https://likedatosocanmeh.wordpress....ty-dont-even-hope-to-get-your-cpf-back-at-55/

With PAP parliamentary majority, don’t hope to get your CPF back at 55

June 22, 2015 by phillip ang

Dear CPF members

With PAP in power, you should not hope for a miracle to happen and somehow you will be able to spend any/much of your hard-earned CPF before you meet your maker.

Do read up on CPF issues and question/discuss all that you have read, including this post. It is likely that you will be convinced PAP has abused the CPF scheme for its own benefit. There will be more delaying tactics to prevent full CPF withdrawal. Learn to read the ‘right’ things instead of propaganda fed to you by PAP’s mainstream media.

What I have written is based on information from various government websites. If I were merely speculating, PAP could have provided counter arguments and put all ‘speculators’ to shame. (Not necessary to resort to legal threats) The fact that PAP has not been able to do so confirms most of what I have written to be factually accurate.

1. You need to realise that:

– CPF is

YOUR hard-earned retirement savings and no political party can have more say than you. You should not allow PAP total control over

YOUR CPF through frequent policy tweaks.

– Many of you NEED your CPF at 55 but somehow keep supporting PAP, a political party whose

objective is to retain increasing amounts of our CPF. Perhaps you have bought into PAP’s propaganda but it’s not too late to realise this and stop victimising yourself.

Ignorance is not bliss.

2. CPF was used by the PAP to fund the construction of HDB flats, infrastructures and the set up of profitable government companies which were subsequently

transferred to Temasek Holdings below market value. After tasting their ‘success’, PAP had proposed to delay the CPF withdrawal age from 55 to 60 in the Howe Yoon Chong report 31 years ago. The clear rejection of this proposal is evidenced by the unprecedented 12.9 % vote swing at the 1984 GE.

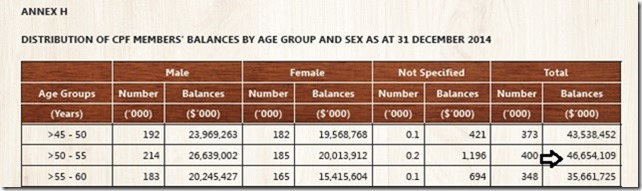

Without parliamentary checks, PAP has become more brazen and progressively increased the withdrawal age to 65 by 2018. The MS of

almost $200,000, including Medisave, is senseless because the majority of CPF members do not even have this amount.

CPF members were unhappy with PAP in 1984 for attempting to retain our CPF and we are unhappier now because the withdrawal age has been increased by 10 years instead of 5 years.

3. CPF appears to be the mother of all Ponzi schemes. A Ponzi scheme entices ‘investors’ with the promise of

high short-term returns; CPF scheme promises

low long-term returns.

The “guarantee” of low CPF interest rate by the PAP government is a joke at our expense. CPF members are also taxpayers and when the “guarantee” comes from taxpayers (government),

we are effectively guaranteeing ourselves. PAP has fooled many in the past and it’s about time you reject the role of being a fool by reading the ‘right’ things in order to break free from PAP’s BS.

4. PAP has effectively hijacked public monies into a private company called GIC. Once our CPF is privately managed, PAP owes no one any explanation as to how or where our CPF is invested.

Since GIC was formed in 1981, it has

never disclosed any absolute figures such as it profits, losses, dividends, etc. Without a

proper set of accounts, GIC’s real performance is concealed from CPF members. It does not even disclose the

tens of million$ paid to its directors or hundreds of million$ to fund managers. All the

percentage figures disclosed are

meaningless to its stakeholders.

GIC has been concealing relevant information from its stakeholders for 34 years. A functioning government needs trust from the people but citizens are not stupid to trust a government which insists on concealing information for decades.

If you are a scholar with stellar academic results from Harvard, would you conceal the information? So if GIC has indeed been a fund manager par excellence, why has it chosen to conceal information for 34 years?

One can only logically assume such information could embarrass the PAP if disclosed.

Many have also speculated GIC has made huge losses which necessitates the retention of larger amounts of CPF.

We have now been forced into a pay-until-you-die CPF installment scheme by the PAP because the government lacks the funds to return a lump sum payment to CPF members at 55.

PAP has the propensity to cook up ridiculous justifications and you should not rule out PAP increasing the withdrawal age to 80 or even 90 from 65.

5. Like you, I used to be impressed by the GIC reported in the mainstream media. But after some research the last couple of years, I believe Singaporeans have been fooled.

