PAP Should Stop CPF Wayang, Just Return OUR CPF

Source:

likedatosocanmeh Blog

20141115 PAP should stop CPF wayang, just return OUR CPF

November 15, 2014 by phillip ang

CPF members are being treated to another PAP ‘wayang’ with the setting up of the

CPF Advisory Panel to ‘listen’ to our feedback.

The

CPFAP comprises PAP-affiliated members such as

NTUC’s Sylvia Choo, Braddell Heights CCC Chairman Ng Cher Yan, Taman Jurong CCC Vice-Chairman Muhammad Faizal and a member of MAS Board of Directors Tan Chorh Chuan. The other 9 members are not average income earners. The PAP has already decided on the topics to be discussed, never mind the transparency which is sorely lacking nor members’ real needs.

The CPFAP is merely another PAP propaganda to impress upon the public that the government is listening when it is actually

maintaining the CPF status quo. Some ‘good news’ may coincide with the election.

Singaporeans should not participate in another meaningless feedback exercise.

The issues which CPF members would like addressed are:

1. The flawed CPF MS scheme which does not take into account our retirement needs. It must either be scrapped or revised an opt-in scheme.

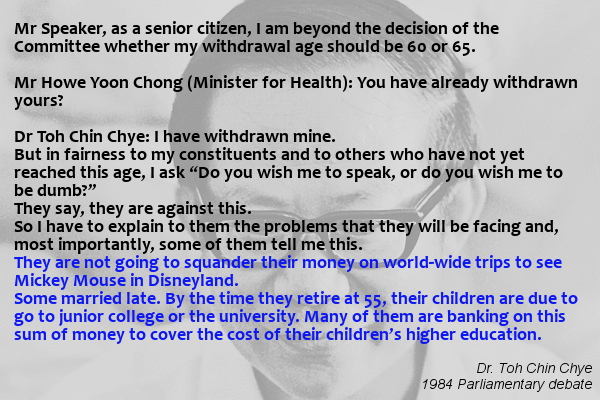

2. The withdrawal age - to be reinstated to 55 years or an age through consensus, not one dictated by PAP. There are obvious reasons for returning OUR money at 55 instead of 65.

3. CPF monies to be managed separately from our country’s reserves.

4. Transparency – disclosure of all CPF investments ie similar to the disclosure of other pension funds such as Norway’s. Even neighbouring Malaysia’s EPF ** is sufficiently transparent to put the PAP to shame.

Instead, of addressing these issues, the CPFAP only wants to address the following:

1. Minimum Sum (MS) – how to adjust beyond 2015 for future retirees.

2. Lump sum withdrawals at age 65 years – how much should CPF members be able to withdraw and under what conditions.

3. CPF payouts – how could CPF payouts be adjusted to address cost of living increases over time.

4. Alternative investments and annuities – how to provide more flexibility for CPF members who are prepared to take on more risks.

The PAP has already decided to keep the CPF features that are discriminatory which most CPF members do not want.

PAP should not continue to ride roughshod over our interests because it is merely a political party which has already overstayed its welcome. Should it continue to dictate to us the terms of our CPF withdrawal, it will be seen as unfit to govern. The only solution should be obvious.

Although the CPF issue has affected hundreds of thousands of citizens, the PAP has never taken this seriously. Recall 2 years ago there was not a whisper on the CPF issue during PAP’s National CONversation, not ours. Would ordinary citizens be happy if our hard-earned money was legally ‘confiscated’, to be kept for a god-knows-when future rainy day until we die while we worry about putting food on the table today?

PAP MP Hri Kumar had his own CPF CONversation in July to ‘discuss’ CPF matters. It turned out to be a blunder after

a video of a 76 year old ex teacher begging for her CPF to be returned went viral. Kumar should have also known he was not in a position to conduct a CPF forum because, like ordinary Singaporeans,

he did not know where GIC invested our CPF monies!

