金储备的三分之一还多。

欧洲各国央行“坐拥金山”,但如何使用这些巨额黄金储备是个问题。2月下旬背负沉重债务包袱的意大利传来消息,考虑出售部分黄金储备,以缓解债务压力。持欧洲怀疑论的意大利议会议员克劳迪奥·博尔吉提出《黄金所有权法案》,该法案的核心内容为,意大利的黄金储备为政府所有,而非央行,因此政府有权出售黄金。此前,组成意大利联合政府之一的“五星运动党”发起人格里洛曾建议在2019年第四季度尝试出售500到600吨黄金,此举能为政府带来多至200亿欧元(约合1534亿元人民币)的现金,这样意大利政府至少在未来4到5年内不用再纠结预算问题了。

在全球不少新兴市场央行纷纷增持黄金的大背景下,意大利考虑出售黄金让人感到惊诧。

而这股推动出售黄金力量的背后,则是近年来兴起的欧洲民粹主义势力。

欧洲民粹主义从本世纪初已逐渐抬头,但在最初数年影响力有限。欧洲民粹主义支持度大增,是2008年全球性金融危机后的事,尤其是2010年的欧元区主权债务危机后,民粹主义在欧洲盛行。2016年英国脱欧和2017年右翼势力在欧洲一系列大选中获得突破,标志着欧洲民粹主义力量达到顶峰。2018年欧洲民粹势力已有所缓和,今年5月举行的欧洲议会选举的结果,将成为衡量民粹主义发展趋势的重要指标。

欧洲民粹主义兴起是欧盟内各国民众反抗本国政治经济精英阶层的结果,其实质是欧洲一体化带来的利益在社会各阶层间和欧盟各国间分配不均而遭遇抵触,各国民粹势力则成为修正这种不均的代言力量。经过20年的发展,民粹政党在欧洲的支持率增长了两倍,目前每4个欧洲人中就有1个支持民粹主义,民粹政党领袖已经在11个欧洲国家政府中担任要职。

在民粹势力进入公共领域后,黄金储备则越来越多地成为他们达到政策目的的工具。

2

声势浩大的“黄金回家”运动

陷入债务泥潭的意大利才需要考虑用黄金家底还债,作为欧洲经济引擎的德国则完全没有这方面的顾虑。但德国央行在民粹主义力量的推动下也同样在对黄金储备下手,表现形式为声势浩大的“黄金回家”运动。

德国虽然是全球黄金储备第二多的国家,但由于历史的原因,其储备中的绝大部分都存在美国。

“黄金回家”运动从2013年开始,具体诉求就是将海外的黄金储备从纽约和巴黎运回到德国央行的金库中。

“黄金回家”运动的发起人彼得·柏林格是德国民粹主义政党新选择党的成员,该党就成立于“黄金回家”运动开始的同一年。在短短的六年里,凭借反欧盟和反移民的主张,新选择党几乎在全德国各地都确立了地盘。如果把柏林算进来的话,该党在德国16个地区议会中拥有10个席位,并在2017年的德国联邦议院全国选举中赢得席位,得票率为12.6%,成为德国自第二次世界大战结束以来首个进入议会的右翼民粹主义政党。

借着“黄金回家”运动积累起的巨大声望,柏林格在德国大选中顺利进入议会,成为议员。柏林格坚信黄金储备是国家对抗风险的基石,尤其是在欧元风雨飘摇的情况下更是如此。因此他还批评德国央行至今没有公布黄金储备的金条编号完全名录,也没有提供照片或视频来证明法兰克福金库里目前存有12.5万块金条。

在柏林格的推动下,德国“黄金回家”运动提前完成。从2013年起的五年里,德国将存在美国和法国的大约27万块金条运回了法兰克福金库中。为了向关心此事的民众做出交代,2018年德国央行还办了一个展览,向公众展示黄金储备,让他们对德国的黄金家底放心。以黄金为主题的特展使德国公众第一次有机会看到德国央行丰富的黄金藏品,其中最引人瞩目的就是储备金条。

