-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

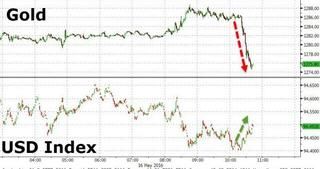

Chitchat Gold Plunges In 10 minutes - fix by london

- Thread starter krafty

- Start date

China to buy $90 billion gold vault in London:

The Chinese state-owned ICBC Standard Bank (IDCBF), the world's biggest bank by assets, has agreed to buy Barclays precious metals storage business, including its state-of-the-art storage facility in London.

The deal will boost China's access to London's gold market, and expand the country's role in the gold business.

http://money.cnn.com/2016/05/16/news/china-buys-london-gold-vault/

The Chinese state-owned ICBC Standard Bank (IDCBF), the world's biggest bank by assets, has agreed to buy Barclays precious metals storage business, including its state-of-the-art storage facility in London.

The deal will boost China's access to London's gold market, and expand the country's role in the gold business.

http://money.cnn.com/2016/05/16/news/china-buys-london-gold-vault/

that news is two days old.i already pump all my money into oil so fuck gold.

Gold, Gold, Gold.....they gotta have that GOLD....... https://www.youtube.com/watch?v=h7mVLWcMm-U

http://www.macrotrends.net/1335/dollar-gold-and-oil-chart-last-ten-years

generally, gold and oil move in same direction unless there is external interference.

generally, gold and oil move in same direction unless there is external interference.

http://www.macrotrends.net/1335/dollar-gold-and-oil-chart-last-ten-years

generally, gold and oil move in same direction unless there is external interference.

You shld try get a chair next to Miss Ho.

You shld try get a chair next to Miss Ho.

bro, i must stay humble by your words.:o

Billionaire George Soros cut his firm’s investments in U.S. stocks by more than a third in the first quarter and bought a $264 million stake in the world’s biggest bullion producer Barrick Gold Corp.

http://www.bloomberg.com/news/artic...oros-cuts-u-s-stocks-by-37-buys-gold-producer

china buy gold vault, soros buy gold mine, whoa... all huat ah!

http://www.bloomberg.com/news/artic...oros-cuts-u-s-stocks-by-37-buys-gold-producer

china buy gold vault, soros buy gold mine, whoa... all huat ah!

Gold Plunges After "Someone" Suddenly Decides To Dump Over $2.3 Billion Notional In 10 Minutes

What talking you? Gold is on the way up.

http://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

What talking you? Gold is on the way up.

http://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

yesterday, if you observe carefully, somebody threw his 2.3 billion bucket worth of gold into the market at about 10am during US trading hour. go refer to your chart.

http://www.zerohedge.com/news/2016-05-16/gold-silver-are-being-dumped

Last edited:

Blackrock says Gold will shine again.

Given slow growth, a cautious Federal Reserve and the proliferation of negative sovereign yields in Japan and Europe, U.S. real rates are likely to remain low for the foreseeable future. At the same time, both core inflation and wages have been firming while the inflation drag from last year’s strong dollar and collapse in oil is beginning to fade. This is exactly the type of environment that has historically been most favorable to gold.

https://www.blackrockblog.com/2016/...tm_source=blktw&utm_content=blog&sf46366093=1

Given slow growth, a cautious Federal Reserve and the proliferation of negative sovereign yields in Japan and Europe, U.S. real rates are likely to remain low for the foreseeable future. At the same time, both core inflation and wages have been firming while the inflation drag from last year’s strong dollar and collapse in oil is beginning to fade. This is exactly the type of environment that has historically been most favorable to gold.

https://www.blackrockblog.com/2016/...tm_source=blktw&utm_content=blog&sf46366093=1

fuck gold,oil will shine again,reaching record highs of $48 since its bottom of $28 in january.......amazing recovery!!!!fuck i only have 6k invested in it,wish i could trade options or something.....hope oil hits a homerun this year so i can have a early retirement in australia.

fuck gold,oil will shine again,reaching record highs of $48 since its bottom of $28 in january.......amazing recovery!!!!fuck i only have 6k invested in it,wish i could trade options or something.....hope oil hits a homerun this year so i can have a early retirement in australia.

welcome mate! hope you succeed an see ya ard, talk soon! cheers!

