Mindless money printing- the S$308.4032B reason why Singapore inflation is so high nowadays.

According to video 'Causes of inflation: Cost-push and demand-pull'[YouTube]

Cost push inflation is input cost inflation caused by land, labour, capital, entrepreneurship- any increase in the cost of these factors increases the final product cost (i.e. an increase in CPI(Consumer Price Index)).

Demand Pull inflation is caused basically by the demand upon certain goods, as measured by the number of dollars people are willing to wage to attain a certain product.

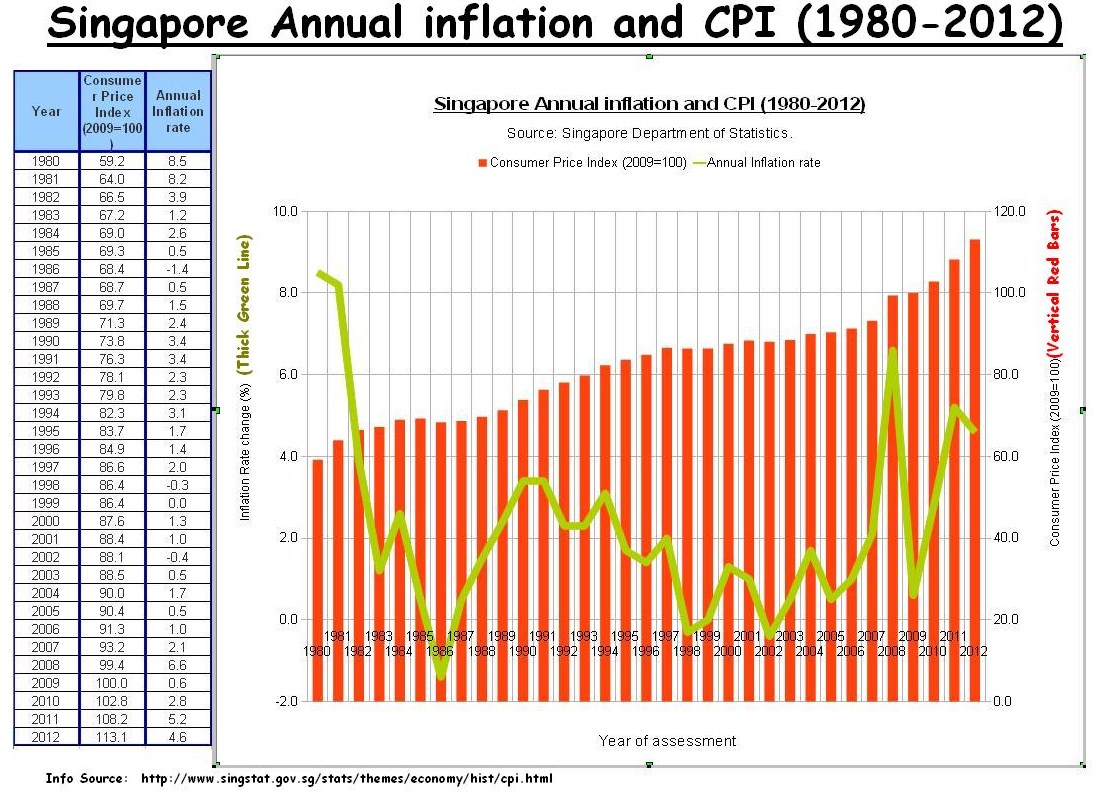

In the general scheme of things, in so far that consumers and suppliers of goods and services (we are all participants in each part in our daily affairs) remain decent and honest persons, with the tendency to 'consume' measured by one's tendency to 'produce'(productivity)- then theoretically, there would be NO consistent CPI rise except the occasional isolated demand/supply imbalance due to natural disaster or war. But Singapore is quite insulated away from any significant natural disaster or war, so why has the average price of goods between 1989 (CPI=71.3) and 2009(CPI=100) increased (inflated) by (100.0-71.3)/71.3 = 40.25% over the 20 years?? [See Pict: 'Singapore Annual Inflation rate and CPI (1980-2012)/Singstat']