那些金条都是上世纪五六十年代的积累,当时出口激增导致德国与其他国家出现了大笔贸易顺差,在布雷顿森林体系下德国将那些贸易盈余转化为黄金。特展解释了金条在货币和外汇政策中所起的作用,并说明了它们是如何储存在德国央行里的,但没有说明的一点是,兴起的民粹主义推动了这些金条出现在特展中。

除了德国外,还有一些欧洲国家也陆续加入了“黄金回家”运动的行列。比如荷兰央行宣布运回了在纽约联邦储备银行的122.5吨黄金,奥地利也计划召回海外的黄金储备。在这两个国家,民粹主义势力同样高涨。2017年3月的大选中,荷兰民粹主义政党自由党获得的议席虽没有预想的多,但仍比之前增加了4个席位,成为议会中的第二大党。2017年10月举行的奥地利大选中,民粹主义政党自由党更是成为联合政府中的一员。

3

民粹力量选择用黄金反欧元

黄金是最古老的价值尺度和衡量手段, 新近兴起的欧民粹力量之所以会这样“返古”地寻求拥抱黄金,背后是他们反欧元、反全球化的诉求。

德国新选择党坚定地反对欧元,反对“德国纳税人”拯救欧元区的负债国。尽管该政党的主要宣传口径均对准难民问题,但是其党章中仍然有一旦执政将发动全民公投决定是否保留欧元。德国新选择党的崛起利用了 德国民间充斥着对欧盟、欧元区未来缺乏信心的思潮,也对迫使德国人为欧元区负债国“埋单”非常不满,德国新选择党充分利用民间这种思潮而崛起,柏林格(新选择党议员)发起的“黄金回家”运动也正是这股风潮的产物。

2018年,匈牙利的黄金购买行为尤其引人注目,在黄金市场蛰伏多年后,匈牙利央行将黄金储备增加了10倍。该央行称黄金“在极端市场条件下或国际金融体系结构变化或地缘政治危机深化时,起着主要的防御线作用”。匈牙利提到的极端条件很容易让人联想起欧盟对该国险些进行的制裁。

由于民粹主义政党青年民主联盟在匈牙利执政,欧盟发布报告称"匈牙利的民主、法治和基本权利受到系统地威胁"。2018年9月欧洲议会通过决议,同意援引《欧盟条约》第七条展开对匈牙利“破坏民主制度”的调查,必要时将停止匈牙利在欧盟的投票权。那是欧洲议会第一次投票决定对一个欧盟成员国展开援引自《欧盟条约》第七条的惩罚措施。

在被欧盟调查前,匈牙利的黄金储备长期停留在3.1吨的水平上,在受到制裁威胁后,仅仅在10月份的前两周,匈牙利的黄金储备就增加了28.4吨,使得其黄金储备总量达到31.5吨。结合匈牙利央行提到的“国际金融体系结构变化或地缘政治危机深化时,起着主要的防御线的作用”的说法,市场普遍认为这种防御就是针对欧盟。

欧洲民粹主义盛行九国的官方黄金储备(数据来源:国际货币基金组织,单位:吨)

欧洲不少民粹主义政党都有反欧盟的诉求,欧元区国家更是直接将矛头指向了欧元。而要取代欧元的话,能成为最后支付手段的黄金就成了现实选择。相比匈牙利央行需要紧急增持黄金,欧洲其他民粹主义盛行的国家就要从容得多,因为那些国家本身拥有大量的黄金储备,而这些黄金储备也让那些国家可以更有底气地说出反欧盟和反欧元的言论。

当然,尽管欧洲的民粹主义政党将黄金当作实现其政治目标的工具, 黄金储备本身是价值中立的,和民粹主义没有直接联系。

国际

Observer network

70,000 articles

18.3 billion total reading

View TA's article >

78

share to

270,000 gold bars were shipped to Germany, and more than 120 tons of gold were shipped to the Netherlands and Europe.

