<TABLE class=msgtable cellSpacing=0 cellPadding=0 width="96%"><TBODY><TR><TD class=msg vAlign=top><TABLE border=0 cellSpacing=0 cellPadding=0 width="100%"><TBODY><TR class=msghead><TD class=msgbfr1 width="1%"> </TD><TD><TABLE border=0 cellSpacing=0 cellPadding=0><TBODY><TR class=msghead vAlign=top><TD class=msgF width="1%" noWrap align=right>From: </TD><TD class=msgFname width="68%" noWrap>AI (3_M) <NOBR></NOBR> </TD><TD class=msgDate width="30%" noWrap align=right>Jan-13 9:50 pm </TD></TR><TR class=msghead><TD class=msgT height=20 width="1%" noWrap align=right>To: </TD><TD class=msgTname width="68%" noWrap>ALL <NOBR></NOBR></TD><TD class=msgNum noWrap align=right> </TD></TR></TBODY></TABLE></TD></TR><TR><TD class=msgleft rowSpan=4 width="1%"> </TD><TD class=wintiny noWrap align=right>27132.1 </TD></TR><TR><TD height=8></TD></TR><TR><TD class=msgtxt>Wanted:

Ideas that pay

In the global contest for innovation, Singapore is falling further behind at a time when its people are paying more and more buying them from others. By Seah Chang Nee.

Jan 10, 2010

(Synopsis: Like a relentless tsunami, high-tech gimmicks from abroad keep flooding Singapore to the detriment of home-grown innovative capabilities.)

AS ONE born here seven decades ago, I have been watching the quickened pace of new digital imports with a tinge of anxiety about Singapore¡¯s future.

Take the latest high-tech Hollywood film Avatar that is mesmerising large audiences here with its awe-inspiring scenes of an imaginary planet.

In just two weeks, it had grossed a record-shattering US$1b worldwide. My family of four paid S$40 for two-and-a-half hours ¨C roughly what an unskilled worker earns in a whole day.

Months earlier, Singapore was invaded by the Internet-phone, or I-Phone, with thousands of young people queuing up for hours and paying top dollars to lay their hands on one.

These were the latest digital innovations to hit our shores, some of them at heart-wringing costs.

The film, like the I-Phone, is a breakthrough in marketable ideas that are lapped up by young Singaporeans.

These kids are spending thousands of dollars on Blackberries, mini-computers and other mobile gimmicks to download music or network with each other. Many are teens who are still years away from their first job.

These are stuff they insist on having for their education ¨C or so they say ¨C and so papa and mama, including the poor, will have to finance it. An endless flow, because technology goes on and on.

Such imports do not necessarily pose great worries if Singaporeans can find benefit from using them.

¡°It is a drain because we ourselves lack innovation or the means to pay for it,¡± said a father of two teenage sons.

In short, Singapore¡¯s move towards a higher-skill economy (to counter threats from countries like China and India) has fallen short of success.

In a competitive world when it comes to fresh ideas, Singaporeans ¨C with their regulated, structured upbringing ¨C are hugely handicapped. They are too compliant to venture into the unconventional.

As I watched Avatar¡¯s widescreen magic, gripping my chair as its awesome plants and animals leapt at me, I thought of our own fledgling movie industry. They are separated by at least a generation.

Innovations and inventions are not just about high-faluting subjects like science and bio-medicine that postgraduates can deliver. More often than not, it involves turning simple ideas into what the public wants.

In 1993, the world was wowed by a film called Jurassic Park that transformed the movie business and almost killed off the industry in Hong Kong.

¡°After seeing this film who wants to watch ours?¡± a producer then asked. But some producers re-adapted, moved West and flourished.

On top of the pack were the Japanese and Koreans ¨C and the older Bollywood ¨C who succeeded in creating at least regional best-sellers with their own stories and cultures.

After returning from two years¡¯ work as a journalist in Hong Kong, I wrote that with its laissez faire it was 10 years ahead of Singapore in the fields of movies, music and fashion.

Today the gap may have widened. Many of its top stars and producers have moved to California or improved at home to produce some world-beaters.

Singapore¡¯s film-makers have made strides in the past decade, but they are too hobbled by regulations and sufficient talent to appeal to a world audience.

¡°Ours is still a cottage industry, not a global one,¡± said a retired cinema executive. ¡°The advances in other countries are making our deficiencies even starker,¡± he added.

Even the Indonesians and Thais have produced horror movies with popular foreign appeal. I noticed they had even come up with their own Jet Li-type heroes, complete with lightning fast stunts.

The imported innovations do add value to our lives, but they have also made us more conscious of our creativity backwardness despite our huge investment on education.

