Minister Mah Bow Tan has continued to claim that HDB flats are "affordable" despite of the 30 years mortgage. He has however, made a few interesting points today.

First he asserts that due to land scarce, in order to have a "SUSTAINABLE" housing policy, the present HDB policy should continue. Secondly, he has somewhat RETRACTED from his earlier position that it is ok to have high HDB prices because we could "monetize" aka sell our flats for retirement. He now says that we may not need to sell our flats and downgrade for retirement.

I have explained why selling flat for retirement is <a href="http://singaporealternatives.blogspot.com/2010/03/hdbs-flawed-direction.html">NOT A WORKABLE and SUSTAINABLE OPTION at all. </a>

Before I talk about why this scheme of "selling flat for retirement" is not sustainable in the long run, I would like to address the basic fundamentals of why such HIGH HDB PRICES under the guise of "asset enhancement" is the deliberate policy direction of PAP government.

<span style="font-weight:bold;"><span style="font-style:italic;">High Property Prices to solve Aging Population Problems</span></span>

Since early 1980s, PAP has suddenly realized that their aggressive "TWO IS ENOUGH" policy is flawed and it would create unprecedented acceleration of aging population. By doing a demographic projection, it would mean that the CPF scheme may not be sustainable in providing adequate retirement financing for this aging population.

The burden of providing retirement financing lies on the government to give constant returns to CPF account holders. If less and less people are going to work in the work force while more and more people are going to withdraw their CPF money, it will create cashflow pressures on CPF. i.e. CPF will have to liquidate its assets to repay the CPF holders while earning lesser returns from a smaller asset pool. This problem will aggravate in time to come. This is also part of the reasons why CPF withdrawal age keep postponing.

The brilliant idea of maintaining high HDB flat price comes about to solve a lot of these problems derived from aging population. The following are the reasoning:

1) If people have less savings in CPF, the government won't be burden by interest payment to the account holders. i.e. the government will wash its hands off from retirement financing of an aging population.

2) How or who will finance the future retirees then? A 30 year mortgage plan will DEFINITELY force Singaporeans to sell their flats for retirement! This is basically because their CPF accounts will have very little amount of funds left! By allowing HDB prices to increase, these future retirees could well "withdraw" their "retirement funds" by selling off their HDB flats at high prices! This would solve their retirement financing!

<span style="font-weight:bold;">

<span style="font-style:italic;">Impact of HDB flat for Retirement Financing</span> </span>

Such simplistic thinking will have a few impacts. All of these impacts are unfavorable to Singaporeans but very favorable to the Government.

1) The Government could benefit from selling HDB flats at high prices to citizens and they no longer need to fork out money for any subsidies. All so call subsidies are basically on paper accounting, market subsidies.

2) The first adjustment is to raise land prices. HDB, on paper is in deficit because it has to buy land from SLA (both under Ministry of Development) at market prices. Please note that SLA has become the biggest land owner in Singapore with monopoly power to determine prices.

3) All proceeds from Land Sales go directly into the reserves and that is why our reserves grow at rapid rate since 1980s.

4) The government earns interests, instead of paying interests, from making loans to HDB buyers. This also means that Singaporeans are paying higher HDB prices using almost all their CPF monies and burden by higher mortgage interests.

5) The prices of HDB flats MUST increase substantially over time in order for this scheme to be sustainable. If not, the whole system will collapse.

<span style="font-weight:bold;"><span style="font-style:italic;">Implications</span></span>

<span style="font-style:italic;">What are the implications? <span style="font-weight:bold;"></span></span>

Apparently, the government benefited the most from such scheme! It relinquishes its responsibility of providing retirement financing for an aging population basically transferring this burden to the future generations in terms of HIGHER HDB PRICES. MAKE PROFITS from these higher HDB prices which transferred into reserves which make them good i.e. they have been boasting how good they are because they have accumulated so much reserves. On top of that, make money from interests collected from HDB buyers!

What they government gain will be what the citizens will lose. This is a very simple logic. HDB is the MONOPOLY of the new HDB flat market and it is also the lender who earns interests from all outstanding loans.

This scheme will impact on both present HDB owners who bought their flats at high prices which end up with 30 year mortgage. They will most probably be FORCED to sell their HDB flats when they want to retire. The future generations will have to suffer higher HDB prices because this is intended, so that the present generation could generate enough funds for their retirement needs!