2019-05-03 08:53 EU / Treaty / Germany

With the approaching of the European Parliament elections in late May 2019, many state-owned factions are worried about the resurgence of populist forces. Because the results of this election are widely regarded as an important indicator of the influence of European populism.

Although populism is still one of the most vague concepts in political science, it does not affect its popularity in Europe in recent years. Populism is often combined with more substantial ideologies such as nationalism, authoritarianism, and liberalism.

On the political front, populists in European countries often take the EU as a target, while on the economic front, populist forces have chosen gold in the same place as the best entry point to meet the confidence of the people.

Text

Wang Yahong

edit

Pu Haiyan

This article is the original article of the think tank. If you need to reprint, please indicate the source of the think tank (zhcz) and the author's information before the text, otherwise the legal responsibility will be strictly investigated.

1

European central banks sit on Jinshan

According to the World Gold Council, the amount of gold purchased by public institutions such as the Central Bank of the world last year was 651.5 tons, an increase of 74% over the previous year. It was the highest level since the abolition of the US dollar to the gold system in 1971. At present, in the global gold market, the central bank has become an important big buyer. At present, central banks hold more than 33,300 tons of gold reserves.

In this 33,300 tons of gold reserves, if the euro zone is considered as a whole, it will hold about 10,800 tons of gold, surpassing the United States with 8133 tons of gold reserves, becoming the world's largest gold reserve holder.

If the country is extended to the entire EU, then its official gold reserves will further increase to more than 112,000 tons, more than one-third of the global central bank's gold reserves.

Central banks in Europe are “sitting in Jinshan”, but how to use these huge gold reserves is a problem. In late February, Italy, carrying heavy debt burdens, came to the news and considered selling some gold reserves to ease debt pressure. Claudio Bolgi, a member of the Italian skeptical European Parliament, proposed the "Golden Ownership Act", the core of which is that Italy's gold reserves are owned by the government, not the central bank, so the government has the right to sell gold. Prior to this, Grilo, the founder of the "Five Star Movement Party", one of the Italian coalition governments, had suggested trying to sell 500 to 600 tons of gold in the fourth quarter of 2019, which could bring the government up to 20 billion euros (about 1534). The cash of 100 million yuan, so the Italian government will not have to worry about budgeting at least in the next 4 to 5 years.

In the context of many central banks in the world that have increased their holdings of gold, Italy is surprised to consider selling gold.

Behind this push to sell gold is the European populist forces that have emerged in recent years.

European populism has gradually risen from the beginning of this century, but its influence in the first few years is limited. The increase in European populist support was after the global financial crisis in 2008, especially after the Eurozone sovereign debt crisis in 2010, populism prevailed in Europe. In 2016, Brexit and the 2017 right-wing forces made breakthroughs in a series of European elections, marking the peak of European populist forces. The European populist forces have eased in 2018, and the results of the European Parliament elections held in May this year will be an important indicator for measuring the development trend of populism.

The rise of European populism is the result of the people of the European Union who are against the political and economic elites of the country. The essence of this is that the benefits brought about by European integration are in conflict with the uneven distribution among the various strata of the society and the EU countries. This unevenness of endorsement power. After 20 years of development, the support rate of populist parties in Europe has tripled. Currently, one out of every four Europeans supports populism, and populist party leaders have held important positions in 11 European governments.

After the populist forces entered the public sphere, gold reserves have increasingly become their tools for policy purposes.

2

The majestic "Golden Home" campaign

Italy, which has fallen into debt, needs to consider repaying its debts with gold. Germany, the engine of the European economy, has no such concerns at all. But the Bundesbank, also driven by populist forces, is also starting to deal with gold reserves, in the form of a massive “golden home” campaign.

Although Germany is the second largest country in terms of global gold reserves, due to historical reasons, most of its reserves exist in the United States.