I must admit that they have made me a little envious of the people who dare to experiment in, and come up with, winning tricks.

Singapore not only lacks that but is becoming too hooked on expensive Western products and services at a time when its own innovative competitiveness is dropping.

Even IT manufacturing, the mainstay of the economy, is facing possible extinction as factories move to cheaper countries.

Among the top 500 fastest growth tech companies in Asia Pacific countries, only two ¨C or 0.4% ¨C are in Singapore, compared with 99 in Taiwan, it was recently reported.

The republic appears to be losing some of its technological capacities.

For example, Seagate, the world¡¯s largest maker of hard-disk drives, will close one of its factories and move to China by the end of this year.

Some 2,000 employees, many of them engineers, will be retrenched. Another giant, Motorola, shut its plant in 2008.

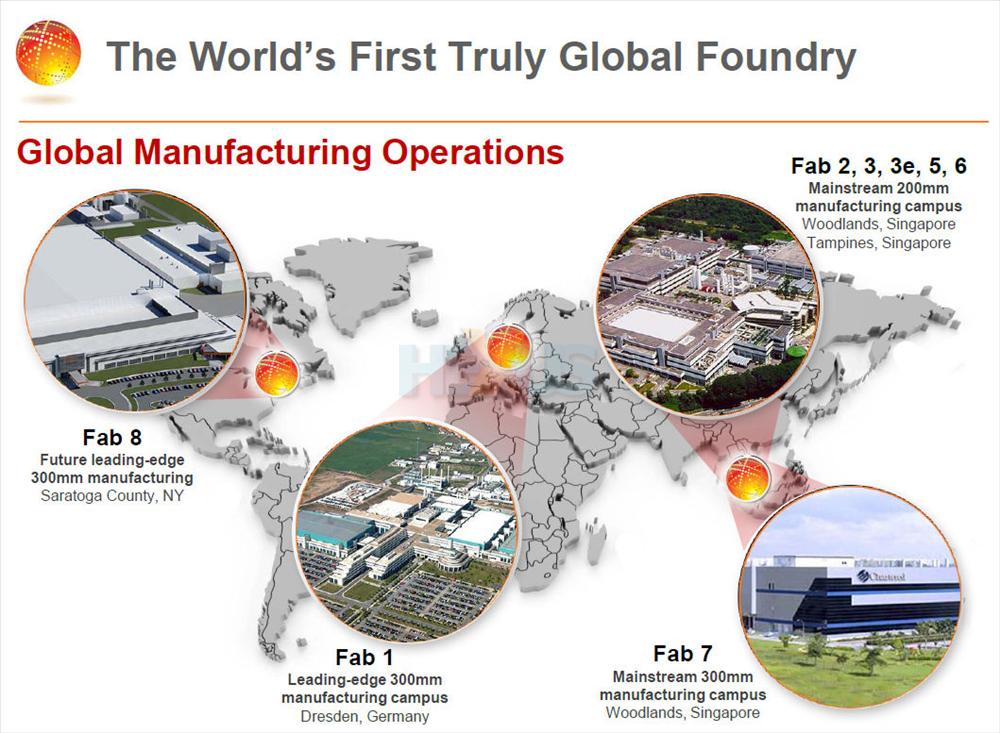

Earlier Chartered, the world¡¯s second-largest semiconductor firm with nine chip plants spread across Singapore, Germany and the US, was taken over by an Abu Dhabi company, after years of losses.

Three other local tech firms were delisted in the last two years.

Many fear the relocations may signal the end of the republic¡¯s role as a supplier of value-added computer parts to the world.

A post-crisis economic review is in progress to see what else Singapore can do to earn a living in the world.

Prime Minister Lee Hsien Loong cautioned his people not to expect a return of the pre-crisis growth rates of 7% or 8%. Instead, he expects from now on, Singapore should settle for 3% to 5% a year.

This means that value-added expansion in future will come mostly from innovative Singaporeans or companies, rather than by just providing service to the region.

(This was published in The Star on Jan 9, 2010.)</TD></TR></TBODY></TABLE></TD></TR></TBODY></TABLE>

Ideas that pay

In the global contest for innovation, Singapore is falling further behind at a time when its people are paying more and more buying them from others. By Seah Chang Nee.

Jan 10, 2010

(Synopsis: Like a relentless tsunami, high-tech gimmicks from abroad keep flooding Singapore to the detriment of home-grown innovative capabilities.)

AS ONE born here seven decades ago, I have been watching the quickened pace of new digital imports with a tinge of anxiety about Singapore¡¯s future.

Take the latest high-tech Hollywood film Avatar that is mesmerising large audiences here with its awe-inspiring scenes of an imaginary planet.

In just two weeks, it had grossed a record-shattering US$1b worldwide. My family of four paid S$40 for two-and-a-half hours ¨C roughly what an unskilled worker earns in a whole day.

Months earlier, Singapore was invaded by the Internet-phone, or I-Phone, with thousands of young people queuing up for hours and paying top dollars to lay their hands on one.

These were the latest digital innovations to hit our shores, some of them at heart-wringing costs.

The film, like the I-Phone, is a breakthrough in marketable ideas that are lapped up by young Singaporeans.

These kids are spending thousands of dollars on Blackberries, mini-computers and other mobile gimmicks to download music or network with each other. Many are teens who are still years away from their first job.

These are stuff they insist on having for their education ¨C or so they say ¨C and so papa and mama, including the poor, will have to finance it. An endless flow, because technology goes on and on.

Such imports do not necessarily pose great worries if Singaporeans can find benefit from using them.

¡°It is a drain because we ourselves lack innovation or the means to pay for it,¡± said a father of two teenage sons.

In short, Singapore¡¯s move towards a higher-skill economy (to counter threats from countries like China and India) has fallen short of success.

In a competitive world when it comes to fresh ideas, Singaporeans ¨C with their regulated, structured upbringing ¨C are hugely handicapped. They are too compliant to venture into the unconventional.

As I watched Avatar¡¯s widescreen magic, gripping my chair as its awesome plants and animals leapt at me, I thought of our own fledgling movie industry. They are separated by at least a generation.

Innovations and inventions are not just about high-faluting subjects like science and bio-medicine that postgraduates can deliver. More often than not, it involves turning simple ideas into what the public wants.

In 1993, the world was wowed by a film called Jurassic Park that transformed the movie business and almost killed off the industry in Hong Kong.

¡°After seeing this film who wants to watch ours?¡± a producer then asked. But some producers re-adapted, moved West and flourished.

On top of the pack were the Japanese and Koreans ¨C and the older Bollywood ¨C who succeeded in creating at least regional best-sellers with their own stories and cultures.

After returning from two years¡¯ work as a journalist in Hong Kong, I wrote that with its laissez faire it was 10 years ahead of Singapore in the fields of movies, music and fashion.

Today the gap may have widened. Many of its top stars and producers have moved to California or improved at home to produce some world-beaters.

Singapore¡¯s film-makers have made strides in the past decade, but they are too hobbled by regulations and sufficient talent to appeal to a world audience.

¡°Ours is still a cottage industry, not a global one,¡± said a retired cinema executive. ¡°The advances in other countries are making our deficiencies even starker,¡± he added.

Even the Indonesians and Thais have produced horror movies with popular foreign appeal. I noticed they had even come up with their own Jet Li-type heroes, complete with lightning fast stunts.

The imported innovations do add value to our lives, but they have also made us more conscious of our creativity backwardness despite our huge investment on education.

I must admit that they have made me a little envious of the people who dare to experiment in, and come up with, winning tricks.

Singapore not only lacks that but is becoming too hooked on expensive Western products and services at a time when its own innovative competitiveness is dropping.

Even IT manufacturing, the mainstay of the economy, is facing possible extinction as factories move to cheaper countries.

Among the top 500 fastest growth tech companies in Asia Pacific countries, only two ¨C or 0.4% ¨C are in Singapore, compared with 99 in Taiwan, it was recently reported.

The republic appears to be losing some of its technological capacities.

For example, Seagate, the world¡¯s largest maker of hard-disk drives, will close one of its factories and move to China by the end of this year.

Some 2,000 employees, many of them engineers, will be retrenched. Another giant, Motorola, shut its plant in 2008.

Earlier Chartered, the world¡¯s second-largest semiconductor firm with nine chip plants spread across Singapore, Germany and the US, was taken over by an Abu Dhabi company, after years of losses.

Three other local tech firms were delisted in the last two years.

Many fear the relocations may signal the end of the republic¡¯s role as a supplier of value-added computer parts to the world.

A post-crisis economic review is in progress to see what else Singapore can do to earn a living in the world.

Prime Minister Lee Hsien Loong cautioned his people not to expect a return of the pre-crisis growth rates of 7% or 8%. Instead, he expects from now on, Singapore should settle for 3% to 5% a year.

This means that value-added expansion in future will come mostly from innovative Singaporeans or companies, rather than by just providing service to the region.

(This was published in The Star on Jan 9, 2010.)</TD></TR></TBODY></TABLE></TD></TR></TBODY></TABLE>