[h=1]SINGAPORE'S CREDIT CRISIS CAUSED BY PAP[/h]

<!-- /.block --> <style>.node-article .field-name-link-line-above-tags{float: right;}.node-article .field-name-ad-box-in-article {float: left;margin: 15px 15px 10px 0;}.node-article .field-tags{clear: both;}</style> Post date:

6 Dec 2014 - 10:32am

<ins id="aswift_0_expand" style="margin: 0px; padding: 0px; border: currentColor; width: 336px; height: 280px; display: inline-table; visibility: visible; position: relative; background-color: transparent; border-image: none;"><ins id="aswift_0_anchor" style="margin: 0px; padding: 0px; border: currentColor; width: 336px; height: 280px; display: block; visibility: visible; position: relative; background-color: transparent; border-image: none;"><iframe name="aswift_0" width="336" height="280" id="aswift_0" frameBorder="0" marginWidth="0" marginHeight="0" scrolling="no" vspace="0" hspace="0" allowfullscreen="true" style="left: 0px; top: 0px; position: absolute;" allowTransparency="true"></iframe></ins></ins>

As of Dec 2014, Singapore is in a recession. We are currently experiencing the start of the credit crisis caused by the long term low interest environment. You may not believe it but various economic signs are indicating that we are in for a free fall and the worse part is we have not reached the trough yet:

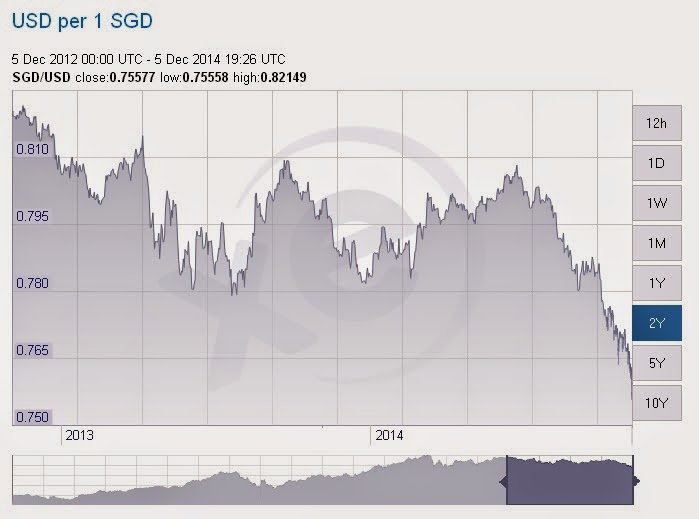

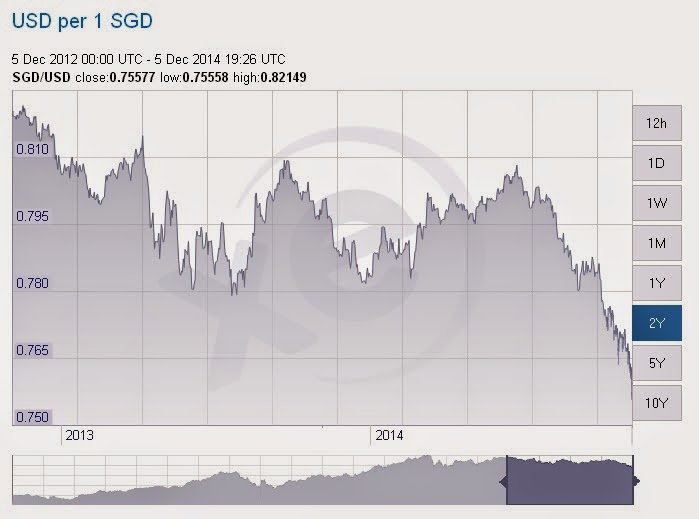

1) SGD at all time low against USD

2) Property prices at its lowest since 2008

Private property prices have been disastrous even for prime areas, with drop ranging from 20% to 40%. Public housing are also going at a discount with more sellers than buyers in the market.