<span style="font-style:italic;">

Unsustainable<span style="font-weight:bold;"></span></span>

This model is NOT sustainable in the long run. The reason is pretty clear. In order to preserve the purchasing power of the amount of money Singaporeans have put into their HDB flats, the future price of their flats has to increase tremendously to cover the interest cost as well as inflation throughout the 30 years period.

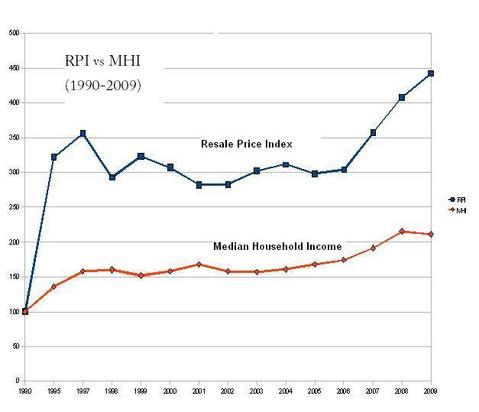

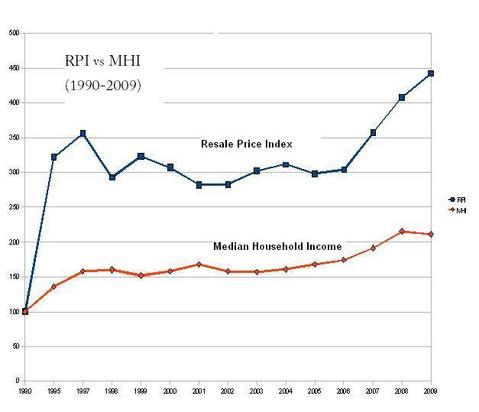

However the wages of the working class normally grow at the rate just enough to cover inflation. That is why we are witnessing this impact of wages lagging behind HDB price growth for the past two decades. From the following graph prepared by <a href="singaporemind.blogspot.com">Lucky Tan </a>.

From 1990 to 2009, wage doubled while HDB prices grow by FOUR folds! This correspond to the increase in the mortgage payment period from 15 years to 30 years! In time to come, our future generations may have to pay for a 40years or even 50 years mortgage for just a decent HDB flat!

<span style="font-weight:bold;">Is this sustainable?<span style="font-style:italic;"></span></span>

Nobody can guarantee property prices to grow forever at such rapid rate. With an aging population, less youngsters will demand for MORE supply due to more elders trying to sell their flats. This will have downward pressure on relative prices.

There are CONFLICTING policy objectives. On one hand, in order for the scheme of utilizing high HDB prices as a means for retirement financing, we need HDB prices to outstrip wage growth but in order to maintain "AFFORDABILITY" for all generations, we need to maintain the price increase according to wage growth! How could these CONFLICTING policy targets be met simultaneously?

This is really an ill-thought out HDB-retirement scheme by the PAP government. This scheme benefits only the present government by alleviating its burden to provide for the retirement funding needs for the citizens while benefiting from all the higher HDB prices and interests earned from loans to HDB owners. This is in the expense of Singaporeans both present and future.

Almost all present Ministers will not be around in 30 years time to take responsibility for the effects of their policies. It is important for Singaporeans to understand the great implications of this HDB-retirement scheme upon our present generations as well as future generations.

I have come to this realization of this scheme ever since PAP started to embark the so call "Asset Enhancement Scheme" back in early 1990s. I have written a number of articles in protest of this scheme but many Singaporeans were overwhelmed by the immediate gain of paper capital gains. There were even Singaporeans trying to capitalize on the sudden increase in their flat value by upgrading or multiple upgradings. In the whole process, they committed higher and higher debts.

The latest <a href="http://singaporemind.blogspot.com/2010/12/consequences-of-govt-inaction-in.html">report</a> has indicated Singapore's housing debt has constituted more than 51% of total loans from our financial loans! This is even higher than Hong Kong's 20%! We will be doomed if there is a property crash! The whole financial system will be burden with unperforming loans!

An economy cannot invest too much of its financial resources in assets like properties which are not "productive" for the economy. If the property sector takes up too much of financial resources of the economy, we will not be able to have enough resources to finance investments by our local entrepreneurs. It will also means that the financial sector will be over-exposed to a potential bubble which will wipe off our wealth when it burst.

Experiences from Japan, Ireland and even US have shown that over-exposure of the financial sector to the bubble prone property sector will destroy the economy. Japan has hardly recover from its collapse of economy due to property bubble since 1990s!

It is up to every Singaporeans to judge on whether what I write here make any sense. It is easy to sell greed to the masses but it will create non-reversal damage to our future generations. It is not easy to convince people that high property prices are BAD for them. I have waited this long for the opportune time to explain what I have learned throughout these years. I urge every readers who agree with my views to help me to spread this message to your friends and relatives.

This unsustainable and potentially damaging HDB-retirement scheme must be stopped and ceased else our future generations will suffer in vain for our inaction.

Goh Meng Seng

First he asserts that due to land scarce, in order to have a "SUSTAINABLE" housing policy, the present HDB policy should continue. Secondly, he has somewhat RETRACTED from his earlier position that it is ok to have high HDB prices because we could "monetize" aka sell our flats for retirement. He now says that we may not need to sell our flats and downgrade for retirement.

I have explained why selling flat for retirement is <a href="http://singaporealternatives.blogspot.com/2010/03/hdbs-flawed-direction.html">NOT A WORKABLE and SUSTAINABLE OPTION at all. </a>

Before I talk about why this scheme of "selling flat for retirement" is not sustainable in the long run, I would like to address the basic fundamentals of why such HIGH HDB PRICES under the guise of "asset enhancement" is the deliberate policy direction of PAP government.

<span style="font-weight:bold;"><span style="font-style:italic;">High Property Prices to solve Aging Population Problems</span></span>

Since early 1980s, PAP has suddenly realized that their aggressive "TWO IS ENOUGH" policy is flawed and it would create unprecedented acceleration of aging population. By doing a demographic projection, it would mean that the CPF scheme may not be sustainable in providing adequate retirement financing for this aging population.

The burden of providing retirement financing lies on the government to give constant returns to CPF account holders. If less and less people are going to work in the work force while more and more people are going to withdraw their CPF money, it will create cashflow pressures on CPF. i.e. CPF will have to liquidate its assets to repay the CPF holders while earning lesser returns from a smaller asset pool. This problem will aggravate in time to come. This is also part of the reasons why CPF withdrawal age keep postponing.

The brilliant idea of maintaining high HDB flat price comes about to solve a lot of these problems derived from aging population. The following are the reasoning:

1) If people have less savings in CPF, the government won't be burden by interest payment to the account holders. i.e. the government will wash its hands off from retirement financing of an aging population.

2) How or who will finance the future retirees then? A 30 year mortgage plan will DEFINITELY force Singaporeans to sell their flats for retirement! This is basically because their CPF accounts will have very little amount of funds left! By allowing HDB prices to increase, these future retirees could well "withdraw" their "retirement funds" by selling off their HDB flats at high prices! This would solve their retirement financing!

<span style="font-weight:bold;">

<span style="font-style:italic;">Impact of HDB flat for Retirement Financing</span> </span>

Such simplistic thinking will have a few impacts. All of these impacts are unfavorable to Singaporeans but very favorable to the Government.

1) The Government could benefit from selling HDB flats at high prices to citizens and they no longer need to fork out money for any subsidies. All so call subsidies are basically on paper accounting, market subsidies.

2) The first adjustment is to raise land prices. HDB, on paper is in deficit because it has to buy land from SLA (both under Ministry of Development) at market prices. Please note that SLA has become the biggest land owner in Singapore with monopoly power to determine prices.

3) All proceeds from Land Sales go directly into the reserves and that is why our reserves grow at rapid rate since 1980s.

4) The government earns interests, instead of paying interests, from making loans to HDB buyers. This also means that Singaporeans are paying higher HDB prices using almost all their CPF monies and burden by higher mortgage interests.

5) The prices of HDB flats MUST increase substantially over time in order for this scheme to be sustainable. If not, the whole system will collapse.

<span style="font-weight:bold;"><span style="font-style:italic;">Implications</span></span>

<span style="font-style:italic;">What are the implications? <span style="font-weight:bold;"></span></span>

Apparently, the government benefited the most from such scheme! It relinquishes its responsibility of providing retirement financing for an aging population basically transferring this burden to the future generations in terms of HIGHER HDB PRICES. MAKE PROFITS from these higher HDB prices which transferred into reserves which make them good i.e. they have been boasting how good they are because they have accumulated so much reserves. On top of that, make money from interests collected from HDB buyers!

What they government gain will be what the citizens will lose. This is a very simple logic. HDB is the MONOPOLY of the new HDB flat market and it is also the lender who earns interests from all outstanding loans.

This scheme will impact on both present HDB owners who bought their flats at high prices which end up with 30 year mortgage. They will most probably be FORCED to sell their HDB flats when they want to retire. The future generations will have to suffer higher HDB prices because this is intended, so that the present generation could generate enough funds for their retirement needs!

<span style="font-style:italic;">

Unsustainable<span style="font-weight:bold;"></span></span>

This model is NOT sustainable in the long run. The reason is pretty clear. In order to preserve the purchasing power of the amount of money Singaporeans have put into their HDB flats, the future price of their flats has to increase tremendously to cover the interest cost as well as inflation throughout the 30 years period.

However the wages of the working class normally grow at the rate just enough to cover inflation. That is why we are witnessing this impact of wages lagging behind HDB price growth for the past two decades. From the following graph prepared by <a href="singaporemind.blogspot.com">Lucky Tan </a>.

From 1990 to 2009, wage doubled while HDB prices grow by FOUR folds! This correspond to the increase in the mortgage payment period from 15 years to 30 years! In time to come, our future generations may have to pay for a 40years or even 50 years mortgage for just a decent HDB flat!

<span style="font-weight:bold;">Is this sustainable?<span style="font-style:italic;"></span></span>

Nobody can guarantee property prices to grow forever at such rapid rate. With an aging population, less youngsters will demand for MORE supply due to more elders trying to sell their flats. This will have downward pressure on relative prices.

There are CONFLICTING policy objectives. On one hand, in order for the scheme of utilizing high HDB prices as a means for retirement financing, we need HDB prices to outstrip wage growth but in order to maintain "AFFORDABILITY" for all generations, we need to maintain the price increase according to wage growth! How could these CONFLICTING policy targets be met simultaneously?

This is really an ill-thought out HDB-retirement scheme by the PAP government. This scheme benefits only the present government by alleviating its burden to provide for the retirement funding needs for the citizens while benefiting from all the higher HDB prices and interests earned from loans to HDB owners. This is in the expense of Singaporeans both present and future.

Almost all present Ministers will not be around in 30 years time to take responsibility for the effects of their policies. It is important for Singaporeans to understand the great implications of this HDB-retirement scheme upon our present generations as well as future generations.

I have come to this realization of this scheme ever since PAP started to embark the so call "Asset Enhancement Scheme" back in early 1990s. I have written a number of articles in protest of this scheme but many Singaporeans were overwhelmed by the immediate gain of paper capital gains. There were even Singaporeans trying to capitalize on the sudden increase in their flat value by upgrading or multiple upgradings. In the whole process, they committed higher and higher debts.

The latest <a href="http://singaporemind.blogspot.com/2010/12/consequences-of-govt-inaction-in.html">report</a> has indicated Singapore's housing debt has constituted more than 51% of total loans from our financial loans! This is even higher than Hong Kong's 20%! We will be doomed if there is a property crash! The whole financial system will be burden with unperforming loans!

An economy cannot invest too much of its financial resources in assets like properties which are not "productive" for the economy. If the property sector takes up too much of financial resources of the economy, we will not be able to have enough resources to finance investments by our local entrepreneurs. It will also means that the financial sector will be over-exposed to a potential bubble which will wipe off our wealth when it burst.

Experiences from Japan, Ireland and even US have shown that over-exposure of the financial sector to the bubble prone property sector will destroy the economy. Japan has hardly recover from its collapse of economy due to property bubble since 1990s!

It is up to every Singaporeans to judge on whether what I write here make any sense. It is easy to sell greed to the masses but it will create non-reversal damage to our future generations. It is not easy to convince people that high property prices are BAD for them. I have waited this long for the opportune time to explain what I have learned throughout these years. I urge every readers who agree with my views to help me to spread this message to your friends and relatives.

This unsustainable and potentially damaging HDB-retirement scheme must be stopped and ceased else our future generations will suffer in vain for our inaction.

Goh Meng Seng

Then join me in Heaven. Free board and lodging!:p:p:p please direct enquiries to

Then join me in Heaven. Free board and lodging!:p:p:p please direct enquiries to