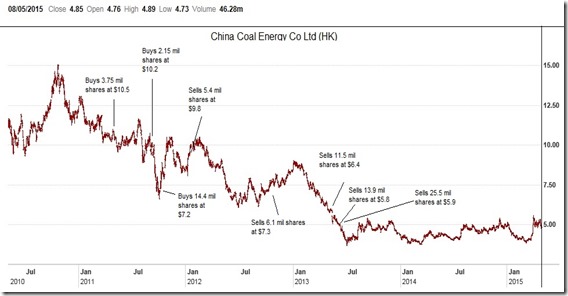

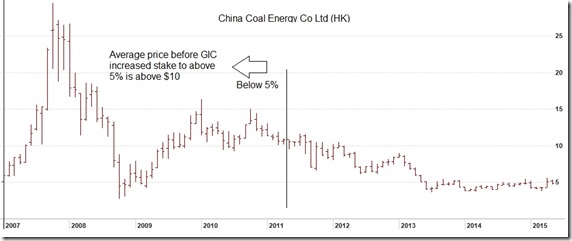

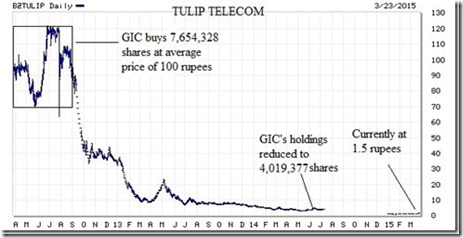

Investment losses are inevitable but massive losses could have been avoided if only GIC had a game plan. Holding on to bad investments after fundamentals have changed confirms GIC has no discipline.

By becoming a substantial shareholder in many companies with no track record, GIC is merely speculating on capital gains. GIC has no margin for error in its judgement as any mistake will wipe out the investment. And GIC has lots of these wipeout investments. Here are a few:

Link:

https://likedatosocanmeh.wordpress....pf-using-tikam-tikam-model-and-based-on-hope/

More details on GIC’s China Coal Energy here:

https://likedatosocanmeh.wordpress....provide-more-transparency-on-cpf-investments/

Less than a year ago, GIC invested in Serco Group PLC in what appears to be ‘bottom picking’. But the bottom has since fell out and Serco’s shares are now worth one third of GIC’s original price.

More details on GIC’s Serco Group PLC here:

https://likedatosocanmeh.wordpress....ights-issue-ida-type-due-diligence-suspected/

More details on GIC’s investments at this link:

https://likedatosocanmeh.wordpress....ter-cpf-investments-not-only-profitable-ones/

There are of course

many more such investments.

6. GIC will never learn from its mistakes because there has been

no accountability. Not even after Citigroup or UBS. There are simply too many bad investments which confirm GIC has not conducted due diligence.

Since a steady stream of about $20 billion CPF is being channeled into GIC every year, it can sit on every underwater investment. It is like our local punters who ‘cold storage’ a collapsed penny stock and then hope for the best in the next bull cycle.

GIC’s investment ‘strategy’ does not provide for a lump sum withdrawal by CPF members.

7. Last year, DPM Tharman revealed in Parliament that “

In eight out of 20 years, GIC’s returns were lower than the rate promised to CPF members, but the Government absorbed the losses”. GIC claims to have made annual real return of 4.1% over a 20 year period.

Although Tharman’s statement appears to have revealed little, it has actually

confirmed GIC’s mediocre performance.

It would be fine if GIC’s return was lower than CPF rate for a couple of years but it did so 40% of the time.

“Lower than the rate promised to CPF members” could also mean GIC had made losses in a number of years. And when PAP is unable to state factually its underachievements, rest assured it must be an embarrassing number.

It could also be due to GIC’s mediocre performance that it is unable to return a lump sum CPF to members at 55.

There have been too many attempts to project GIC’s ‘superior’ performance. If GIC’s client and board of directors isn’t the Singapore government, it would have folded years ago.

Do you think GIC has the funds to pay every CPF member a lump sum at 55?

9. By admitting that “the Government absorbed the losses”, Tharman must have meant our reserves were used to pay CPF members for 8 years. If so, why was this not highlighted in Parliament?

Since GIC had to resort to using our reserves to pay CPF interest on 8 occasions during a 20-year period, does this not confirm it

did not have the funds to make lump sum payments to CPF members?

10. CPF is not invested in foreign companies with strong earnings which are able to pay regular dividends. GIC has taken excessive risks by speculating for capital gains. If this is factually inaccurate, GIC could quell speculation by simply producing a complete list of its investments.

GIC could have been as transparent as Norway’s GPFG and easily provided FULL disclosure.

PAP has no reason to invite unnecessary speculation on GIC but why does it continue to conceal basic information of CPF investments?

11. It is obvious GIC does not have sufficient funds to return all CPF monies to CPF members at 55 or 65. Perhaps it’s time you query your MPs but don’t get your hopes too high – chances are they know only as much as you do.

Conclusion

Your CPF belongs to you, it is YOUR money but how you spend your hard-earned savings is now dictated by PAP.

The CPF scheme the mother of all Ponzi schemes. A Ponzi scheme promises high returns to attract investors whereas CPF legislates low returns.

GIC does not seem to be managing our investments, appears to be speculating and does not have an exit plan when market fundamentals have changed. If due diligence has been conducted, there is no reason for investments to lose half their market value in a year, wiped out within 2 years.

PAP should not expect CPF members to trust an organisation managing more than $1/4 trillion of our retirement savings when it

has not produced a proper set of accounts for 34 years.

There are obvious

question marks all over our CPF scheme but PAP has repeatedly refused to provide relevant answers.

The original contract for the government to return our CPF at 55 was amended by PAP because Singaporeans voted for a PAP majority in Parliament. The only way to undo this self-created problem is to

deny PAP its 2/3 parliamentary majority. There is no alternative.

Without any checks on the PAP, all your hard-earned CPF will never be returned to you at 55.

Phillip Ang