China's top securities regulator vows legal action against rogue officials who abuse power to trade stocks

Local branches urged to step up checks to stop staff from abusing power to trade in stocks

PUBLISHED : Sunday, 30 August, 2015, 11:10pm

UPDATED : Sunday, 30 August, 2015, 11:12pm

Jun Mai

[email protected]

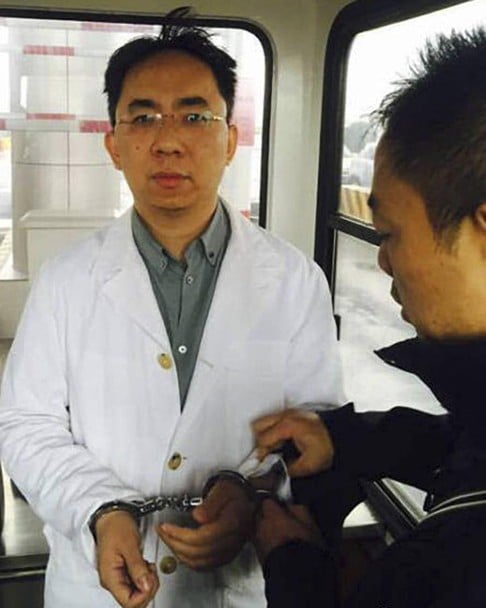

The CSRC's disciplinary committee had instructed its local branches to intensify checks into irregularities. Photo: EPA

China's top securities regulator has warned its local cadres against abusing their power to trade stocks, vowing to take legal action against officials who violate the rules, amid a widespread crackdown on rampant market irregularities.

The China Securities Regulatory Commission's warning came as authorities investigate illegal securities trading, taking away several brokerages' senior executives for questioning.

Citic Securities confirmed on Sunday that public security officials had asked several of its senior management members and employees to assist in investigations, but said the company's operations remained stable.

The CSRC's disciplinary committee had instructed its local branches to intensify checks into irregularities, according to a notice on the website of the nation's top anti-graft agency, the Central Commission for Discipline Inspection.

The committee's chief, Wang Huimin, visited the CSRC's local branches in Fujian , Jilin , Shaanxi and Sichuan provinces, the notice said.

"Irregularities such as abusing power for stock trading will be resolutely handled, and legal responsibility will be pursued," the statement read.

The notice called on local CSRC branches to save their daily documents, and urged discipline inspection offices at different levels to conduct frequent checks on those documents.

Police took away eight Citic Securities officials last week, sending shockwaves through the mainland's stock market. One serving and one former CSRC official and a reporter from Caijing financial magazine were also questioned, Xinhua reported.

The South China Morning Post reported last week that Citic Securities managing director Xu Gang and two other members of the brokerage's executive committee, Ge Xiaobo and Liu Wei, were "asked to assist in the investigation", as was Liang Jun, the secretary of Citic Securities chairman Wang Dongming.

Citic Securities employees were now required to submit a report prior to leaving on business trips, China Business News reported.

Citic Securities said it was proactively cooperating with the authorities and initiating measures to "probe into problems that may exist in its business".

"The company will continue to adhere to the principle of compliant operation in accordance with the laws and regulations and contribute to the national economic construction and capital market development," it said.

State media published commentaries last week that said the authorities would punish those who breached market regulations and continue the investigations until they "got to the bottom of things".

The CSRC is also investigating Haitong Securities, GF Securities, Huatai Securities and Founder Securities.