3) Mounting debt

No thanks to PAP ex-Minister Mah Bow Tan's "asset appreciation policy" that led to exorbitant public housing prices during his reign, Singapore residents are among the highest indebted people in the world with the average debt per person standing at $80,000 or 2.4 times the average annual salaries. More homeowners especially private property owners are defaulting on their mortgage and auctioning of private homes foreclosed by banks is picking up. It will only be a matter of time when HDB prices are so low, mortgage debt owners are serving a mortgage lower than the possible resale price.

4) Weakening purchasing power

Real wage growth after deduction for CPF and accounting for yearly inflation has been stagnated for the past 11 years since 2003 when Lee Hsien Loong become Prime Minister. There isn't anything young people who are fresh in the job market could afford without landing themselves in debt and this including dating and family building which explains the lowest birth rate ever - conveniently under Lee Hsien Loong's charge too. Naturally of course, the PAP uses the pretext of materialism to deny themselves of any failure in shoring up income.

<ins id="aswift_1_expand" style="margin: 0px; padding: 0px; border: currentColor; width: 336px; height: 280px; display: inline-table; visibility: visible; position: relative; background-color: transparent; border-image: none;"><ins id="aswift_1_anchor" style="margin: 0px; padding: 0px; border: currentColor; width: 336px; height: 280px; display: block; visibility: visible; position: relative; background-color: transparent; border-image: none;"><iframe name="aswift_1" width="336" height="280" id="aswift_1" frameBorder="0" marginWidth="0" marginHeight="0" scrolling="no" vspace="0" hspace="0" allowfullscreen="true" style="left: 0px; top: 0px; position: absolute;" allowTransparency="true"></iframe></ins></ins>

5) Low interest rate

The years of cheap credit since 2003 (more noticeably 2.5% CPF OA interest rate) have caused massive inflation, created the credit crisis and saving losses among the people. Continual depression of interest rate to boost investments has reached saturation - investments are not happening and more people rather keep their money in low interests defensive instruments. Just recently, the PAP legislated that private loan firms cannot raise their lending rate. Raising the interest rate will affect CPF's interest rate and add additional pressure to the PAP government who have recently been raising CPF Minimum Sum and Withdrawal Age in order to delay their fiduciary obligations to CPF account holders. There is really no one to blame except the PAP for the built up of the credit crisis as they are subscribed to the simplistic view that Singapore has but only one economic strategy: foreign investment. Singapore became a tax haven and sacrificed even its people for foreign investment. The low interest rate has been manipulated to attract foreign investment and borrowing.

The Credit Crisis will be at its hardest hit when the $19 billion debt is due for most property developers. As condos are not selling (vacancy rate is currently at 7.1% and still climbing), developers are likely to belly up when the deadline June 2015 comes. The next stage is of course more people defaulting on their mortgage and all these spells good news for buyers of course. This is when we will see property prices for both private and public at its lowest for a good number of months, and depending on the general election result of 2016.

Should the PAP win the 2016 GE, we will expect them to fulfill the 6.9 million population target and further increase the housing price - basically the same of what they have done over the past 10 years. Should the PAP lose by a great margin and several Ministers who become jobless as they lose the GRCs, we will expect the prices to continue resonating to becoming affordable again like Singaporeans enjoyed during the 1980s.

Alex Tan

TRS Contributor

<!-- /.block --> <style>.node-article .field-name-link-line-above-tags{float: right;}.node-article .field-name-ad-box-in-article {float: left;margin: 15px 15px 10px 0;}.node-article .field-tags{clear: both;}</style> Post date:

6 Dec 2014 - 10:32am

<ins id="aswift_0_expand" style="margin: 0px; padding: 0px; border: currentColor; width: 336px; height: 280px; display: inline-table; visibility: visible; position: relative; background-color: transparent; border-image: none;"><ins id="aswift_0_anchor" style="margin: 0px; padding: 0px; border: currentColor; width: 336px; height: 280px; display: block; visibility: visible; position: relative; background-color: transparent; border-image: none;"><iframe name="aswift_0" width="336" height="280" id="aswift_0" frameBorder="0" marginWidth="0" marginHeight="0" scrolling="no" vspace="0" hspace="0" allowfullscreen="true" style="left: 0px; top: 0px; position: absolute;" allowTransparency="true"></iframe></ins></ins>