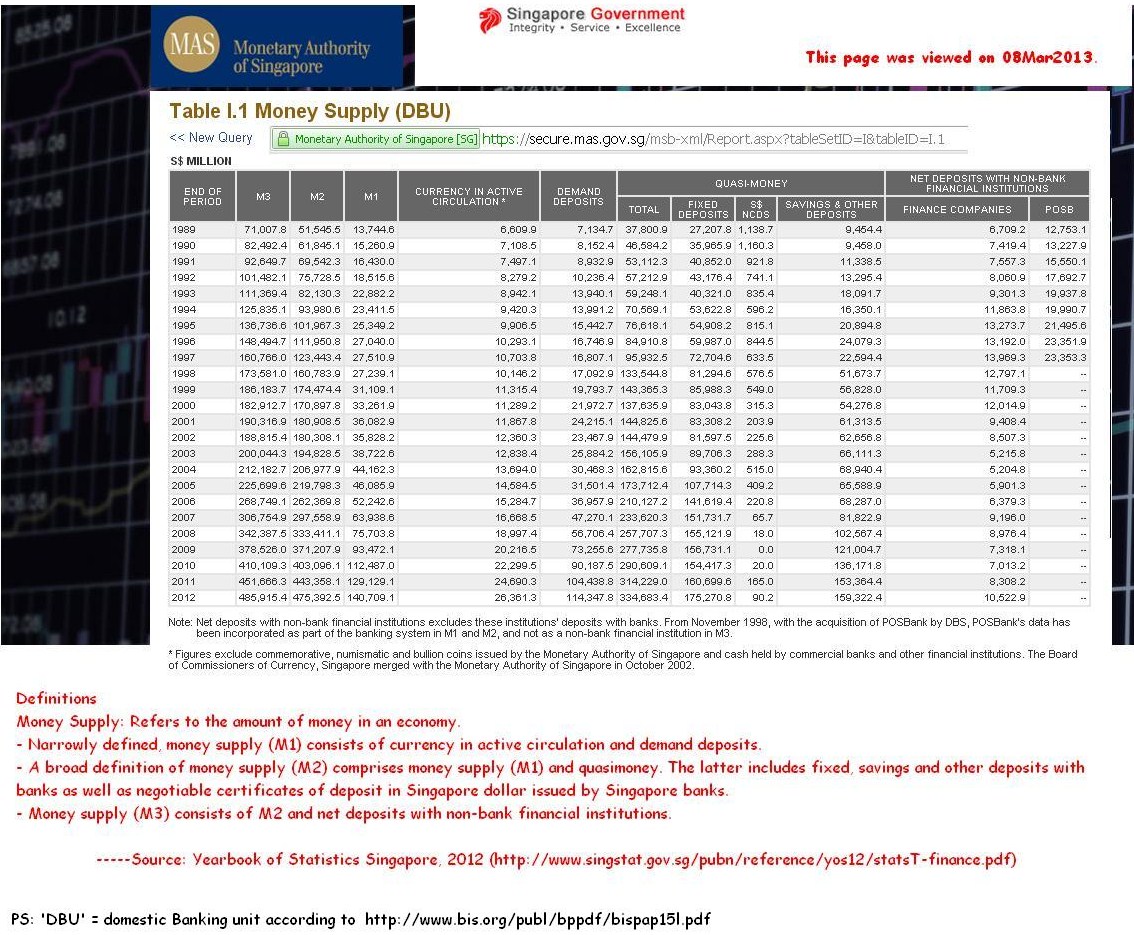

Studying the chart about 'Singapore Money Supply (DBU), M1,2,3, 1989 to 2012' for monetary supply changes between 1989 and 2009, one would easily note that M1 (Narrowly defined, money supply (M1) consists of currency in active circulation and demand deposits) M1 grew from S$13.7446B (1989) to S$93.4721B(2009)- a whopping 5.8fold increase over the 20years documented. (WRT to the M3 numbers of S$71.0078B(1989) vs S$378.5260(2009), the increase is a 4.33fold increase over 20 yrs)

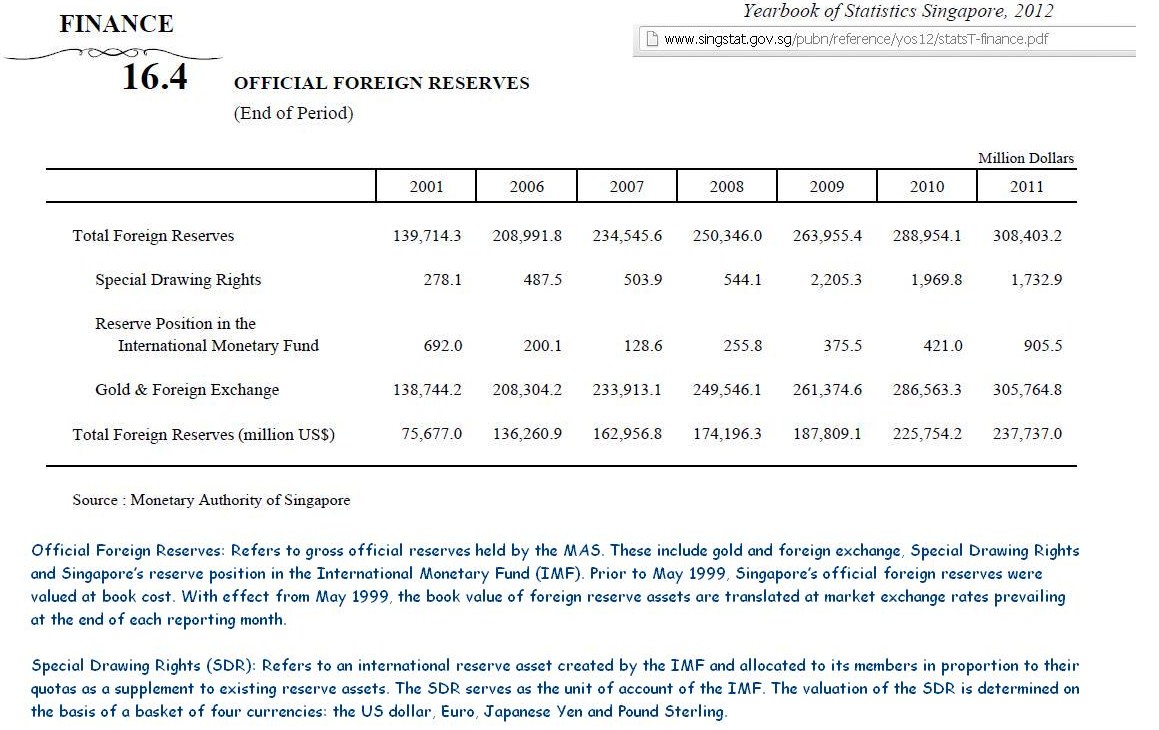

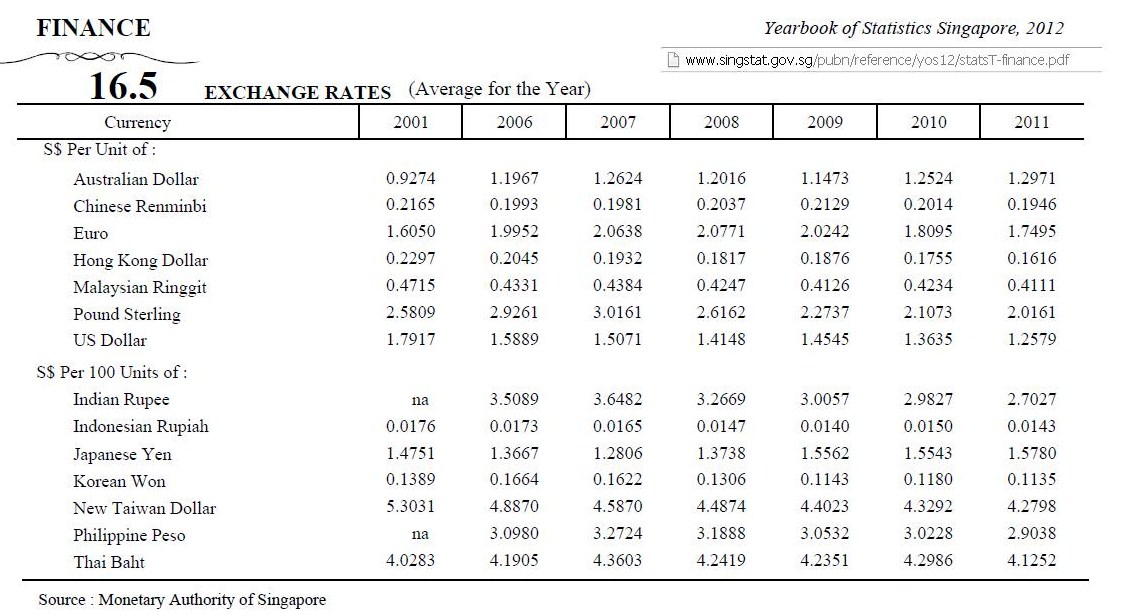

The official foreign reserves of Singapore between 1989 and 2000 are not available but according to 'Singapore official financial reserves (2001-2011)', the totals were S$139.7143B(2001) and S$308.4032B(2011)- amounting to a 1.207fold increase over the 10 year period (of course subject to variations in international currency exchange rates [SGD exc rt, 2001-2011]).

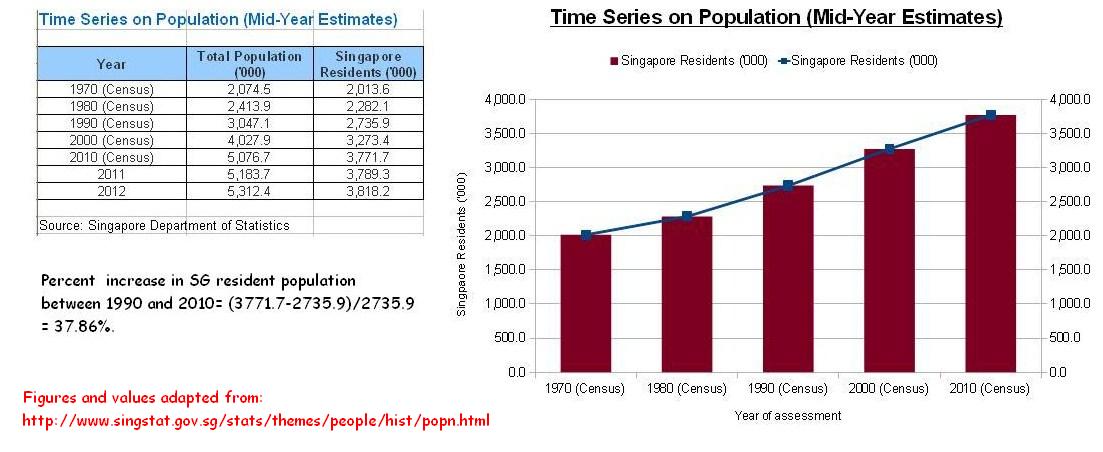

According to 'Singapore Time Series on Population (Mid-Year Estimates)' using the 20 year interval where census were taken between 1990 and 2010, the local resident population increased from 2735.9K (1990) to 3771.7K(2010): a 37.86% Singapore resident population increase over the 20 years mentioned.

Singaporeans have not become more lazy, on the contrary, according to 'Singstat: Trends in Productivity and Value Added by industry' 'total economy' (large olive green dot) productivity in Singapore has certainly increased between 1991 and 2011.

Whilst currency exchange rates may be a proximate measure of the relative depreciation of a nation's currency relative to others due to the effect of over supply of one nation's currency as compared to that of another, it cannot be denied that all nations around the world, led by the USA, are into a conspiracy of freely printing money which is of course inflationary 'Chart: Estimated global monetary Aggregates (1971-2010)' - the chart showing an approx 3 fold increase in world M3 money supply between 1989 to 2009.

Thus in 'Singapore's inflation may remain elevated for years to come: survey' [CNA, 24Jan2013] "survey by the Singapore Management University (SMU)... composite five-year-expectation is 4.97 per cent"

Guess Singaporeans are all victims of a world wide government conspiracy to keep them always working (savings are always eroded by inflation) till the day they die, and also in power (the SG govt has S$308.4032B(2011) alone in foreign reserves and gold).

So moral of the story is that governments all around the world should stop printing so much money to keep inflation under control and voters need to demand so (so as to safeguard one's retirement years).

Guess in Singapore, recent curbs upon car loan and housing loan quantum(s) are merely cosmetic changes meant to fudge inflation statistics yet do minimal to improve the lives of the poor and downtrodden.

Perhaps the Singapore government could lead the way forward by firstly not printing so much money which only breeds inflation if not hyper inflation as the population growth within a limited land area can only be so much.

Perhaps the Singapore government could start the discussion by explaining to the populace what it intends to do with its SGD 308.4032B(2011) in foreign reserves (should be more by now), and please be reminded, that convenient half truths by Ministers really do not help.

Picts below,

Rgds,

B.C.

,+M1,2,3,+1989+to+2012..JPG) [PictSource: SG money supply]

[PictSource: SG money supply]

.JPG) [PictSource: 'Singapore Annual Inflation rate and CPI (1980-2012)/Singstat']

[PictSource: 'Singapore Annual Inflation rate and CPI (1980-2012)/Singstat']

.JPG) [PictSource: SG official Foreign Reserves (YOS2012)]

[PictSource: SG official Foreign Reserves (YOS2012)]

.JPG) [PictSource: Time Series on Population (Mid-Year Estimates)(1970-2012)]

[PictSource: Time Series on Population (Mid-Year Estimates)(1970-2012)]

.JPG) [PictSource: Estimated global monetary Aggregates (1971-2010)]

[PictSource: Estimated global monetary Aggregates (1971-2010)]

(2001-2011).JPG) [PictSource: SGD exc rates, finance (2001-2011), YOS2012]

[PictSource: SGD exc rates, finance (2001-2011), YOS2012]

Tags: Inflation, foreign reserves, gold, government, Singapore, politics, printing, corruption, fraud, democracy, dictatorship, capitalism, currency, gold standard,

Anyhow, nice music that I like that U too might like:

By Faith - Keith & Kristyn Getty - YouTube.

