-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

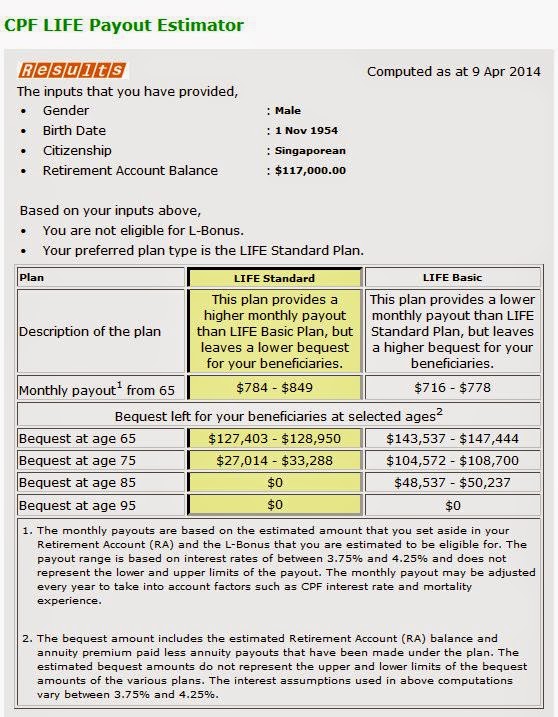

Why CPF Life payout keep dropping?

- Thread starter theDoors

- Start date

Rubbish. Whiether drop or scam? CPF is the best gift ever given by PAP to Singaporeans!

What gift? It's their hard earned savings!

If you start your CPF Life after the age of 55, you are no longer eligible for the L-Bonus. The 2009 plan assumes a 55 year old citizen and includes the L-Bonus. If you change the birthdate for the current calculator to 1959 so that you are eligible for the L-Bonus, then you will get a payout that is comparable to the 2009 plan.

As with any Life Annunity scheme, monthly payouts are calculated based on interest rate and life expectation. So an update in interest rates and actuarial tables will affect the payouts.

As with any Life Annunity scheme, monthly payouts are calculated based on interest rate and life expectation. So an update in interest rates and actuarial tables will affect the payouts.

Cpf board is already bankrupt. Ho ching took all the money and threw it away.

screw this compulsory annuity! vote the PAP out!

Just curious, what do you think is a better alternative to a life annuity?

Just curious, what do you think is a better alternative to a life annuity?

why living beyond 85 wasn't a big issue pre 2009?

suddenly became big issue after TH lost tens of billons in 2009?

Just curious, what do you think is a better alternative to a life annuity?

better alternative to compulsory annuity? a freedom of choice to do whatever you want with your money!

return us our CPF monies when we're 55, simple as that!

better alternative to compulsory annuity? a freedom of choice to do whatever you want with your money!

return us our CPF monies when we're 55, simple as that!

I want medisave to be able to use for psychiatric expenses. My anti depression and ADHD medicine is costing me so much money. Please return me my medisave and my CPF.

better alternative to compulsory annuity? a freedom of choice to do whatever you want with your money!

return us our CPF monies when we're 55, simple as that!

Unfortunately the sad fact of the matter is that when returned all the CPF money, most Singaporeans will end up screwing themselves by mismanaging that money more than CPF supposedly screws us.

Let's leave aside the people that will simply blow all the money within a few years overindulging, and then become a social burden that the rest of us will have to pay for.

Most people would probably put the money into a bank, let's say they put into FD which at best earns 1% interest today, this is far lower than the 4% offered by CPF Life. Using a TVM calculator based on $100k balance and monthly withdrawals of $850 starting at 65 DDA, the money will only last until 77. With CPF Life, the ~$850 monthly is paid out until you die.

The financially savvy people might be able to get larger yields of maybe 6% by investing the money in equities, but this comes with additional risks, and is probably not a suitable choice for majority of Singaporeans.

Like it or not, a Life Annuity is simply the best place for most Singaporeans to put their money in. Making it compulsory is simply the right thing to do.

Like it or not, a Life Annuity is simply the best place for most Singaporeans to put their money in. Making it compulsory is simply the right thing to do.

in that case you deserve the PAP, like it or not i'm voting them out

......when returned all the CPF money, most Singaporeans will end up......mismanaging that money..

Most people would probably put the money into a bank.....

Are you assuming (on what basis?) or have the statistics to back up your argument?

The simple fact is that nobody has the right to tell an adult what to with their own monies much less force you to deposit it with them -whether as CPF, annuity or whatever.

Last edited:

why living beyond 85 wasn't a big issue pre 2009?

suddenly became big issue after TH lost tens of billons in 2009?

Our life expectancy has been steadily rising, from 65 in 1960, and it is now almost 85. Under the old minimum sum scheme, monthly payouts simply stopped once the balance has been exhausted. Since the payouts were calculated to pay out over 20 years from age 60, that means retirees over age 80 would suddenly have no income. With a life annuity, there is a lower payout, but everyone under the scheme will continue to receive the income until death.