As of Dec 2014, Singapore is in a recession. We are currently experiencing the start of the credit crisis caused by the long term low interest environment. You may not believe it but various economic signs are indicating that we are in for a free fall and the worse part is we have not reached the trough yet:

1) SGD at all time low against USD

2) Property prices at its lowest since 2008

Private property prices have been disastrous even for prime areas, with drop ranging from 20% to 40%. Public housing are also going at a discount with more sellers than buyers in the market.

3) Mounting debt

No thanks to PAP ex-Minister Mah Bow Tan's "asset appreciation policy" that led to exorbitant public housing prices during his reign, Singapore residents are among the highest indebted people in the world with the average debt per person standing at $80,000 or 2.4 times the average annual salaries. More homeowners especially private property owners are defaulting on their mortgage and auctioning of private homes foreclosed by banks is picking up. It will only be a matter of time when HDB prices are so low, mortgage debt owners are serving a mortgage lower than the possible resale price.

4) Weakening purchasing power

Real wage growth after deduction for CPF and accounting for yearly inflation has been stagnated for the past 11 years since 2003 when Lee Hsien Loong become Prime Minister. There isn't anything young people who are fresh in the job market could afford without landing themselves in debt and this including dating and family building which explains the lowest birth rate ever - conveniently under Lee Hsien Loong's charge too. Naturally of course, the PAP uses the pretext of materialism to deny themselves of any failure in shoring up income.

<ins id="aswift_1_expand" style="margin: 0px; padding: 0px; border: currentColor; width: 336px; height: 280px; display: inline-table; visibility: visible; position: relative; background-color: transparent; border-image: none;"><ins id="aswift_1_anchor" style="margin: 0px; padding: 0px; border: currentColor; width: 336px; height: 280px; display: block; visibility: visible; position: relative; background-color: transparent; border-image: none;"><iframe name="aswift_1" width="336" height="280" id="aswift_1" frameBorder="0" marginWidth="0" marginHeight="0" scrolling="no" vspace="0" hspace="0" allowfullscreen="true" style="left: 0px; top: 0px; position: absolute;" allowTransparency="true"></iframe></ins></ins>

5) Low interest rate

The years of cheap credit since 2003 (more noticeably 2.5% CPF OA interest rate) have caused massive inflation, created the credit crisis and saving losses among the people. Continual depression of interest rate to boost investments has reached saturation - investments are not happening and more people rather keep their money in low interests defensive instruments. Just recently, the PAP legislated that private loan firms cannot raise their lending rate. Raising the interest rate will affect CPF's interest rate and add additional pressure to the PAP government who have recently been raising CPF Minimum Sum and Withdrawal Age in order to delay their fiduciary obligations to CPF account holders. There is really no one to blame except the PAP for the built up of the credit crisis as they are subscribed to the simplistic view that Singapore has but only one economic strategy: foreign investment. Singapore became a tax haven and sacrificed even its people for foreign investment. The low interest rate has been manipulated to attract foreign investment and borrowing.

The Credit Crisis will be at its hardest hit when the $19 billion debt is due for most property developers. As condos are not selling (vacancy rate is currently at 7.1% and still climbing), developers are likely to belly up when the deadline June 2015 comes. The next stage is of course more people defaulting on their mortgage and all these spells good news for buyers of course. This is when we will see property prices for both private and public at its lowest for a good number of months, and depending on the general election result of 2016.

Should the PAP win the 2016 GE, we will expect them to fulfill the 6.9 million population target and further increase the housing price - basically the same of what they have done over the past 10 years. Should the PAP lose by a great margin and several Ministers who become jobless as they lose the GRCs, we will expect the prices to continue resonating to becoming affordable again like Singaporeans enjoyed during the 1980s.

Alex Tan

TRS Contributor