Rise of oil will b curtailed by lacklustre demand. Good does not react in this manner ut more of last resort safe haven. Check companies like chepespeake steep in debt, no recovery in sight, save for gongchee bye who speculated wrongly on it top investors see no upside in it. Fracking is so dead, even trump cant save it.fuck gold,oil will shine again,reaching record highs of $48 since its bottom of $28 in january.......amazing recovery!!!!fuck i only have 6k invested in it,wish i could trade options or something.....hope oil hits a homerun this year so i can have a early retirement in australia.

The rise in consumer spending is no more than manipulation of sadistics gone awry. It forces the hands of feds to raise the rates and strangle themelves.

Btw soros just bought nto spdr.

What talking you? Gold is on the way up.

http://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

Huge resistance at 1300 but it is expected. I prefer this way. A slow growth would push it higher n less profit taking along its path

Rise of oil will b curtailed by lacklustre demand. Good does not react in this manner ut more of last resort safe haven. Check companies like chepespeake steep in debt, no recovery in sight, save for gongchee bye who speculated wrongly on it top investors see no upside in it. Fracking is so dead, even trump cant save it.

The rise in consumer spending is no more than manipulation of sadistics gone awry. It forces the hands of feds to raise the rates and strangle themelves.

Btw soros just bought nto spdr.

gold i think is still overpriced metal,supposed to be in a downwards death spiral in the last 2 years but for some reason stopped.no rush.no need to invest in it when theres thousands of other things to invest in.....oil however although not as low as jan,but still in a comfortable spot.lots of potential for upside.good to own anytime as long as theres no contango.oil right now is like gold when its 700 to 800 dollars.

Who wouldn’t want a peek at the portfolio of George Soros, Warren Buffett and other billionaire investors? And thanks to the regulators, they have to give you one.

However, don’t put too much emphasis on these snapshots.

Monday was the deadline for the filing of a form with the Securities and Exchange Commission known as a 13-F. The SEC requires any institutional investment manager with positions of at least $100 million to reveal all long stock positions held at the end of each quarter.

It is a great way to get a feel for what the “smart money” is doing, but, as the The Tell has warned before, there are caveats.

For one, the data is old: The filings aren’t due until 45 days after the end of the quarter. So think of it as more of a month-and-a-half old snapshot. In most cases, you don’t know exactly when in the quarter the shares were bought or whether the investor has subsequently dumped them or added more.

Second, the data isn’t necessarily a complete picture. Investors must only report their long positions, so any short bets on individual stocks or on particular options won’t be apparent. That isn’t necessarily a big deal for many portfolios, particularly those held by long-term focused, buy-and-hold types.

But for hedge-fund managers, including Soros, who pursue a variety of long-short strategies, it’s worth keeping in mind that the glimpse of their investment strategies often is incomplete.

With that in mind, there were some interesting shifts. And Soros, of course, attracted a lot of headlines as his fund, Soros Fund Management, more than doubled its position in put options on the SPDR S&P 500 exchange-traded fund SPY, -0.93% in the first quarter and reduced its long equity exposure. A put option gives the holder the right but not the obligation to sell the underlying security at a set price within a specified time frame. Put options tend to rise in value as the price of underlying stocks fall. In that way, they can be used as protection against a decline in the large-cap benchmark.

Such moves would seem to be in keeping with Soros’s warning in January that he had shorted the S&P 500 SPX, -0.94% amid worries over an “unavoidable” hard landing in China and global deflation. Soros is considered one of the greatest hedge-fund investors of all time. The 85-year-old investor became world famous in 1992 when his huge bet against the British pound, led to the currency’s “Black Wednesday,” resulting in an ejection from the European Exchange Rate Mechanism. The wager earned him the title “the man who broke the Bank of England.”

Soros also bought a sizable stake in gold miner Barrick Gold Corp. ABX, +2.43% and around 1 million call options, which give holders the right but not the obligation to buy the underlying security at a set price within a specified time, on the SPDR Gold Trust ETF GLD, +0.34%

[ABX making a double top? It sure looked like a double top in late February except that general stock market was just turning up, now it's potential double top with the general stock market already having turned down. So, where do the probabilities lie?]

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=abx&insttype=&freq=1&show=&time=8

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=spx&insttype=&freq=1&show=&time=8

Soros isn’t the only hedge-fund manager to take an apparent shine to the yellow metal GCM6, +0.29% Renowned investor Stanley Druckenmiller, who was also once Soros’s right-hand man, earlier this month made the case for gold, and other big investors have also turned bullish on the metal.

http://www.marketwatch.com/story/so...wn-2016-05-17?siteid=bigcharts&dist=bigcharts

However, don’t put too much emphasis on these snapshots.

Monday was the deadline for the filing of a form with the Securities and Exchange Commission known as a 13-F. The SEC requires any institutional investment manager with positions of at least $100 million to reveal all long stock positions held at the end of each quarter.

It is a great way to get a feel for what the “smart money” is doing, but, as the The Tell has warned before, there are caveats.

For one, the data is old: The filings aren’t due until 45 days after the end of the quarter. So think of it as more of a month-and-a-half old snapshot. In most cases, you don’t know exactly when in the quarter the shares were bought or whether the investor has subsequently dumped them or added more.

Second, the data isn’t necessarily a complete picture. Investors must only report their long positions, so any short bets on individual stocks or on particular options won’t be apparent. That isn’t necessarily a big deal for many portfolios, particularly those held by long-term focused, buy-and-hold types.

But for hedge-fund managers, including Soros, who pursue a variety of long-short strategies, it’s worth keeping in mind that the glimpse of their investment strategies often is incomplete.

With that in mind, there were some interesting shifts. And Soros, of course, attracted a lot of headlines as his fund, Soros Fund Management, more than doubled its position in put options on the SPDR S&P 500 exchange-traded fund SPY, -0.93% in the first quarter and reduced its long equity exposure. A put option gives the holder the right but not the obligation to sell the underlying security at a set price within a specified time frame. Put options tend to rise in value as the price of underlying stocks fall. In that way, they can be used as protection against a decline in the large-cap benchmark.

Such moves would seem to be in keeping with Soros’s warning in January that he had shorted the S&P 500 SPX, -0.94% amid worries over an “unavoidable” hard landing in China and global deflation. Soros is considered one of the greatest hedge-fund investors of all time. The 85-year-old investor became world famous in 1992 when his huge bet against the British pound, led to the currency’s “Black Wednesday,” resulting in an ejection from the European Exchange Rate Mechanism. The wager earned him the title “the man who broke the Bank of England.”

Soros also bought a sizable stake in gold miner Barrick Gold Corp. ABX, +2.43% and around 1 million call options, which give holders the right but not the obligation to buy the underlying security at a set price within a specified time, on the SPDR Gold Trust ETF GLD, +0.34%

[ABX making a double top? It sure looked like a double top in late February except that general stock market was just turning up, now it's potential double top with the general stock market already having turned down. So, where do the probabilities lie?]

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=abx&insttype=&freq=1&show=&time=8

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=spx&insttype=&freq=1&show=&time=8

Soros isn’t the only hedge-fund manager to take an apparent shine to the yellow metal GCM6, +0.29% Renowned investor Stanley Druckenmiller, who was also once Soros’s right-hand man, earlier this month made the case for gold, and other big investors have also turned bullish on the metal.

http://www.marketwatch.com/story/so...wn-2016-05-17?siteid=bigcharts&dist=bigcharts

...........................

Soros also bought a sizable stake in gold miner Barrick Gold Corp. ABX, +2.43% and around 1 million call options, which give holders the right but not the obligation to buy the underlying security at a set price within a specified time, on the SPDR Gold Trust ETF GLD, +0.34%

[ABX making a double top? It sure looked like a double top in late February except that general stock market was just turning up, now it's potential double top with the general stock market already having turned down. So, where do the probabilities lie?]

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=abx&insttype=&freq=1&show=&time=8

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=spx&insttype=&freq=1&show=&time=8

...............................

Huat arh! Barrick Gold (ABX) down 9% yesterday! Bearish candle makan four candles from previous five days. Looks like this is the real double top, but in theory have to wait until it breaks the neckline by which time a lot of profits would have to be given back.

Huat arh! Barrick Gold (ABX) down 9% yesterday! Bearish candle makan four candles from previous five days. Looks like this is the real double top, but in theory have to wait until it breaks the neckline by which time a lot of profits would have to be given back.

i dun really think that Fed is going hike rate in June. same like Japan, all NATO. small windfall for you, congrats! but in mid to long term, it's still going up.

i dun really think that Fed is going hike rate in June. same like Japan, all NATO. small windfall for you, congrats! but in mid to long term, it's still going up.

there is no shame in going back in again if and when it breaks out of the double top on the upside (but beware of false breakouts), though i won't be shorting it even if it does break below the neckline. brokerage costs are very low nowadays and i am not trading in large blocks.

Last edited:

Similar threads

- Replies

- 0

- Views

- 212

- Replies

- 5

- Views

- 550

- Replies

- 3

- Views

- 731

- Replies

- 1

- Views

- 447

- Replies

- 4

- Views

- 560