Property cartel REDAS pressures gahmen to line its member's pockets with more money.

Me thinks that any professionalism/ work pride in REDAS is long evaporated. No longer an organisation priding itself for providing good and affordable housing to Singaporeans, REDAS, like some PAP politicians (see below (appended)) are probably filled with rent seekers, out to exploit the poor in the name of 'dignity': basically a financial arms race amongst the rich to see who can exploit the poor most and drive the most flashy luxury car to catch the other's attention if not envy.

Professional organisation members in Singapore seem to be driven by greed and envy: service to humanity has become a long forgotten creed.

Where was Redas when home prices were rising? - Forum Letters Premium News - The Straits Times

Me thinks that any professionalism/ work pride in REDAS is long evaporated. No longer an organisation priding itself for providing good and affordable housing to Singaporeans, REDAS, like some PAP politicians (see below (appended)) are probably filled with rent seekers, out to exploit the poor in the name of 'dignity': basically a financial arms race amongst the rich to see who can exploit the poor most and drive the most flashy luxury car to catch the other's attention if not envy.

Professional organisation members in Singapore seem to be driven by greed and envy: service to humanity has become a long forgotten creed.

Where was Redas when home prices were rising? - Forum Letters Premium News - The Straits Times

The Straits Times, Published on Dec 01, 2014

Where was Redas when home prices were rising?

LAST Thursday's report ("Property sector 'needs govt support'") reads like a case of the Real Estate Developers' Association of Singapore (Redas) wanting to have its cake and eat it, too.

Redas president Chia Boon Kuah warned of grave consequences for the country, noting how property prices have declined amid falling sales in the last four consecutive quarters.

Did Redas make any such warning when property prices ran ahead of the growth in household incomes, and did it ask the Government to take action then?

It was only last year that we saw the second-quarter private residential property price index hitting an all-time high despite a few rounds of cooling measures.

Did Redas not realise that rising property prices caused the public to fear that homes would be beyond their reach, and that many have bought property even though they may not be able to service the housing loans?

The supply of 68,000 completed residential units over the next few years will be built by the association's members.

More properties may have been put on the block due to mortgage defaults ("More homes go under the hammer in weak market"; Nov 21), if not for the cooling measures and the total debt servicing ratio framework.

Khong Kiong Seng

Copyright © 2014 Singapore Press Holdings. All rights reserved.

Where was Redas when home prices were rising? - Forum Letters Premium News - The Straits Times

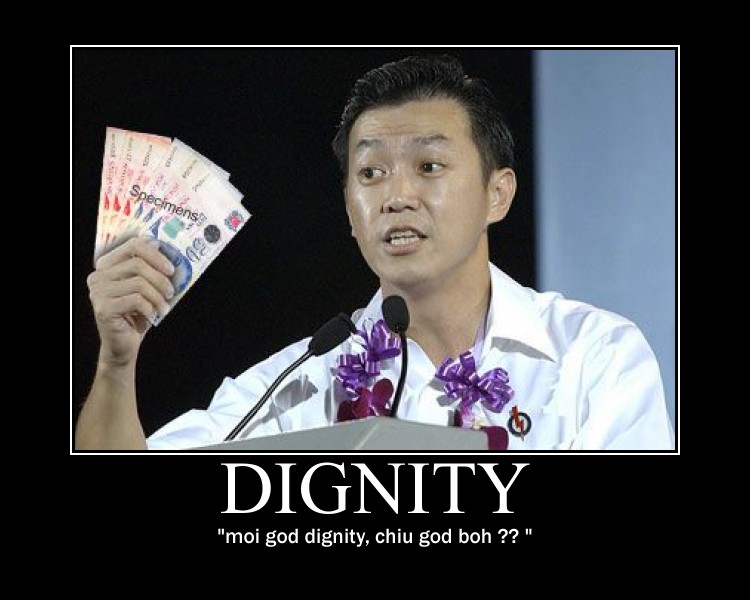

"If the annual salary of the Minister of Information, Communication and Arts is only $500,000, it may pose some problems when he discuss policies with media CEOs who earn millions of dollars because they need not listen to the minister's ideas and proposals. Hence, a reasonable payout will help to maintain a bit of dignity."

- MP Lim Wee Kiak apologises for comments on pay

[IMG URL]

Last edited: