Singapore's concept of averting bank bankruptcy- sleeping with the enemy.

PM Lee says that he cannot regulate banks; time to put your $$$ in portions of $50k in different Singapore banks?

Saw the following news report about PM Lee saying that he cannot really tell the difference between retail banking and investment banking functions that some banks operate: 'Regulating tightly 'not always feasible'' [ST, 08Oct2012] : e.g. your savings earning 0.1% interest p.a. could be (mis)used by some banks to bet on extremely risky 'investments'- futures/ derivatives/ CFD/ CDO/ CDS etc etc, with potential benefits (banker's bonuses) but equally high downsides: see 'Rogue trader costs UBS $2 billion' [CNN, 19Sept2011] which losses cannot help but be translated into share holder losses, (SG inc. not being spared): 'Singapore Inc. Facing $7.4 Billion UBS Loss Tops Chain of Soured Bank Bets' [Bloomberg, 27Sept2011].

According to PM Lee Hsien Loong, "financial markets have variegated into all kinds of sophisticated activities, products, derivatives, investment activities, trading - and the (commercial banks) are also in these... It's very hard to draw a line,... if all the banks threaten to die at the same time, governments cannot help but go and rescue them" (as they did in 2008 and 2009).

So whilst the SG govt seems very eager to help foreigners (and ostensibly foreign tax evaders) whose funds are stashed in Singapore banks via the very act of using the Singapore reserves to bail out Singapore registered banks, my suggestion would be for humble Singaporeans to better to put your $$$ in $50k lots into different SG banks in case PM Lee's generous plan to bail out banks fail to materialize (the greed of some bankers cannot be underestimated).

This is because it seems from my reading of the SDIC web page that whilst S$200k in one bank would only be insured to the amount of S$50k, it's silent about the $200k being placed into 4 banks in the equal amts of $50k each; (nothing seems to state to the converse that $200k in lots of 50k in 4 different banks would be accepted as if it were $50k in each bank owned by four independent and separate persons).

Perhaps this is what the SG govt, in its shallow minded approach to the separation of retail banking from investment banks, is expecting Singaporeans to discover and do; perhaps the SG govt is indeed preparing to use its reserves to bail out banks en-masse.

And since the PA, a statutory / civil service board, already overfilled with coat-tail PAP MPs and wanna be MPs who have lost general elections but titled 'advisers to grassroots' cannot seem much intent upon the protection of Singaporeans and SG reserves through the establishment of clear and distinct rules regarding the conduct of retail banks (the safest) as opposed to the conduct of investment banks (the riskiest), my only solution left towards benefiting society, is for each Singaporean to divide their life savings into lots of $50k into each local bank in SG so that just in case the SG govt is unable to bail out banks in a bank domino situation such as the Lehman crisis of 2008 (to prevent foreigners investing in investment banks (/ the mishmash) from needlessly benefiting)- at least SGporeans have more than just S$50K of life savings left to spend out of all that they had originally saved.

Really, I cannot see why retail banks and investment banks cannot be separated. Lawyers and medical practitioners are licensed in Singapore and trusted by Singaporeans insofar that they are properly regulated, even Western and Chinese medical practitioners each have separate and distinct licensing bodies. Why can't an 'A class' license for retail banks be awarded, with an equally 'A class' insurance back-up scheme? International banks who seek such an A class certification shall be expected to conform to equally stringent capital requirements and rules, and all banks deposits subsumed under such scheme shall strictly reside locally. The properties of Genting Singapore I understand reside locally, and are separate and are not interchangeable with its parent group 'Genting international'. Just as some Singaporeans don't mind savings bank accounts earning interest of under 1%, these savings accounts too need to be protected against the higher risk operations of the average investment/ venture capitalist bank. Even for international banks in Singapore, its investment arm might fail but certainly not its retail arm. Too bad if retail banks, in view of lower profit margins can only occupy the outskirts of the city or charge fees like the CPF for over-the-counter transactions in excess of a prescribed frequency or even sans interest- what is most important is that the funds remain safe, and thus absent the need for national reserves to be used to bail out the bank- $80million in losses to a venture capitalist with a $100million investment budget speculating on a novel enterprise is totally different from the loss in life savings of $100k in the savings book account of an unmarried laborer, saved to fund his twilight years.

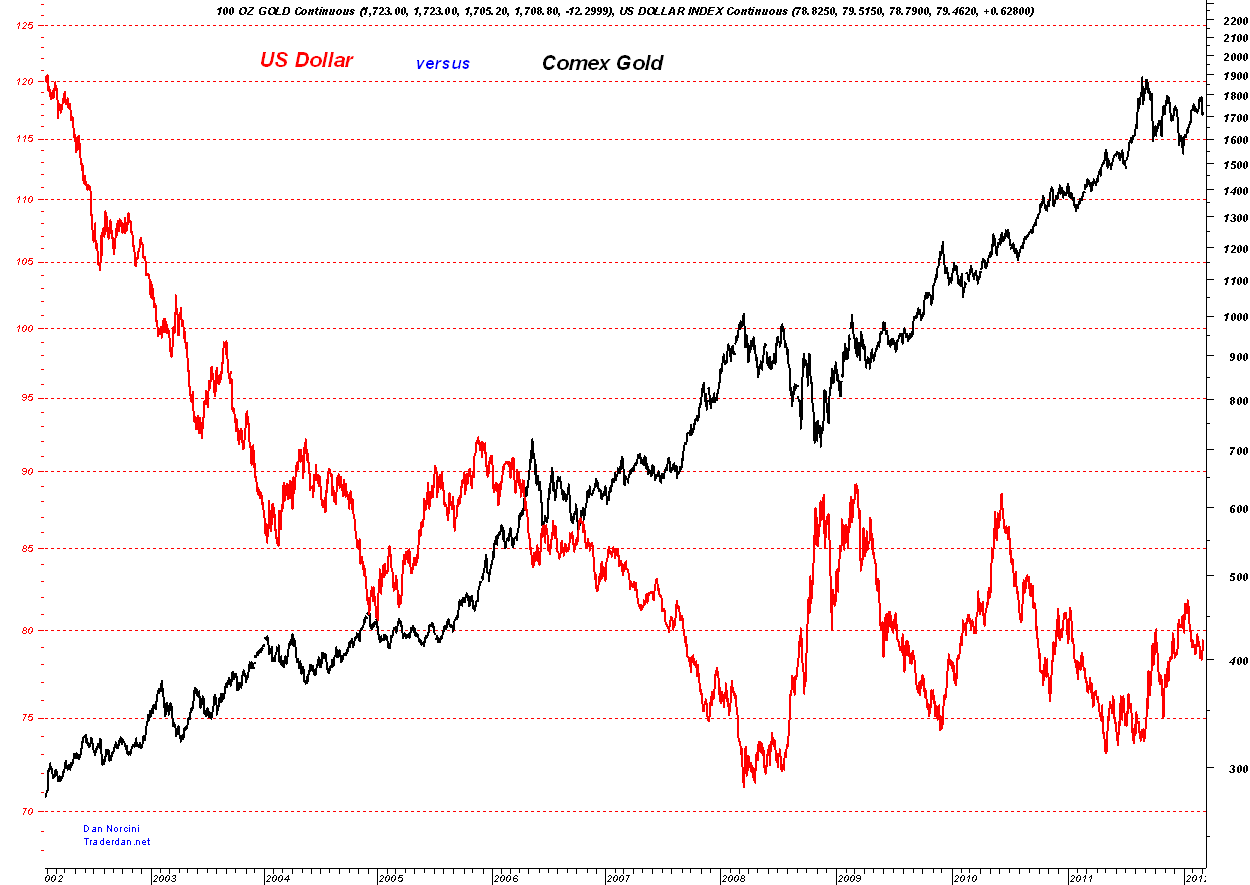

But for the US Fed printing USD to bail out its ailing banks resulting in dilution of strength of the USD how else would the inflation in price of gold be explained (see 2nd pict below)? Isn't it the ever rising national debt of nations that has caused faith in currency to wane with consequent inflation reigning its ugly head in commodities and services ranging from corn to healthcare to gold? If the funds of the average American had not been illicitly invested by banks the likes of BOA and Citibank through the lack of segregation, why would these bailouts have been necessary in the very first place?

Shame on the PAP for placing Singapore's national reserves at the doorstep of greedy investment bankers and shamelessly advocating that the whole world do the same. Shame on PM Lee, he sleeps with the enemy.

The people of Singapore have much to worry.

-----------

Picts:

PM Lee suggesting that bank regulation is impossible and bankers are above the law:

The price of gold rising as the USD dilutes itself (10yrs till Feb2012):

[pict source]

TODAY newspaper SDIC advert 16Oct2012, pg5; trying hard to shore up confidence in Singapore banks:

Army of ruling party Politicians as grassroots advisers in the Peoples Association who ostensibly concur with the wisdom of repeated bank bailouts [pictsource]:

Anti bank bailout protests around the world:

[pict source]

[pict source]

[pict source]

[pict source]

... to be continued, but

Watch for preview: consequent of the printing of excess $$$ to fund recurrent bank bailouts... :

Hyperinflation Nation Part 1/3 - YouTube

Rest of the videos: [link]

PM Lee says that he cannot regulate banks; time to put your $$$ in portions of $50k in different Singapore banks?

Saw the following news report about PM Lee saying that he cannot really tell the difference between retail banking and investment banking functions that some banks operate: 'Regulating tightly 'not always feasible'' [ST, 08Oct2012] : e.g. your savings earning 0.1% interest p.a. could be (mis)used by some banks to bet on extremely risky 'investments'- futures/ derivatives/ CFD/ CDO/ CDS etc etc, with potential benefits (banker's bonuses) but equally high downsides: see 'Rogue trader costs UBS $2 billion' [CNN, 19Sept2011] which losses cannot help but be translated into share holder losses, (SG inc. not being spared): 'Singapore Inc. Facing $7.4 Billion UBS Loss Tops Chain of Soured Bank Bets' [Bloomberg, 27Sept2011].

According to PM Lee Hsien Loong, "financial markets have variegated into all kinds of sophisticated activities, products, derivatives, investment activities, trading - and the (commercial banks) are also in these... It's very hard to draw a line,... if all the banks threaten to die at the same time, governments cannot help but go and rescue them" (as they did in 2008 and 2009).

So whilst the SG govt seems very eager to help foreigners (and ostensibly foreign tax evaders) whose funds are stashed in Singapore banks via the very act of using the Singapore reserves to bail out Singapore registered banks, my suggestion would be for humble Singaporeans to better to put your $$$ in $50k lots into different SG banks in case PM Lee's generous plan to bail out banks fail to materialize (the greed of some bankers cannot be underestimated).

This is because it seems from my reading of the SDIC web page that whilst S$200k in one bank would only be insured to the amount of S$50k, it's silent about the $200k being placed into 4 banks in the equal amts of $50k each; (nothing seems to state to the converse that $200k in lots of 50k in 4 different banks would be accepted as if it were $50k in each bank owned by four independent and separate persons).

Perhaps this is what the SG govt, in its shallow minded approach to the separation of retail banking from investment banks, is expecting Singaporeans to discover and do; perhaps the SG govt is indeed preparing to use its reserves to bail out banks en-masse.

And since the PA, a statutory / civil service board, already overfilled with coat-tail PAP MPs and wanna be MPs who have lost general elections but titled 'advisers to grassroots' cannot seem much intent upon the protection of Singaporeans and SG reserves through the establishment of clear and distinct rules regarding the conduct of retail banks (the safest) as opposed to the conduct of investment banks (the riskiest), my only solution left towards benefiting society, is for each Singaporean to divide their life savings into lots of $50k into each local bank in SG so that just in case the SG govt is unable to bail out banks in a bank domino situation such as the Lehman crisis of 2008 (to prevent foreigners investing in investment banks (/ the mishmash) from needlessly benefiting)- at least SGporeans have more than just S$50K of life savings left to spend out of all that they had originally saved.

Really, I cannot see why retail banks and investment banks cannot be separated. Lawyers and medical practitioners are licensed in Singapore and trusted by Singaporeans insofar that they are properly regulated, even Western and Chinese medical practitioners each have separate and distinct licensing bodies. Why can't an 'A class' license for retail banks be awarded, with an equally 'A class' insurance back-up scheme? International banks who seek such an A class certification shall be expected to conform to equally stringent capital requirements and rules, and all banks deposits subsumed under such scheme shall strictly reside locally. The properties of Genting Singapore I understand reside locally, and are separate and are not interchangeable with its parent group 'Genting international'. Just as some Singaporeans don't mind savings bank accounts earning interest of under 1%, these savings accounts too need to be protected against the higher risk operations of the average investment/ venture capitalist bank. Even for international banks in Singapore, its investment arm might fail but certainly not its retail arm. Too bad if retail banks, in view of lower profit margins can only occupy the outskirts of the city or charge fees like the CPF for over-the-counter transactions in excess of a prescribed frequency or even sans interest- what is most important is that the funds remain safe, and thus absent the need for national reserves to be used to bail out the bank- $80million in losses to a venture capitalist with a $100million investment budget speculating on a novel enterprise is totally different from the loss in life savings of $100k in the savings book account of an unmarried laborer, saved to fund his twilight years.

But for the US Fed printing USD to bail out its ailing banks resulting in dilution of strength of the USD how else would the inflation in price of gold be explained (see 2nd pict below)? Isn't it the ever rising national debt of nations that has caused faith in currency to wane with consequent inflation reigning its ugly head in commodities and services ranging from corn to healthcare to gold? If the funds of the average American had not been illicitly invested by banks the likes of BOA and Citibank through the lack of segregation, why would these bailouts have been necessary in the very first place?

Shame on the PAP for placing Singapore's national reserves at the doorstep of greedy investment bankers and shamelessly advocating that the whole world do the same. Shame on PM Lee, he sleeps with the enemy.

The people of Singapore have much to worry.

-----------

Picts:

PM Lee suggesting that bank regulation is impossible and bankers are above the law:

The price of gold rising as the USD dilutes itself (10yrs till Feb2012):

[pict source]

TODAY newspaper SDIC advert 16Oct2012, pg5; trying hard to shore up confidence in Singapore banks:

Army of ruling party Politicians as grassroots advisers in the Peoples Association who ostensibly concur with the wisdom of repeated bank bailouts [pictsource]:

Anti bank bailout protests around the world:

... to be continued, but

Watch for preview: consequent of the printing of excess $$$ to fund recurrent bank bailouts... :

Hyperinflation Nation Part 1/3 - YouTube

Rest of the videos: [link]

Last edited: