How Quantitave Easing makes average Joe sick, hungry and poor.

I.e. how QE induced inflation, low interest rate environment helps the rich as it disenfranchises the poor.

By rich I mean shareholders/ MNC C-suite staffers and politicians by extension since in the Singapore context, political salaries are tagged to the highest private sector salaries (I.e. CEO level salaries)

By the poor, I mean working class, retirees etc whose income is to a lesser degree from share holdings/ property rent seeking but savings/ bank savings interest in cash or kind (I.e. bank $$$ deposits)

This is because every MNC KNOWS that in a high inflation low interest rate environment is an abnormality suited to make CEOs/ $$$ investors filthy rich since products manufactured at low costs (low capital costs due to low interest rates) can be sold for much higher costs depending on what the inflation rate is. It is thus a no brainer that without improving product quantity/ quality, the manufacturer (shareholders/ CEO) pockets the difference (generally assumed as) the QE/ inflation induced price increase over the artificially depressed interest rate (due to the flood of printed new $$$: aka quantitave easing (QE).

Thus, whilst GDP has increased due to products costing more, there is no material gain to the quality of life of the man in the streets. To politicians however, there is the satisfaction of an IMMEDIATE improvement in salary earned since either through bribes/ lobby funds from MNCs (I am pressured to declare this absent in Sink@poor) or by benchmarking to CEO level salaries.

QE is thus the construct of EVIL MEN out to rig GDP numbers in the hope of lining their own pockets at the expense of the masses or the poor.

The right way to improve the lives of the poor (which would probably improve GDP WITHOUT any QE would be to improve education and the level of moral persuasion in society (better public kindness/ cooperation, environment consciousness and personal hygiene, charity etc) so that poor people can achieve their fullest creative personal potential, in moral consciousness).

Inducing growth through QE is like an athlete on steriods: an illegal act with seriously detrimental future health consequences.

Politicians of today who espouse QE (e.g. Abenomics) will soon be overwhelmed with the overwhelming social costs and unrest due to wealth inequality caused by QE.

Shame on QE promoting politicians, the miseries that they will suffer in Hell are well deserved/ self-inflicted.

Illustrations:

Benchmarking political salaries to the highest possible:

Ben Bernanke (@FED Chairman) giving printed $$$ to his friends (MNCs in exchange for some sham bonds to keep interest rates artificially low):

(Pict source)

(Pict source)

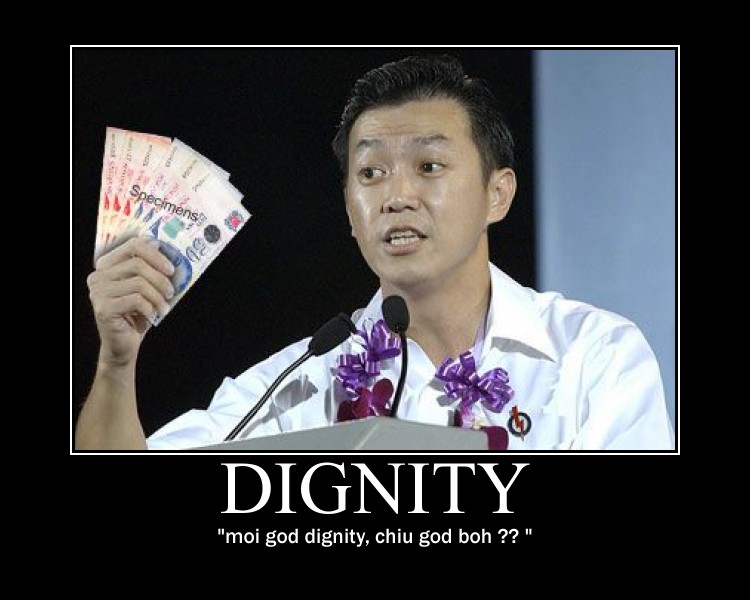

Singaporean politicians leveraging on the indignity of mean, corrupt & greedy capitalist to demand higher salaries (misrepresenting the meaning of the term 'dignity'):

How much $$$ the Singapore gahmen has since printed, leveraging on USA FED QE as a lame excuse.

.JPG) [pict source: https://secure.mas.gov.sg/msb-xml/Re...=I&tableID=I.1 ]

[pict source: https://secure.mas.gov.sg/msb-xml/Re...=I&tableID=I.1 ]

The ultimate outcome of all this QE: a quality of life for the average citizen, no different/ worse than that of the average Zimbabwean given that the Zimbabweans have ALREADY learnt their lesson (not to trust Mugabe too much)... Cash that can buy NOTHING...

Caption: Currency to exchange for gold please- takers, anyone?[Image source]

Caption: Currency to exchange for gold please- takers, anyone?[Image source]

More Picts:

Children of rich Singapore politicians jeering at/ abusing poor people:

Wee Shu Min elitism controversy

Wee Shu Min elitism controversy

Lawlessness/ legal bias in Singapore:

(Pict source)

(Pict source)

The man/ system behind it all (In Singapore that is)...

I.e. how QE induced inflation, low interest rate environment helps the rich as it disenfranchises the poor.

By rich I mean shareholders/ MNC C-suite staffers and politicians by extension since in the Singapore context, political salaries are tagged to the highest private sector salaries (I.e. CEO level salaries)

By the poor, I mean working class, retirees etc whose income is to a lesser degree from share holdings/ property rent seeking but savings/ bank savings interest in cash or kind (I.e. bank $$$ deposits)

This is because every MNC KNOWS that in a high inflation low interest rate environment is an abnormality suited to make CEOs/ $$$ investors filthy rich since products manufactured at low costs (low capital costs due to low interest rates) can be sold for much higher costs depending on what the inflation rate is. It is thus a no brainer that without improving product quantity/ quality, the manufacturer (shareholders/ CEO) pockets the difference (generally assumed as) the QE/ inflation induced price increase over the artificially depressed interest rate (due to the flood of printed new $$$: aka quantitave easing (QE).

Thus, whilst GDP has increased due to products costing more, there is no material gain to the quality of life of the man in the streets. To politicians however, there is the satisfaction of an IMMEDIATE improvement in salary earned since either through bribes/ lobby funds from MNCs (I am pressured to declare this absent in Sink@poor) or by benchmarking to CEO level salaries.

QE is thus the construct of EVIL MEN out to rig GDP numbers in the hope of lining their own pockets at the expense of the masses or the poor.

The right way to improve the lives of the poor (which would probably improve GDP WITHOUT any QE would be to improve education and the level of moral persuasion in society (better public kindness/ cooperation, environment consciousness and personal hygiene, charity etc) so that poor people can achieve their fullest creative personal potential, in moral consciousness).

Inducing growth through QE is like an athlete on steriods: an illegal act with seriously detrimental future health consequences.

Politicians of today who espouse QE (e.g. Abenomics) will soon be overwhelmed with the overwhelming social costs and unrest due to wealth inequality caused by QE.

Shame on QE promoting politicians, the miseries that they will suffer in Hell are well deserved/ self-inflicted.

Illustrations:

Benchmarking political salaries to the highest possible:

Ben Bernanke (@FED Chairman) giving printed $$$ to his friends (MNCs in exchange for some sham bonds to keep interest rates artificially low):

Singaporean politicians leveraging on the indignity of mean, corrupt & greedy capitalist to demand higher salaries (misrepresenting the meaning of the term 'dignity'):

"If the annual salary of the Minister of Information, Communication and Arts is only $500,000, it may pose some problems when he discuss policies with media CEOs who earn millions of dollars because they need not listen to the minister's ideas and proposals. Hence, a reasonable payout will help to maintain a bit of dignity."

- MP Lim Wee Kiak apologises for comments on pay

[IMG URL]

How much $$$ the Singapore gahmen has since printed, leveraging on USA FED QE as a lame excuse.

The ultimate outcome of all this QE: a quality of life for the average citizen, no different/ worse than that of the average Zimbabwean given that the Zimbabweans have ALREADY learnt their lesson (not to trust Mugabe too much)... Cash that can buy NOTHING...

More Picts:

Children of rich Singapore politicians jeering at/ abusing poor people:

Lawlessness/ legal bias in Singapore:

The man/ system behind it all (In Singapore that is)...