The “Golden Home” campaign began in 2013 with the specific appeal of transporting overseas gold reserves from New York and Paris back to the Bank of Germany’s vault.

Peter Berger, the founder of the "Golden Home" campaign, is a member of the German Populist Party's New Choice Party, which was founded in the same year as the "Golden Home" campaign. In the short span of six years, with the anti-EU and anti-immigration claims, the New Choice Party has established sites in almost all parts of Germany. If Berlin is included, the party has 10 seats in 16 regional councils in Germany and won seats in the 2017 German Bundestag national election, with a 12.6% vote, becoming Germany since the end of the Second World War. The first right-wing populist party to enter the parliament.

With the great reputation accumulated by the "Golden Home" campaign, Berliner successfully entered the parliament in the German general election and became a member of parliament. Berliner believes that gold reserves are the cornerstone of the country's fight against risks, especially in the case of the euro. Therefore, he also criticized the Bundesbank for not publishing the full list of the gold bars of the gold reserves, and did not provide photos or videos to prove that there are currently 125,000 gold bars in Frankfurt.

Under the impetus of Berliner, the German “Golden Home” campaign was completed ahead of schedule. In the five years from 2013, Germany has shipped about 270,000 gold bars from the United States and France back to the Frankfurt vault. In order to explain to the people concerned about this matter, the Bundesbank also organized an exhibition in 2018 to show the public the gold reserves, so that they can rest assured that the German gold home. The special exhibition on the theme of gold gave the German public the opportunity to see the rich gold collection of the Bundesbank for the first time, the most striking of which was the reserve of gold bars.

Those gold bars were accumulated in the 1950s and 1960s, when the surge in exports led to a large trade surplus between Germany and other countries. Under the Bretton Woods system, Germany turned those trade surpluses into gold. The special exhibition explains the role of gold bars in monetary and foreign exchange policies and explains how they are stored in the Bundesbank, but it is not stated that the rise of populism has prompted these gold bars to appear in special exhibitions.

In addition to Germany, there are also some European countries that have joined the ranks of the “Golden Home” campaign. For example, the Dutch central bank announced that it had shipped 122.5 tons of gold at the Federal Reserve Bank of New York, and Austria also plans to recall overseas gold reserves. In both countries, populist forces are equally high. In the March 2017 general election, the Dutch populist party Liberal Party won no more seats than expected, but it still increased its four seats and became the second largest party in the parliament. In the Austrian general election held in October 2017, the populist party Liberal Party became a member of the coalition government.

3

Populist forces choose to use gold against the euro

Gold is the oldest value scale and measure. The reason why the newly emerging European populist forces seek to embrace gold in such a “returning ancient” is behind their anti-Euro and anti-globalization demands.

The German New Choice Party firmly opposes the euro and opposes "German taxpayers" to save the debtor countries of the euro zone. Although the main propaganda of the party is aimed at the refugee issue, there is still a party constitution that will decide whether to reserve the euro once the ruling will launch a referendum. The rise of Germany's new choice party has taken advantage of the German people's ideological trend of lacking confidence in the future of the EU and the Eurozone. It is also very dissatisfied with forcing the Germans to "pay the bill" for the euro zone debtor countries. The German New Choice Party has fully used the folks to rise up. The "Golden Home" campaign initiated by Berliner (the newly elected party member) is also the product of this trend.

In 2018, Hungary’s gold purchases were particularly striking. After years of stagnation in the gold market, the Hungarian central bank increased its gold reserves by a factor of 10. The central bank said that gold "has played a major defensive role in extreme market conditions or when the international financial system changes or the geopolitical crisis deepens." The extreme conditions mentioned by Hungary are easily reminiscent of the EU’s almost dangerous sanctions against the country.