According to video 'Causes of inflation: Cost-push and demand-pull'[YouTube]

Cost push inflation is input cost inflation caused by land, labour, capital, entrepreneurship- any increase in the cost of these factors increases the final product cost (i.e. an increase in CPI(Consumer Price Index)).

Demand Pull inflation is caused basically by the demand upon certain goods, as measured by the number of dollars people are willing to wage to attain a certain product.

In the general scheme of things, in so far that consumers and suppliers of goods and services (we are all participants in each part in our daily affairs) remain decent and honest persons, with the tendency to 'consume' measured by one's tendency to 'produce'(productivity)- then theoretically, there would be NO consistent CPI rise except the occasional isolated demand/supply imbalance due to natural disaster or war. But Singapore is quite insulated away from any significant natural disaster or war, so why has the average price of goods between 1989 (CPI=71.3) and 2009(CPI=100) increased (inflated) by (100.0-71.3)/71.3 = 40.25% over the 20 years?? [See Pict: 'Singapore Annual Inflation rate and CPI (1980-2012)/Singstat']

Studying the chart about 'Singapore Money Supply (DBU), M1,2,3, 1989 to 2012' for monetary supply changes between 1989 and 2009, one would easily note that M1 (Narrowly defined, money supply (M1) consists of currency in active circulation and demand deposits) M1 grew from S$13.7446B (1989) to S$93.4721B(2009)- a whopping 5.8fold increase over the 20years documented. (WRT to the M3 numbers of S$71.0078B(1989) vs S$378.5260(2009), the increase is a 4.33fold increase over 20 yrs)

The official foreign reserves of Singapore between 1989 and 2000 are not available but according to 'Singapore official financial reserves (2001-2011)', the totals were S$139.7143B(2001) and S$308.4032B(2011)- amounting to a 1.207fold increase over the 10 year period (of course subject to variations in international currency exchange rates [SGD exc rt, 2001-2011]).

According to 'Singapore Time Series on Population (Mid-Year Estimates)' using the 20 year interval where census were taken between 1990 and 2010, the local resident population increased from 2735.9K (1990) to 3771.7K(2010): a 37.86% Singapore resident population increase over the 20 years mentioned.

Singaporeans have not become more lazy, on the contrary, according to 'Singstat: Trends in Productivity and Value Added by industry' 'total economy' (large olive green dot) productivity in Singapore has certainly increased between 1991 and 2011.

Whilst currency exchange rates may be a proximate measure of the relative depreciation of a nation's currency relative to others due to the effect of over supply of one nation's currency as compared to that of another, it cannot be denied that all nations around the world, led by the USA, are into a conspiracy of freely printing money which is of course inflationary 'Chart: Estimated global monetary Aggregates (1971-2010)' - the chart showing an approx 3 fold increase in world M3 money supply between 1989 to 2009.

Thus in 'Singapore's inflation may remain elevated for years to come: survey' [CNA, 24Jan2013] "survey by the Singapore Management University (SMU)... composite five-year-expectation is 4.97 per cent"

Guess Singaporeans are all victims of a world wide government conspiracy to keep them always working (savings are always eroded by inflation) till the day they die, and also in power (the SG govt has S$308.4032B(2011) alone in foreign reserves and gold).

So moral of the story is that governments all around the world should stop printing so much money to keep inflation under control and voters need to demand so (so as to safeguard one's retirement years).

Guess in Singapore, recent curbs upon car loan and housing loan quantum(s) are merely cosmetic changes meant to fudge inflation statistics yet do minimal to improve the lives of the poor and downtrodden.

Perhaps the Singapore government could lead the way forward by firstly not printing so much money which only breeds inflation if not hyper inflation as the population growth within a limited land area can only be so much.

Perhaps the Singapore government could start the discussion by explaining to the populace what it intends to do with its SGD 308.4032B(2011) in foreign reserves (should be more by now), and please be reminded, that convenient half truths by Ministers really do not help.

Picts below,

Rgds,

B.C.

Tags: Inflation, foreign reserves, gold, government, Singapore, politics, printing, corruption, fraud, democracy, dictatorship, capitalism, currency, gold standard,

Anyhow, nice music that I like that U too might like:

By Faith - Keith & Kristyn Getty - YouTube.

Last edited: