Source: Rethinking The Ricebowl Blog

Ho Kwon Ping’s Self-Serving Proposals Have No Merit.

Nov 15 Posted by kjeyaretnam

Yesterday I wrote about why the general Singaporean public paying for foreign workers’ medical care was a bad idea. If companies are allowed to get away without providing adequate medical coverage for their foreign workers this would effectively be a subsidy to those employers to employ foreign workers rather than Singaporeans.

Today I read about the proposals from the Executive Chairman of Banyan Tree, a luxury hotels and resorts group, Ho Kwon Ping.

Who is Ho Kwon Ping?

Mr Ho was detained in the 1970s for writing critical articles about the PAP Government. During his imprisonment, according to an interview he gave to the BBC, he had a conversion realising that he wasn’t Nelson Mandela. Purely coincidentally he became very rich but after assuming the leadership of the family business and purely coincidentally he has become a vocal supporter of the PAP.

What is his proposal?

Ho advocates converting the foreign workers’ levy into a deferred savings account akin to CPF, which the foreign worker would be able to withdraw when he left Singapore.

What is the Foreign Worker’s Levy?

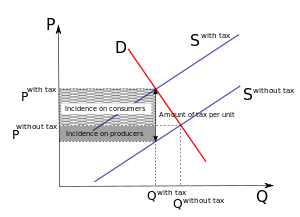

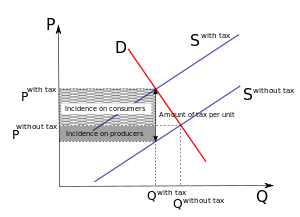

This is a sum paid to the government by the employer. At the moment the foreign worker levy acts as a tax on the use of foreign labour. It should make foreign workers more expensive to employ and thus encourage employers to substitute Singaporeans.

Isn’t that a good thing?

Unfortunately, as I have pointed out repeatedly, if the supply of foreign labour is inelastic ( which means that even if their salaries are cut the amount of labour supplied does not fall by very much ) the levy could act merely to drive down wages for foreign workers while the gross cost to the employer (wage plus levy) remains unchanged. In this case the government is benefitting from the levy but the foreign workers are worse off. Most importantly Singaporeans are even worse off as no new jobs have been created for Singaporeans.

So the Foreign workers levy doesn’t help Singaporeans and is ineffective.

So isn’t Ho’s proposal an improvement?

Ho’s proposal is to convert the levy into a deferred savings account for the foreign workers. The same problems apply.

While the number of Mr Ho’s employees in Singapore appears to be small, he speaks clearly with the economic interests of employers in mind and not Singaporean workers or even foreign workers.

What’s your solution?

Unfortunately judging by the comments on my Facebook page many employers are unhappy that the Government is not subsidising them more to take on foreign workers and making it easier for them to employ foreigners. This will always be so as far as employers are concerned. Labour can never be cheap enough. Slave owners in the American South worried that if slavery was abolished labour would become too expensive to allow them to profitably grow cotton and other crops.

Lets hope that Singaporeans are not too naïve to see through the arguments of special interest groups that appear to have altruistic motives but are actually trying to gain a commercial advantage.

Ho Kwon Ping’s Self-Serving Proposals Have No Merit.

Nov 15 Posted by kjeyaretnam

Yesterday I wrote about why the general Singaporean public paying for foreign workers’ medical care was a bad idea. If companies are allowed to get away without providing adequate medical coverage for their foreign workers this would effectively be a subsidy to those employers to employ foreign workers rather than Singaporeans.

Today I read about the proposals from the Executive Chairman of Banyan Tree, a luxury hotels and resorts group, Ho Kwon Ping.

Who is Ho Kwon Ping?

Mr Ho was detained in the 1970s for writing critical articles about the PAP Government. During his imprisonment, according to an interview he gave to the BBC, he had a conversion realising that he wasn’t Nelson Mandela. Purely coincidentally he became very rich but after assuming the leadership of the family business and purely coincidentally he has become a vocal supporter of the PAP.

What is his proposal?

Ho advocates converting the foreign workers’ levy into a deferred savings account akin to CPF, which the foreign worker would be able to withdraw when he left Singapore.

What is the Foreign Worker’s Levy?

This is a sum paid to the government by the employer. At the moment the foreign worker levy acts as a tax on the use of foreign labour. It should make foreign workers more expensive to employ and thus encourage employers to substitute Singaporeans.

Isn’t that a good thing?

Unfortunately, as I have pointed out repeatedly, if the supply of foreign labour is inelastic ( which means that even if their salaries are cut the amount of labour supplied does not fall by very much ) the levy could act merely to drive down wages for foreign workers while the gross cost to the employer (wage plus levy) remains unchanged. In this case the government is benefitting from the levy but the foreign workers are worse off. Most importantly Singaporeans are even worse off as no new jobs have been created for Singaporeans.

So the Foreign workers levy doesn’t help Singaporeans and is ineffective.

So isn’t Ho’s proposal an improvement?

Ho’s proposal is to convert the levy into a deferred savings account for the foreign workers. The same problems apply.

- Employers can theoretically reduce their foreign workers’ direct pay by up to the full amount of the deferred savings because these workers will be able to access their savings when they return to their home country.

- Given foreign workers’ weak bargaining power it is likely that employers will be able to cut their direct pay substantially.

- Ho’s proposal thus amounts effectively to a removal of the tax on foreign labour.

- Employers are likely to respond by employing MORE foreign labour and cutting back on their usage of Singaporeans as far as they are able.

While the number of Mr Ho’s employees in Singapore appears to be small, he speaks clearly with the economic interests of employers in mind and not Singaporean workers or even foreign workers.

What’s your solution?

- A better solution would be to have a minimum wage that was mandatory for all workers, both local and foreign.

- This would remove the ability of employers to drive down foreign workers’ wages to the detriment of Singaporeans competing with them for jobs.

- The levy could then be converted into a CPF account for foreign workers or retained as a tax on foreign labour.

Unfortunately judging by the comments on my Facebook page many employers are unhappy that the Government is not subsidising them more to take on foreign workers and making it easier for them to employ foreigners. This will always be so as far as employers are concerned. Labour can never be cheap enough. Slave owners in the American South worried that if slavery was abolished labour would become too expensive to allow them to profitably grow cotton and other crops.

Lets hope that Singaporeans are not too naïve to see through the arguments of special interest groups that appear to have altruistic motives but are actually trying to gain a commercial advantage.

End Of Article