Since the populist political youth alliance in Hungary is in power, the EU issued a report saying that "Hungarian democracy, the rule of law and basic rights are systematically threatened." In September 2018, the European Parliament passed a resolution agreeing to invoke the Article 7 of the EU Treaty to launch an investigation into Hungary’s “destruction of democracy” and, if necessary, to stop Hungary’s voting rights in the EU. That was the first time the European Parliament voted to punish an EU member state for citing Article 7 of the EU Treaty.

Before being investigated by the EU, Hungary's gold reserves stayed at the level of 3.1 tons for a long time. After the threat of sanctions, Hungary's gold reserves increased by 28.4 tons in the first two weeks of October, making its total gold reserves. It reached 31.5 tons. In light of the Hungarian central bank’s statement that “the international financial system changes or the geopolitical crisis deepens and plays a major role as a defensive line”, the market generally believes that this defense is aimed at the EU.

European populism prevails in the official gold reserves of the nine countries (Source: International Monetary Fund, unit: tons)

Many populist parties in Europe have anti-EU demands, and the euro zone countries have directly pointed the finger at the euro. To replace the euro, gold, which can be the last means of payment, becomes a realistic choice. Compared with the Hungarian central bank's need to urgently increase its holdings of gold, other populist countries in Europe will be much more comfortable, because those countries have a large amount of gold reserves, and these gold reserves allow those countries to speak more anti-EU. And anti-Euro remarks.

Of course, although populist parties in Europe use gold as a tool to achieve their political goals, gold reserves are inherently value-neutral and not directly related to populism.

http://www.informationclearinghouse.info/49298.htm

=====

=====

https://www.ft.com/content/4edf00ee-a43c-11e7-8d56-98a09be71849

How Germany got its gold back

It was kept abroad to escape the Soviet Union. But then Germany decided to bring it home

- Share on Twitter (opens new window)

- Share on Facebook (opens new window)

- Share on LinkedIn (opens new window)

- Save to myFT

Claire Jones in Frankfurt

November 11, 2017

Print this page 94

When Carl-Ludwig Thiele was 11, his aunt gave him a 21-carat gold coin as a gift. “It was an incredible feeling to own it. I still have it now and can picture it. There is an image of Pope John XXIII on one side, and on the reverse an image of the Holy Ghost floating above the bishops.”

In the five decades since receiving that coin, Mr Thiele — tall and forthright with a liveliness in his face when the subject switches to bullion — has risen high in Germany’s state bureaucracy. He served 20 years in parliament before making the switch from Berlin to Frankfurt to sit on the executive board of the Bundesbank, the country’s central bank and custodian of its gold.

Today, Germany is one of the biggest holders of gold in the world: it owns 3,378 tonnes, worth €119bn, second only to the US. But until recently, most of that gold was stored in New York, London and Paris. When the country decided to bring half of its gold back home, Mr Thiele was put in charge.

Over the past five years, he has masterminded the transportation of almost 54,000 gold bars — each with a value of just under $510,000 — to Frankfurt, Germany’s financial capital, moving $27bn (in today’s prices) from the vaults of the US Federal Reserve and the Banque de France. The last bars arrived at the Bundesbank’s headquarters, a few kilometres north of Frankfurt’s city centre, in August. But how Germany’s gold came to be abroad is a story that goes back to the second world war and beyond.

Germany has a stronger relationship with gold than most nations. The country’s experience with hyperinflation between 1919 and 1923, during the years of the Weimar Republic, is ingrained in the national consciousness. Gold, above all, stands for stability.

Carl-Ludwig Thiele masterminded the transportation of almost 54,000 gold bars — worth $27bn — to Frankfurt © Martin Leissl for the FT

During the second world war, Nazi Germany looted gold from central banks across Europe. The Reichsbank stored more than 3,700kg (4.1t) of this stolen gold through the Bank for International Settlements in Switzerland. By the time the Allies, through the Tripartite Commission for the Restitution of Monetary Gold, recovered it in 1948, Germany’s state coffers were bare.

It was during the Wirtschaftswunder — the economic miracle of the 1950s and 1960s — that West Germany began to stockpile large amounts of gold. The country’s export surpluses meant businesses were flush with dollars, which were swapped at the central bank — initially the Bank deutscher Länder, then, from 1957, its successor the Bundesbank — in return for Deutschmarks. Under the Bretton Woods system of fixed exchange rates that then underpinned global finance, the Bundesbank could use the dollars to purchase gold at the rate of $35 an ounce, storing most of its holdings in the New York Fed’s underground stores on Liberty Street. In 2012, just before the move began, just over 1,500 tonnes of German gold was stored there.

Frankfurt was not much more than 100km from the border with Soviet-controlled East Germany, so with the threat of Russian invasion, West Germany kept bullion built up before the collapse of Bretton Woods in the early 1970s abroad. “During the cold war, the threat came from the east, so it made sense to store it further west, in Paris, London or New York,” says Mr Thiele. After the fall of the Berlin Wall in 1989 and the collapse of the Soviet Union in 1991, that rationale disappeared.

Germany has brought gold back from the Bank of England © Getty Images

Mr Thiele masterminded the transportation of almost 54,000 gold bars — worth $27bn — to Frankfurt

It was another decade before the Bundesbank began to repatriate its gold, however. In the early years of the new millennium, it moved 930 tonnes, worth about $40bn today, from the vaults beneath the Bank of England’s Threadneedle Street base in the City of London back to Frankfurt, after the Bank increased its rents. That move, shrouded in secrecy owing to security concerns, came as pressure mounted on the Bundesbank to reveal more about the nation’s reserves.

Ten years later, the Bundesrechnungshof, Germany’s federal accounting office, and members of the German parliament, the Bundestag, began asking questions about the country’s gold. Lawmakers wanted to know where the gold was stored, calling on the central bank to provide an inventory of the bars in its possession.

More controversial was a public campaign spearheaded by Peter Boehringer, a former asset manager who earlier this year became a member of parliament representing the Eurosceptic Alternative for Germany (AfD) party. “Initially we weren’t taken seriously. We wrote to the Bundesbank, but we got standardised, worthless answers. We didn’t get any answers, so we had to go public,” Mr Boehringer says. “We had attention from online media, then the international media. We are the owners; we’re talking about €100bn of public assets.”

Mr Boehringer believes that Germany needs its gold back for more than symbolic reasons. The European Central Bank’s aggressive response to the global financial crisis has, he says, made cash worthless. “People are always interested in gold, but we live in a time when central banks are running amok. In 1971, all currencies were linked to gold. That’s no longer the case, and the behaviour of central banks is ridiculous. More and more people can see that.”

The Bundesbank denies that Mr Boehringer’s campaign spurred its decision to bring the gold home. It also denies accusations by gold bugs (those bullish on gold as a commodity) that the German gold has disappeared from the New York Fed’s vaults. Mr Thiele says he has seen it twice, in 2012 and 2014. “It is there. And it was never a problem to see it or have it transported to Germany.”

Gold on display at the Frankfurt headquarters of the Bundesbank. Repatriation of German gold began in the early years of the 21st century © Martin Leissl for the FT

Gold’s appeal has risen in tandem with turmoil throughout history. Many economists agree with John Maynard Keynes’ attack on linking gold and paper money as a “barbarous relic” of a bygone era. The link was abandoned in the 1970s, when the Bretton Woods system ended. Some nations have sold much of their gold since.

Yet when markets become choppy or heads of state turn warmongers, bullion lures back investors. During the most recent global financial crisis, the price rose from around $650 an ounce in the spring of 2007 to a peak of more than $1,800 in summer 2011.

Other central banks have reacted to unrest by storing gold abroad, too, although their methods of transportation have, in many instances, created considerable risk. During the first week of July 1940, the Bank of England had gold worth £200m ($18bn in today’s prices, according to the World Gold Council) on liners in transit over the Atlantic. If any of those ships had sunk, the Bank would not have received a penny in return for the loss of almost 41,000 bars, because the shipments were irreplaceable and thus uninsurable.

A Bundesbank employee piles up bars of gold during a press conference announcing the planned repatriation of German gold reserves © Frank Rumpenhorst/DPA/PA Images

In January 2013, the Bundesbank revealed where its gold was stored and announced the plan to move half of it home. The bank has refused to divulge how the 53,780 bars were transferred, but bullion transportation has moved on from the era of ocean liners.

People familiar with the field say it was most likely that the gold was flown from Paris and New York back to Frankfurt. Road transportation may have been tried but is unlikely to have been used frequently. Moving the gold 600km from the Banque de France’s vaults in the middle of Paris to the Bundesbank would put drivers at risk, and the bars are often too heavy to be moved in substantial volumes. While a bar of gold takes up less space than a litre of liquid, each weighs about 12.5kg.

Once the Bundesbank had decided to move its gold, lawyers then had to scour contracts to insure it against being lost in transit. Many insurers pay out only in dollars, rather than the precious metal, potentially leaving the central bank on the hook if the price of gold were to rise between the contract being signed and the bullion arriving safely in the Bundesbank’s vaults.

More than 4,400 bars transferred from New York were taken to Switzerland, where two smelters remoulded the bullion into bars that meet London Good Delivery standards for ease of handling. The London market requires gold bars to look as they do on the silver screen — the technical name for the shape is a trapezoid prism — as their sloping edges make the bars easier to pick up than New York bars, which are shaped like simpler-to-store bricks.

Germany has brought gold back from the New York Federal Reserve © National Geographic Creative / Alamy Stock Photo

The whole exercise cost €7.6m. All of the bars returned from both New York and Paris were checked by an in-house team of between five and eight people. The team assessed the purity using X-ray techniques, and by weighing the bars. In October 2015, the bank published a list (since updated annually) with specific details of all of the gold it held. The gold still abroad is in London — the world’s biggest bullion market — and New York, which remains an important location because of the US dollar’s status as a global reserve currency. Germany currently has no plans to repatriate it.

It is a sunny day in late October and light streams through the large windows of a room on the Bundesbank’s executive floor. The views stretch across the city’s skyline and beyond to the forests that surround the south of the city. But my attention is fixed on the five gold bars before me.

Together they are worth €2.2m, and I imagine all the fun — the exquisite food, the plush properties, the lavish holidays — one could buy with that or the jewellery one could make. It seems a shame to keep the wealth locked up, out of sight, in a form no one will use. Yet these bars — each with slight differences in shape and weight, some dating back to the 1950s — hold an allure.

In August 2017, Carl-Ludwig Thiele announced the repatriation of German gold reserves from Paris and New York © ARNE DEDERT/AFP/Getty Images

Mr Thiele remarks on the attention that surrounded the operation. When the move was completed earlier this year, it made front-page headlines and filled prime slots on evening news broadcasts. “There is a lot of public interest,” he says, with some understatement.

It is a strange sensation to pick up gold for the first time. The surfaces of the Bundesbank’s bars are unpolished, each with its own distinct branding and scratches — signs of the metal’s malleability. Its colour gives it a certain appeal, but it is not until you feel the weight of it — the bars are hard to hold for more than a few seconds — that you begin to understand why.

According to the pictures, the walls and shelves of the Bundesbank’s vaults are grey, in keeping with the design of the headquarters, a Brutalist 13-storey concrete slab built long and narrow like a ship. But we are denied access and the gold will remain out of public view — a decision that Mr Thiele acknowledges will fuel suspicions about whether half of Germany’s gold has really come home.

“We’re the most transparent of all the central banks about our holdings of gold and there are still more questions. With gold there are always more questions.”

Main image: Nils Thies/Deutsche Bundesbank

Get alerts on Gold when a new story is published

Copyright The Financial Times Limited 2019. All rights reserved.