Does the PAP really want to listen and help CPF members retire comfortably? The answer is ‘no’. It is only interested in ‘wayang’.

According to the

2013 CPF statistics (Annex I) CPF members (active) in the 50 to 55 age group:

- There are about 70,000 members with $150,000 or less in their CPF. (Since almost everyone uses CPF for housing, this would mean they are likely to have close to nothing in their CPF)

- 142,525 members have $150,000 and above. (After deducting the amount used for housing and Medisave, the majority would be unlikely to meet the current OA MS of $155,000)

Including inactive members such as women who have left the workforce to raise a family, the

majority of CPF members between 50 and 55 age group are not able to meet the OA MS.

If PAP had really wanted to help retirees, why does the government

increase the MS to insane levels, money which the majority of CPF members do not have in their accounts?

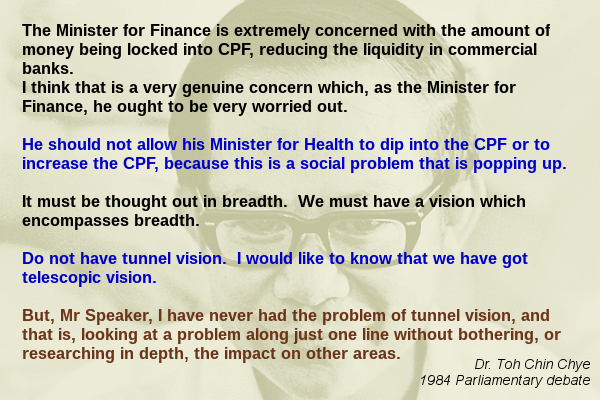

An increasing number of CPF members now fear our CPF savings in GIC have been lost in bad investments. The issue of transparency needs to be urgently addressed because there appears to be something very wrong when our government continuously channel hundreds of billions into GIC through legislation but is afraid to state the exact amount managed by GIC.

In 2007, CPF monies managed by GIC was $128 billion (page 111); by June this year, CPF balance has

increased by $136 billion to $264 billion.

Why did the PAP channel a staggering $136 billion into GIC within 7 years? .

In 2000, CPF monies managed by GIC was only $60 billion (page 97). 14 years later, the amount has

increased by more than 400% to $264 billion. What is PAP’s real motive for channeling more than $200 billion into GIC?

With the number of CPF members constantly increasing and the Population White Paper rammed through parliament to increase our population to 6.9 million, does this not resemble a Ponzi scheme?

Transparency on our CPF investments in GIC has been an issue for more than 3 decades. Why does the PAP continue to hide information which CPF members deserve to know? Why will the CPFAP not be discussing the issue of transparency?

Conclusion

By appointing PAP-affiliated members to the CPFAP, the PAP is clearly not sincere to resolve our CPF issues. It is just another PR exercise/propaganda aka wayang.

CPF members deserve to know where our funds are invested. But when the government insists on continued opacity, this has raised concerns on the solvency of GIC which manages CPF monies.

Postponing the lump sum withdrawal to 65 is

not acceptable. CPF members will also not accept a partial lump sum payout at 65. The PAP is not doing us any favour because it is OUR money.

Policies are not cast in stone. The PAP has lost its moral authority to govern when it legislated an increasing amount of our retirement savings for

GIC’s investments which are subjected to very high risks. CPF members demand the PAP government revamp the flawed CPF policy. Our CPF must be returned without conditions attached.

**

page 4 and 5 – detailed EPF members’ profile whereas CPF disclosure is selective

page 6 – information on their staff strength which CPF does not have

page 7 – information on the top 30 equity investment listed on Bursa Malaysia, CPF none

page 8 – detailed information on withdrawal under different schemes over a 4-year period, CPF only 1 year with much less information

Check out CPF statistics

here and you will be asking this question – why doesn’t the CPF Board disclose statistics similar to those of EPF?

End Of Article