Note that the Life Annuity thing in CPF was not a new thing, before 2009 it was Opt-in and you are allowed, even encouraged (the returns were really really good when it first started and my Dad immediately got on it), to purchase Life Annuity plans with parts of your Minimum Sum.

2009 of course was right after the 2008 Financial Crisis, and TH wasn't the only SWF in the world which saw a loss in portfolio value - all of them did. Fortunately this was more than recovered in 2010 and TH ended that financial year stronger than the 2008 position.

CPF wasn't the only pension scheme that was reviewed in 2009 either. Pension schemes all over the world were reviewed and many of them made adjustments to increase the length of payouts and to increase retirement age. If you are interested to learn more about this, look up the Melbourne Mercer Global Pension Index.

in that case you deserve the PAP, like it or not i'm voting them out

Oh, I'm voting against the PAP too. I dislike the PAP like many people here do, but like them or not, the CPF as our national pension scheme is one of the things they actually get (mostly) right.

It's not like voting in opposition is going to get your CPF money out. Take a look at the manifesto of WP, SDP, and the rest. They all support CPF and the minimum sum, although they mostly want to make some adjustments here and there.

Like it or not, countries with a life expectancy significantly higher than retirement age need a good pension scheme in place. Most of them do, quite a few of them are struggling. The CPF is one of the better schemes out there. It's not perfect - the Mercer report lists a few places where it needs improving, but the basic principals are sound.

Oh, I'm voting against the PAP too. I dislike the PAP like many people here do, but like them or not, the CPF as our national pension scheme is one of the things they actually get (mostly) right.

It's not like voting in opposition is going to get your CPF money out. Take a look at the manifesto of WP, SDP, and the rest. They all support CPF and the minimum sum, although they mostly want to make some adjustments here and there.

Like it or not, countries with a life expectancy significantly higher than retirement age need a good pension scheme in place. Most of them do, quite a few of them are struggling. The CPF is one of the better schemes out there. It's not perfect - the Mercer report lists a few places where it needs improving, but the basic principals are sound.

You got to be joking that the PAP got the CPF right! The CPF is totally wrong. It is NOT a pension fund. It is your savings, controlled by the government, to provide cheap loans to the government. You don't get any more than you contribute, besides the pittance interest. My insurance policy gives me the same rate as the CPF but I can withdraw the money.

Look, Mercer focus on the sustainability of the CPF, not on how good the CPF is providing a livable income for retirees.

A true pension fund is one that uses the contributions to generate income that will pay participants a decent fixed sum over their lifetime. The PAP took our money and used it to generate income and pay us pittance. Because the CPF is sustainable, it decides to hang on to our money forever. That's the reality.

You got to be joking that the PAP got the CPF right! The CPF is totally wrong. It is NOT a pension fund. It is your savings, controlled by the government, to provide cheap loans to the government. You don't get any more than you contribute, besides the pittance interest. My insurance policy gives me the same rate as the CPF but I can withdraw the money.

Look, Mercer focus on the sustainability of the CPF, not on how good the CPF is providing a livable income for retirees.

A true pension fund is one that uses the contributions to generate income that will pay participants a decent fixed sum over their lifetime. The PAP took our money and used it to generate income and pay us pittance. Because the CPF is sustainable, it decides to hang on to our money forever. That's the reality.

Well, you are right in that CPF isn't a pension fund. Pension is just one of the components of the CPF. It also provide medical insurance and converage and the controversial savings thing. To be precise, the retirement account which is the amount that goes into Minimum Sum and CPF Life is the pension portion of CPF, and I think you'll be hard pressed to find private insurance that will underwrite a better interest rate than the 4% (+1% bonus for first 60k) offered by CPF and provides the same level of guarantee.

CPF-OA is probably your major concern and I agree with you that that rate is low (although being much higher than FD). Fortunately, most of our OA can be taken out and invested, and the portion that can't gets a 1% bonus.

Both WP and SDP advocate for dividends to be paid out to CPF account holders whenever GIC/TH have good years, and I definitely agree with that. Sucks to see GIC and TH making big profits but not having such profits come back to us. But that doesn't mean that the basic principals of CPF are unsound.

in that case you deserve the PAP, like it or not i'm voting them out

wwabbit has been solidly with the opposition and his record is here in SBF for all to see.

The annuity issue has no easy solution. I'm all for the abolition of compulsory annuity, but with the caveat that if you squander your life savings on wine, women and song, society will not be asked to save you.

Destitution in old age in singapore is currently caused not because people squander their life savings in their golden years, but because they reached 55 without any savings to speak of. There are always a variety of reasons ranging from illness, domestic problems, a messy divorce, personal bankruptcy, being cheated in business, or spending too much hanging flowers, and so on.

If CPF is liberalized, destitution may rise slightly because some people will do as wwabbit says, squander their life savings in their golden years. But then if you are 55 of sound mind and you still do that, I think society should leave you to get fucked.

I say liberalize our CPF and let people be responsible for their lives, for good or for ill.

Similar threads

- Replies

- 5

- Views

- 956

- Replies

- 5

- Views

- 836

- Replies

- 8

- Views

- 1K

- Replies

- 2

- Views

- 540